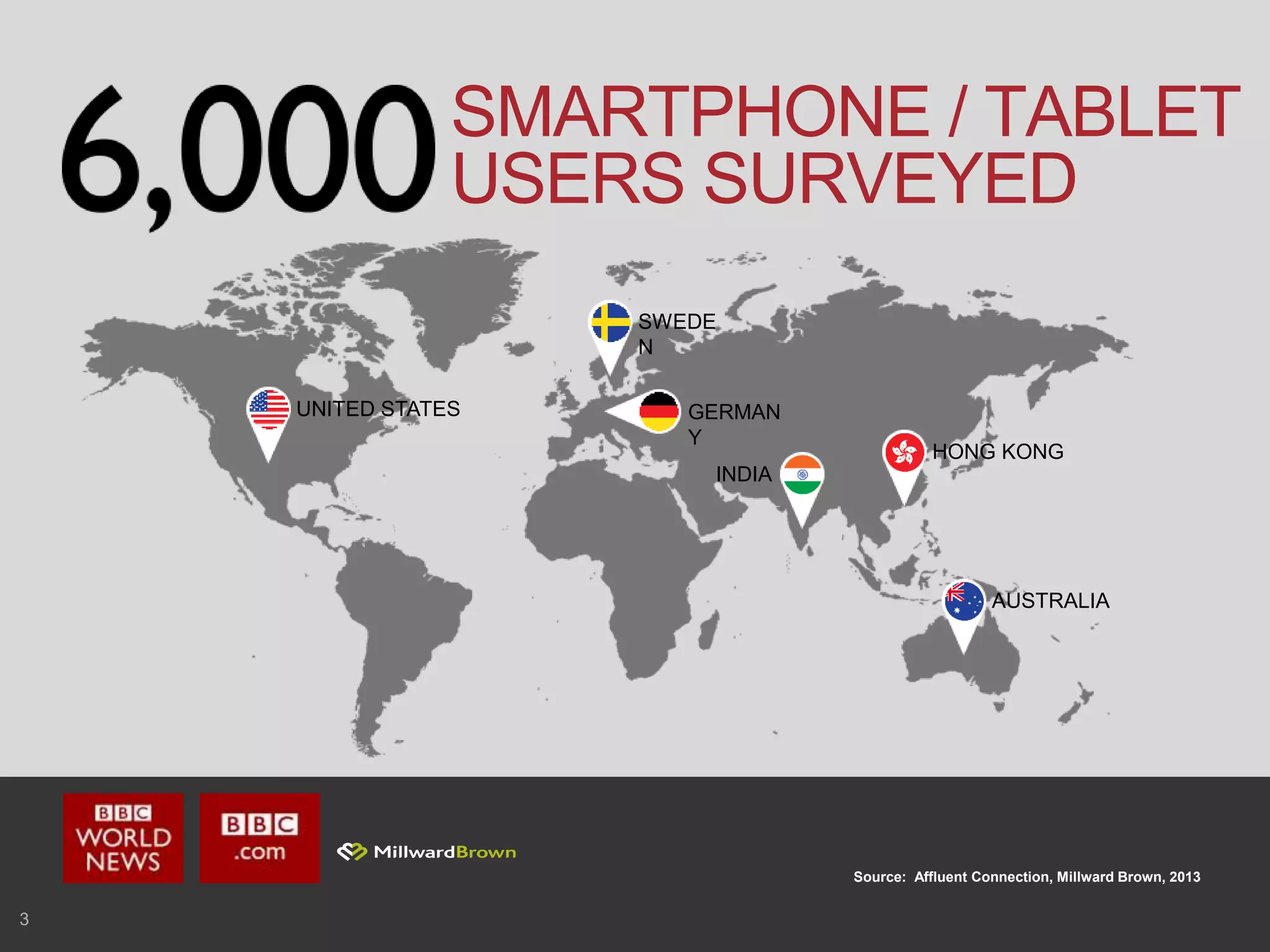

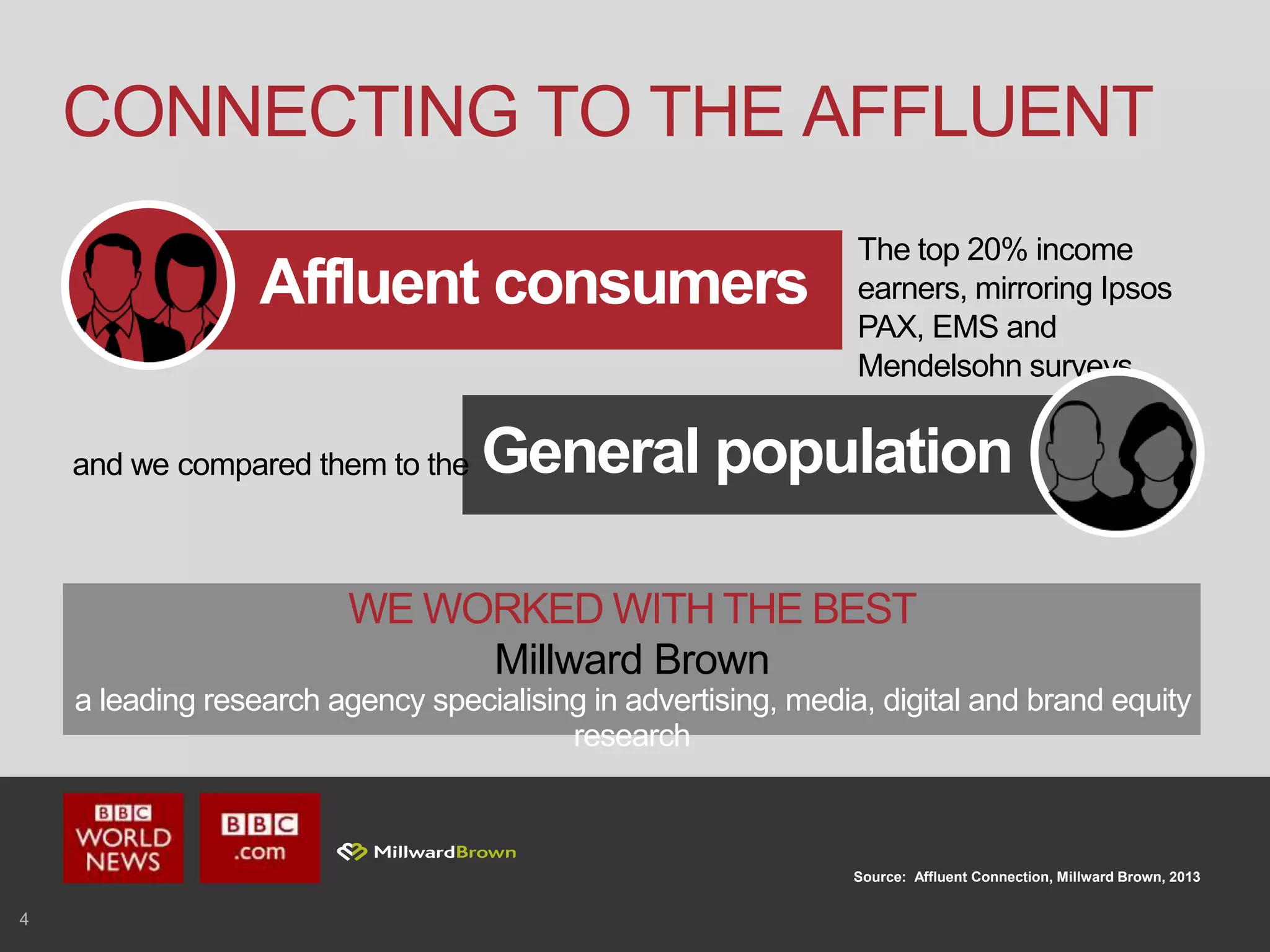

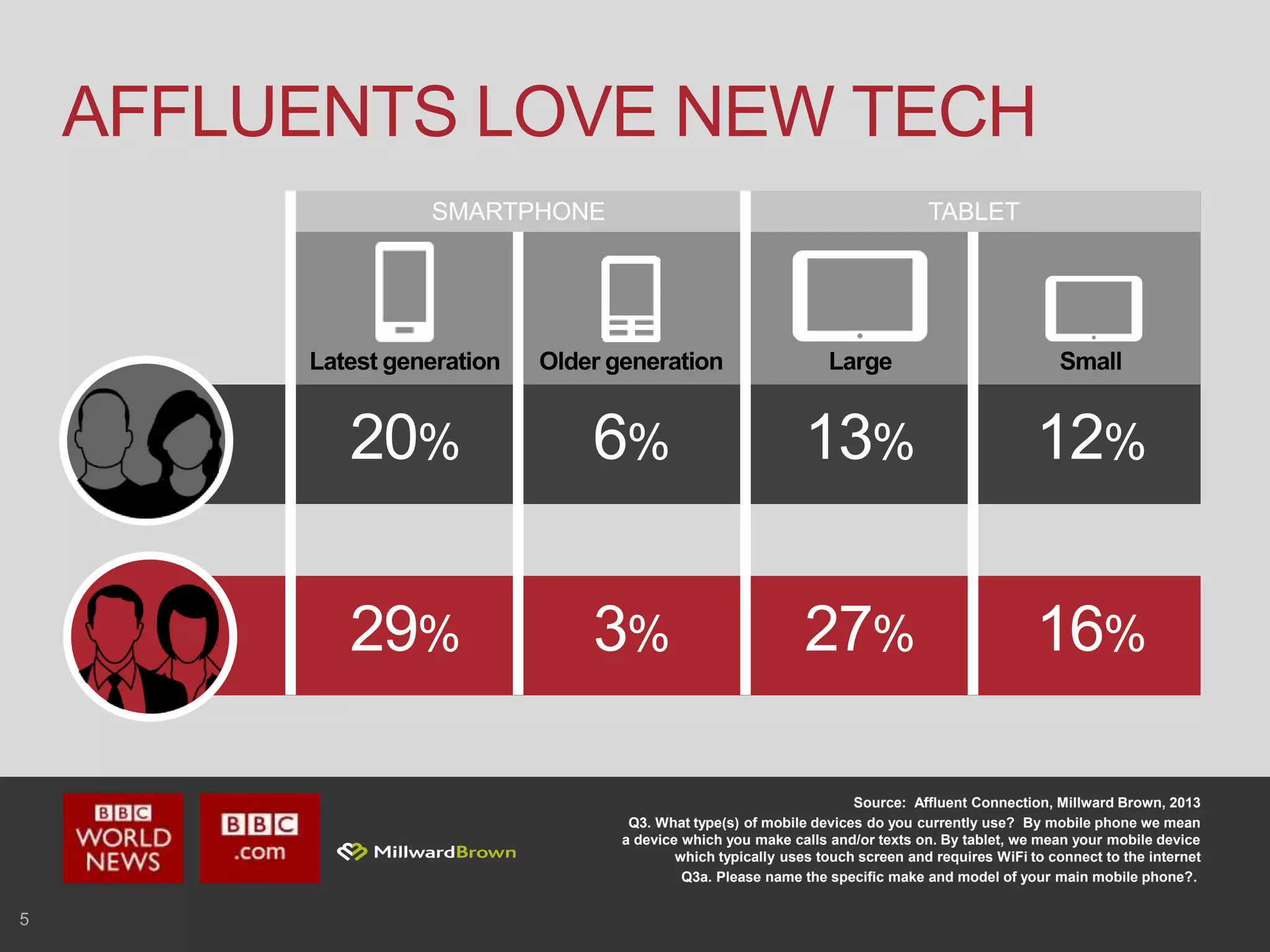

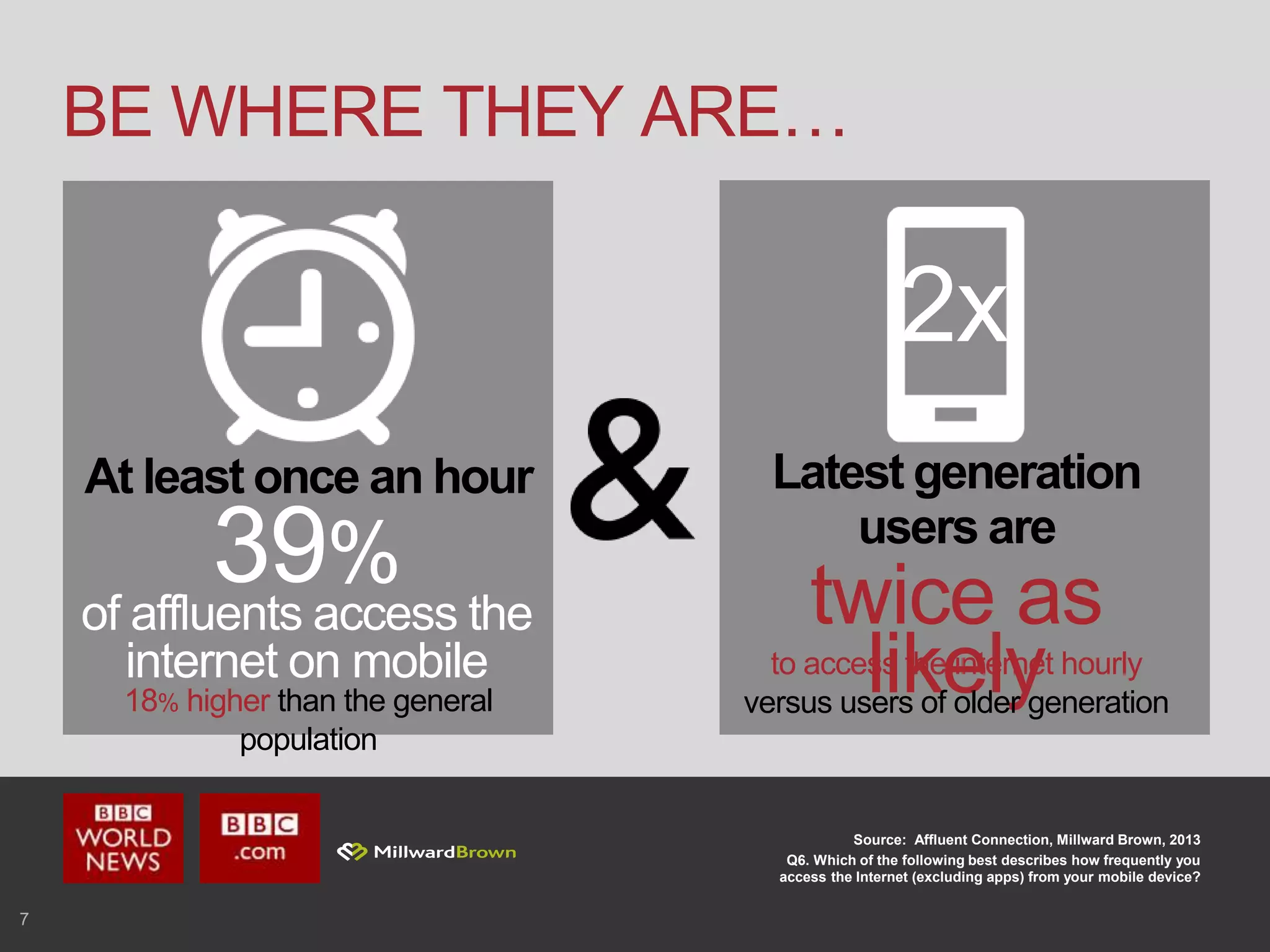

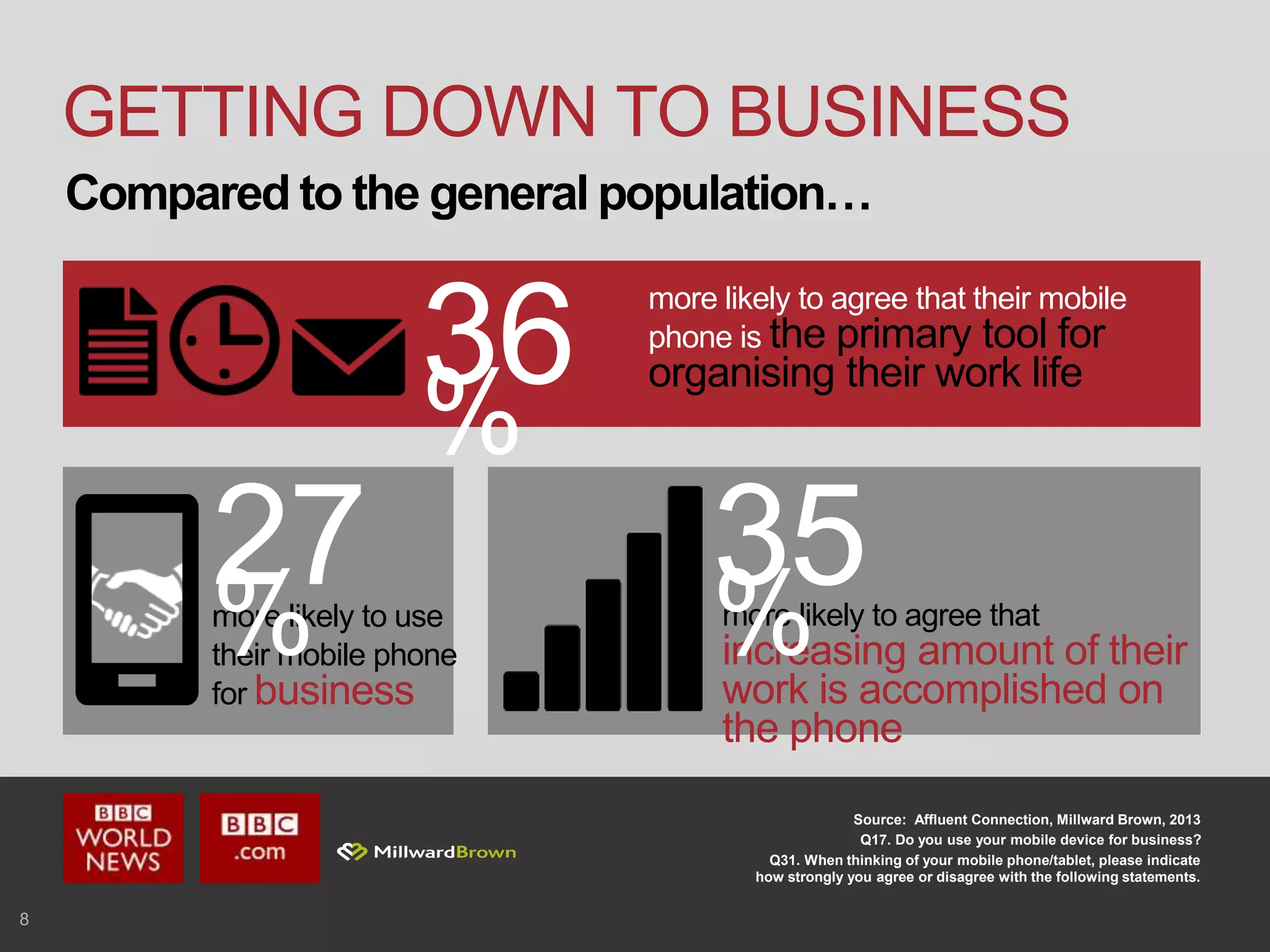

