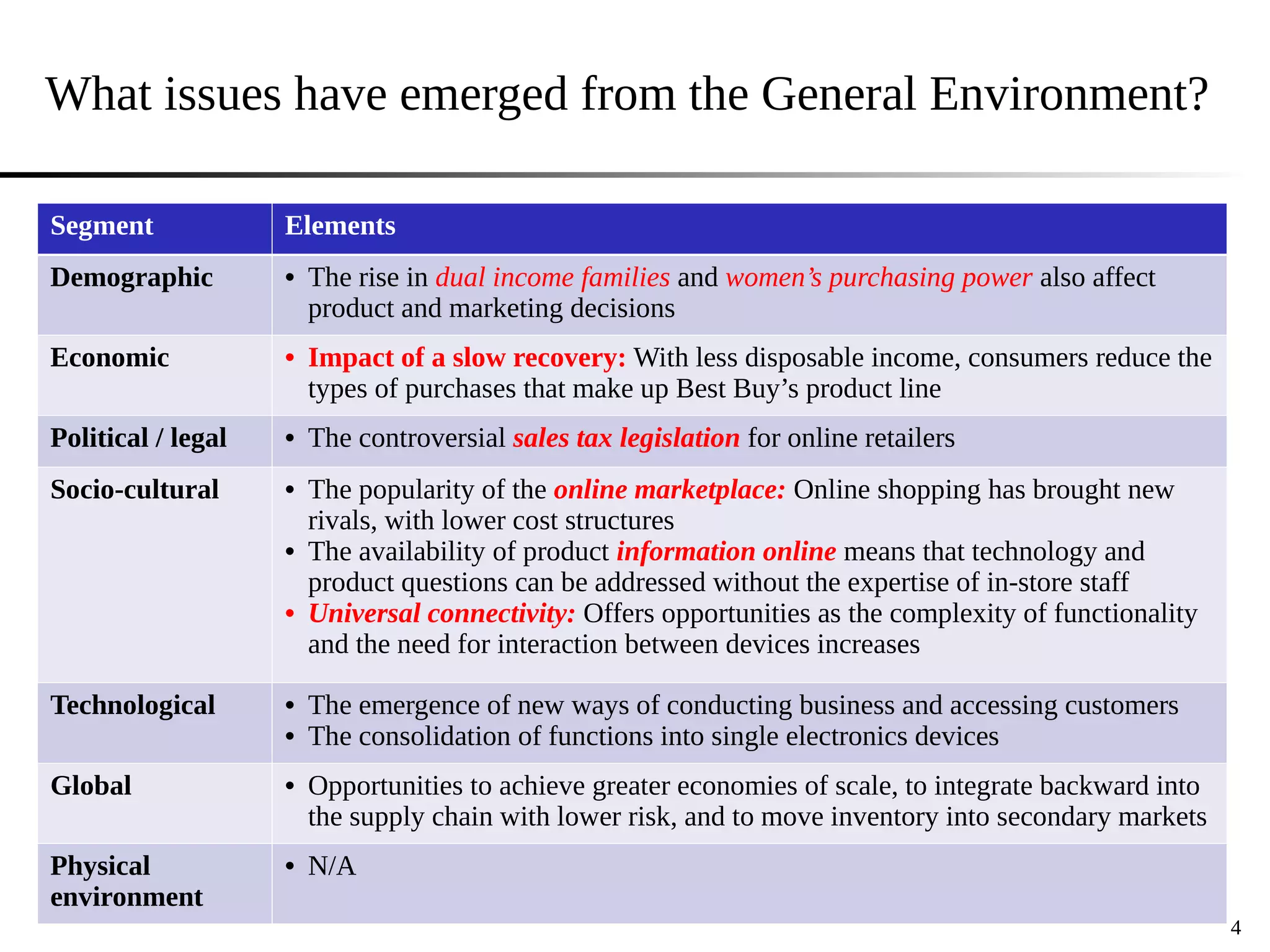

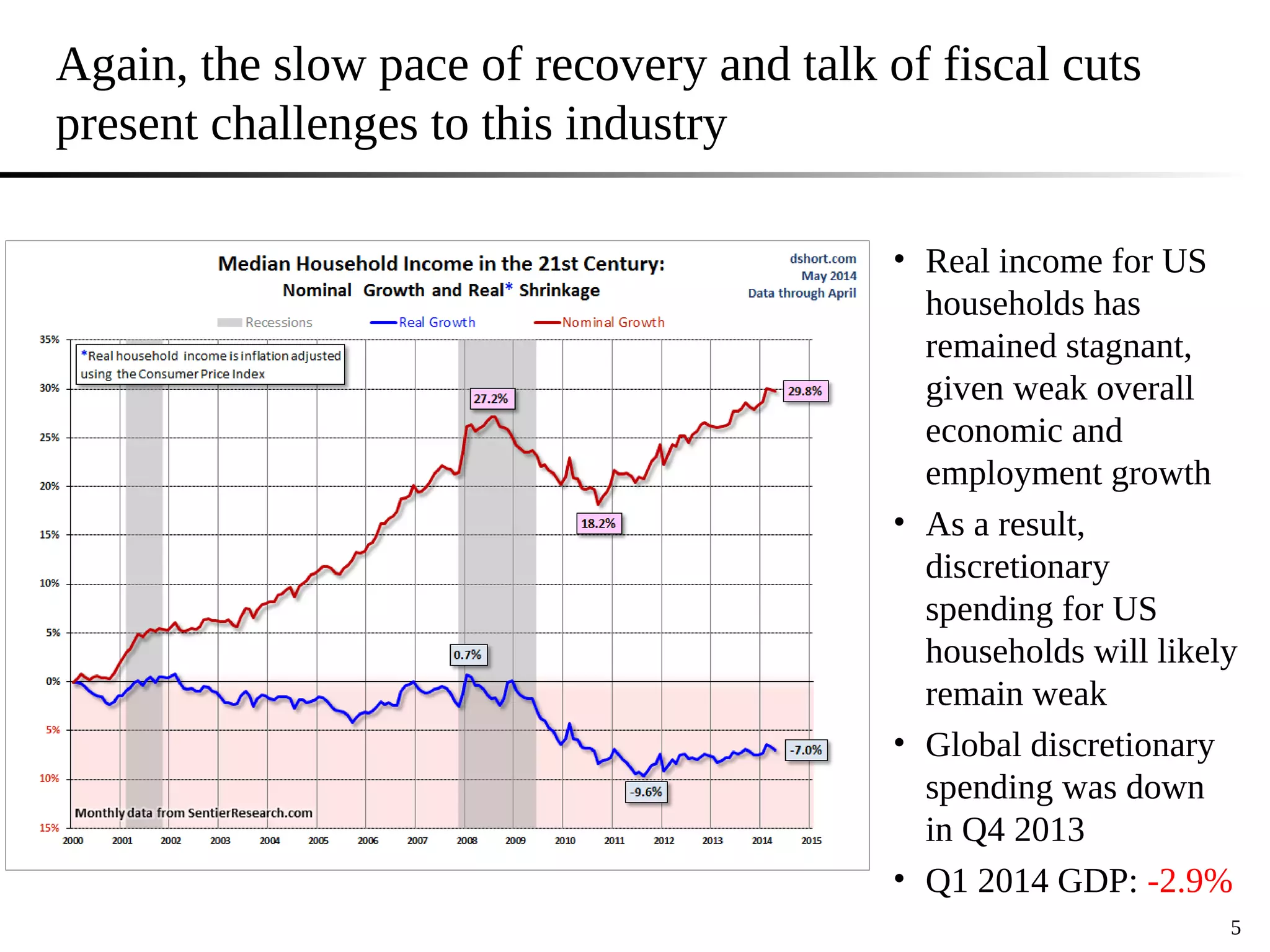

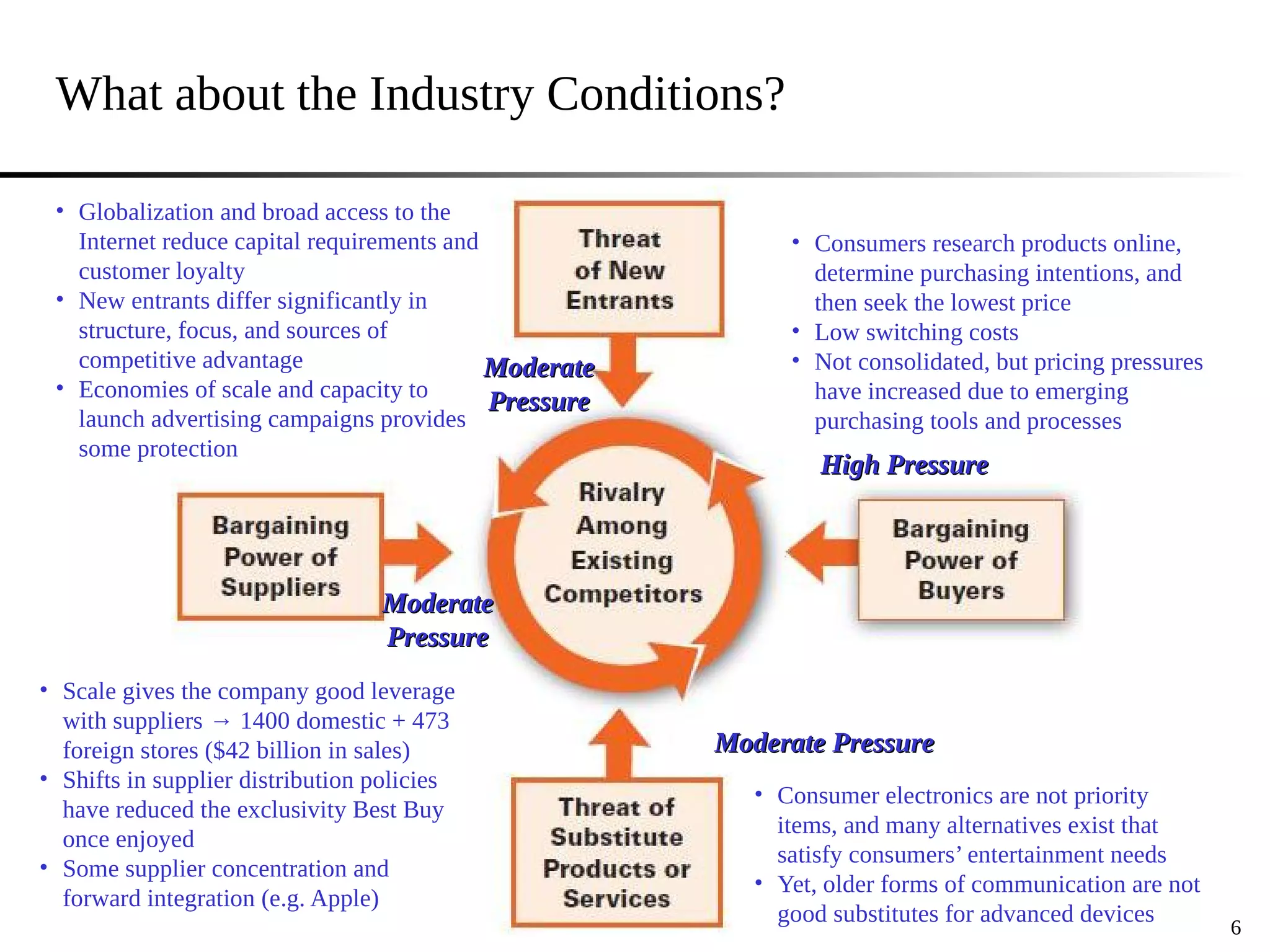

