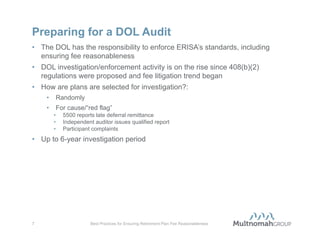

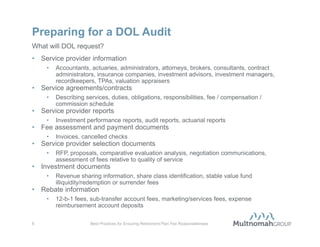

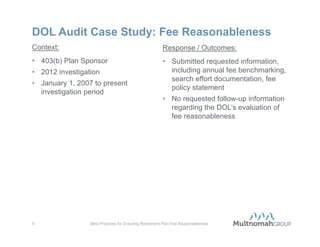

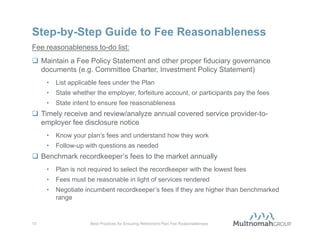

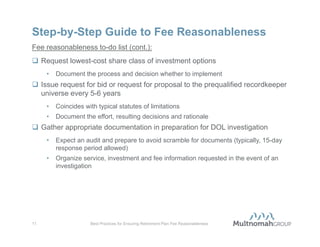

This document provides best practices for ensuring the reasonableness of retirement plan fees under ERISA section 408(b)(2). It emphasizes the importance of maintaining a prudent process for fee evaluation, preparing for DOL audits, and understanding fee disclosures, while summarizing relevant legislative and judicial contexts. Additionally, it includes a step-by-step guide for plan sponsors to assess and benchmark fees effectively.