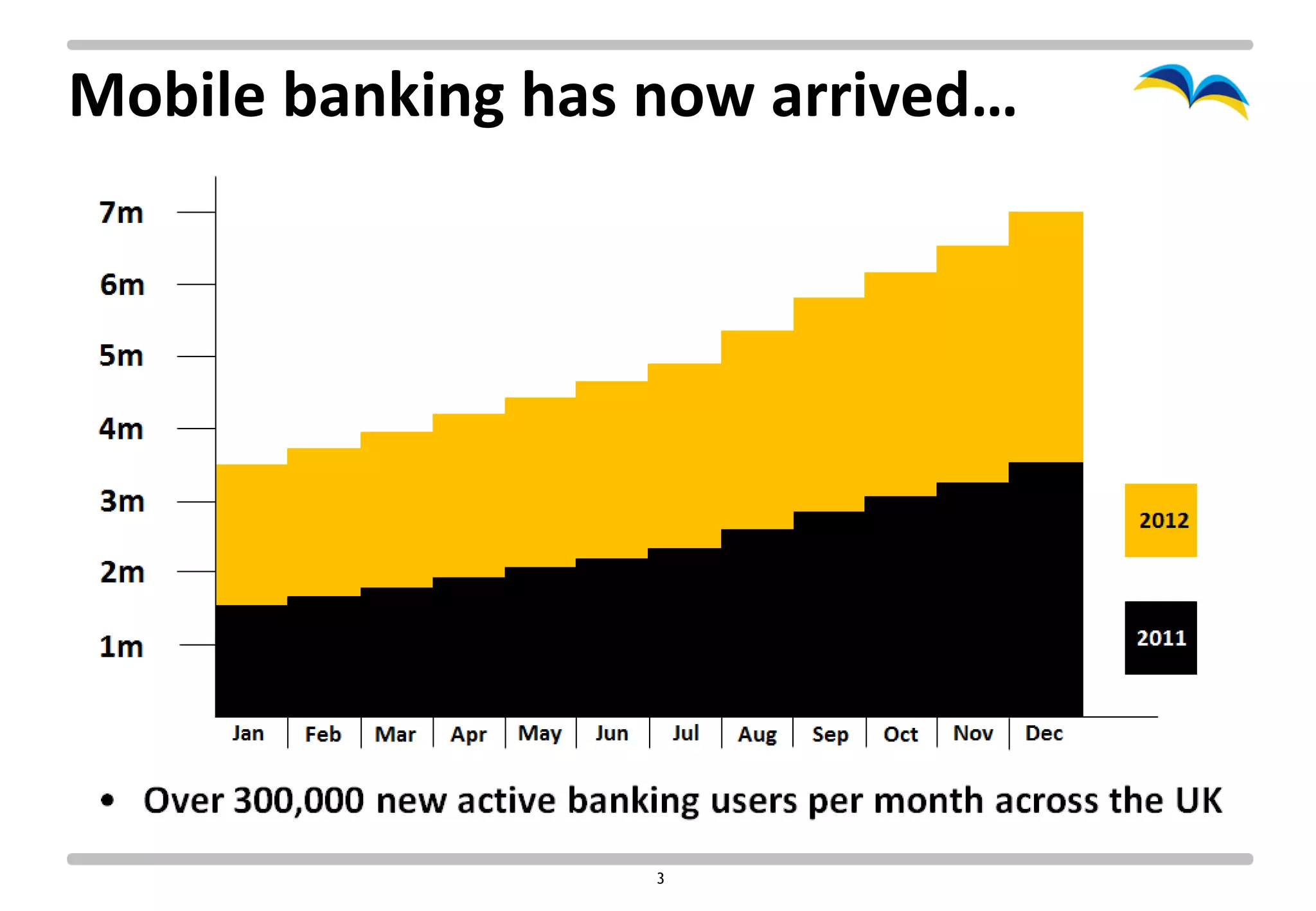

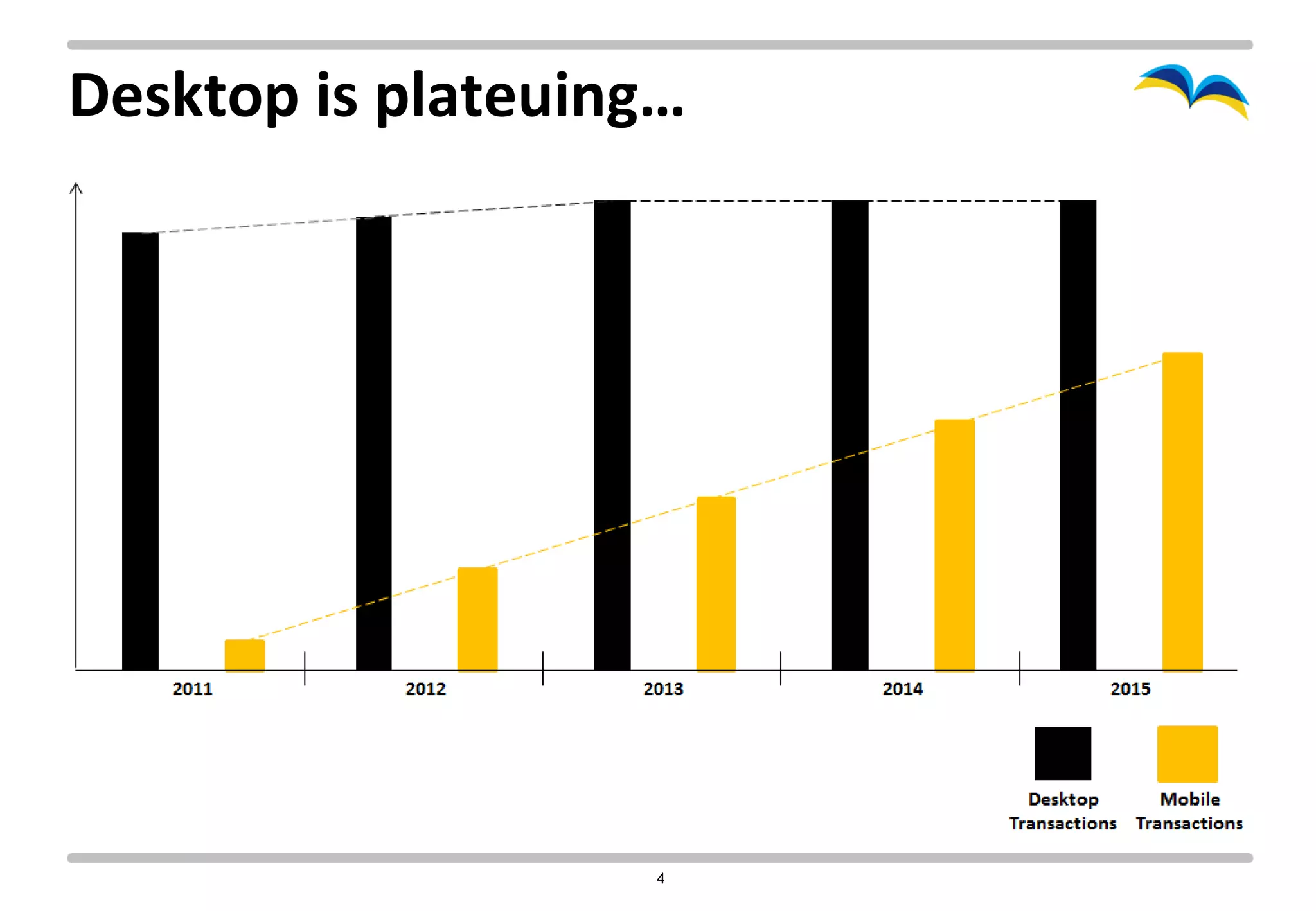

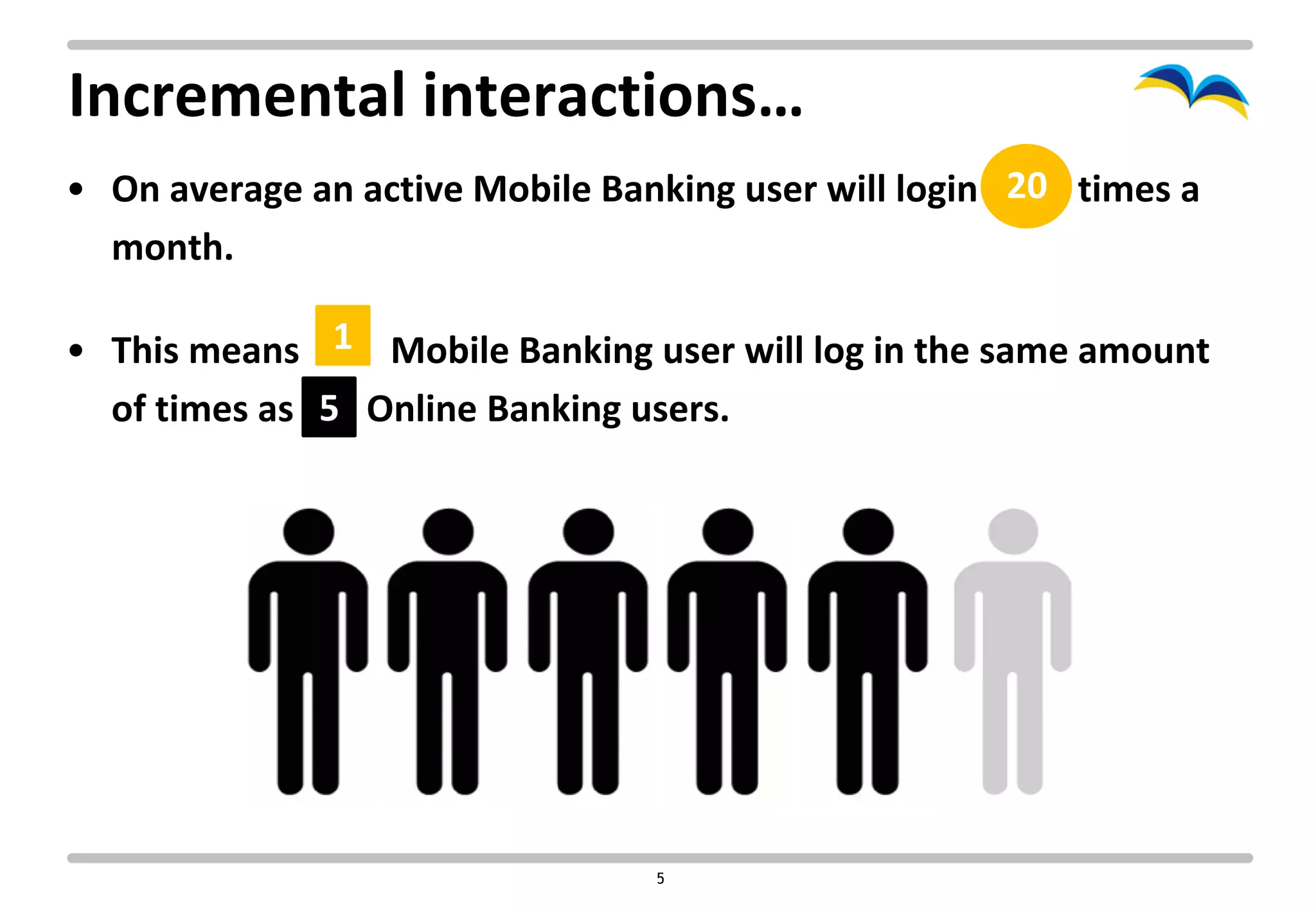