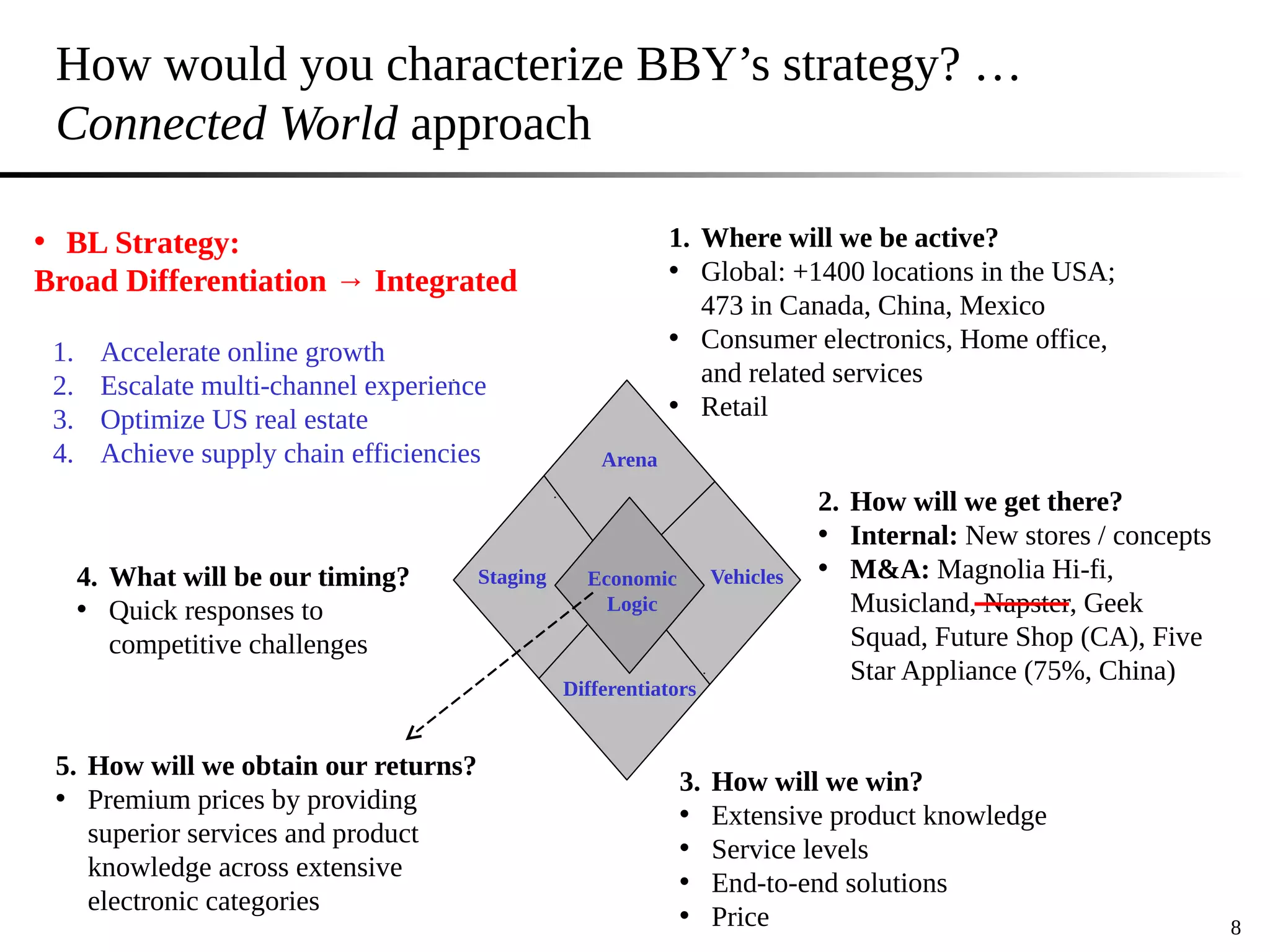

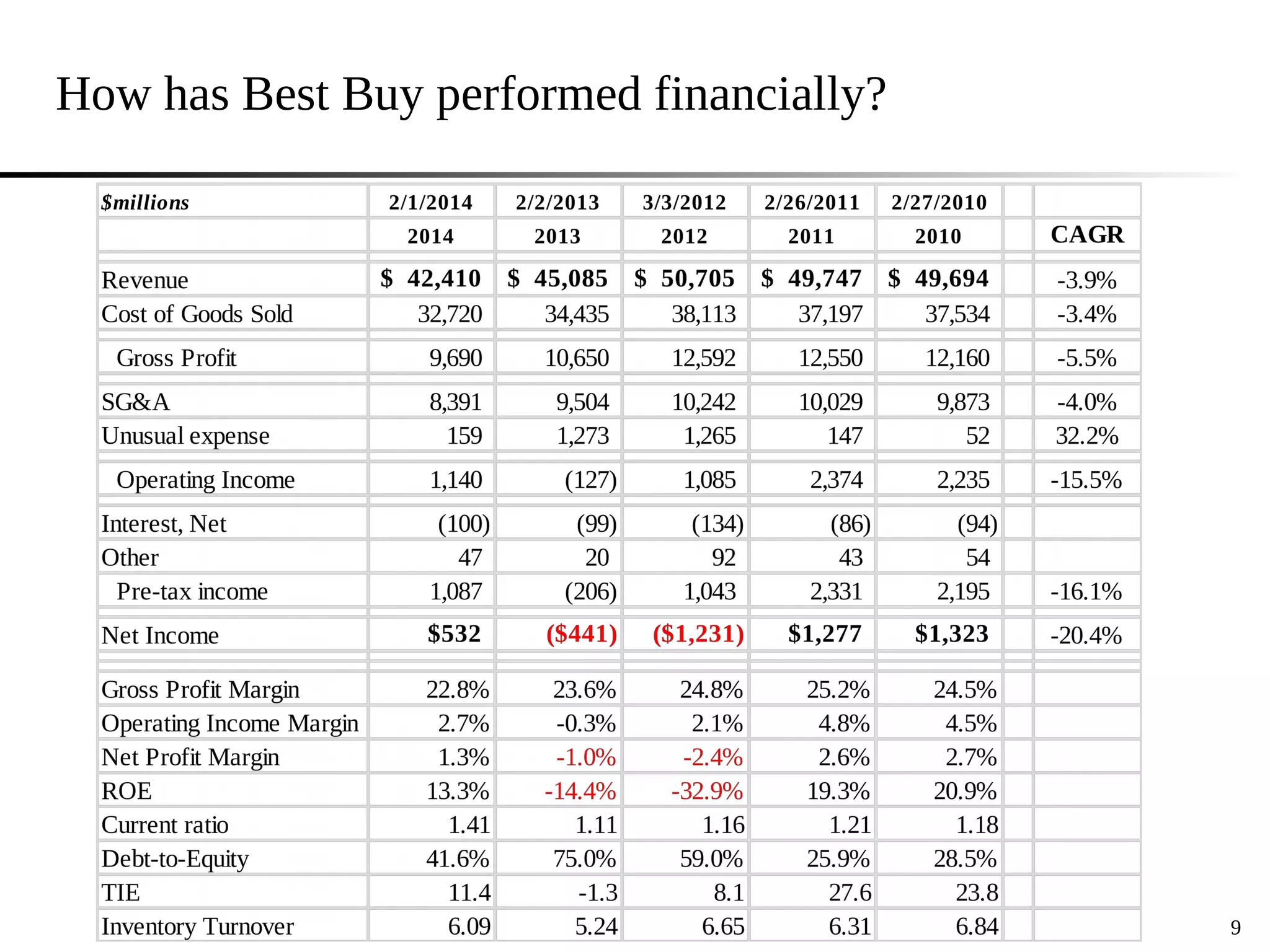

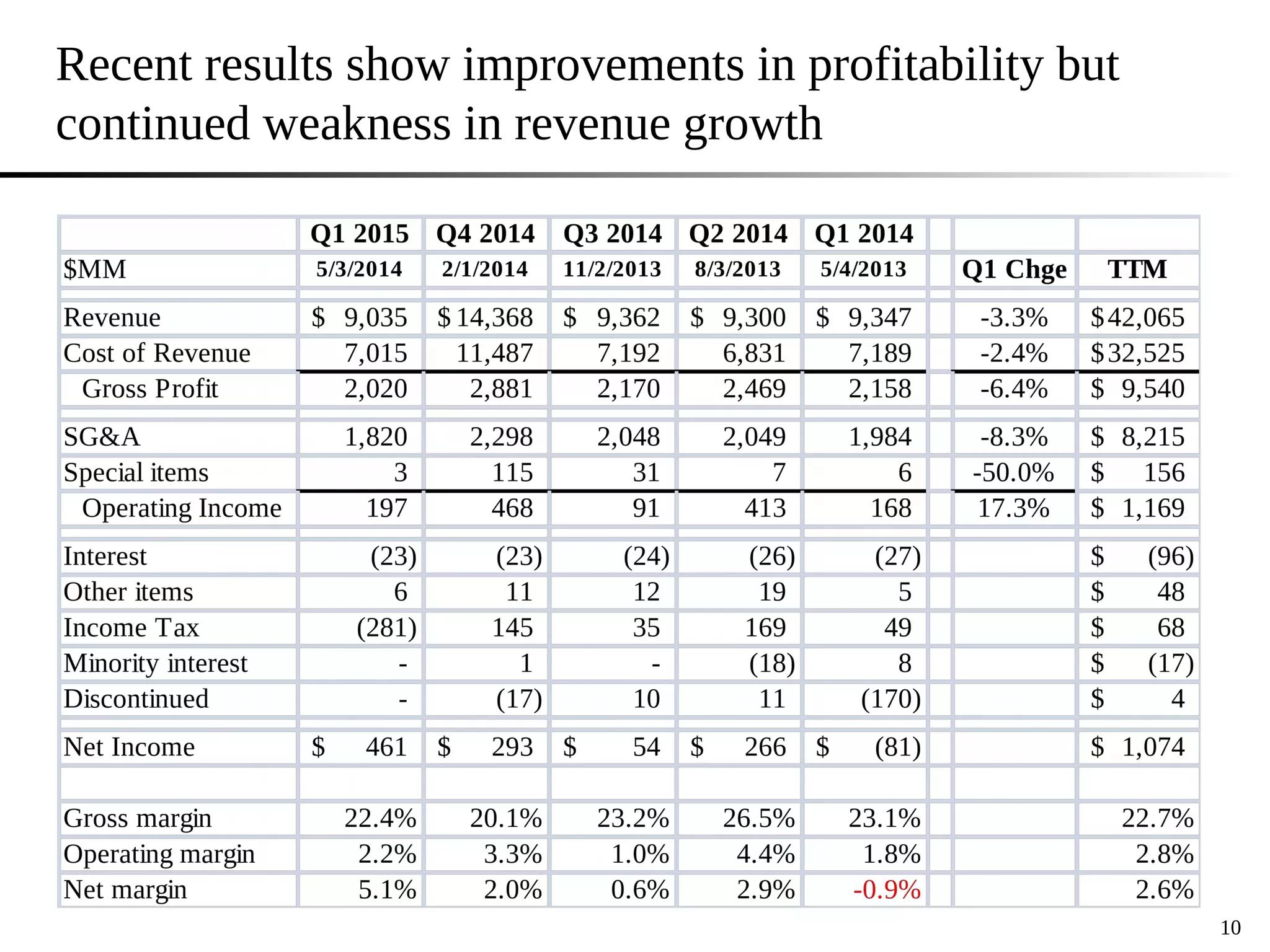

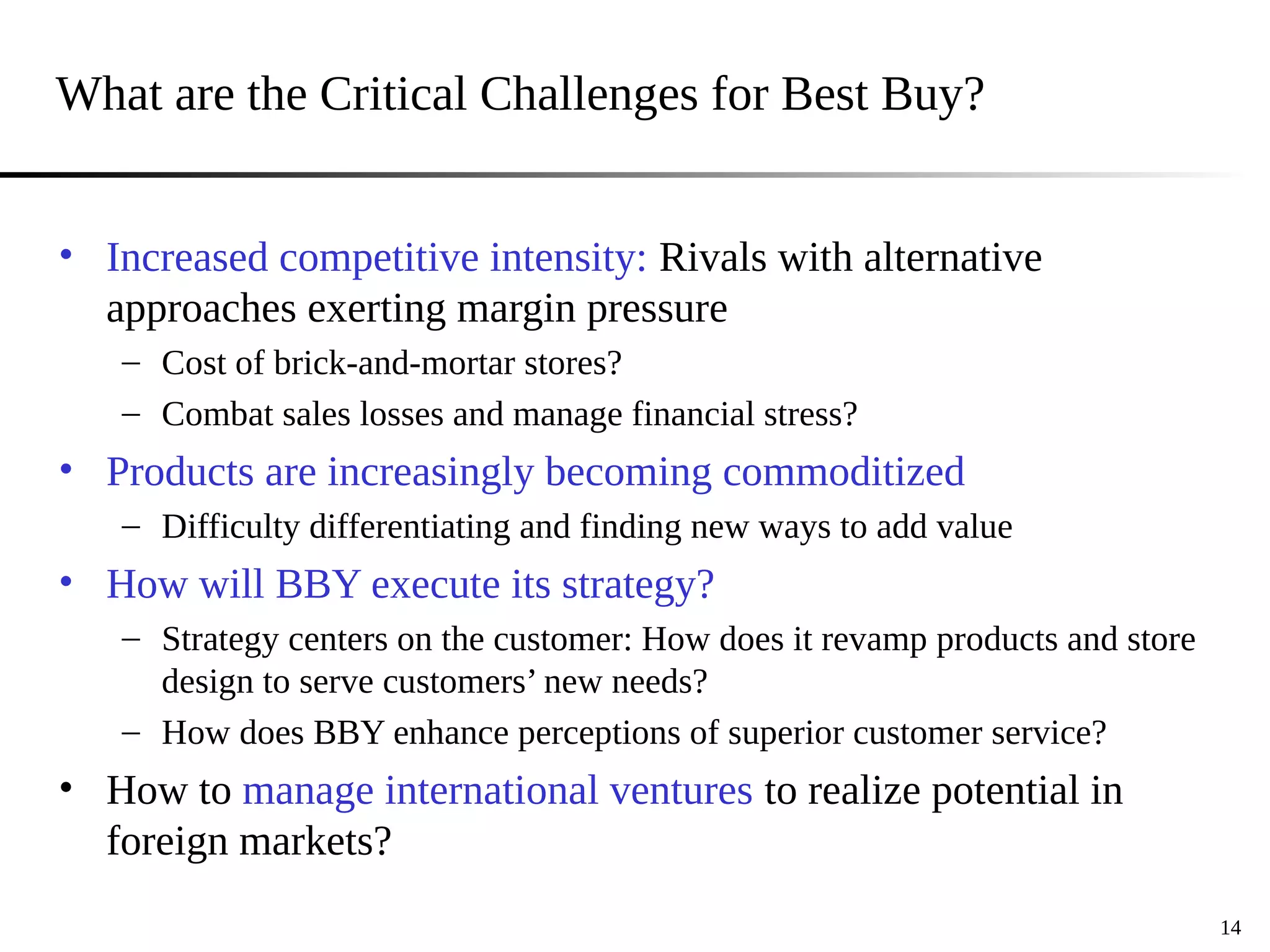

Best Buy Co., Inc. is a multi-national retailer of consumer electronics facing challenges from increased competition and changing consumer preferences. Revenues have grown slowly while profits have declined. Best Buy has strengths in extensive product knowledge and offering end-to-end solutions, but weaknesses in high operating costs and perceptions of inferior service compared to competitors. Critical challenges include differentiated in a commoditized market, enhancing the customer experience, and managing international operations. Options to address issues focus on consultative home office and business services, store-within-a-store concepts, improved cost management, and building value through customer support.