The document analyzes Best Buy's (BBY) valuation and provides a recommendation. It summarizes that:

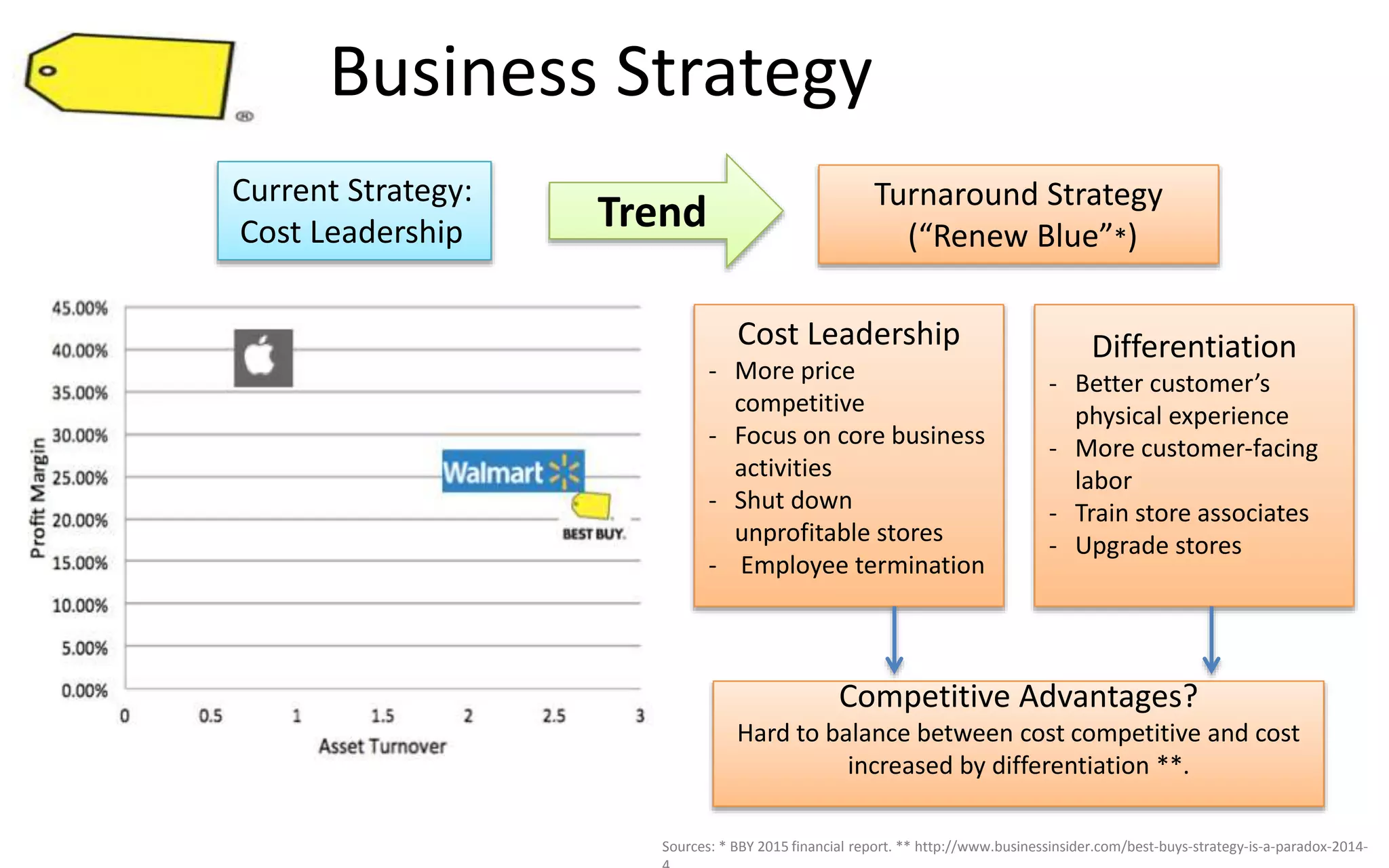

1. BBY's "Renew Blue" turnaround strategy aims to balance cost leadership with differentiation, but this is paradoxical and difficult to achieve.

