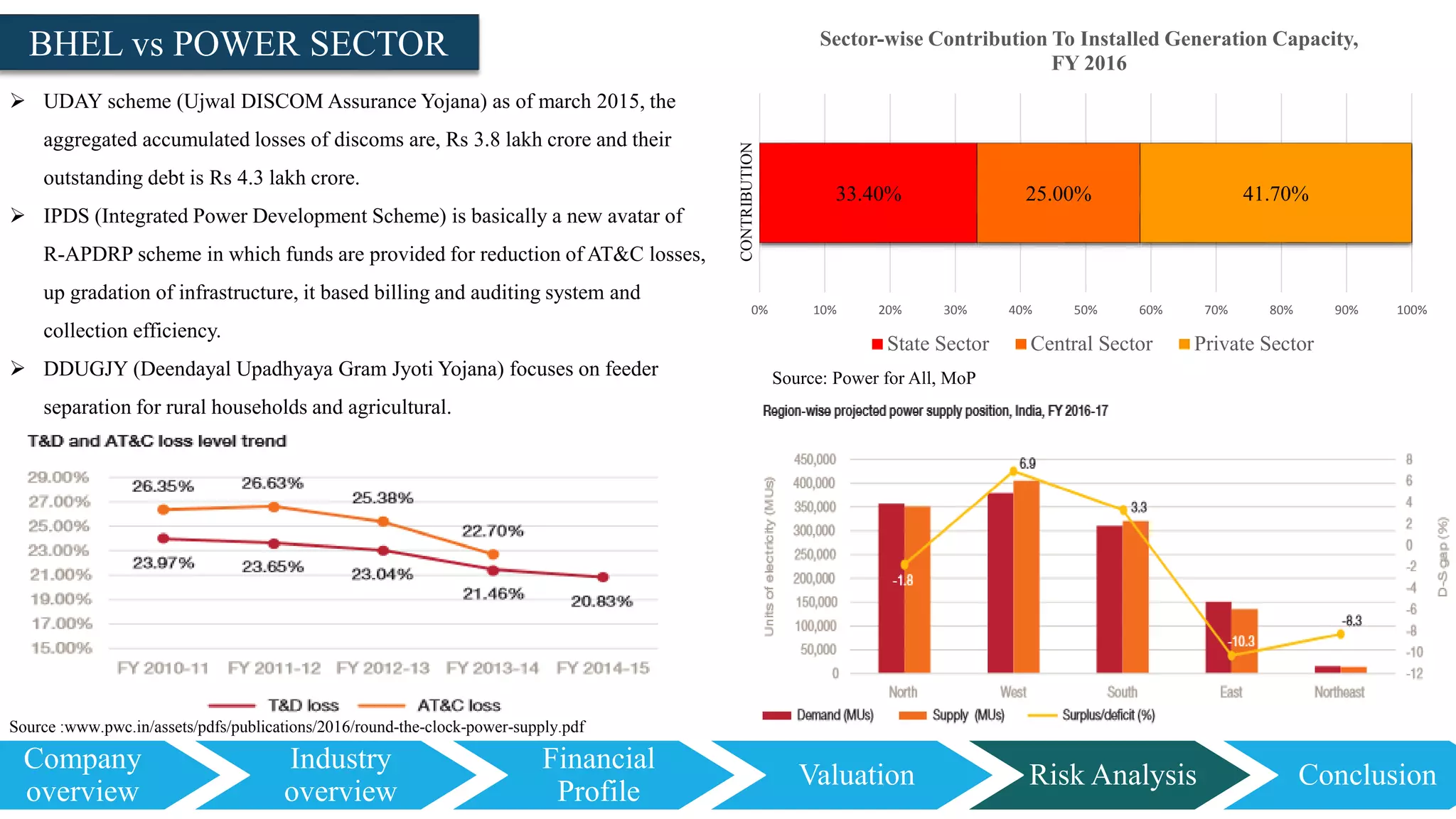

The document provides information on Bharat Heavy Electricals Limited (BHEL), including its shareholding structure, financial performance, industry overview, and comparison to peers. Some key points:

- BHEL is one of India's largest engineering and manufacturing companies with over 10,000 MW of power projects commissioned.

- Its top shareholders are promoters (63.06%) followed by mutual funds (2.25%) and FI/Banks (5.26%).

- Between 2011-2016, BHEL's turnover grew from Rs. 30,947 crore to Rs. 50,156 crore though margins declined.

- The capital goods industry in India is expected to reach $125.4 billion by FY