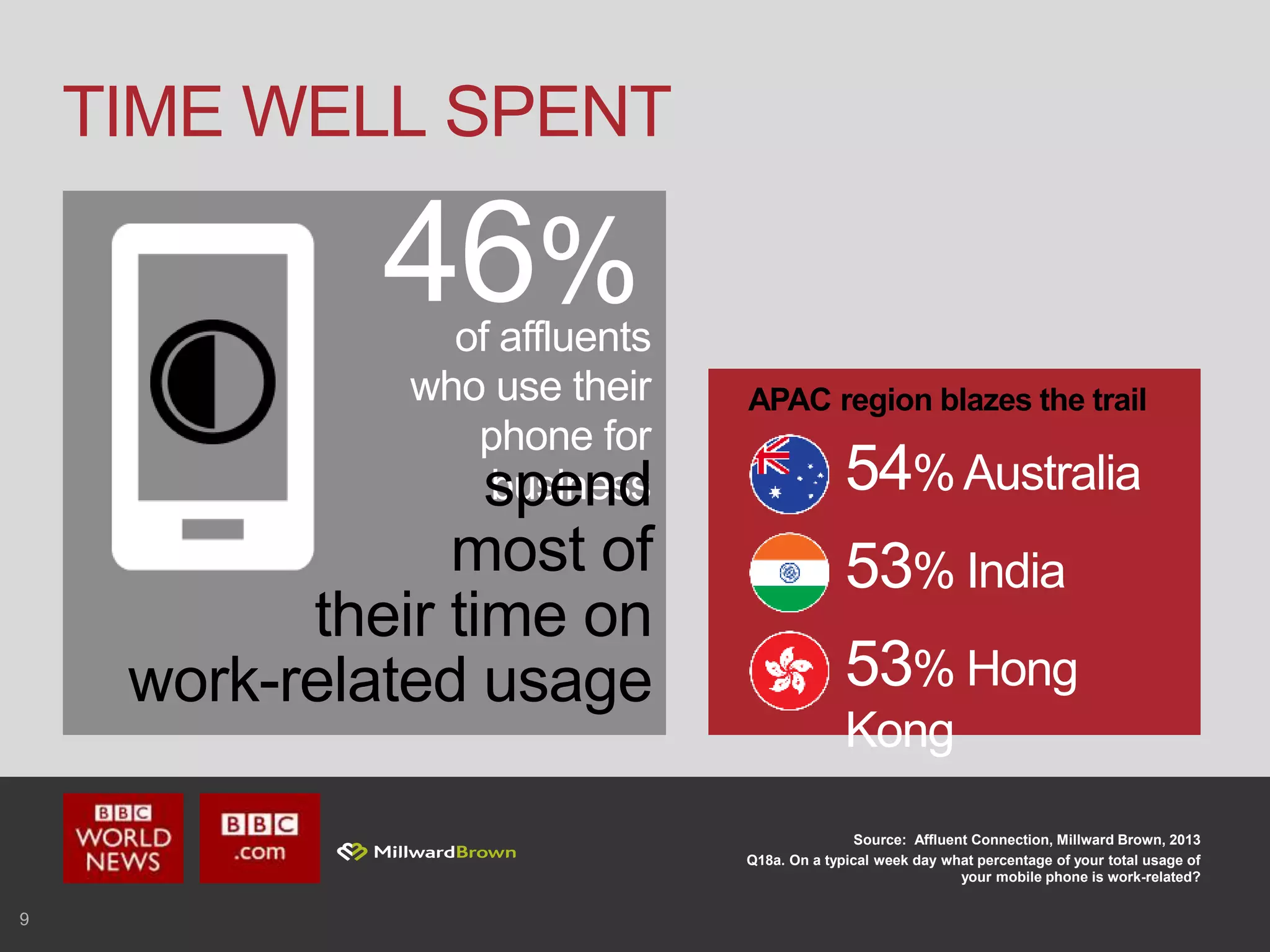

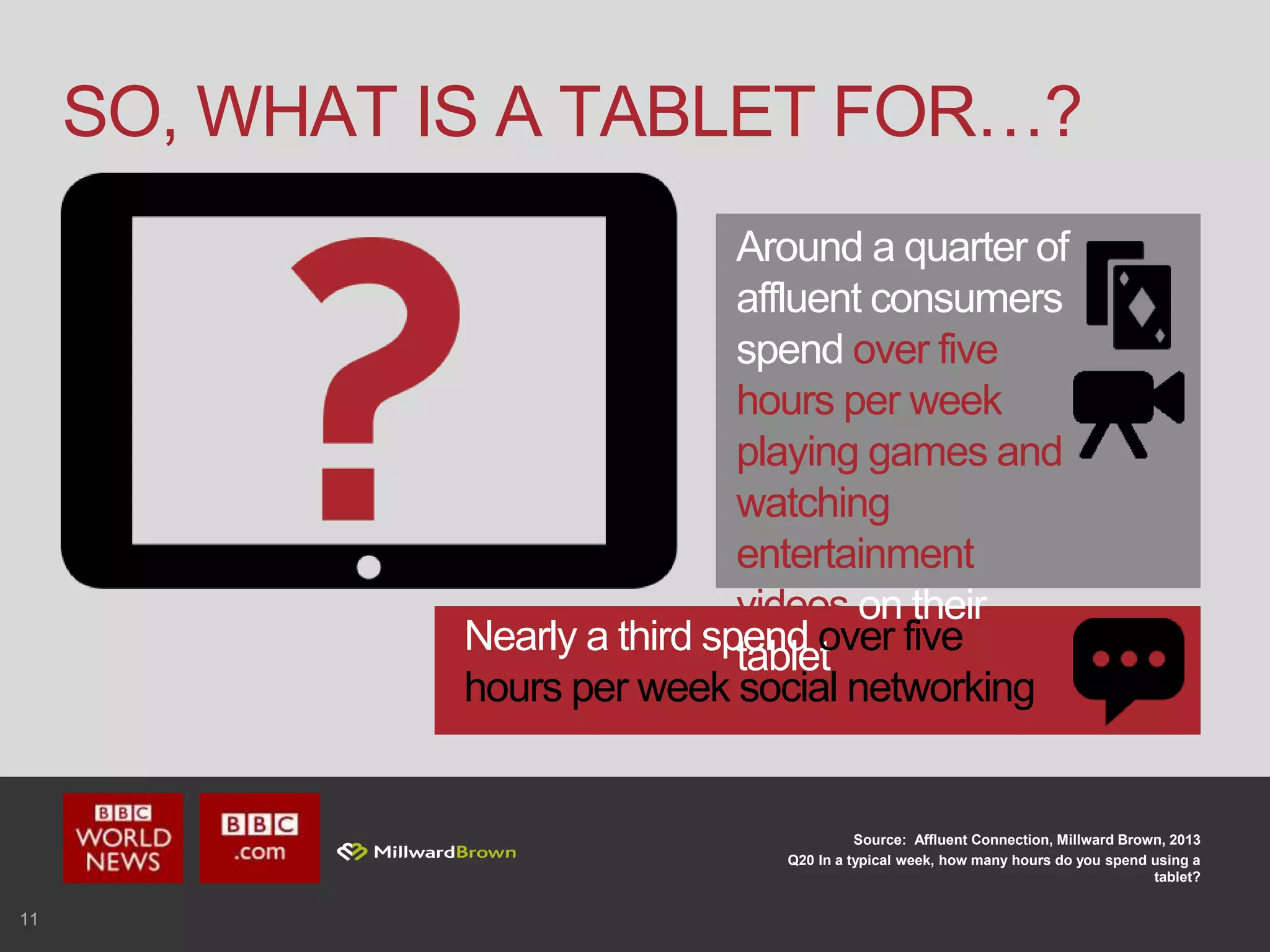

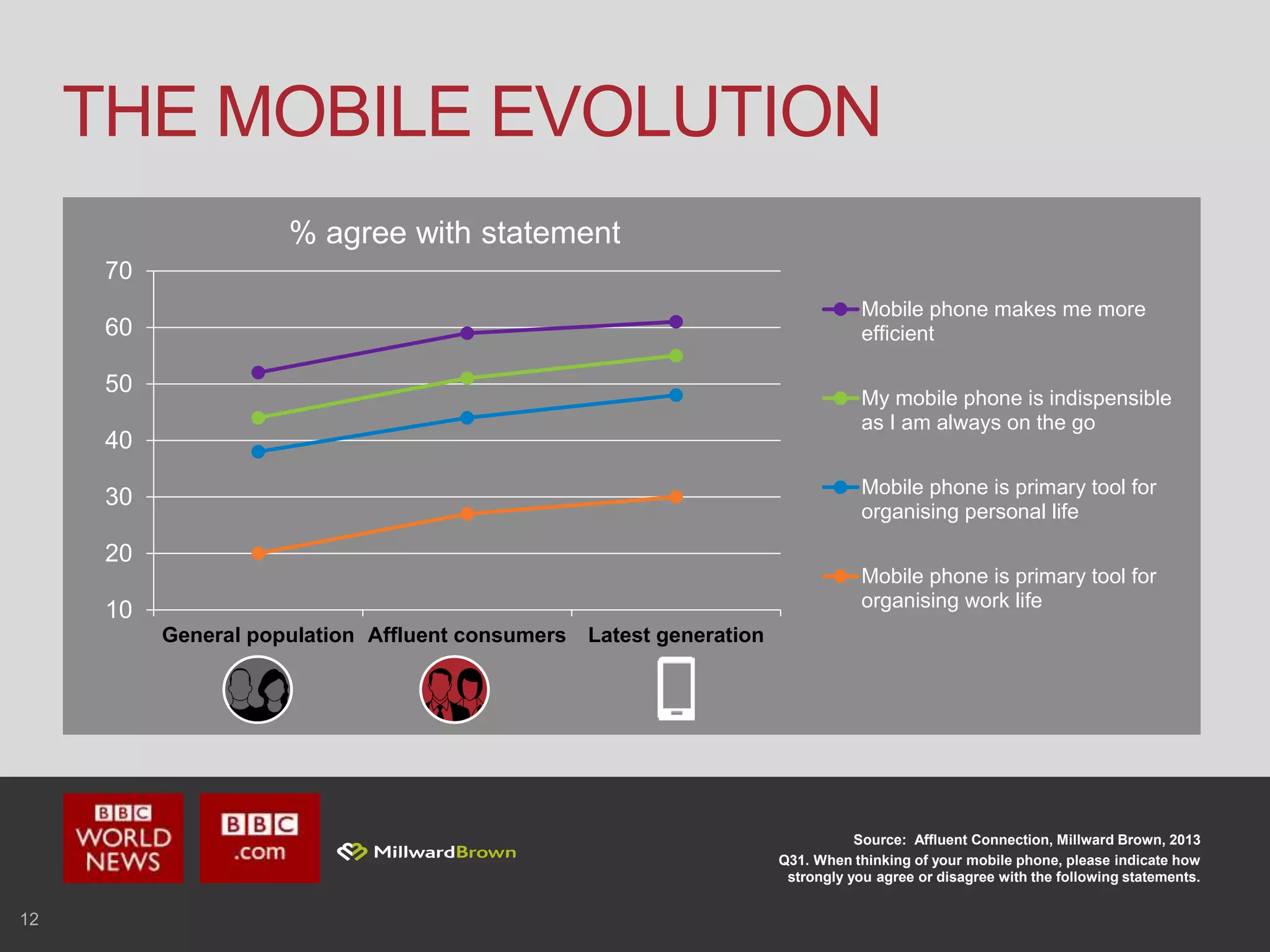

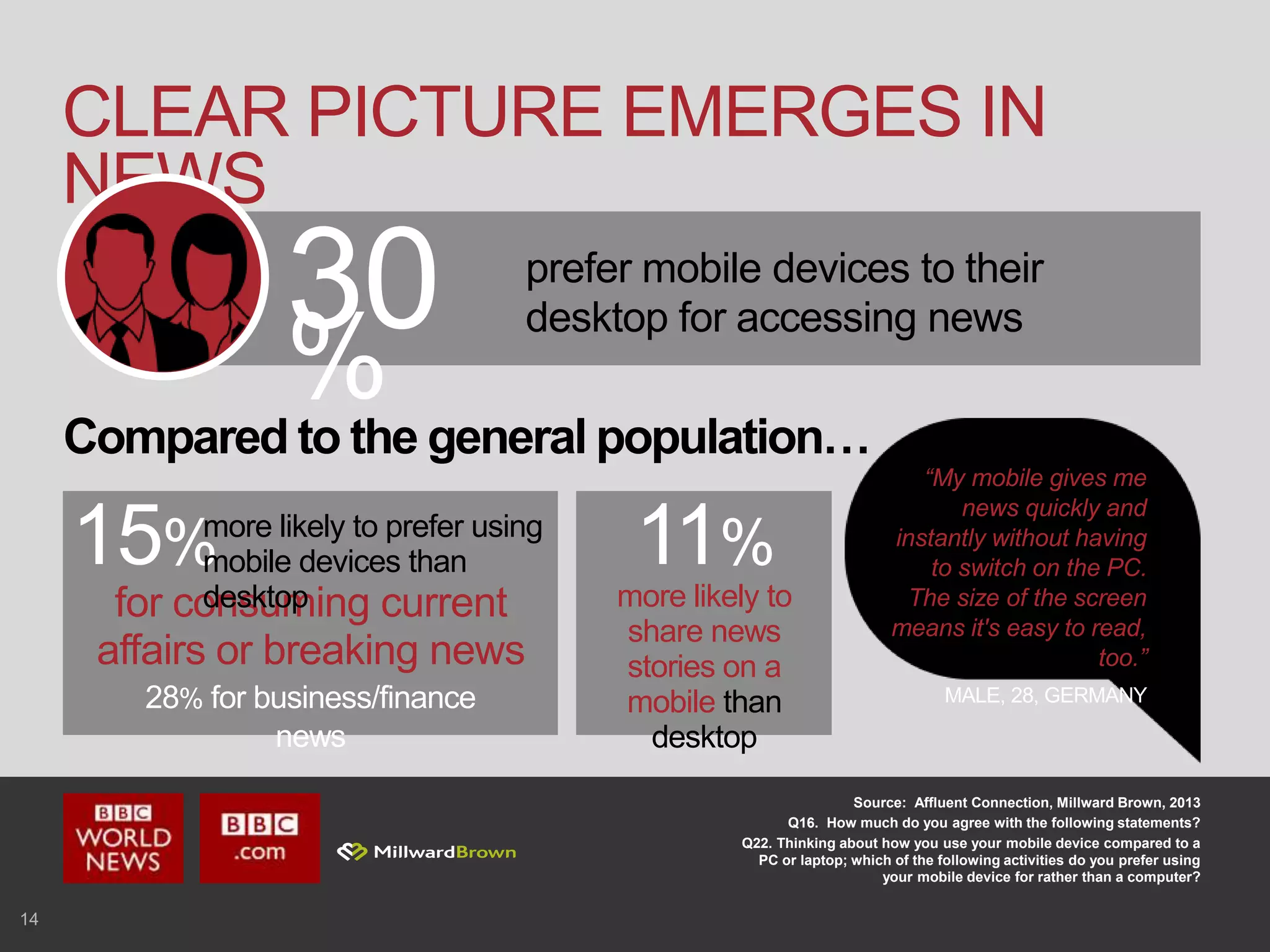

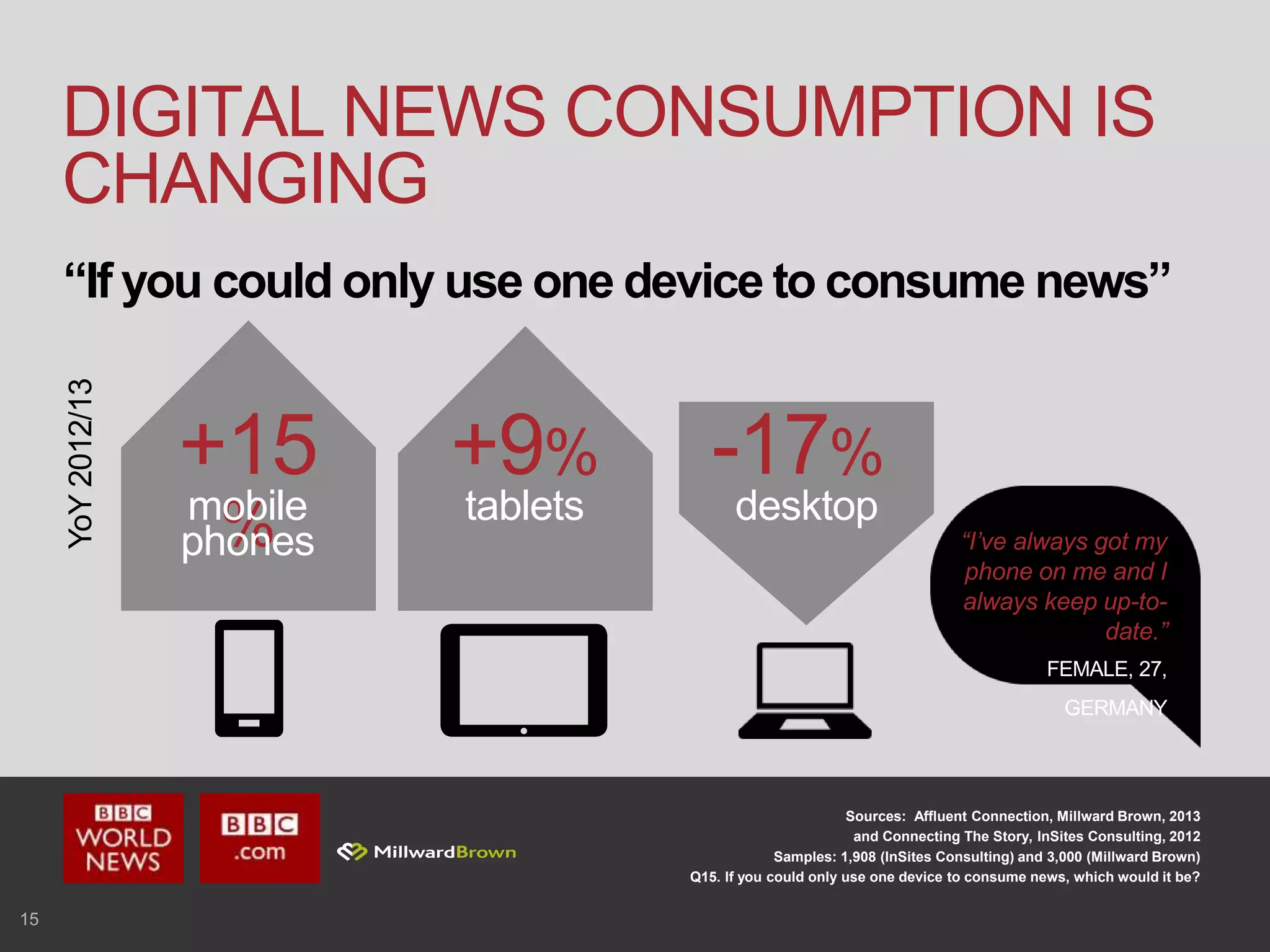

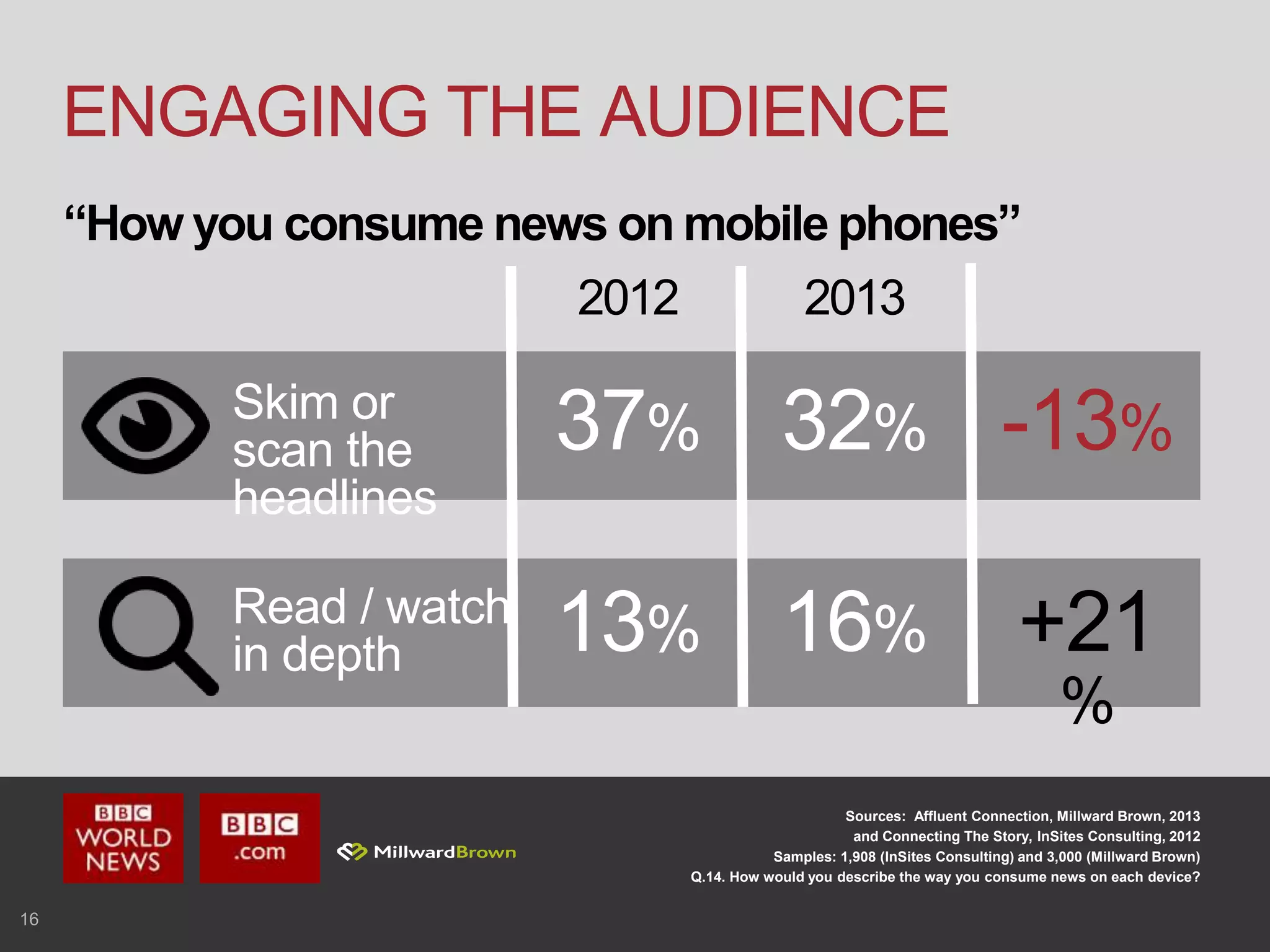