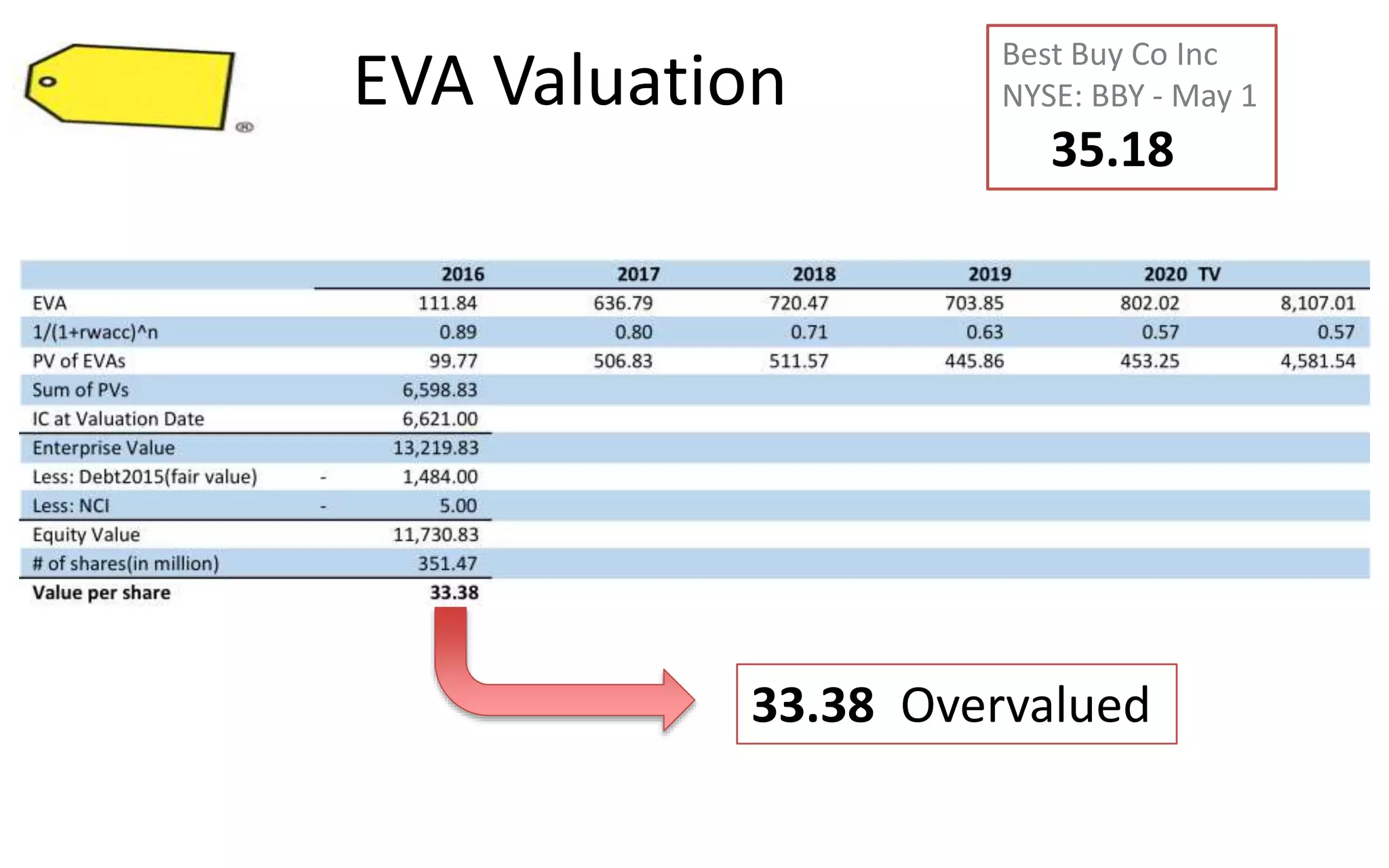

