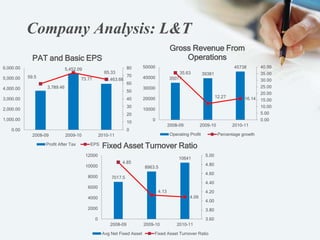

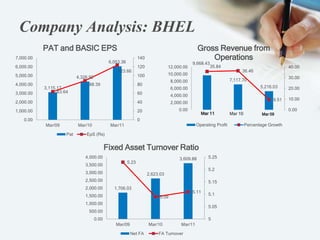

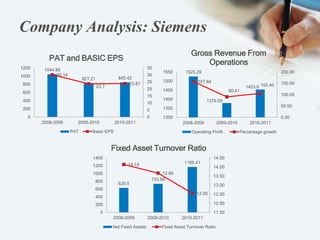

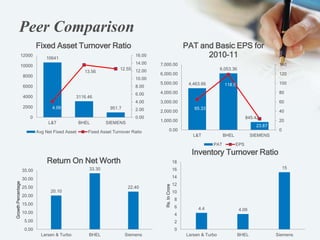

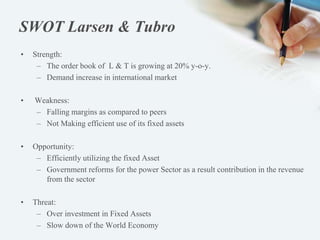

The document provides a sector analysis of the capital goods sector in India, focusing on major companies like Larsen & Toubro (L&T), Bharat Heavy Electricals Limited (BHEL), and Siemens amidst global economic challenges and domestic slowdown. It outlines the current economic conditions, business scenarios, and SWOT analyses for each company, highlighting their strengths, weaknesses, opportunities, and threats. The analysis indicates a gradual build-up in growth momentum for the Indian economy in 2012-13, with infrastructure development as a key focus area.