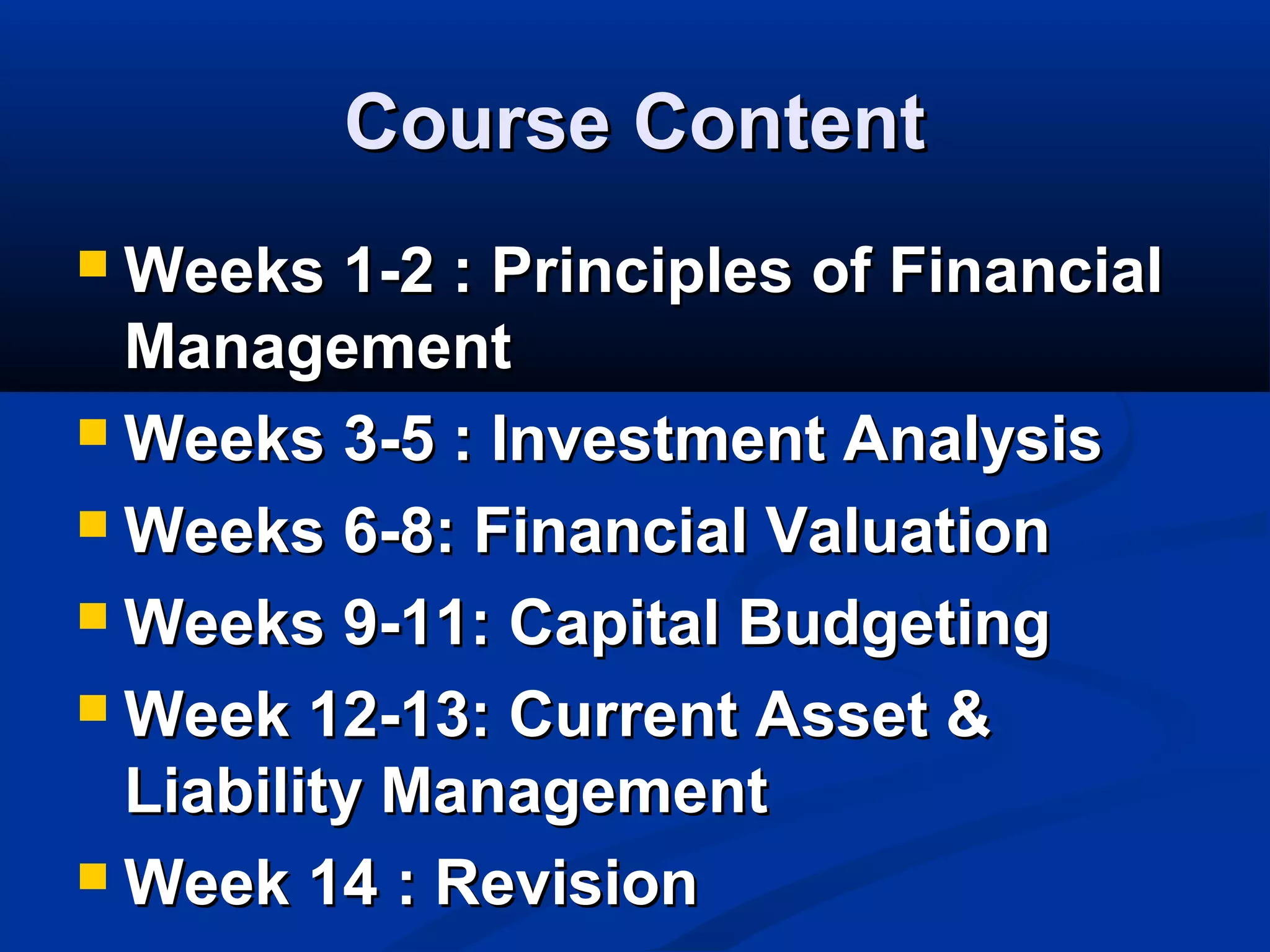

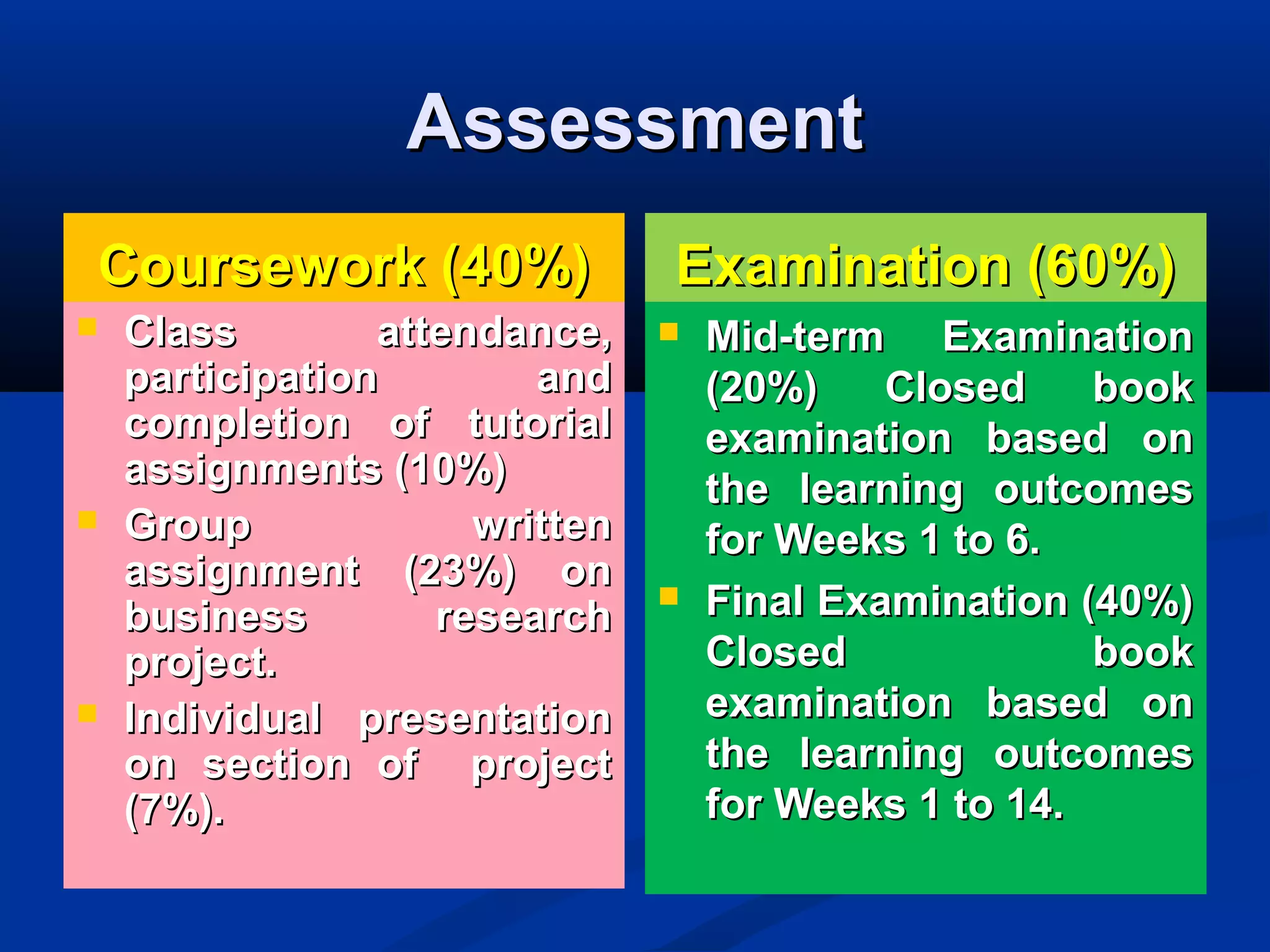

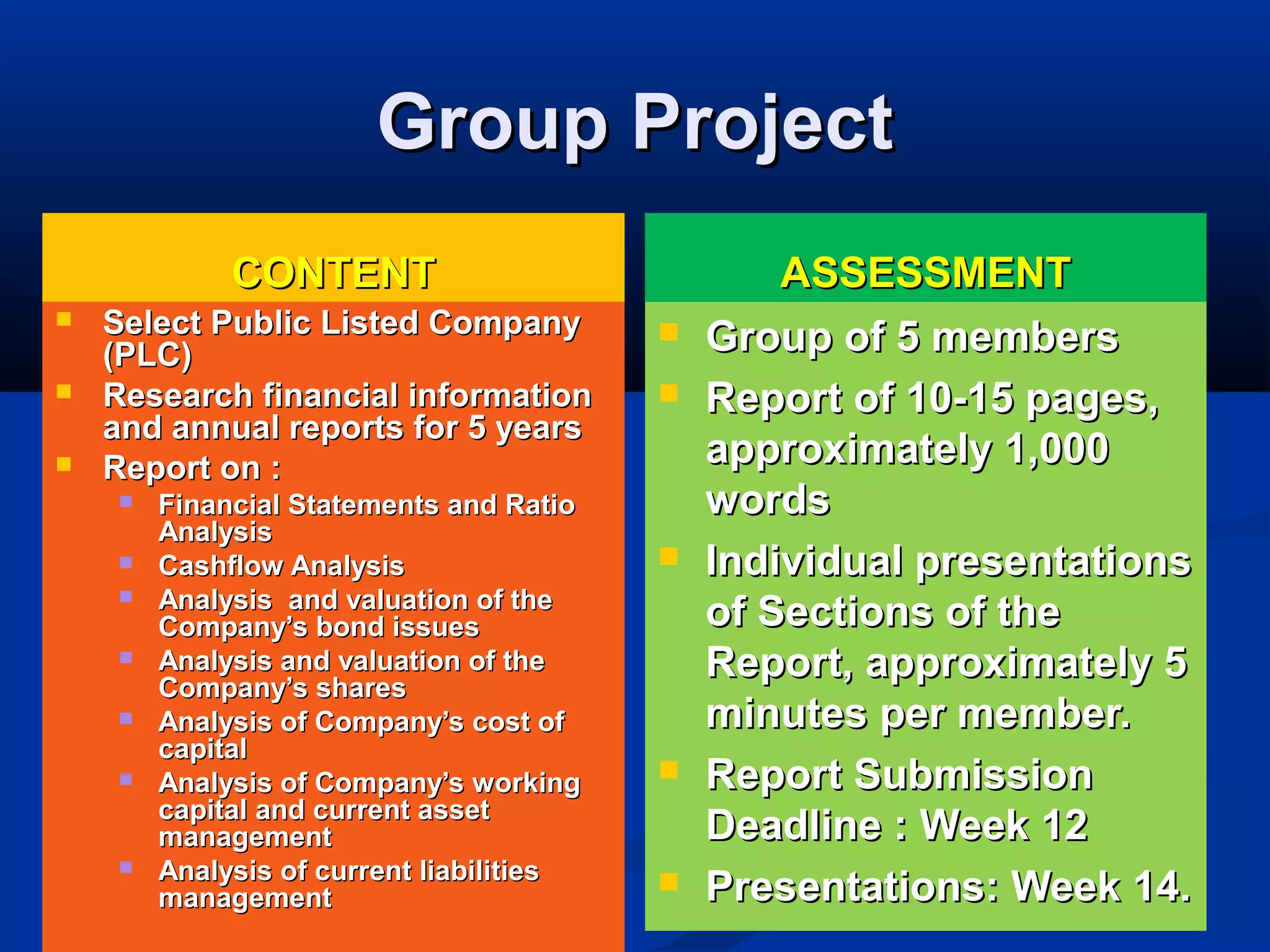

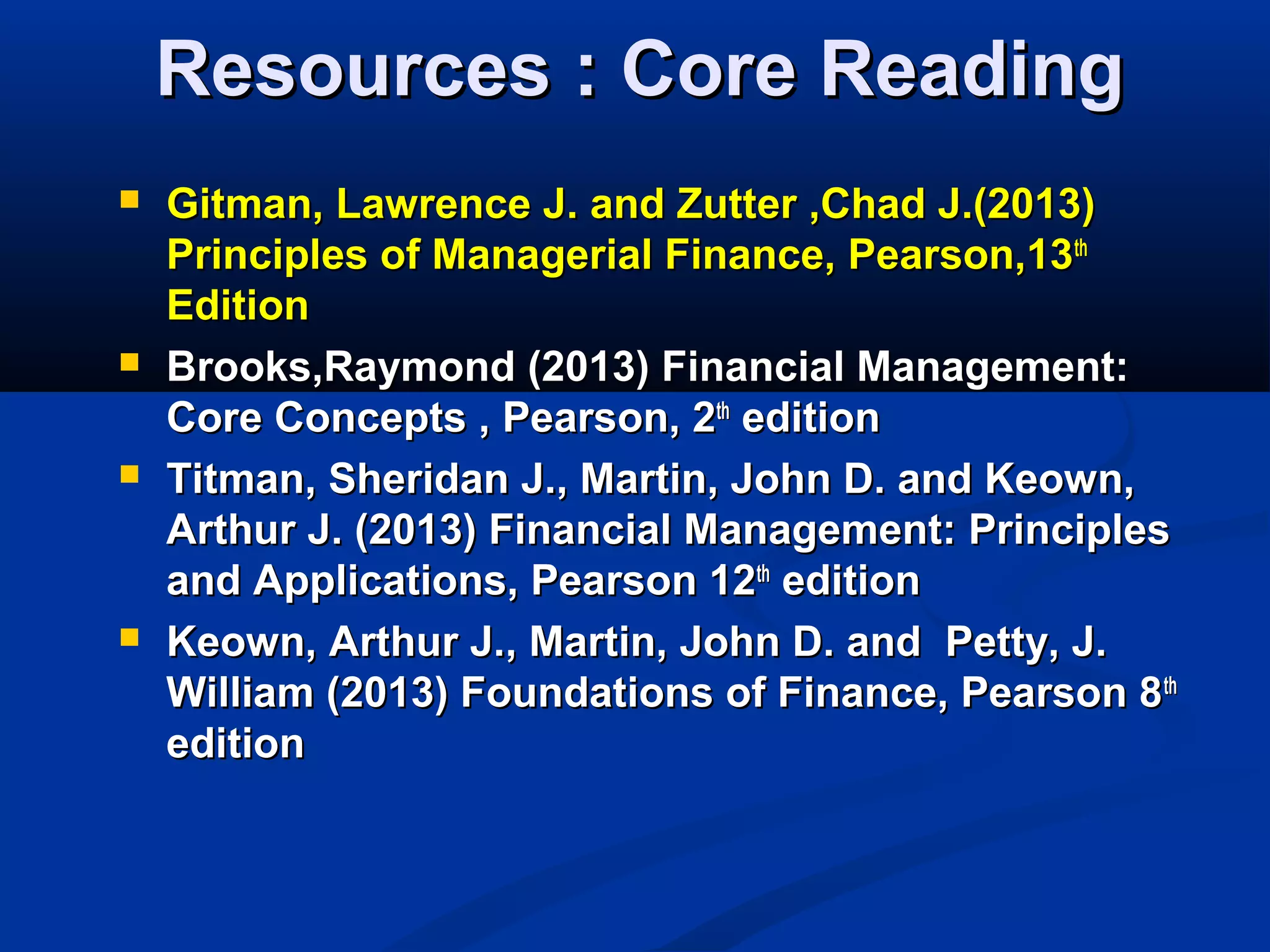

This document provides an overview and syllabus for a course on financial management. The course is intended to build upon fundamentals and prepare students for advanced study in financial management. Key topics covered include principles of financial management, investment analysis, financial valuation, capital budgeting, and current asset and liability management. Assessment includes classwork, a group research project and presentation, a midterm exam, and a final exam. Resources provided include an online learning system, lecture slides, and recommended textbooks. Office hours and contact information are also included.