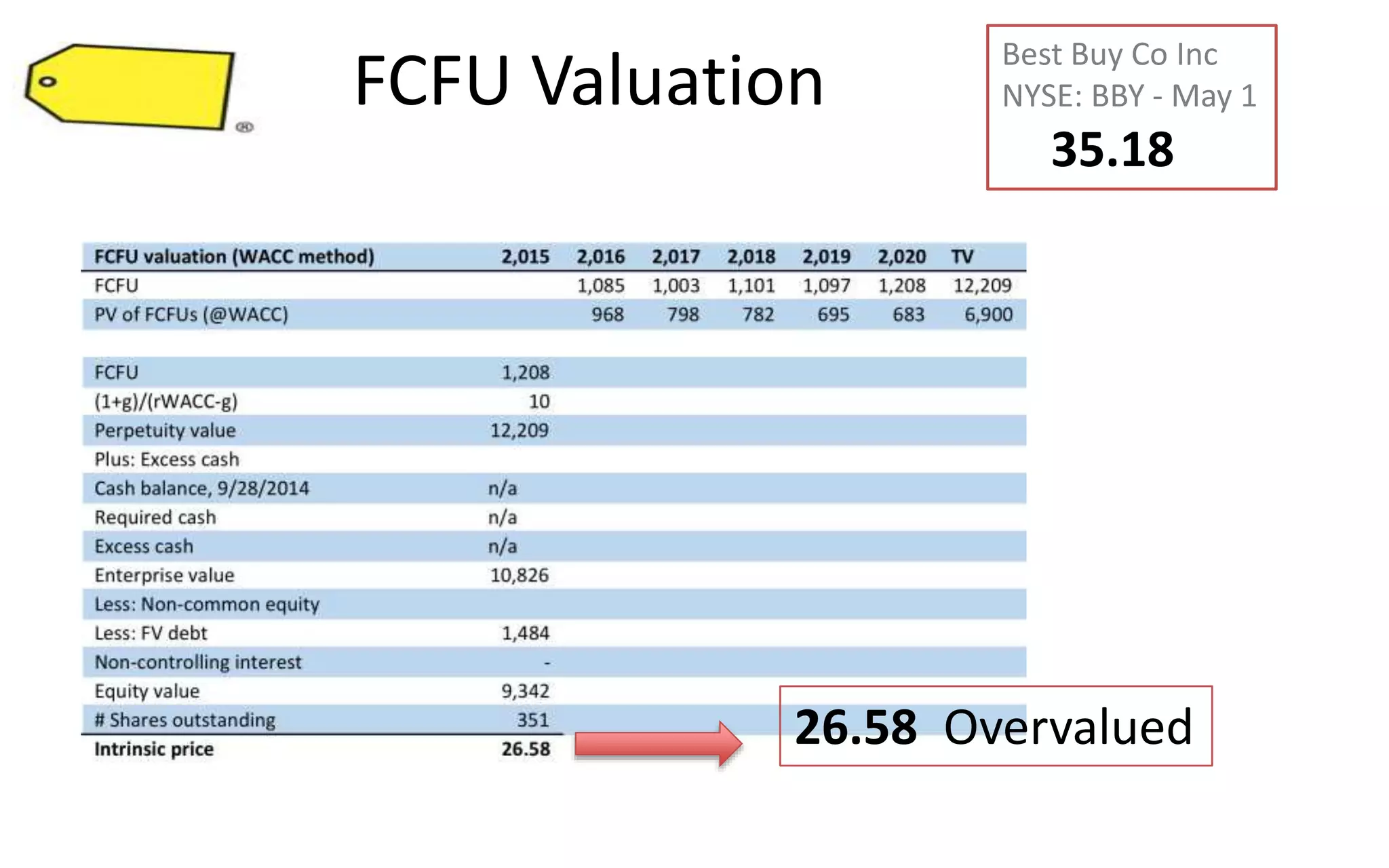

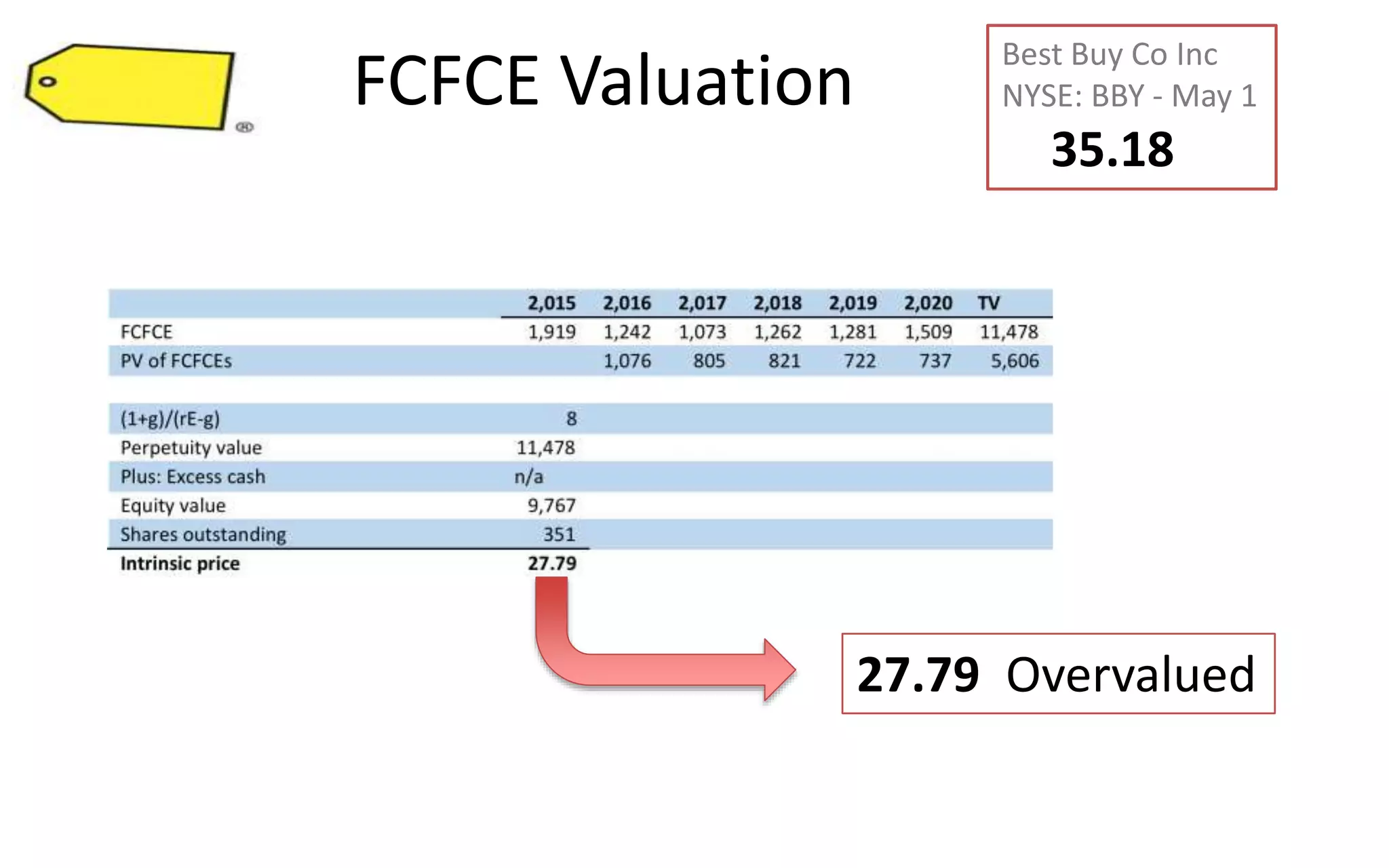

