1) Finance is essential for any business to operate and survive. It involves managing monetary resources at different stages from generating business ideas to liquidation. Finance aids in procuring resources and maintaining smooth operations.

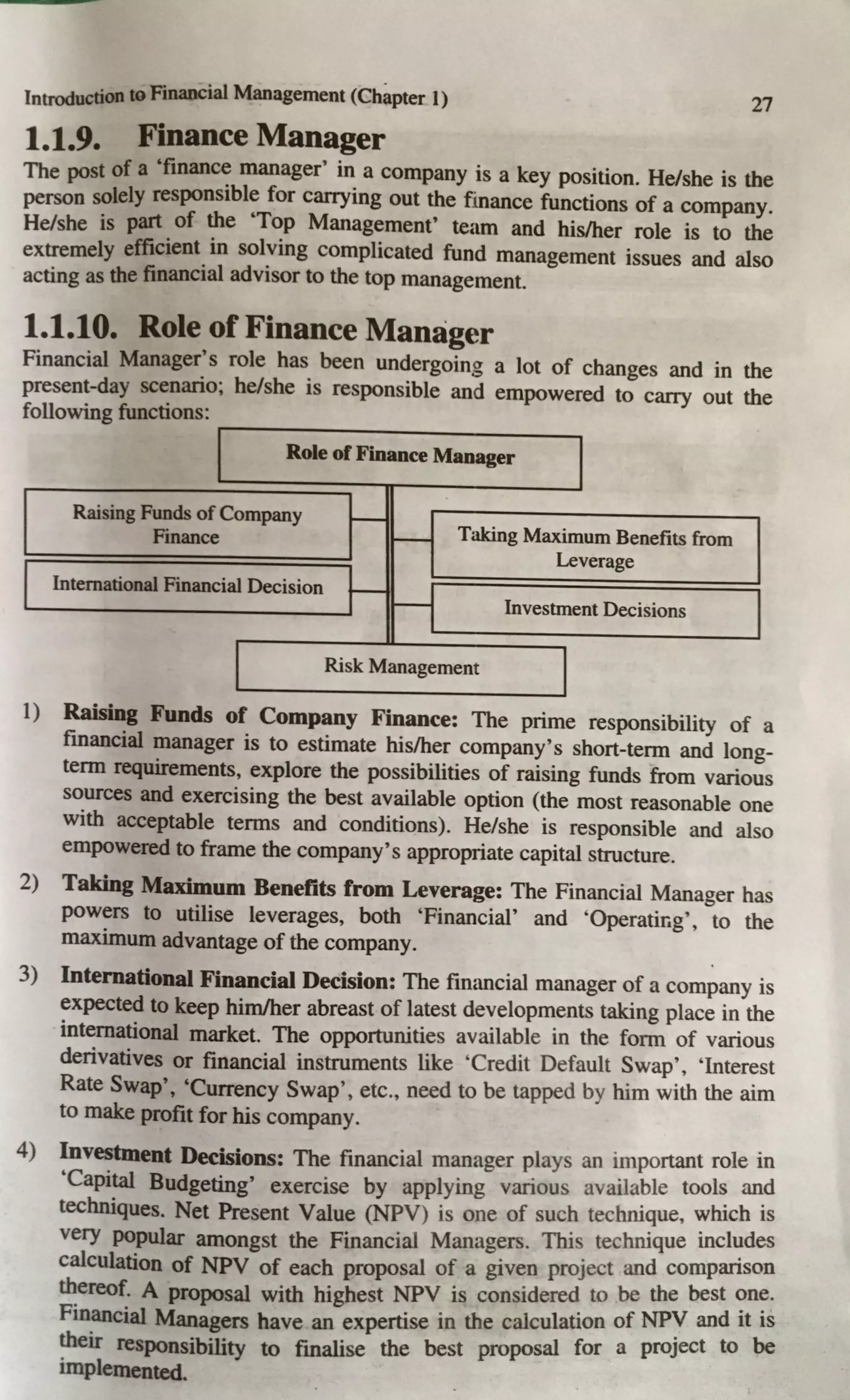

2) Modern financial management deals with investment, financing, and dividend decisions. It takes a comprehensive view involving analysis of financial decision making, not just obtaining funds. Key functions include capital budgeting, working capital management, capital structure, and dividend policy decisions.