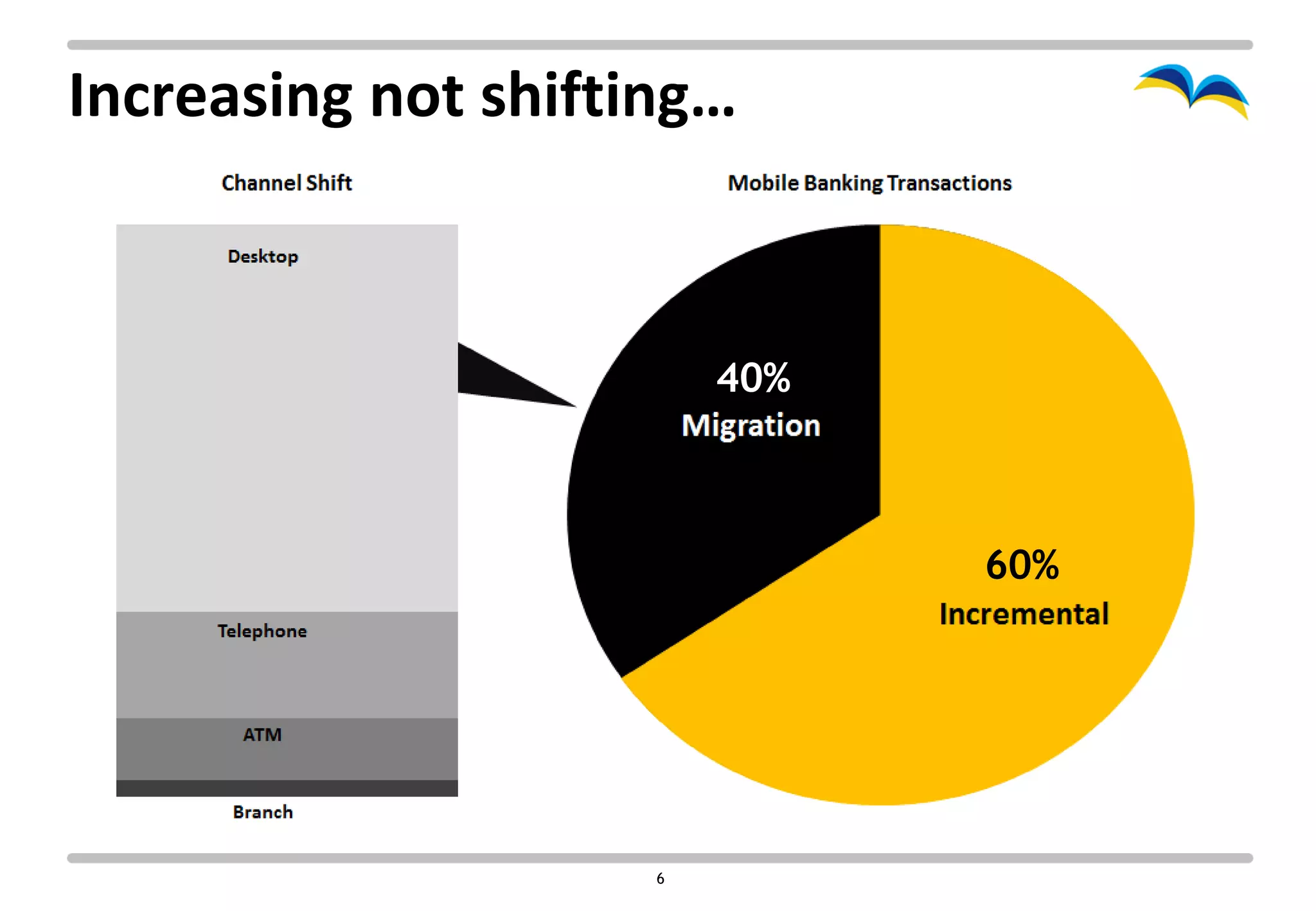

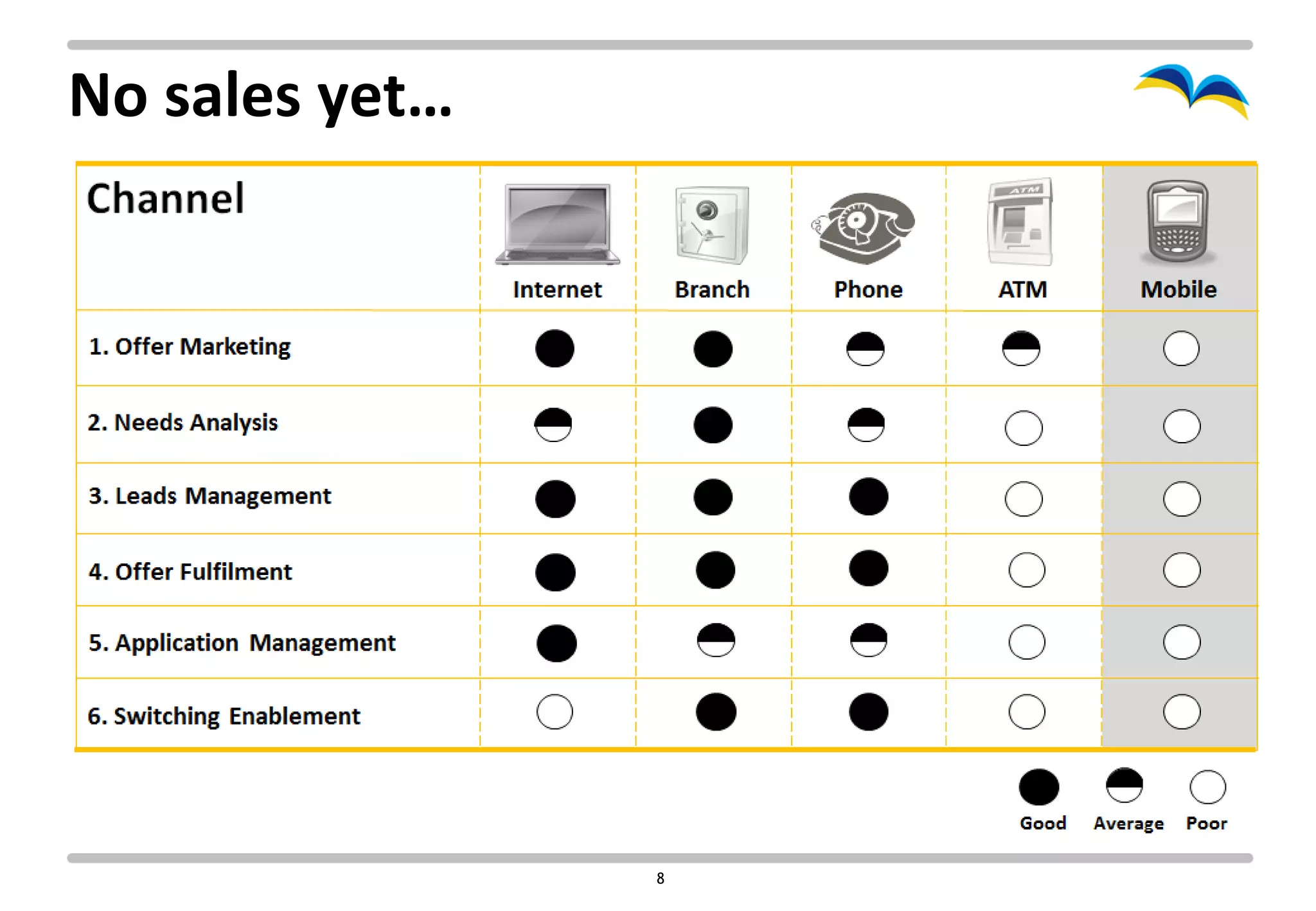

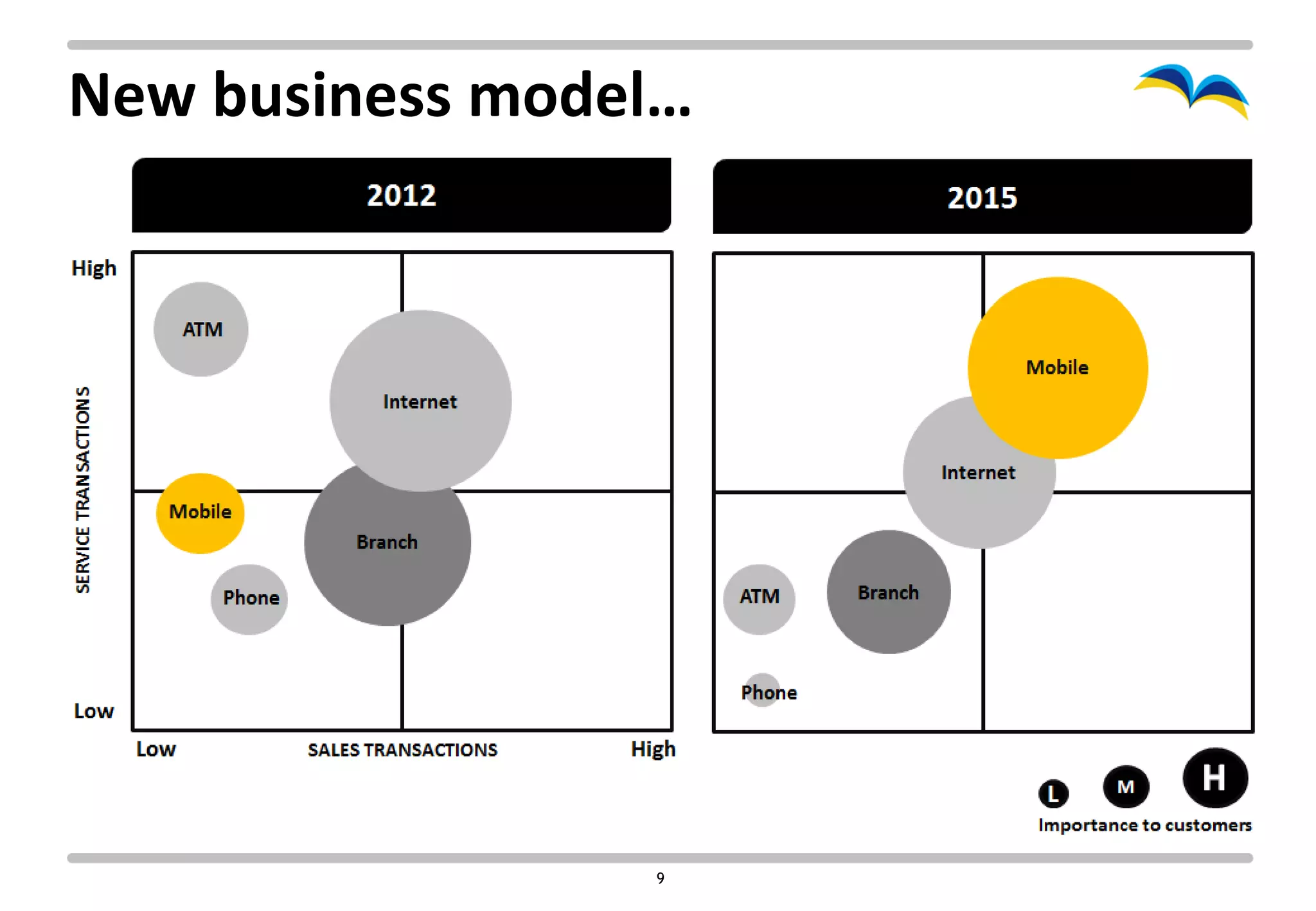

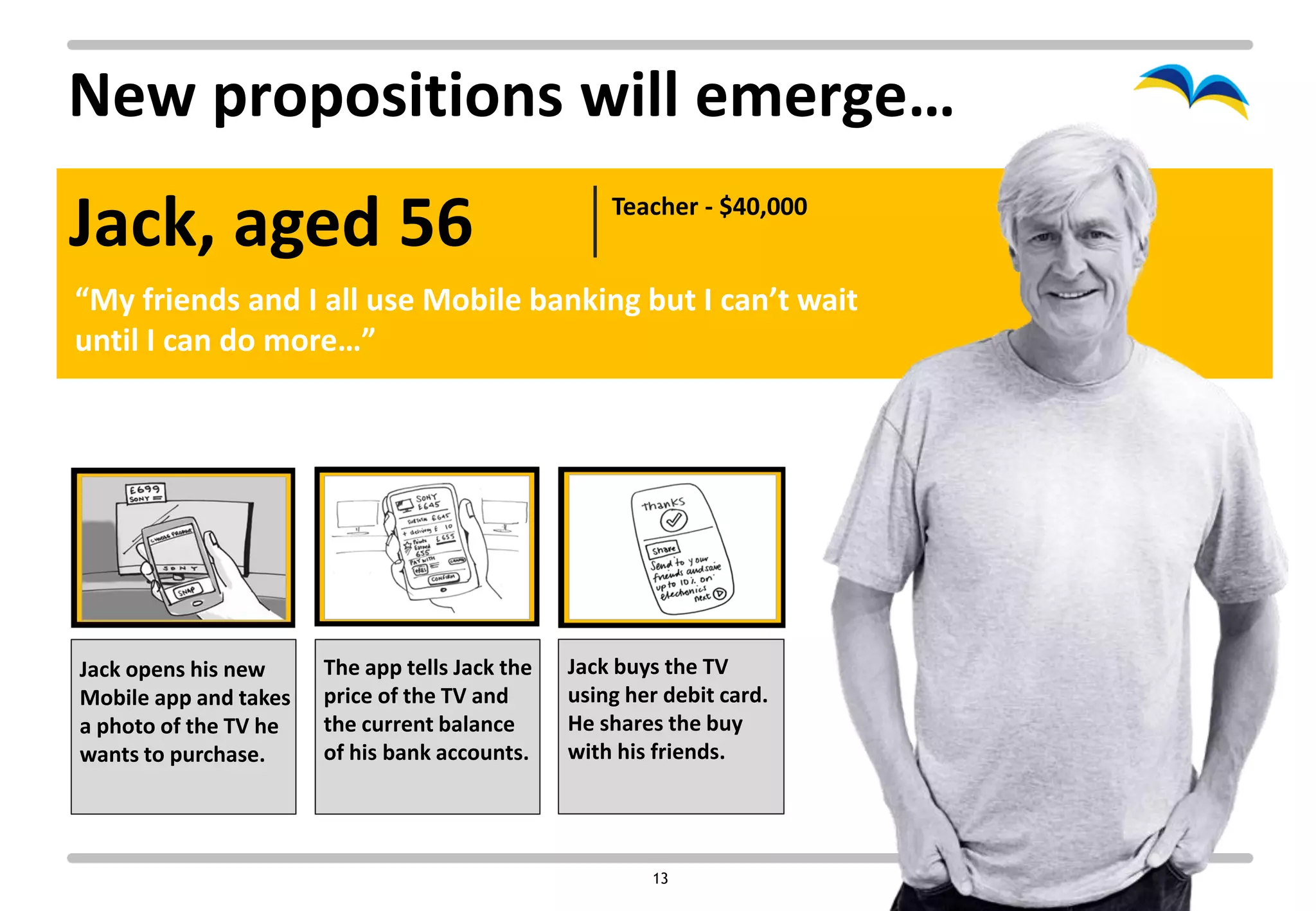