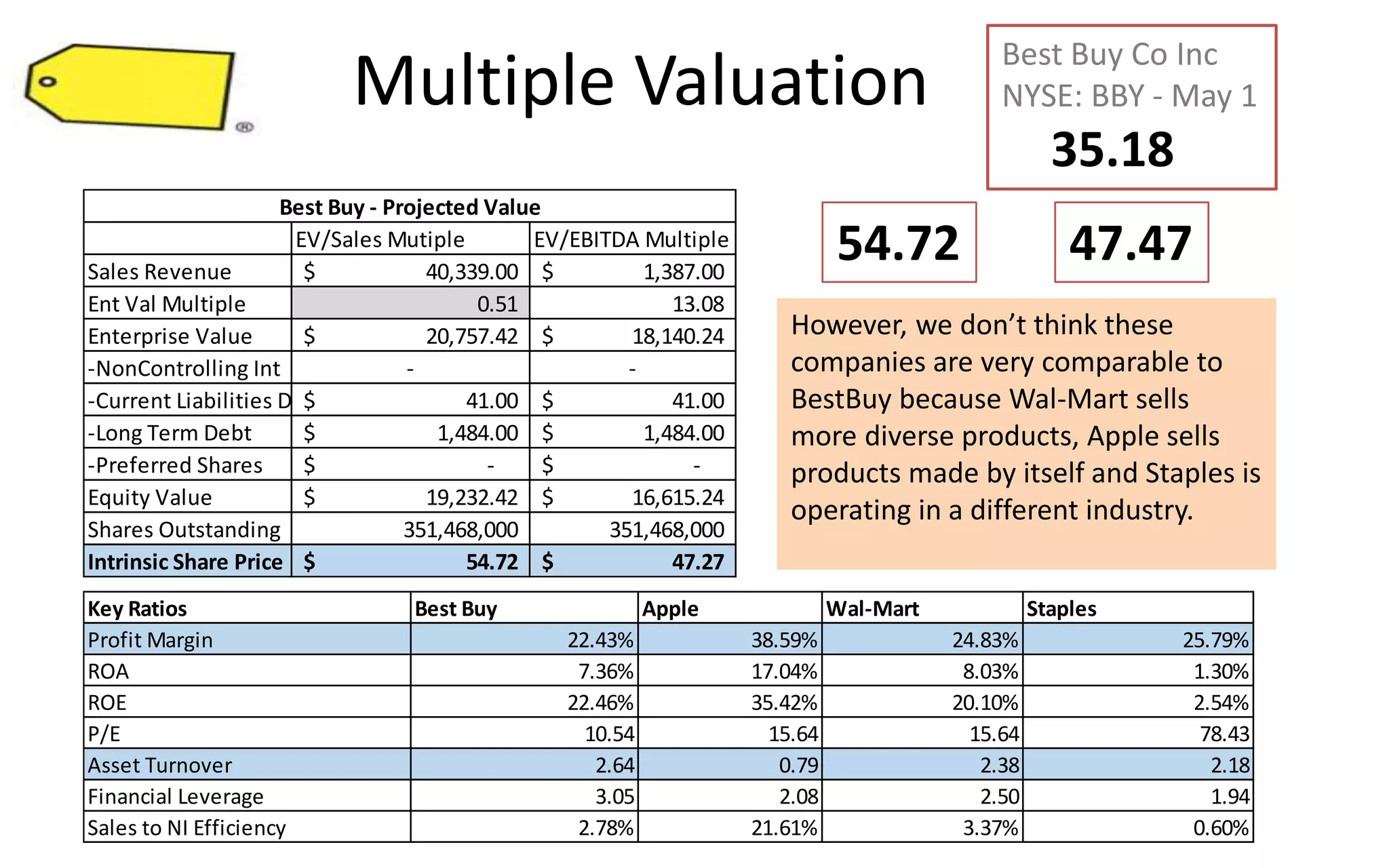

