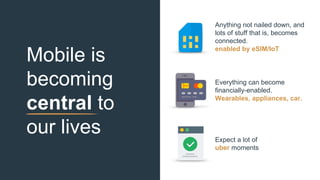

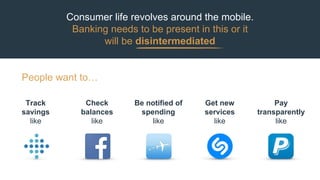

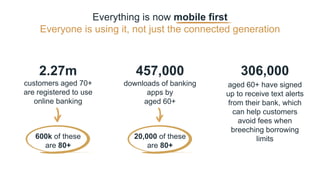

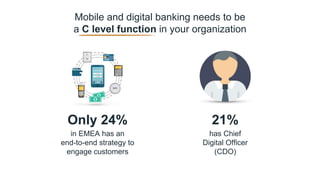

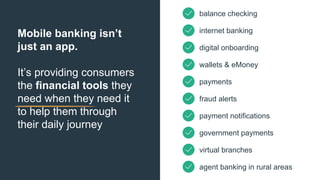

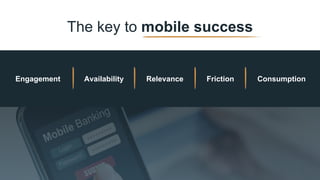

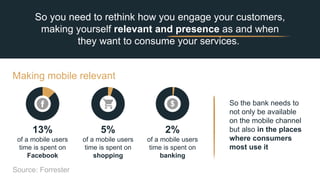

Mobile technology is becoming central to customer engagement in banking, with more people using mobile banking than visiting branches. As banking transitions to a mobile-first approach, financial institutions must adapt to provide seamless access and relevant services across multiple channels. Success depends on understanding customer needs, leveraging data, and integrating banking seamlessly into consumers' lifestyles.