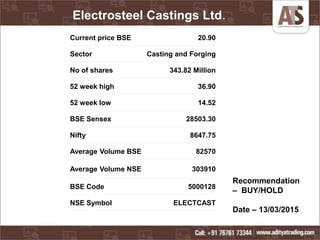

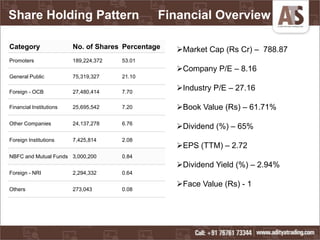

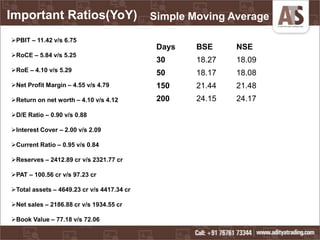

Electrosteel Castings Ltd, India's largest manufacturer of ductile iron pipes, has a current market price of Rs 20.90 and a market capitalization of Rs 788.87 crore. The company reported a standalone sales of Rs 597.44 crore and a net profit of Rs 15.76 crore for the quarter ended December 2014, with a recommendation to buy/hold. The global forgings industry shows potential growth, with domestic demand for ductile iron pipes increasing due to infrastructure projects.