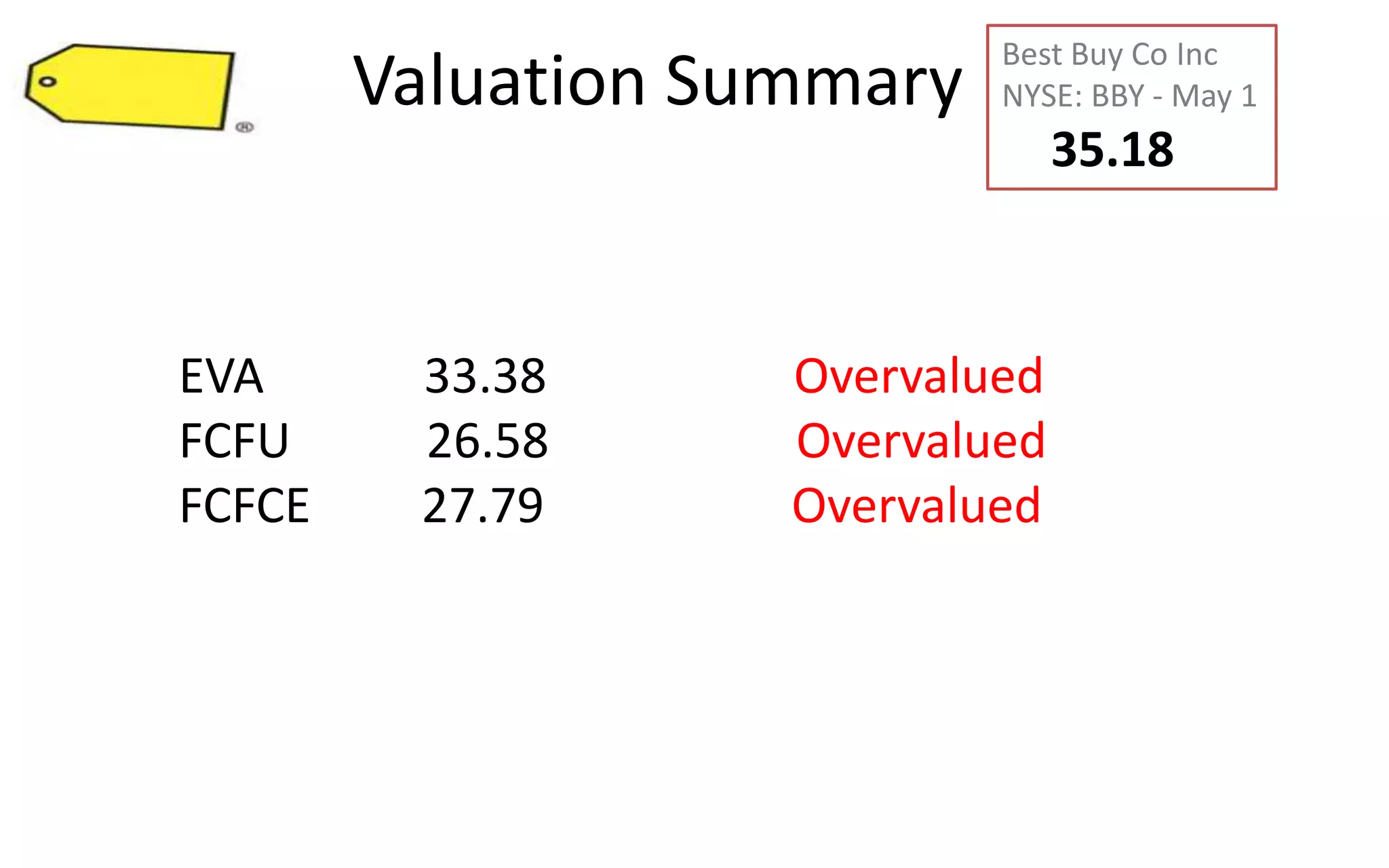

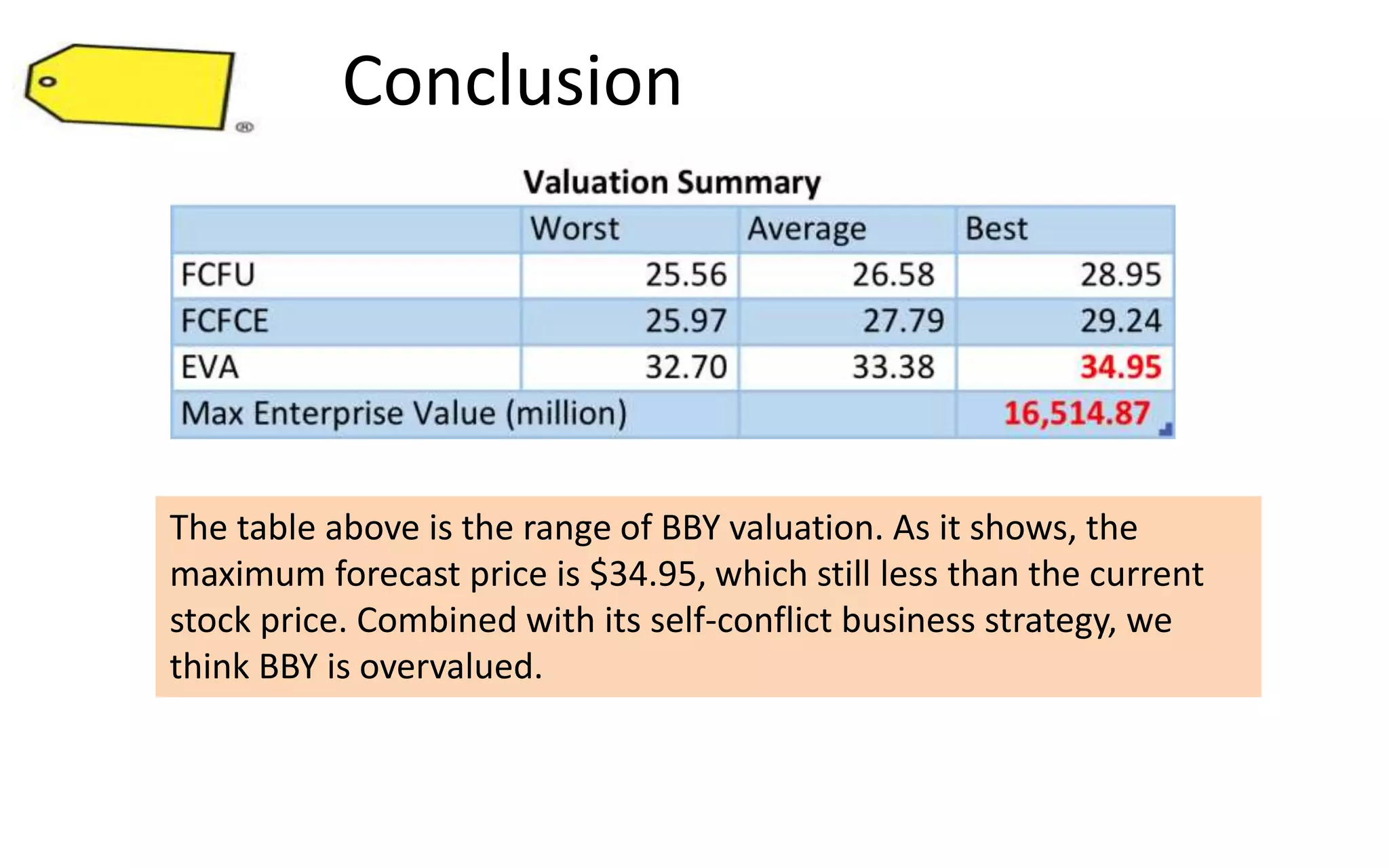

2. Financial valuations using the EVA, FCFU, and FCFCE models indicate that BBY is overvalued at its current stock price.

