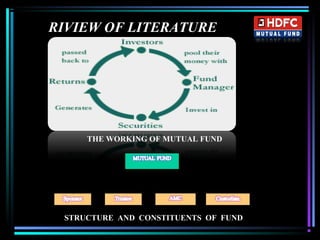

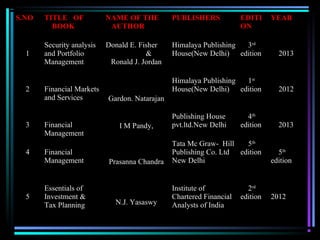

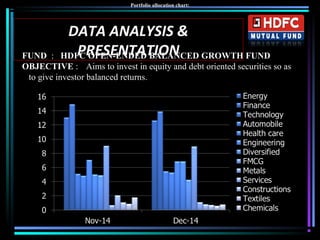

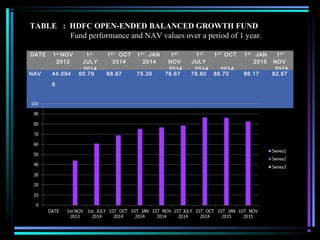

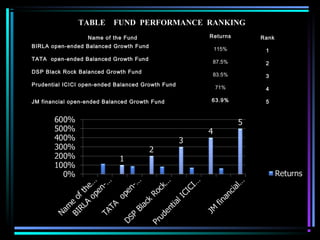

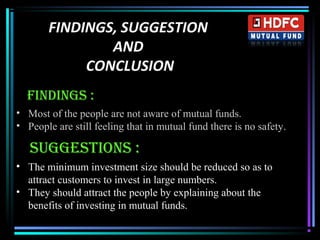

The document is a project presentation on mutual funds at HDFC. It includes an introduction to mutual funds, objectives of the study which is to understand recent trends and workings of mutual funds. It analyzes various schemes of HDFC mutual fund including its balanced growth fund. The balanced fund has 73.58% allocation to equity, 12.16% to debt and 16.68% to money market. It ranks various balanced funds based on their returns, with Birla fund ranking first with 115% returns. The findings suggest people lack awareness of mutual funds and safety, and recommendations include reducing minimum investment sizes and better education of benefits.