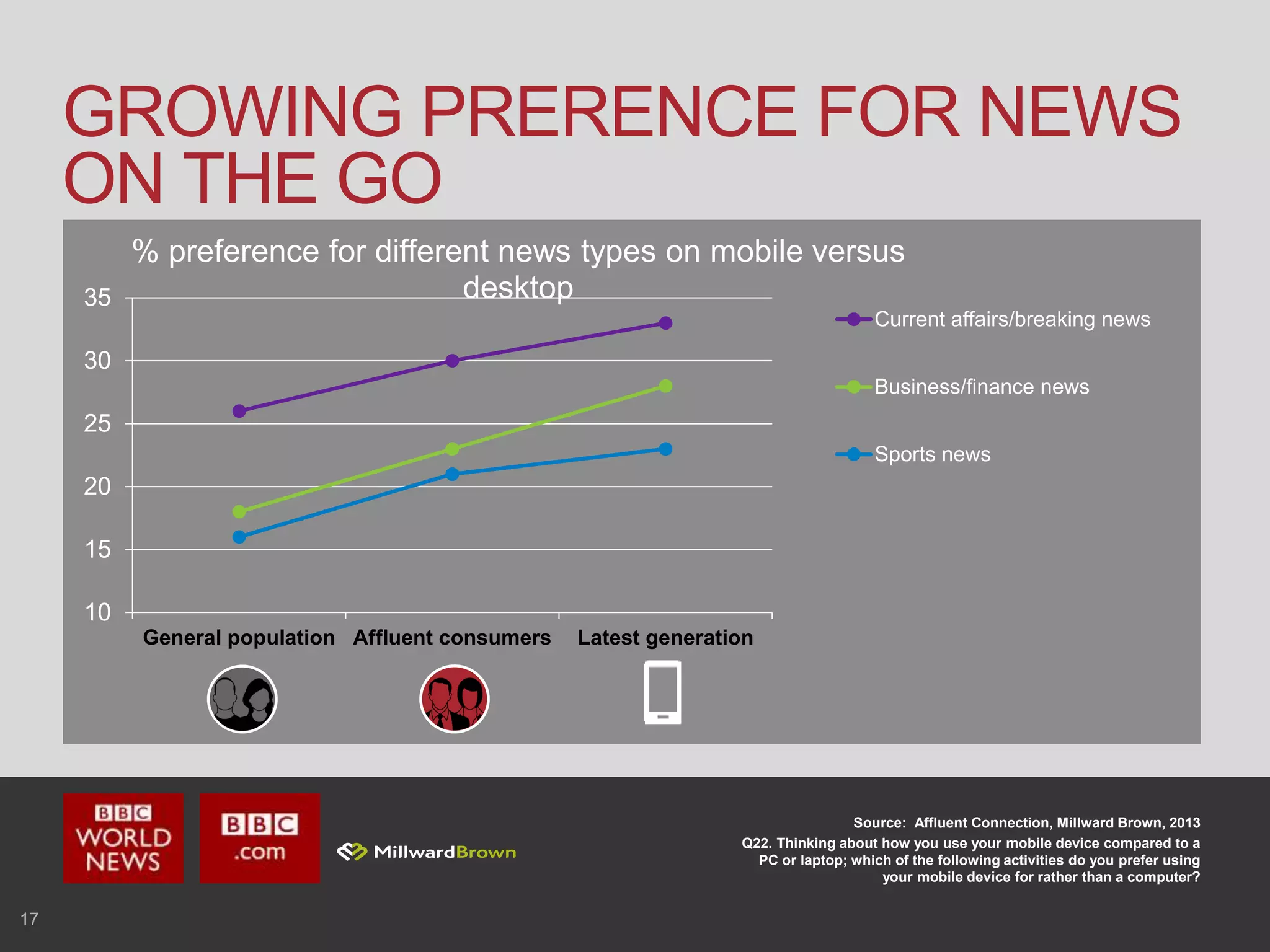

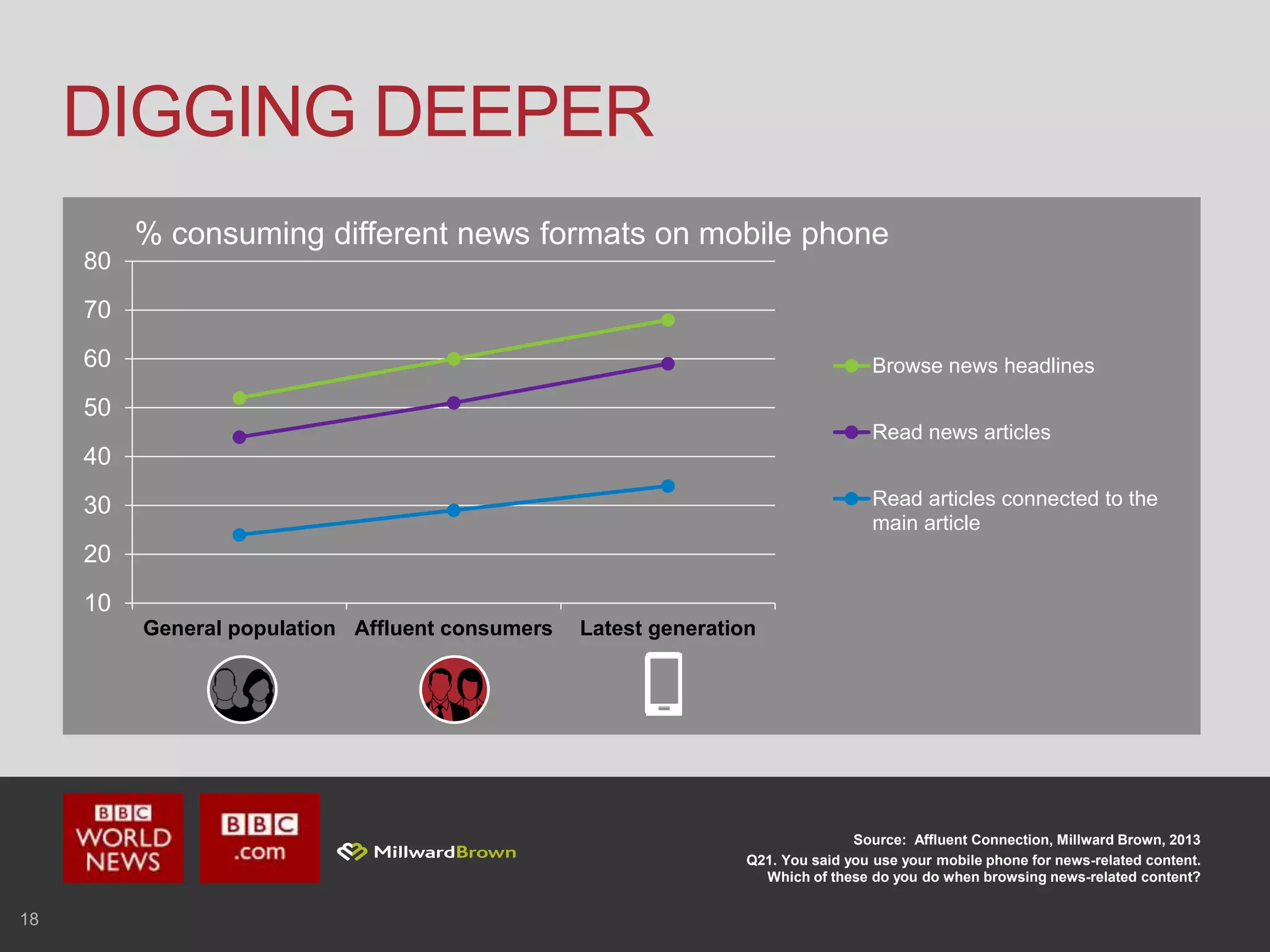

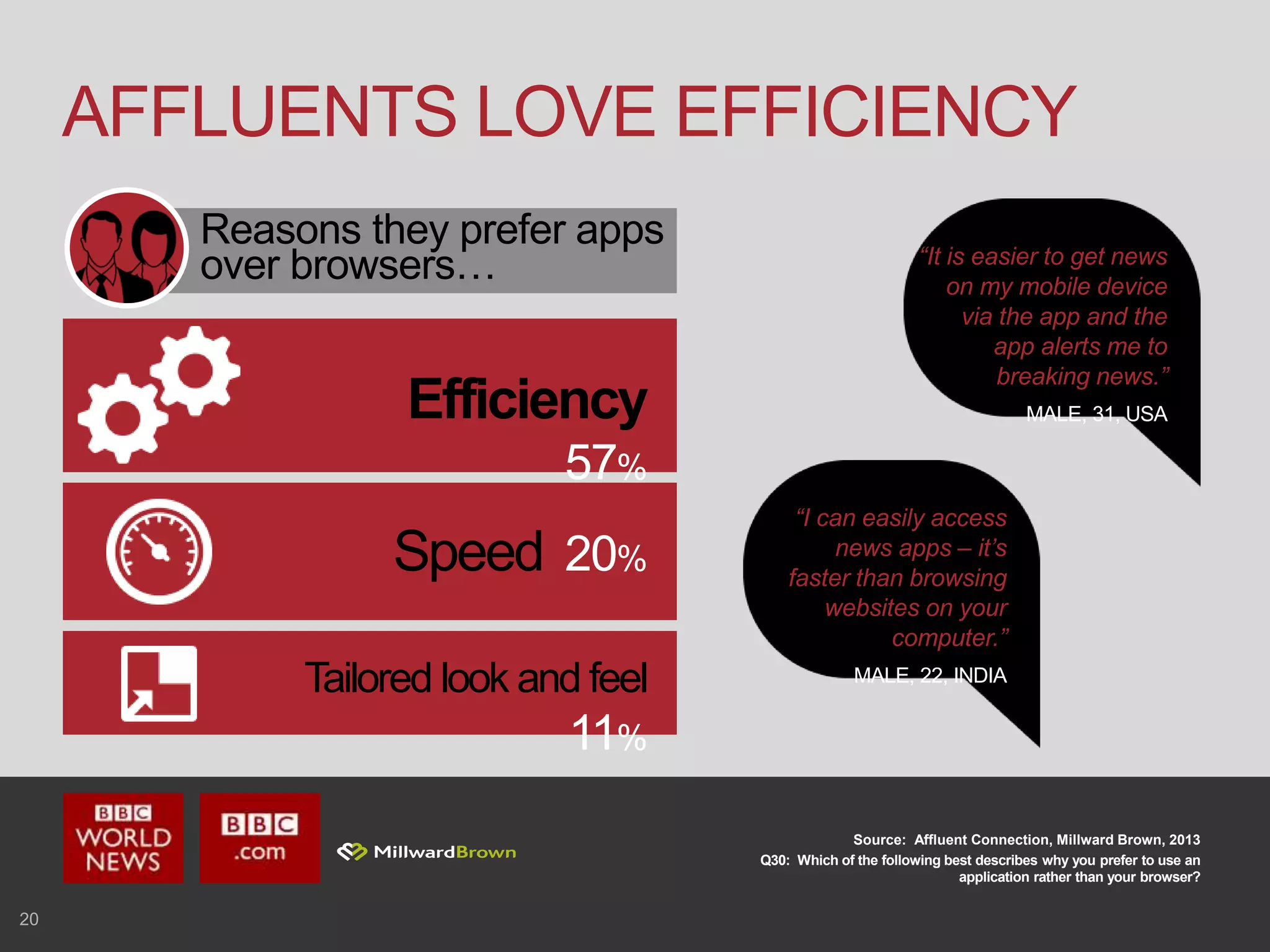

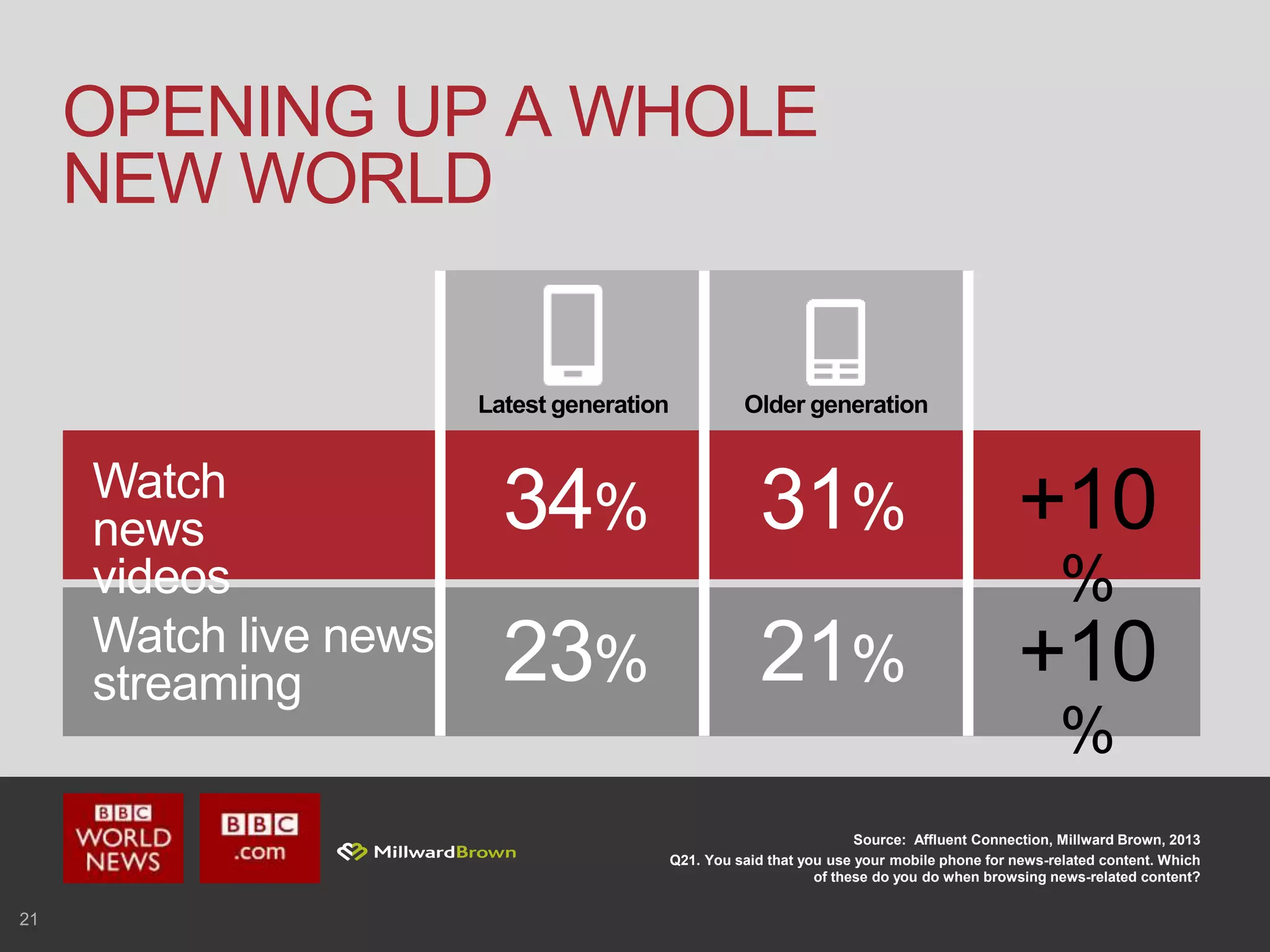

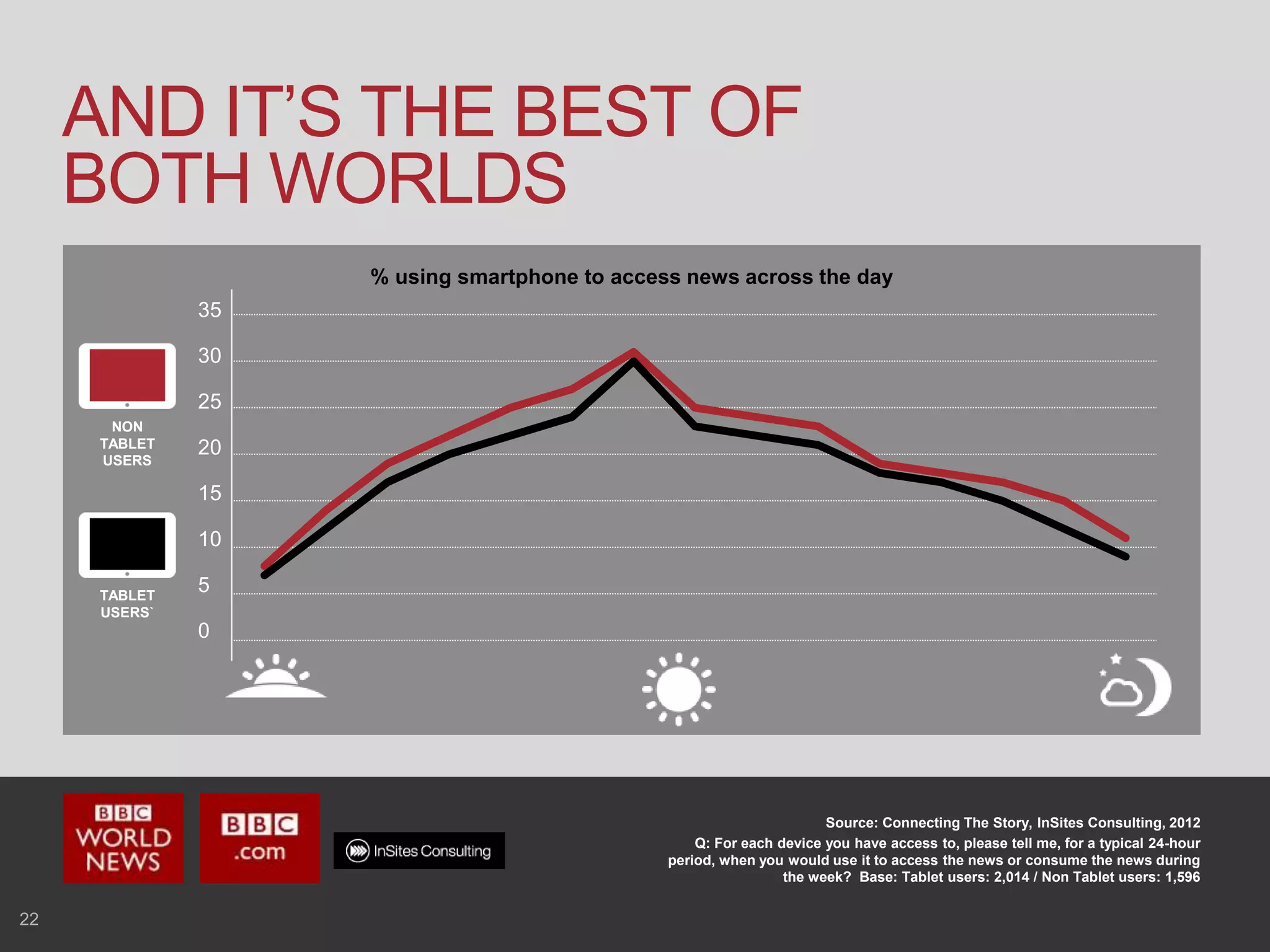