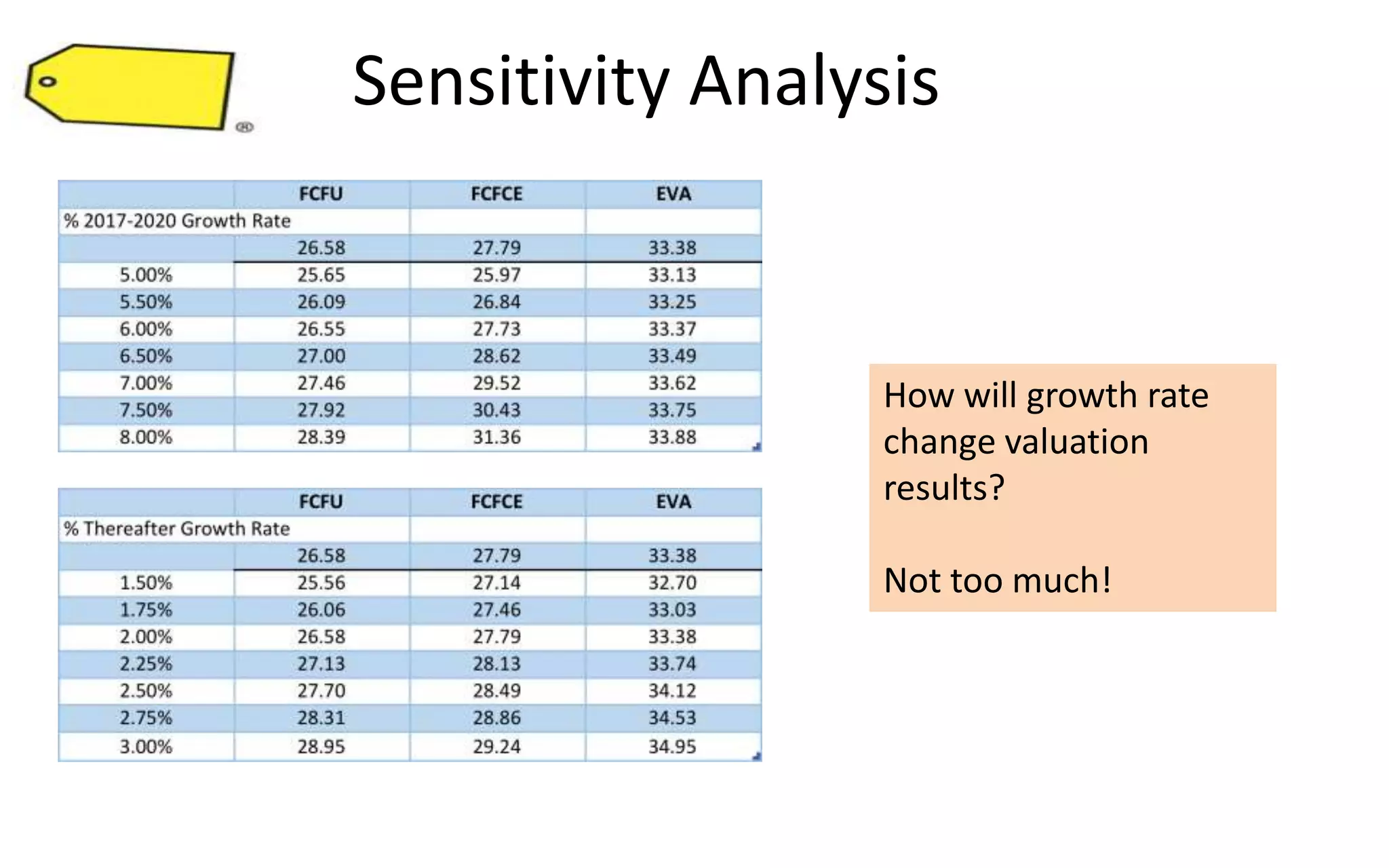

3. Sensitivity analysis shows that even with optimistic growth rate assumptions, the maximum forecast price is below the current stock price, reinforcing the assessment that BBY is overvalued given challenges with its business strategy.