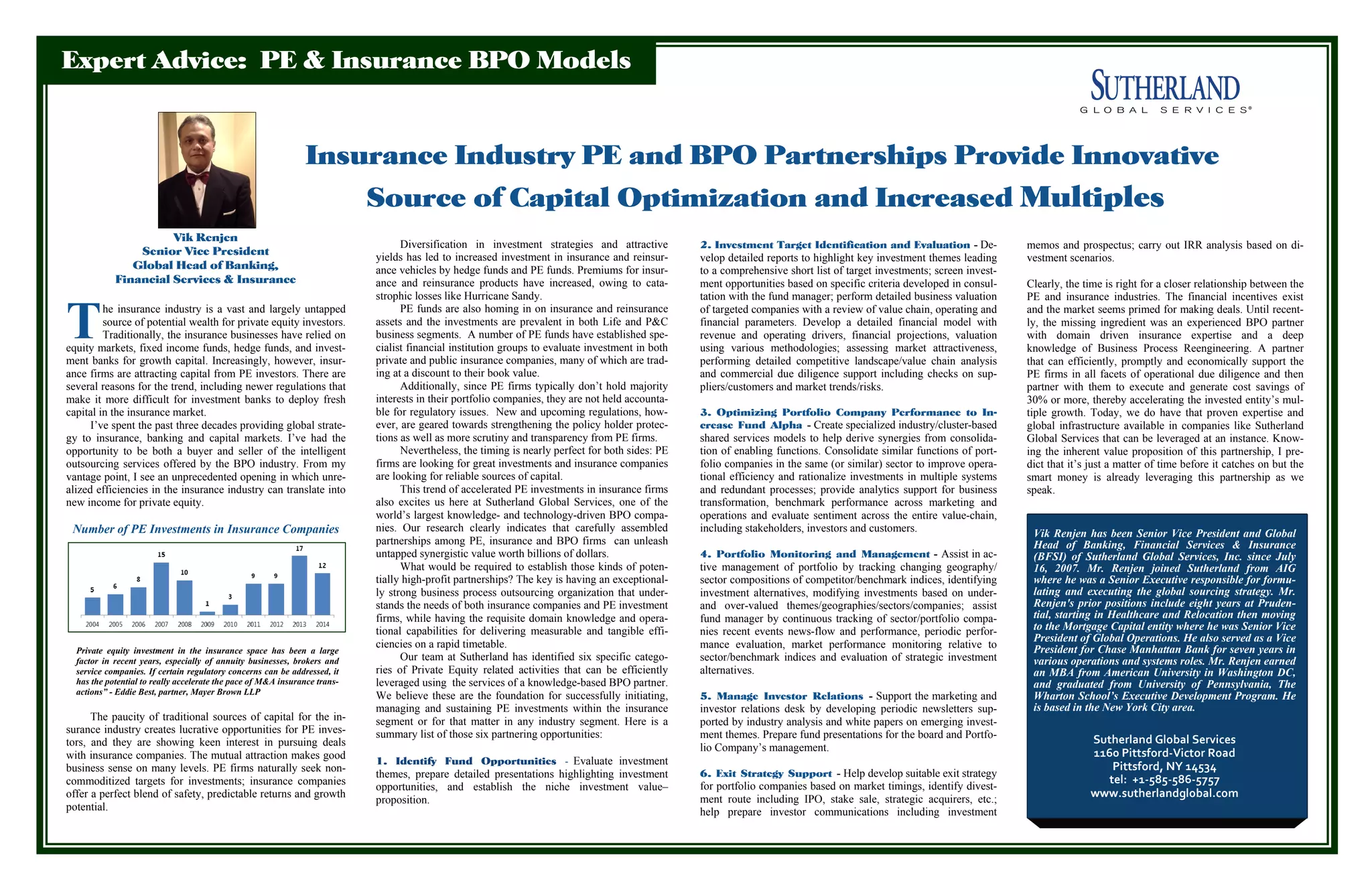

Private equity investment in the insurance industry has increased in recent years due to new regulations and a lack of traditional capital sources for insurance companies. Partnering private equity firms with insurance companies and business process outsourcing (BPO) firms can generate significant value by improving efficiencies. BPO firms with insurance industry expertise can help private equity firms identify investment opportunities, evaluate targets, improve portfolio company performance, manage investments, support investor relations, and develop exit strategies. This allows private equity to generate higher returns and insurance companies to access more capital. The partnership between these three industries is poised for growth as each side recognizes the potential benefits.