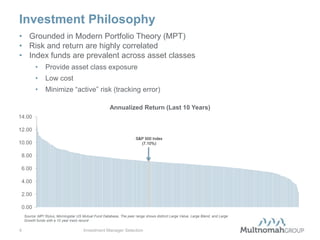

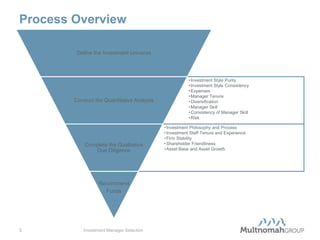

The document outlines the investment manager selection process by the Multnomah Group, emphasizing a philosophy grounded in modern portfolio theory, risk and return correlation, and cost efficiency. It details a structured approach that includes quantitative analysis, qualitative due diligence, and a comprehensive review of investment managers based on factors like expenses, tenure, and skill. Finally, it stresses the importance of aligning investment choices with client objectives and ensuring operational integrity in fund recommendations.

![Investment Personnel

• Funds Don’t Have Track Records, People Do.

• What is the Structure of the Investment Team?

• Single portfolio manager or team?

• Centralized research analysts or team-specific?

• Analysts assigned a sector or generalists?

• What is the Experience of the Investment Team Together?

• Portfolio Manager(s) [Manager tenure is a limited measure of experience]

• Research analysts

• How Does the Team Interact?

• Is there a king?

• Does the team strive for consensus?

• Does everyone understand their roles and responsibilities

20 Investment Manager Selection](https://image.slidesharecdn.com/investmentmanagerselection-130220164257-phpapp01/85/Investment-Manager-Selection-20-320.jpg)