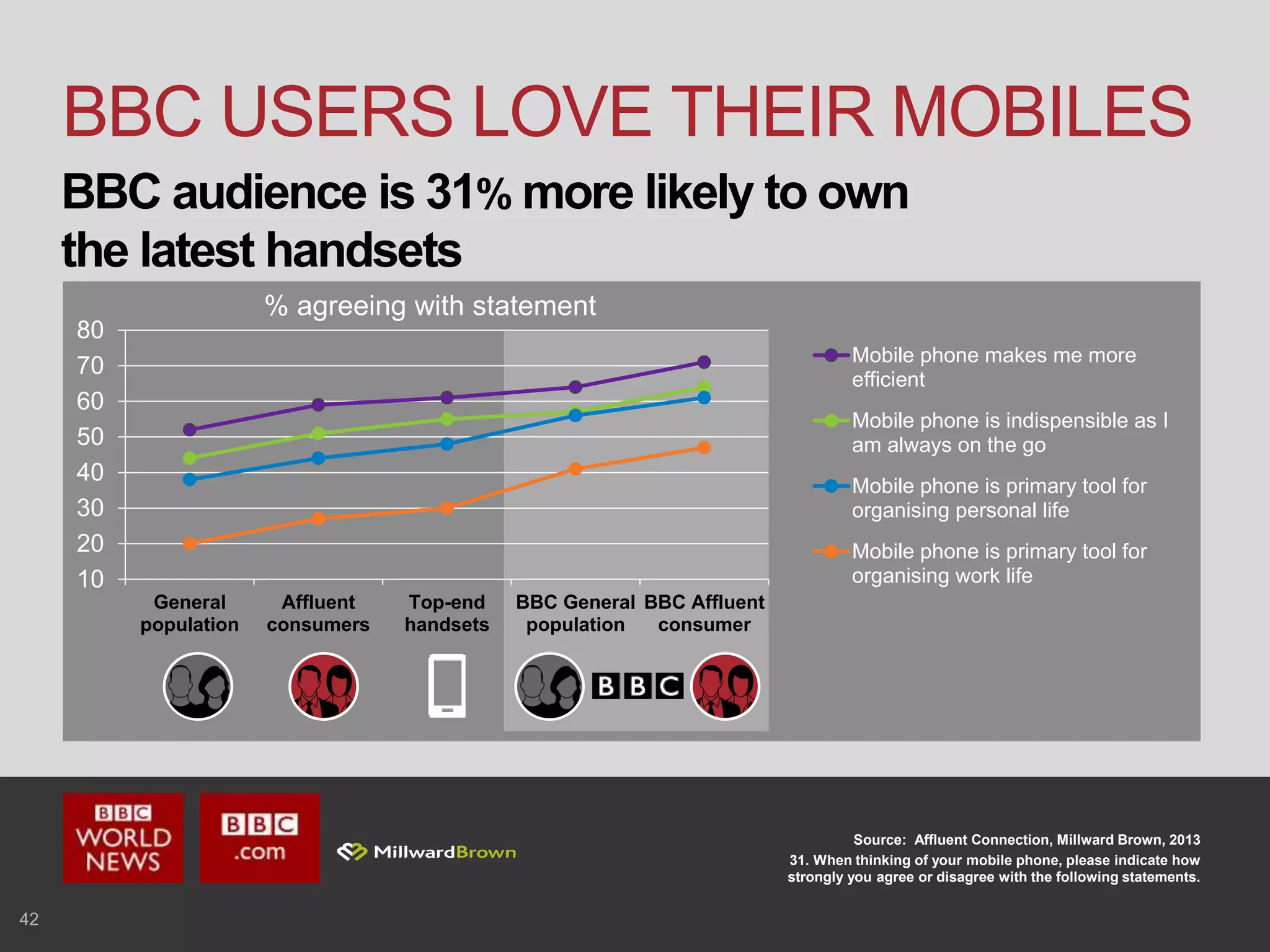

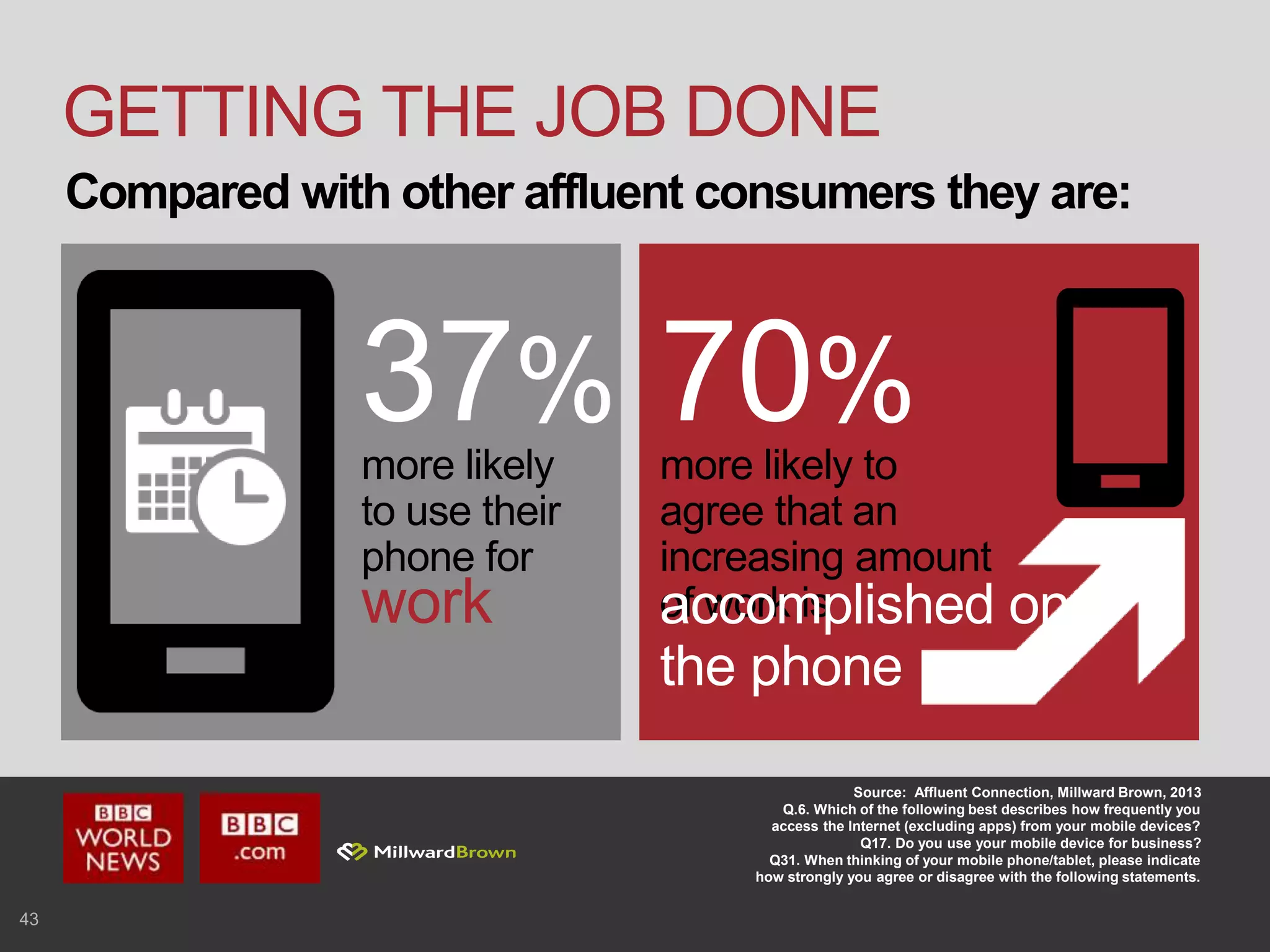

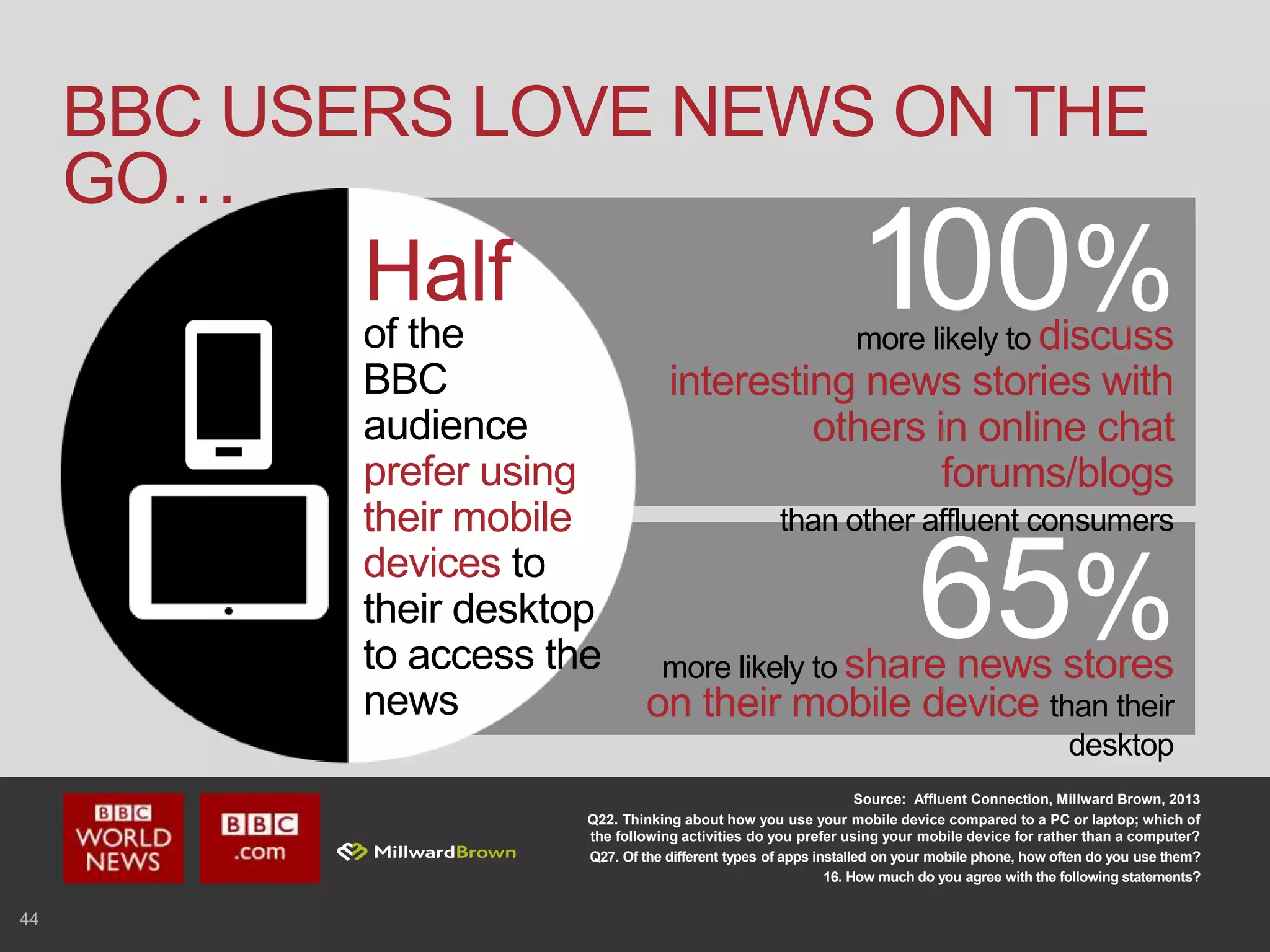

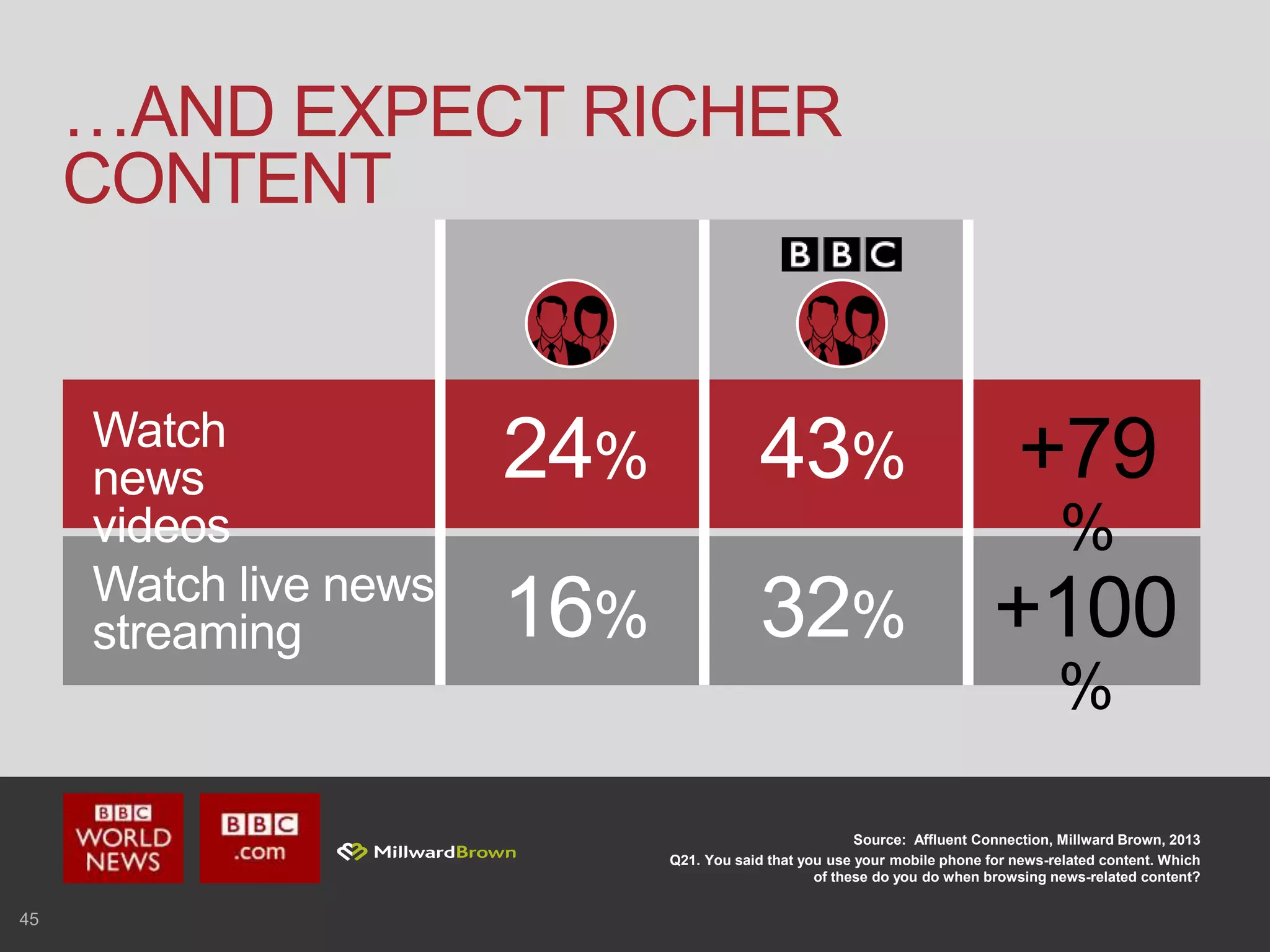

1. The document analyzes data from a study on smartphone and tablet usage among affluent consumers in several countries. It finds that affluent consumers use their mobile devices extensively and prefer them over desktop computers for many tasks like accessing news, social media, and work-related activities.

