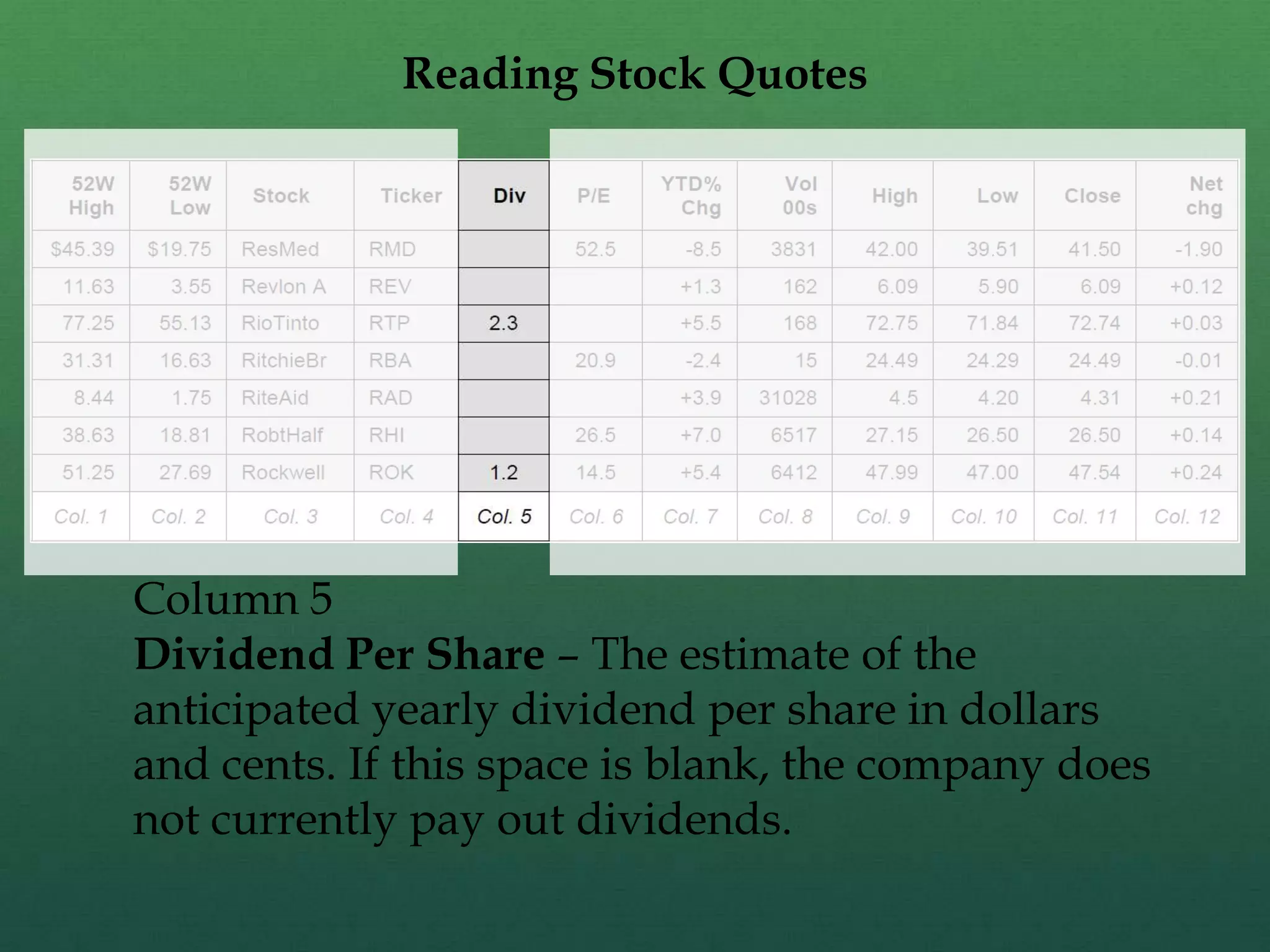

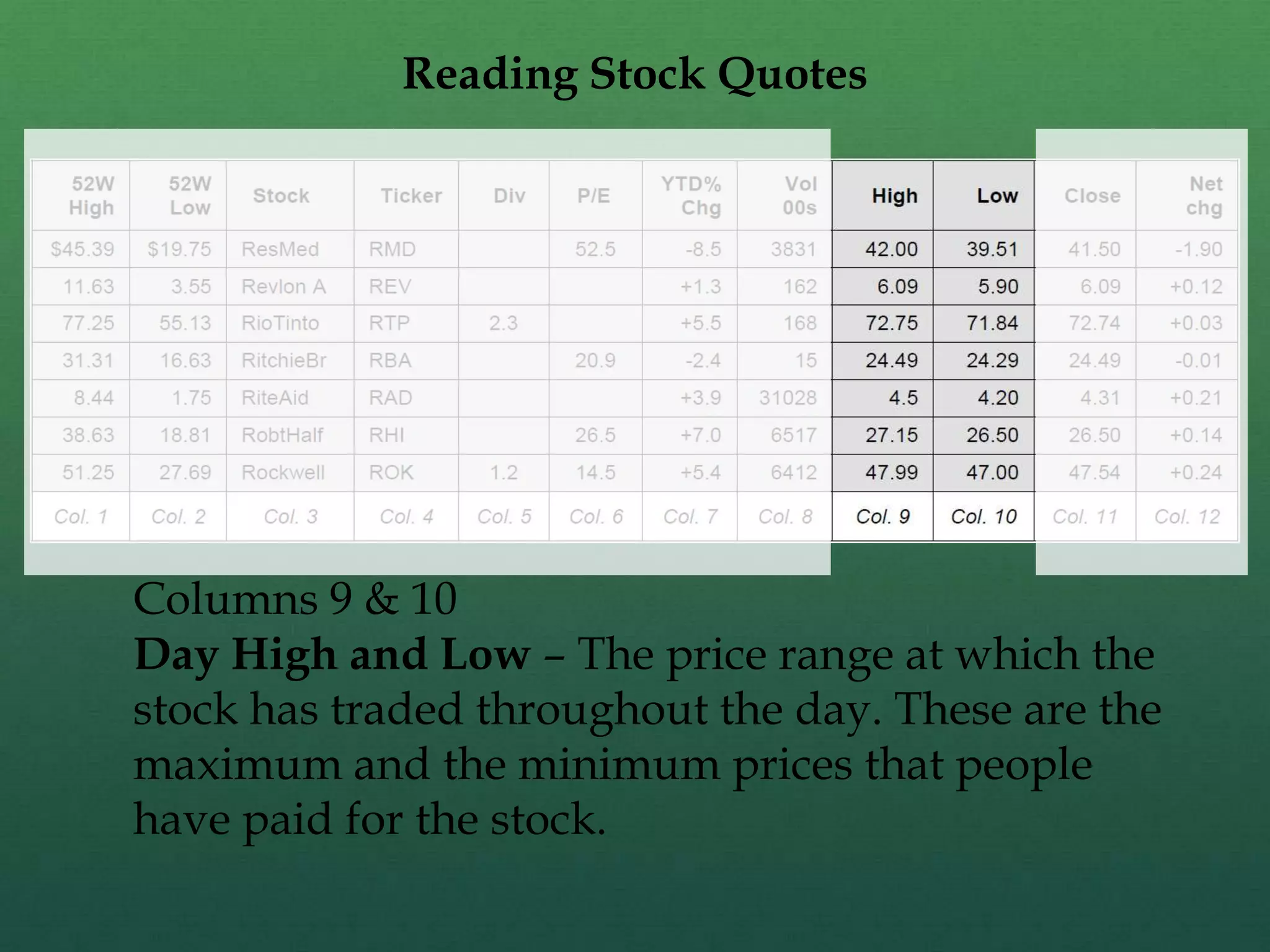

This document provides an introduction to the stock market and the LHA Stock Market Game. It defines key market concepts like stocks, bonds, indexes and exchanges. It explains how to read stock quotes and factors that influence stock prices. The goal of the game is for students to compete by investing a virtual $100,000 in stocks and tracking their portfolio value.