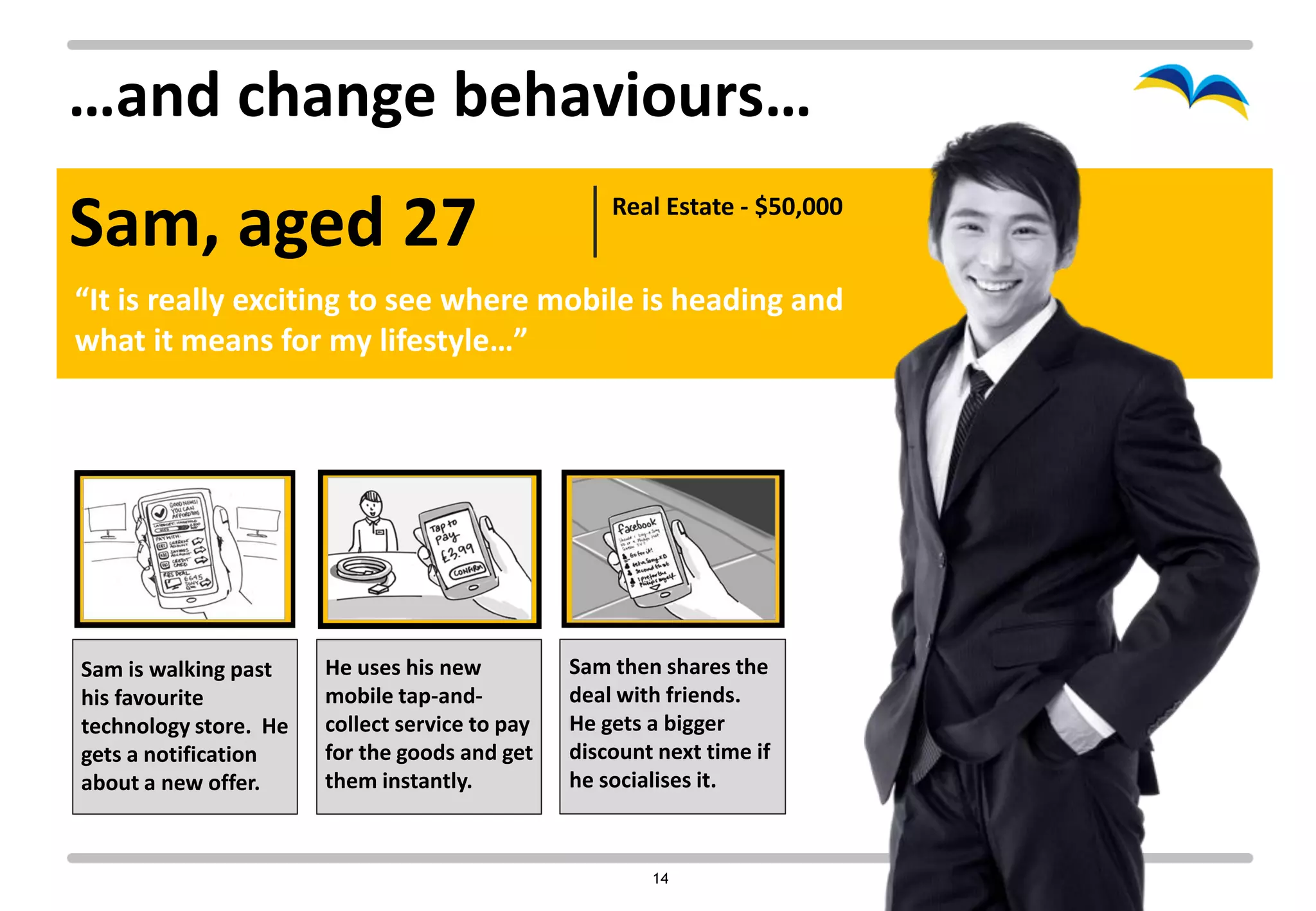

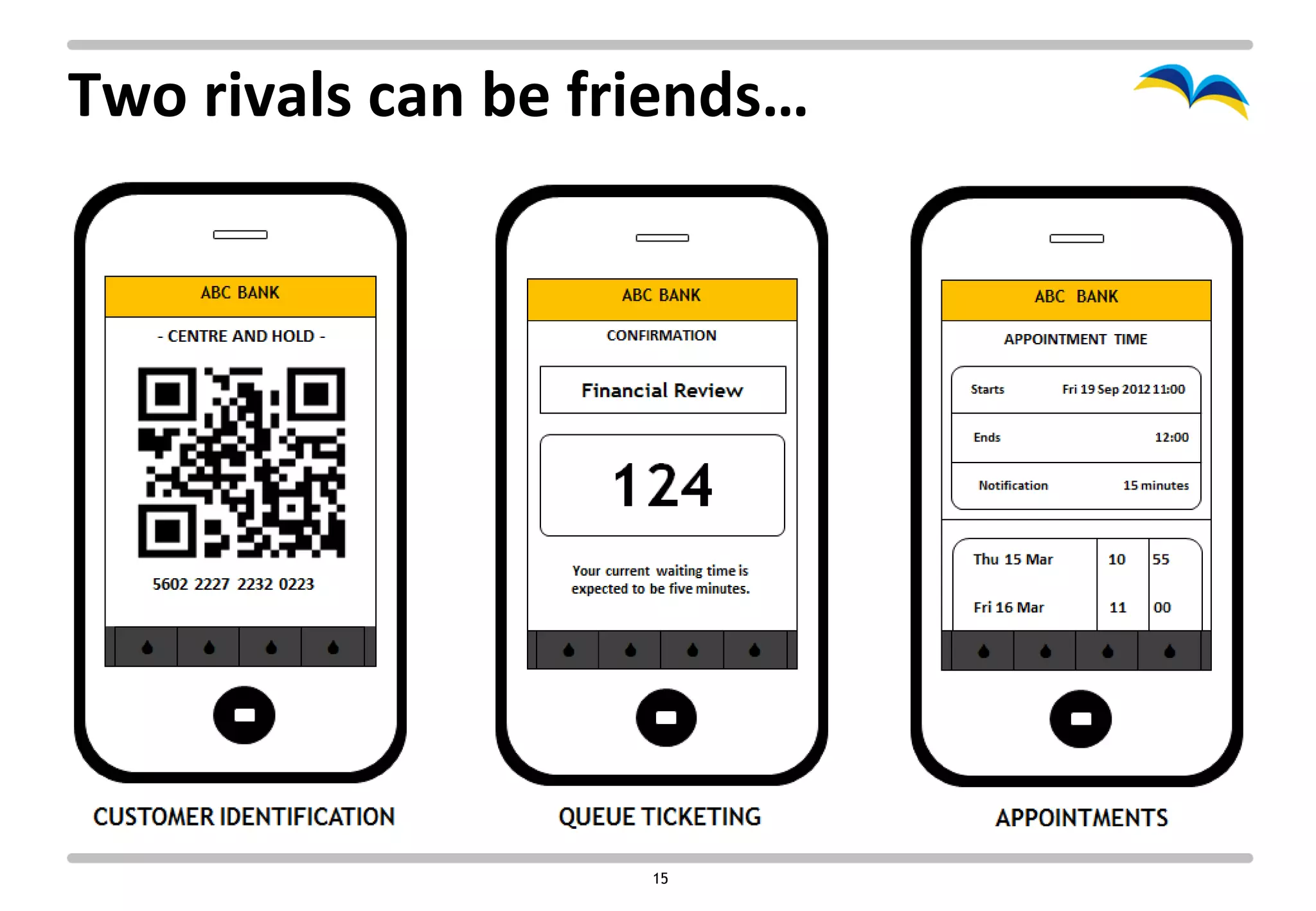

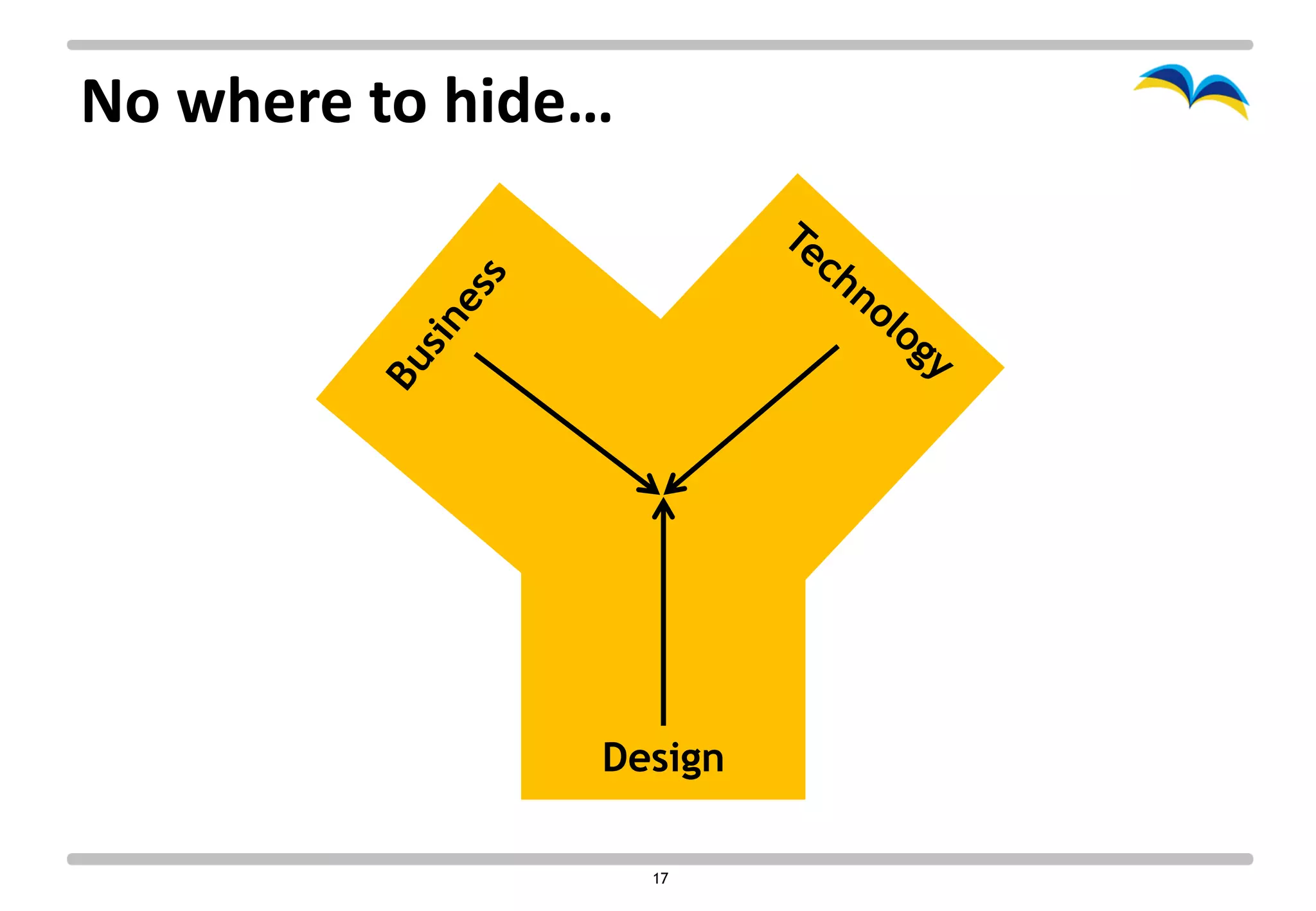

The document discusses the capabilities and future of mobile financial services. It examines how mobile is impacting the financial services sector and changing consumer relationships. Mobile banking usage is increasing and will become the primary digital channel by 2013. This means interactions with banks have risen from once a week historically to nearly daily now. New propositions and behaviors are emerging as customers give permission for banks to engage through mobile. However, organizations face challenges in aligning processes and skills to fully capitalize on these opportunities. The document ends with a group exercise to discuss impacts and opportunities for different business areas.