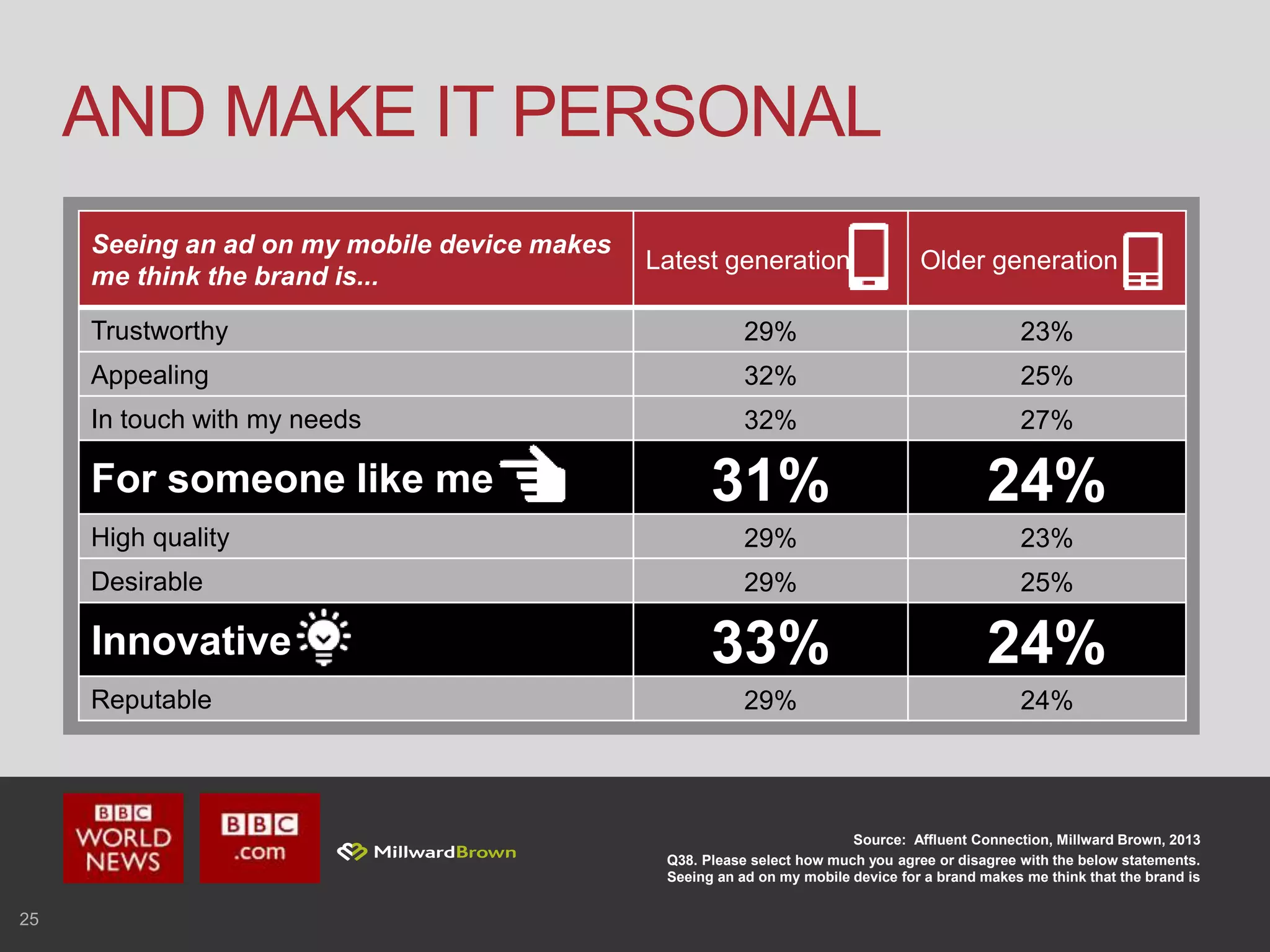

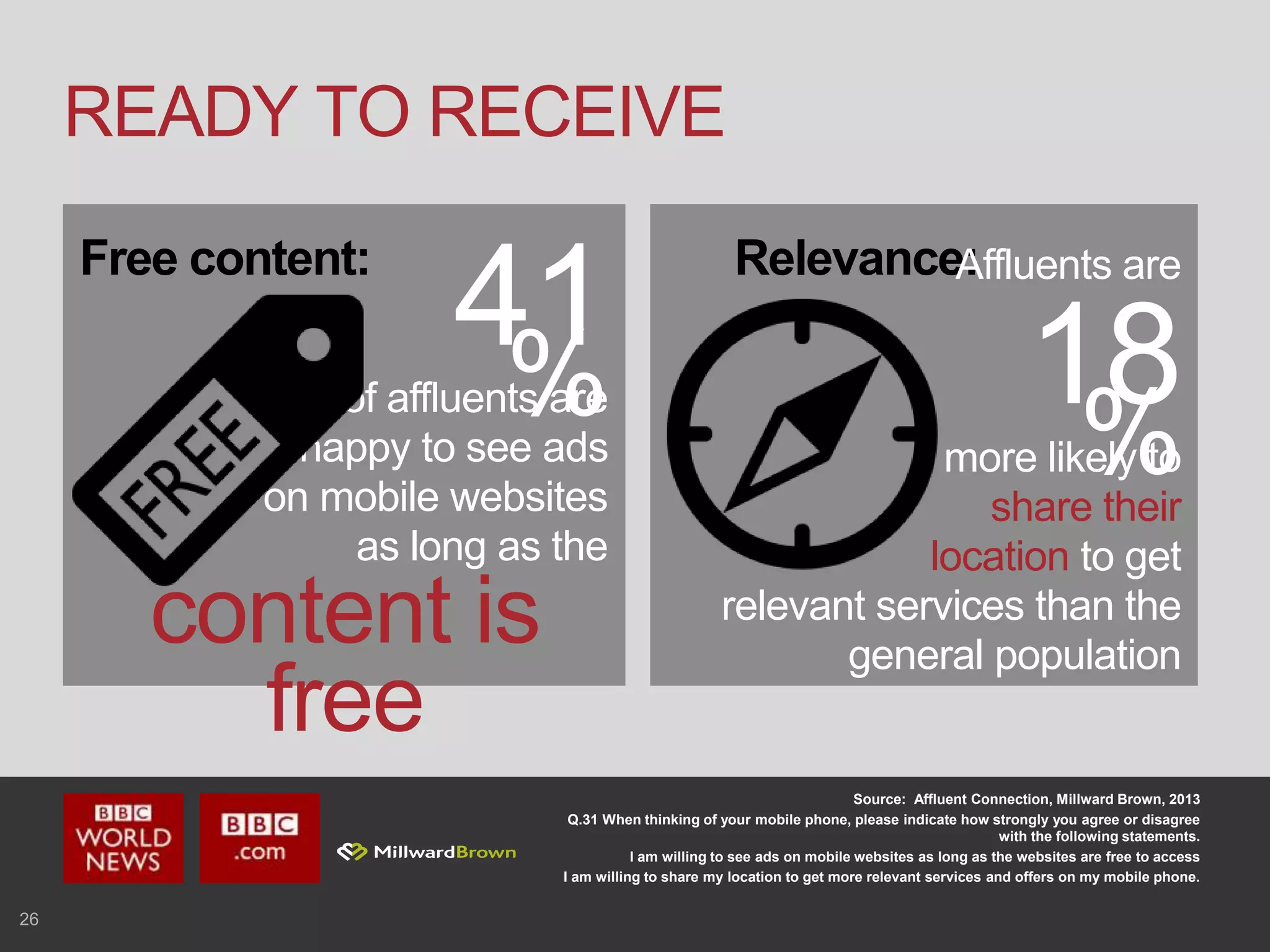

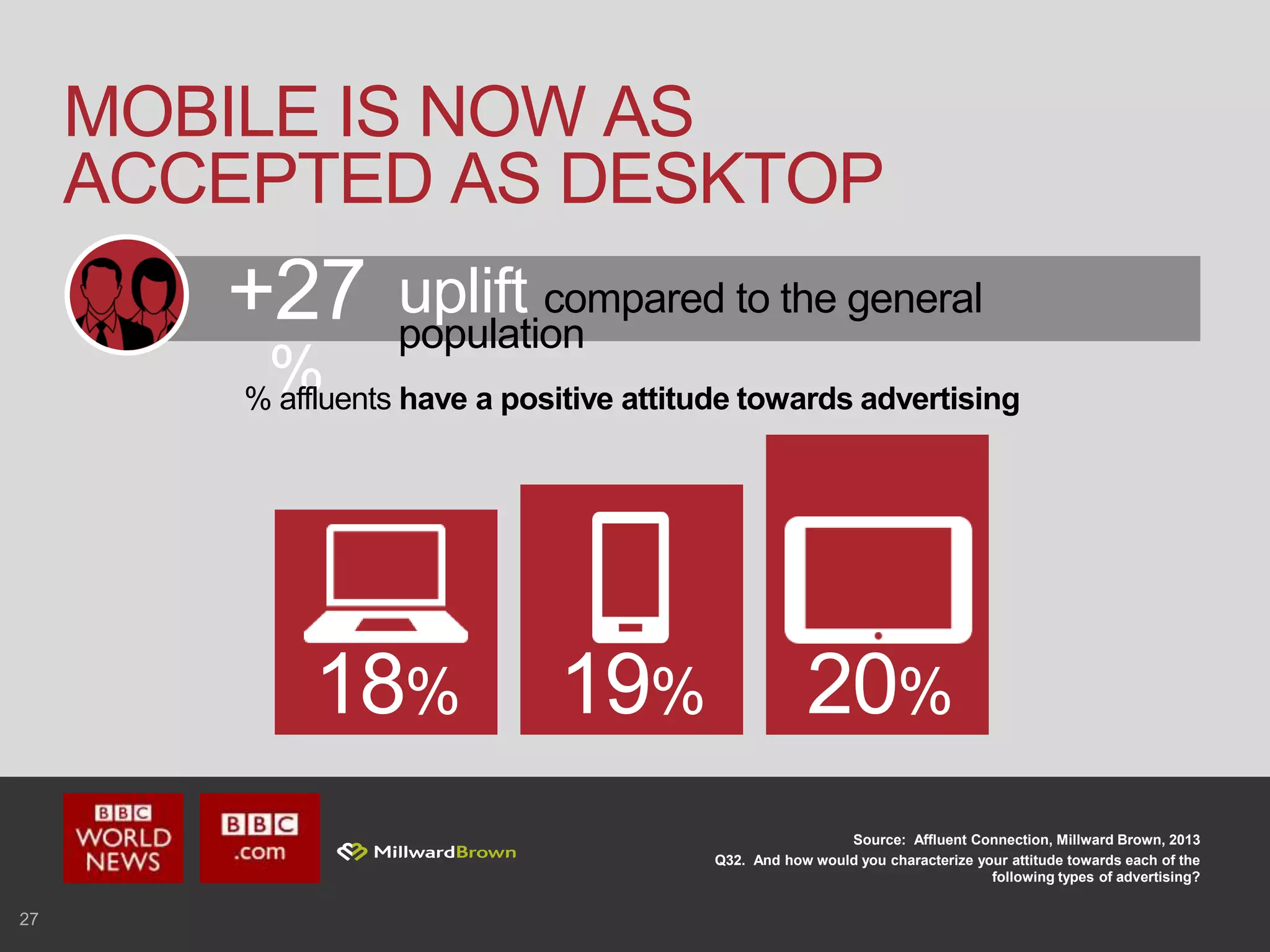

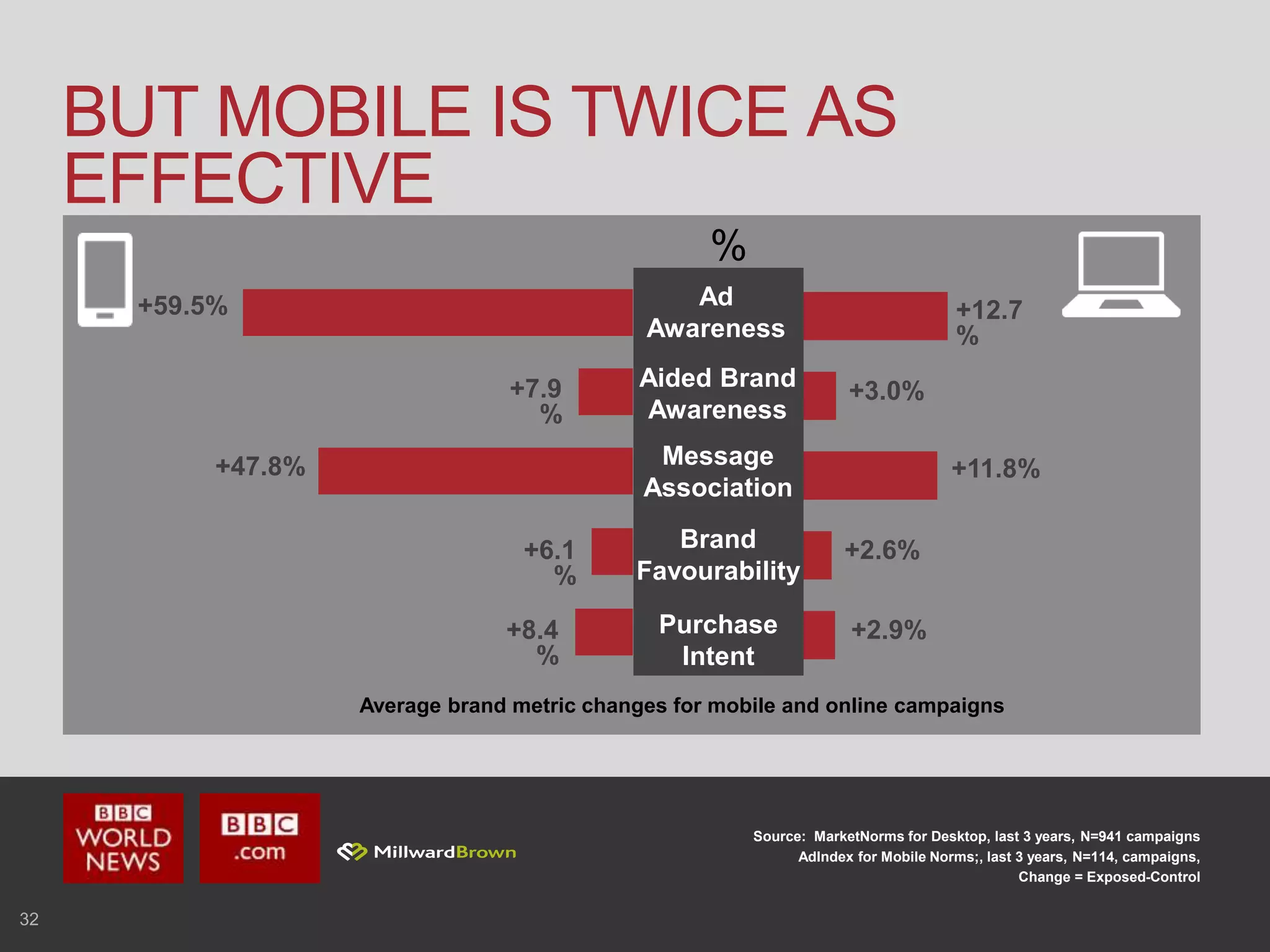

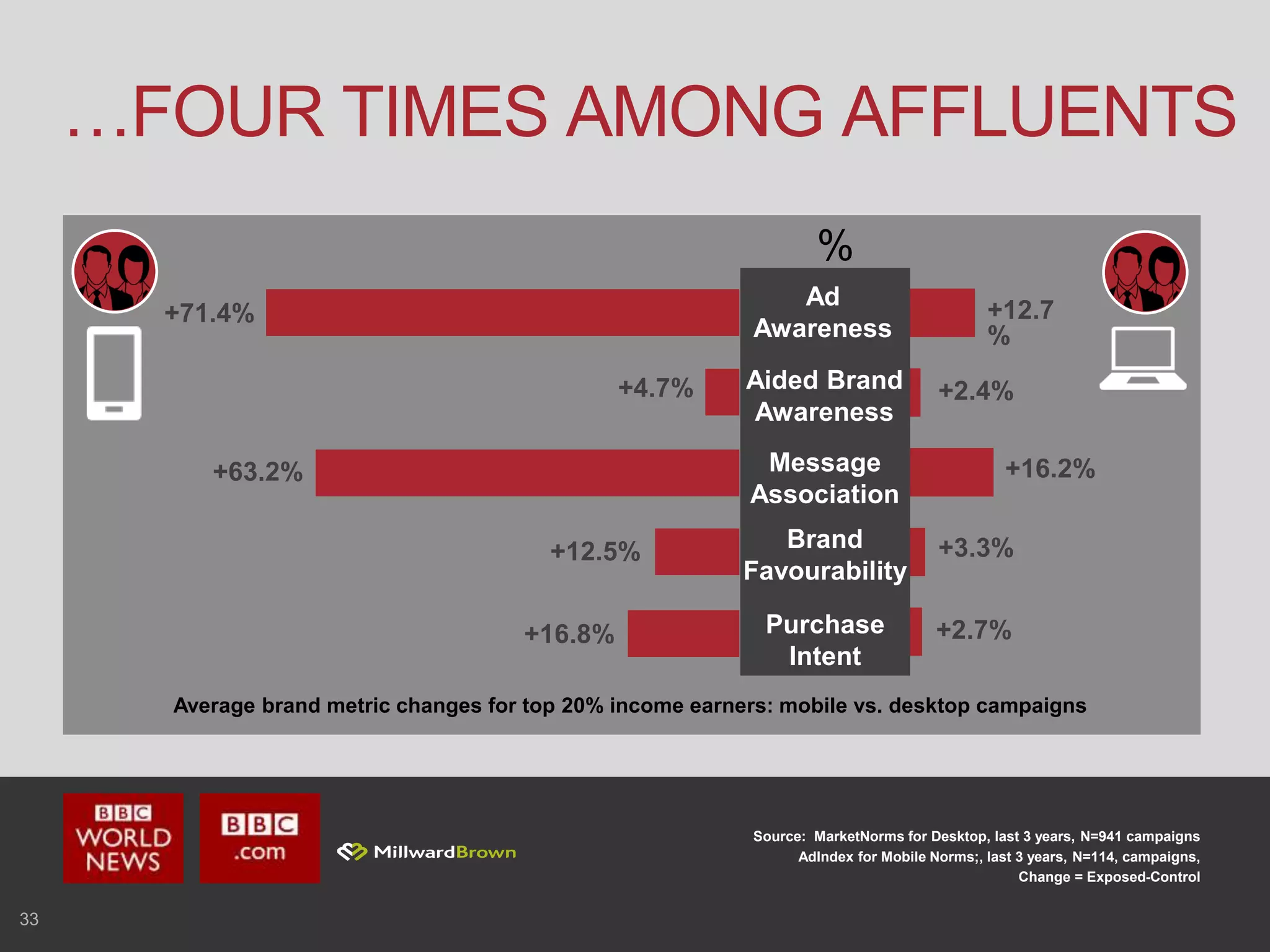

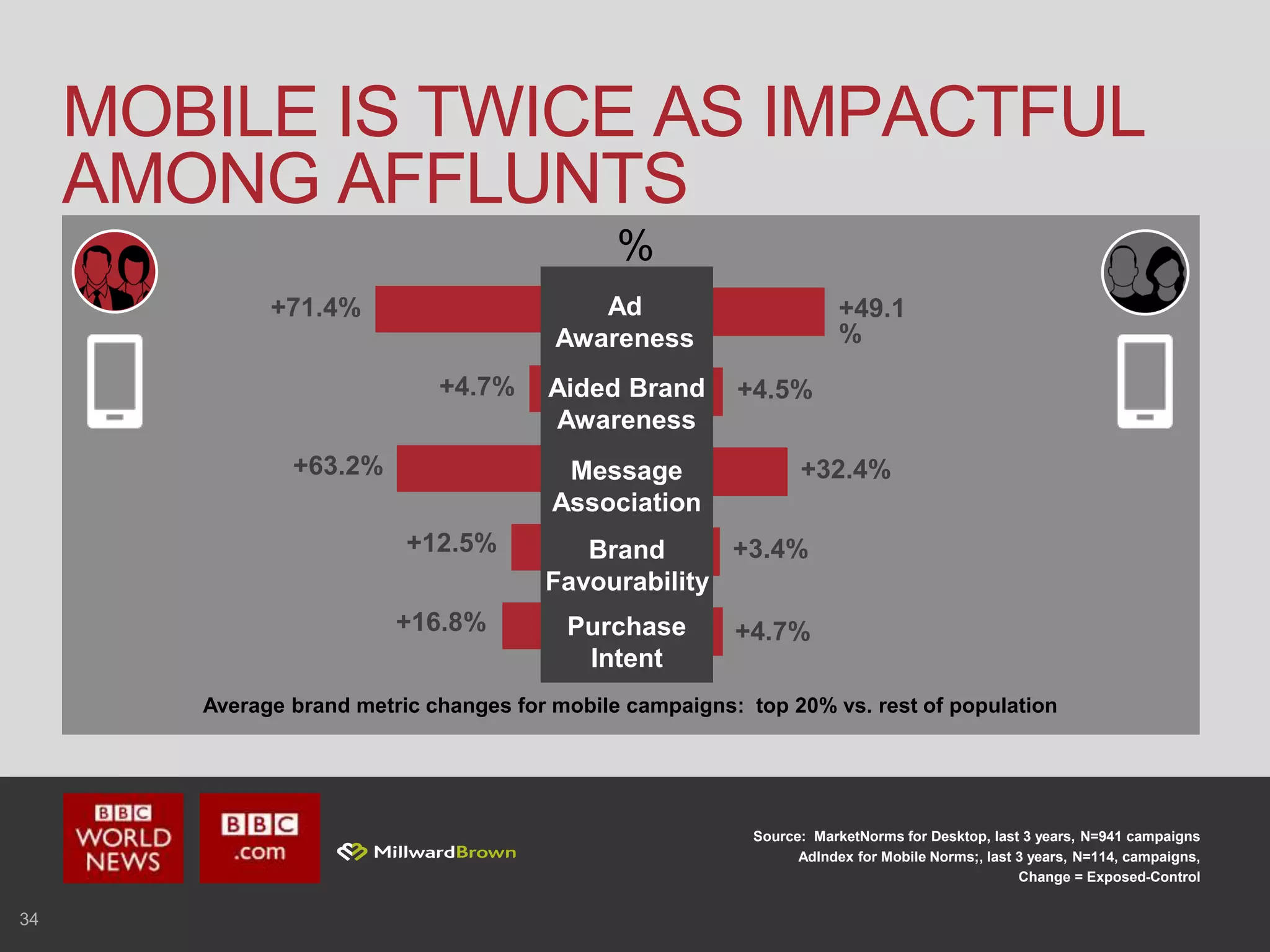

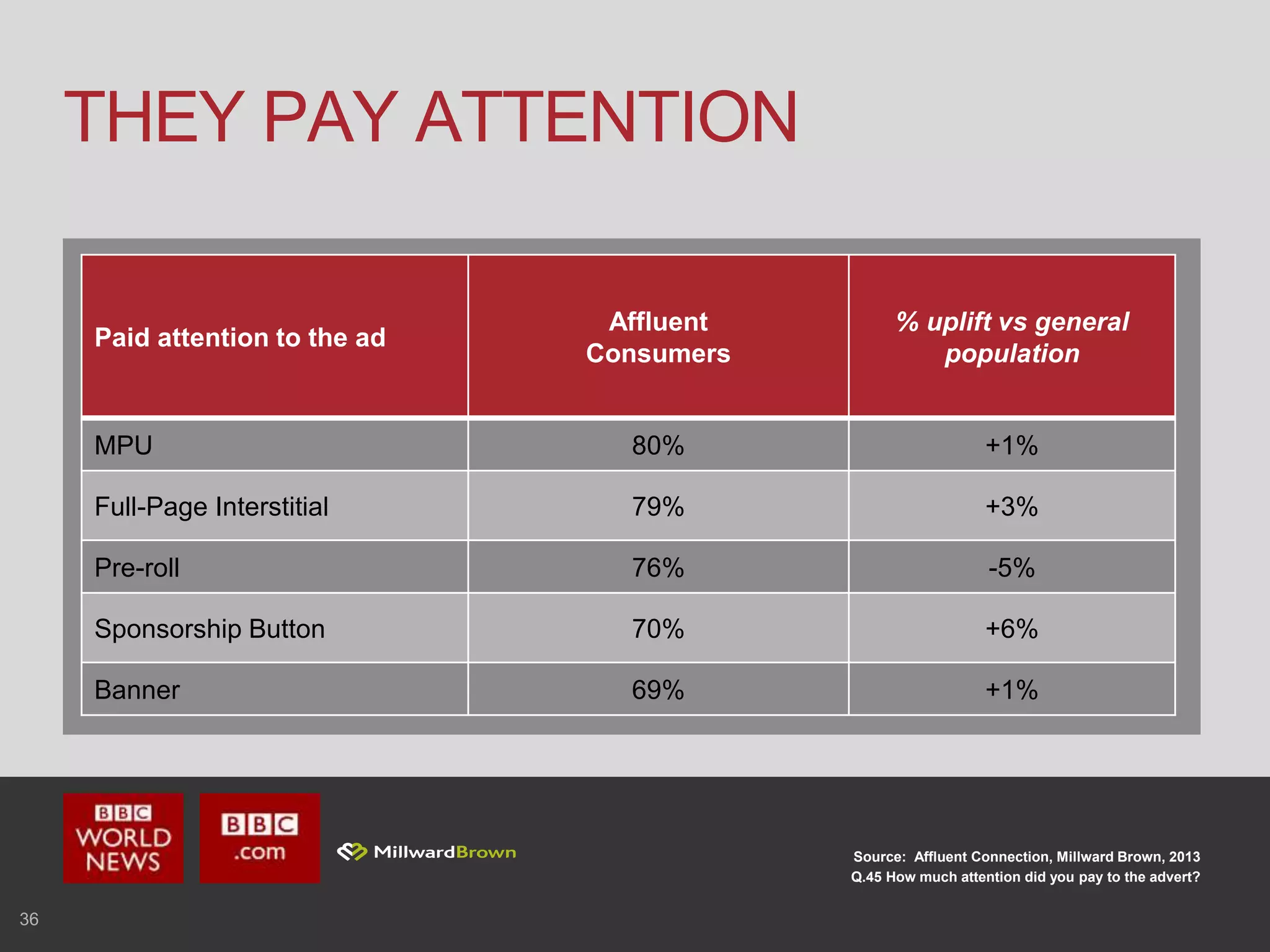

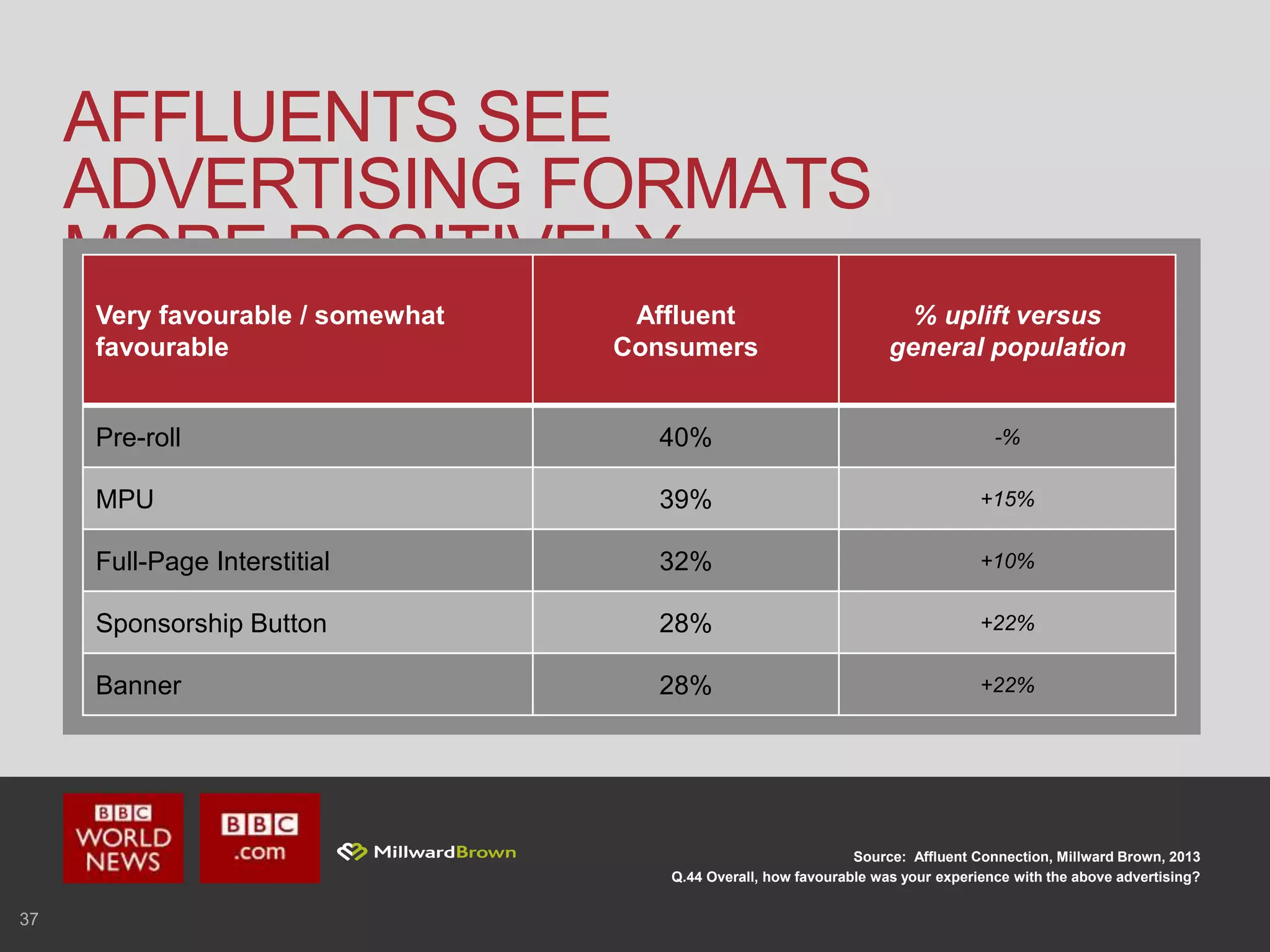

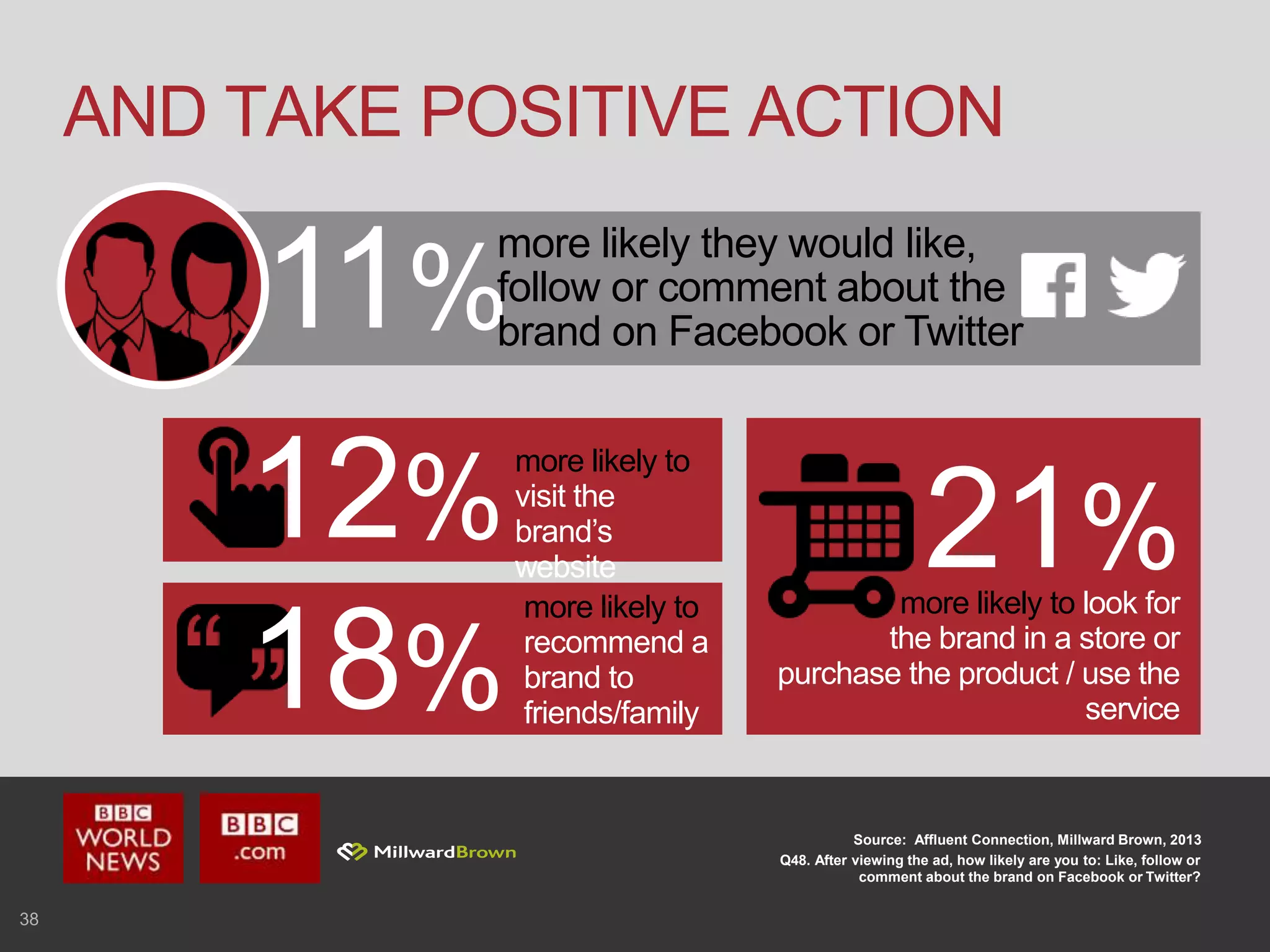

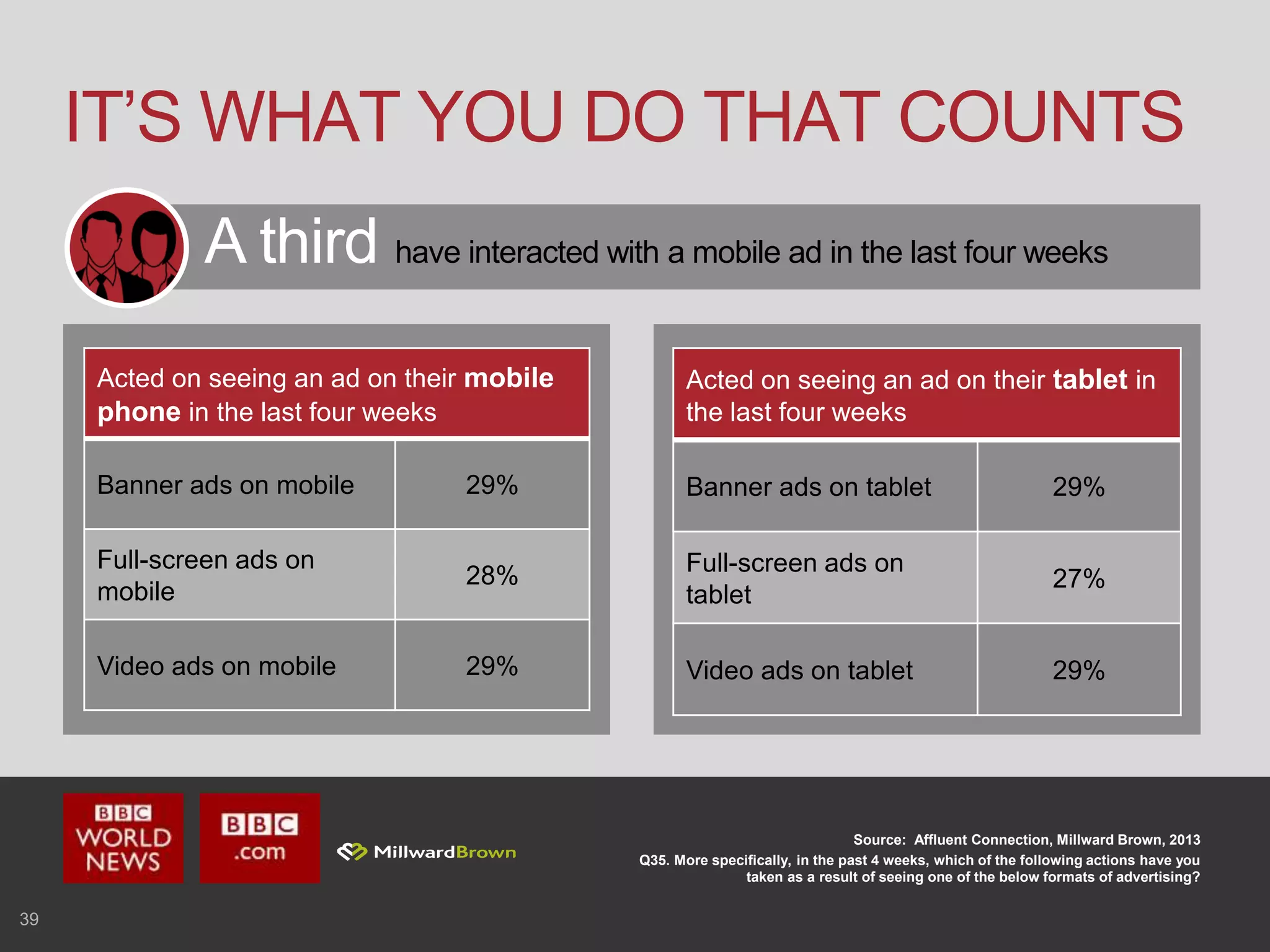

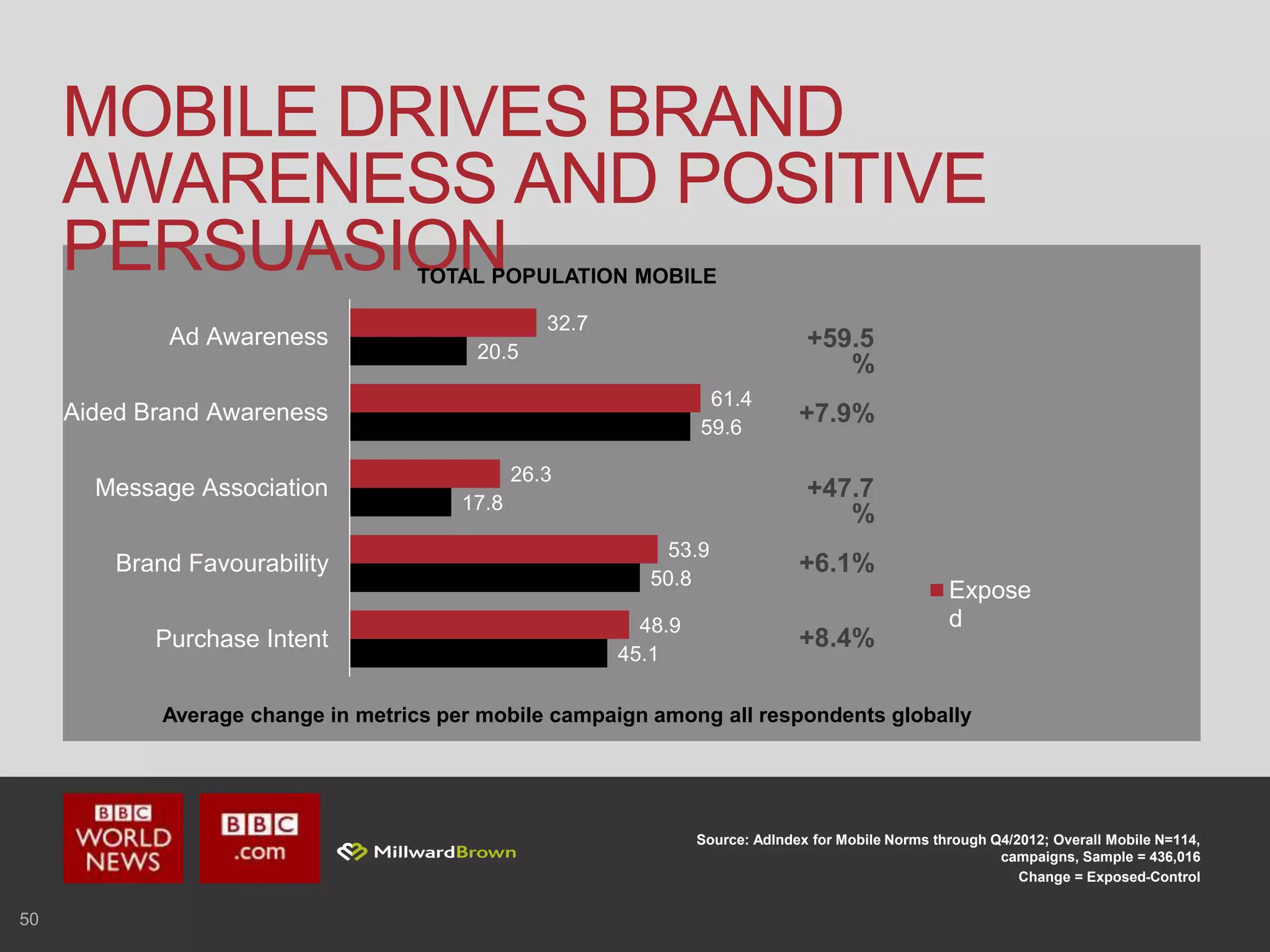

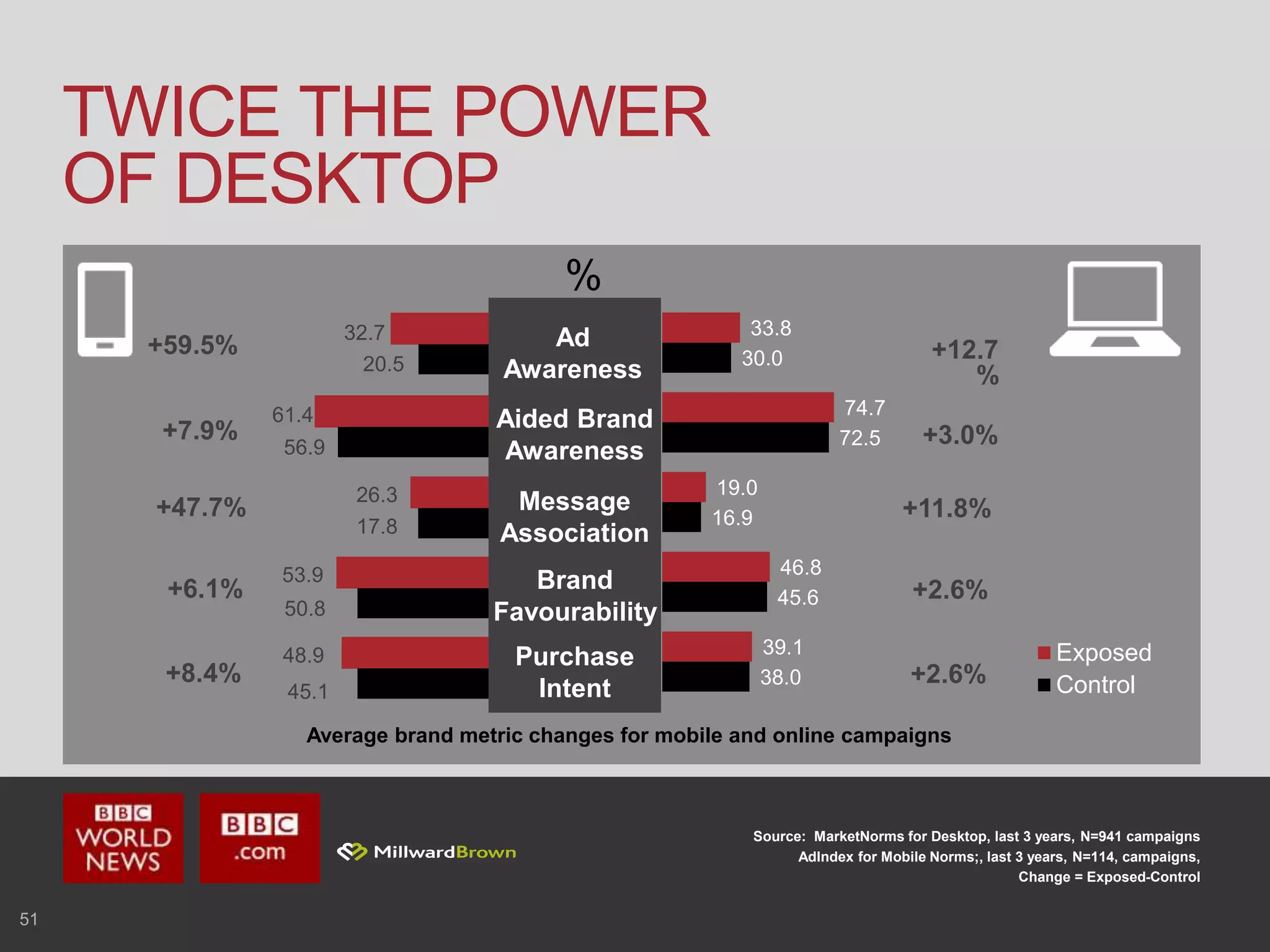

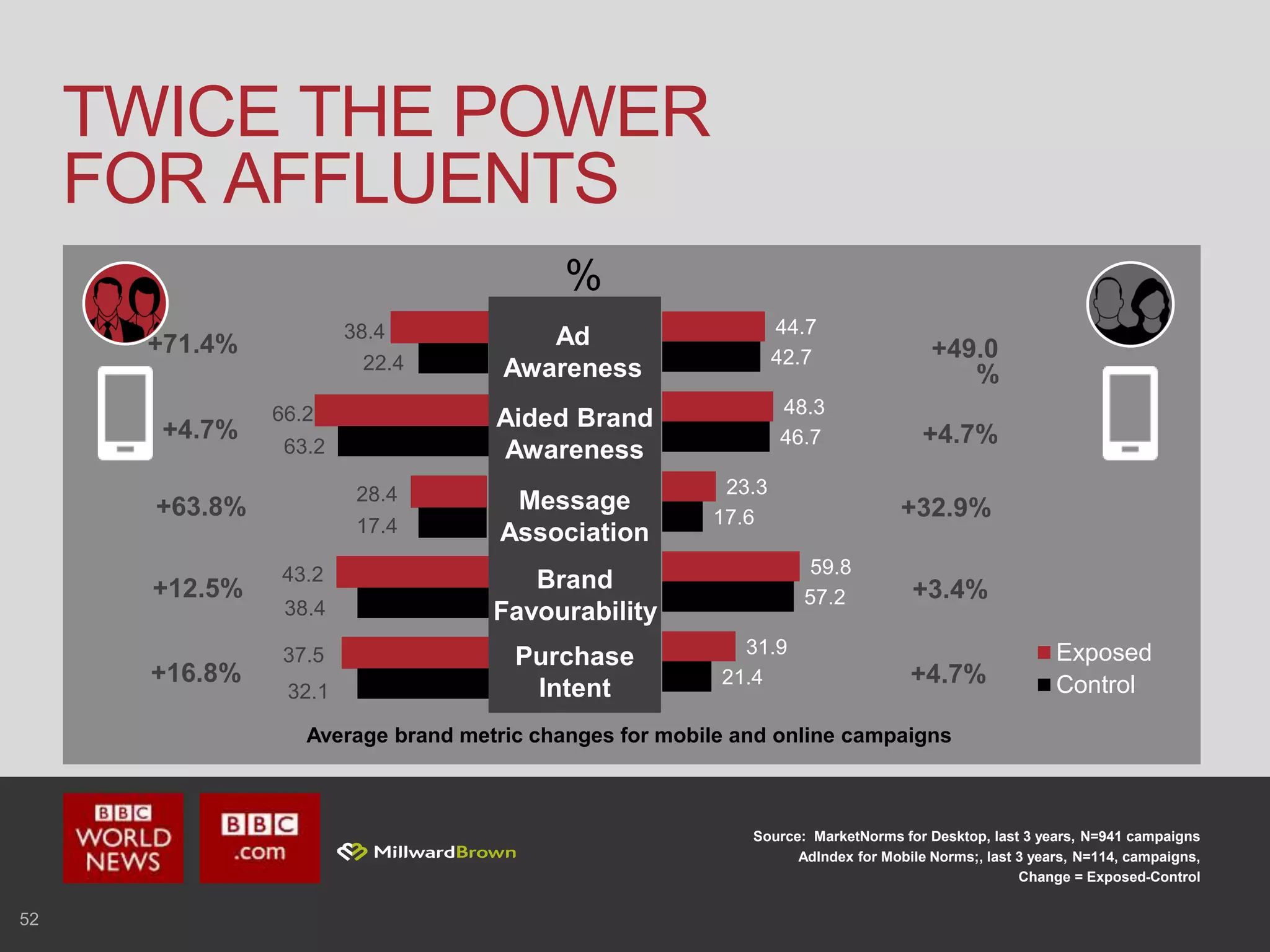

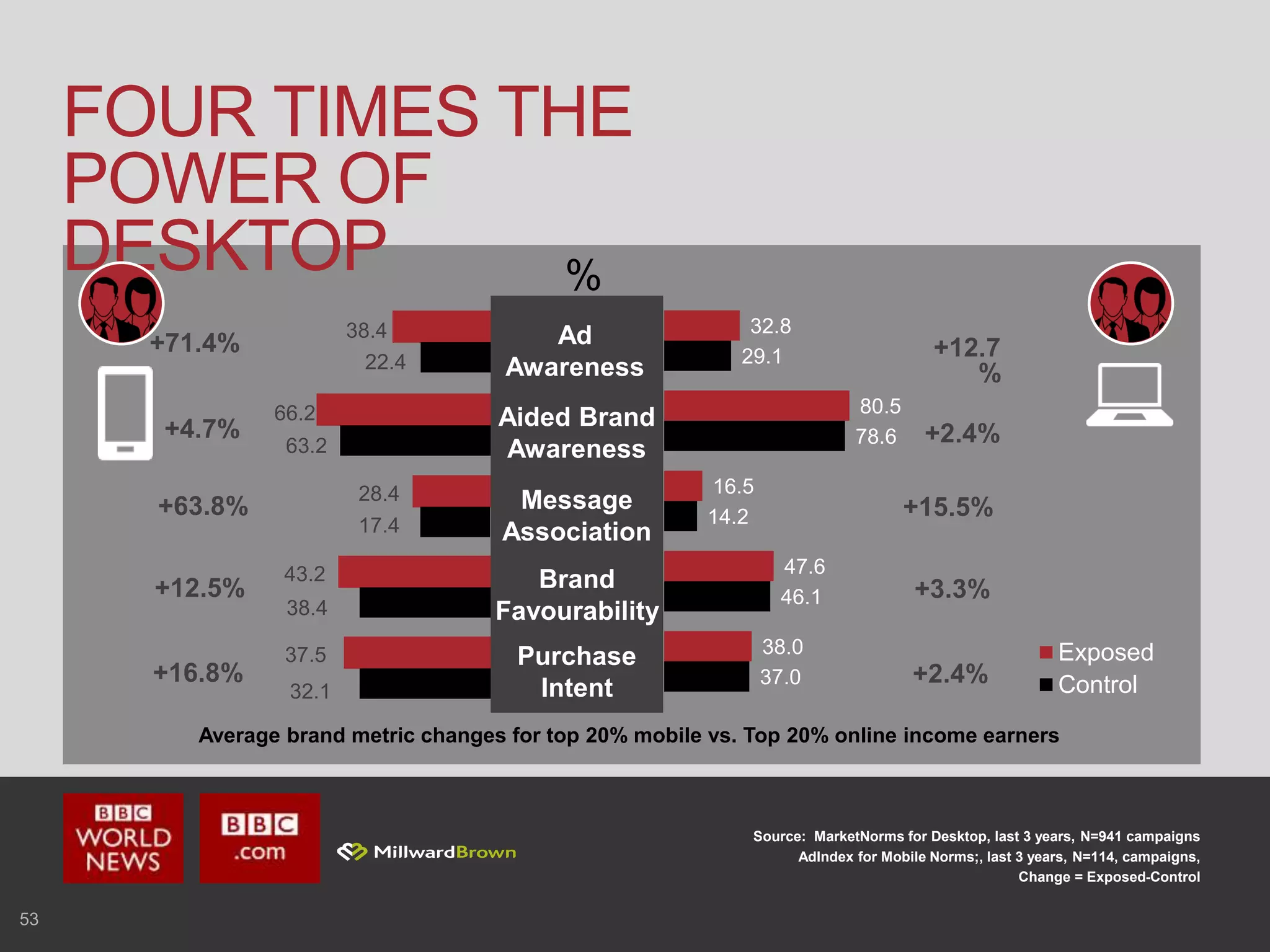

2. Affluent consumers, especially those with the latest generation of devices, are highly receptive to mobile advertising. They are willing to see ads if it means accessing free content and services, and feel mobile ads can help brands appear modern, innovative, and in touch with their needs.

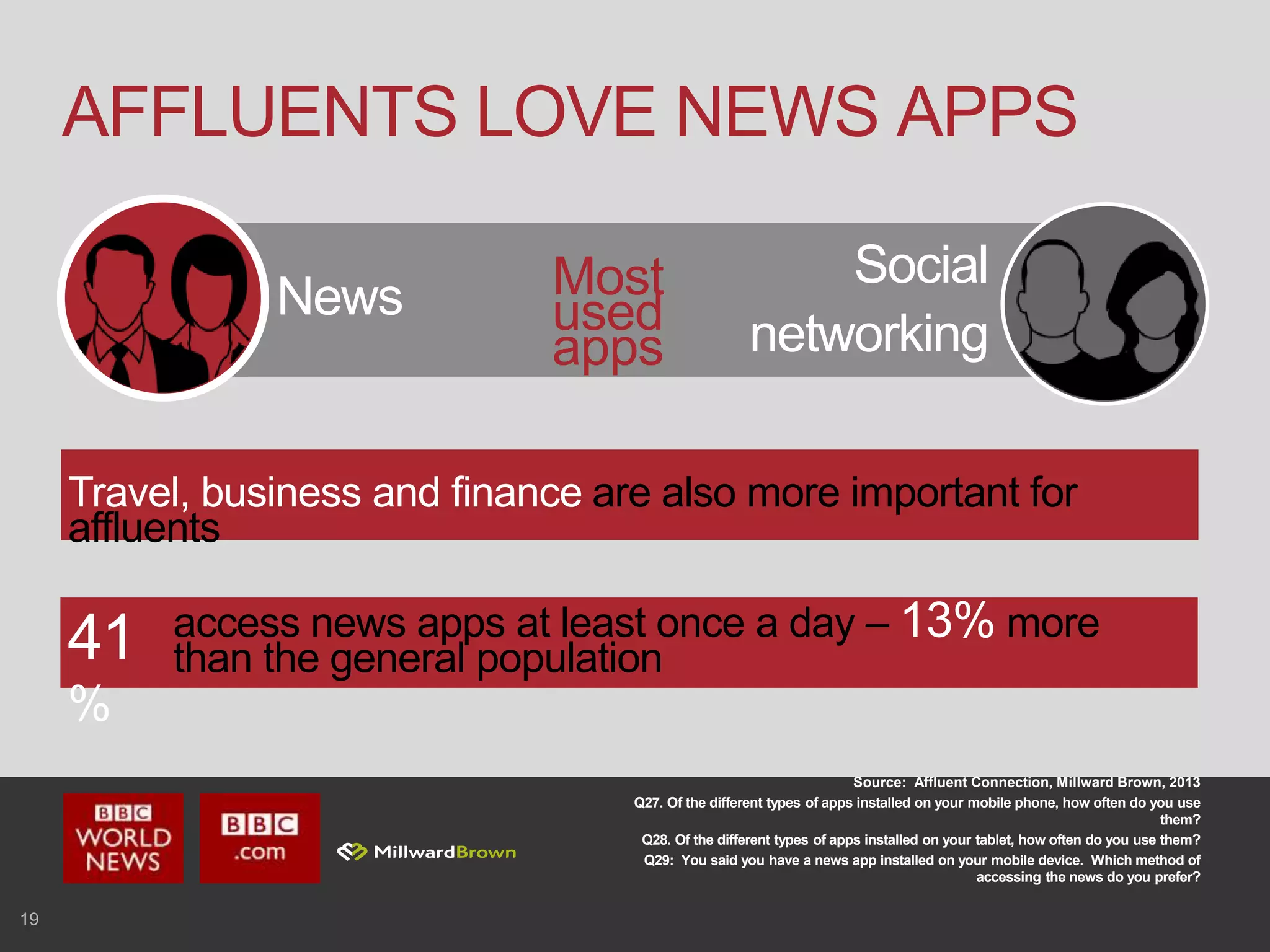

3. The data shows affluent consumers spend significant time on their mobile devices each day accessing news apps and content, checking social media