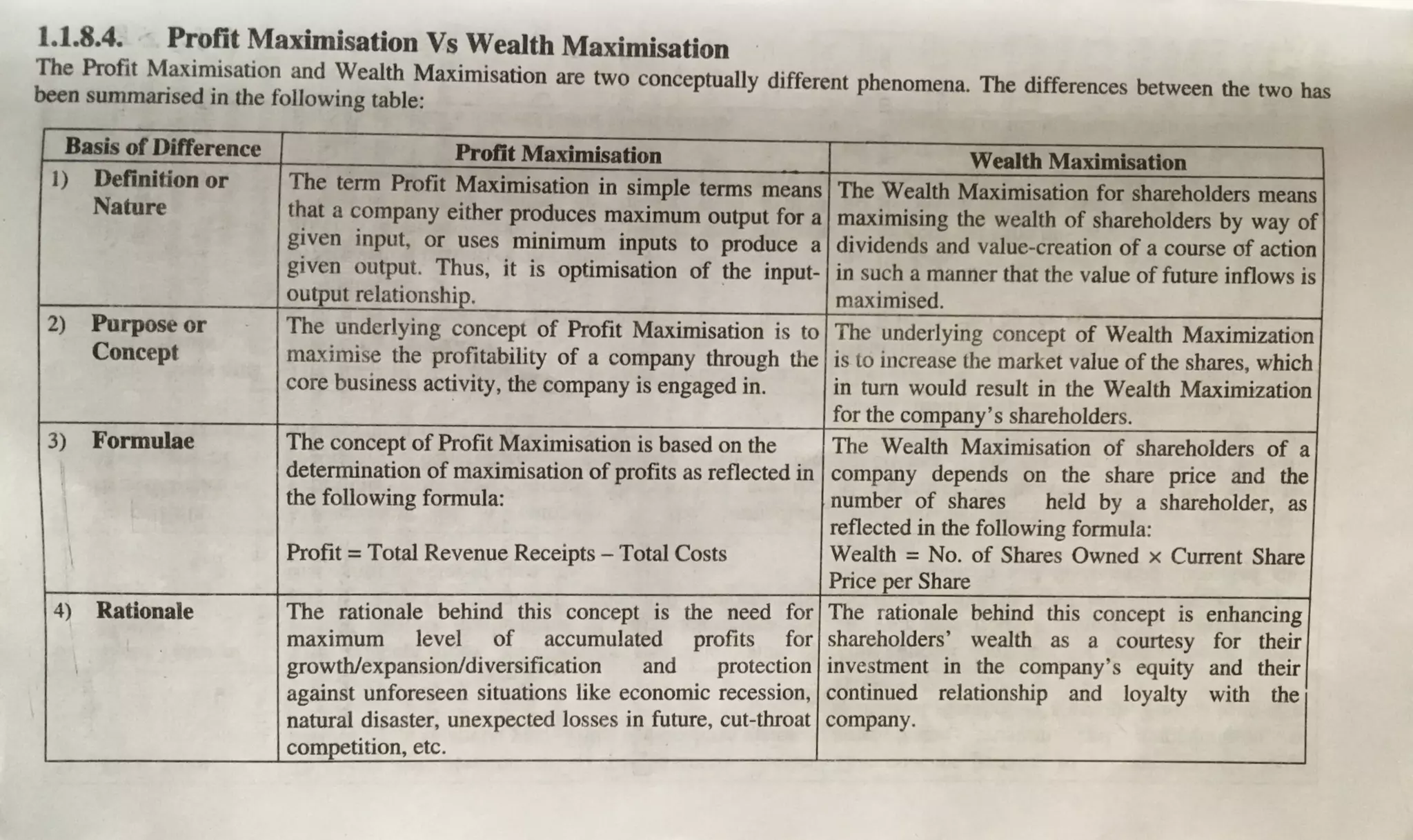

3) Financial management objectives are maximizing shareholder wealth and firm value in the long run. Profit maximization alone is a narrow traditional view, whereas wealth maximization considers shareholders' long term interests through efficient investment and financing decisions.

![16

(Unit-I) MBA Second Semester (Financial Management) Al)

2) I Prlive of si7e natnre, legal status, ev_ery organisation has a finance

rt.esp::,; ~ ~•..n:.ii!.)16.

--............_ _ _ _ f I th · · ·

function,--as it [>_l!ts across certain a"!ount o _contro on o er acttv1t1es and

- ..

functions of the orgamsauon. . . .

3) Ftnance and its reTated activitie~pla~ a _very s1gmficant role 10 the long.

t~rID¥Jll and survival of the org~1sat10~.. .

4) Finance function helps in managenal dec1s1on-making, through analysis

'iitdfu~etation of financial data.

5) Finance function is interrelated to other primary functions of business as

~:-SU-ch as ~keting, production planning. human resources, etc. These

functions are very much depenoent on finance and get affected by external

factors of environment.

6) Basically, "Valuation of a Firm" is one of the important aspects of the

finance function.

~1.3. Meaning & Definition ofFinancial Management

The term 'Financial Management' consists of two words - 'Financial' and

'Management'. In order to fully grasp the meaning of this term, one needs to

understand the meaning of two words. "Financial" denotes the process of

identifybl& obtaining and allocating sources of money. ''Management" is the

proce8s of planning, organising, coordinating and controlling various resources

for the accomplishment of organisational goal. Therefore, Financial

Management is that branch of business management process which deals with

management of financial resources of the enterprise. Financial management is

the skilful and proper management of financial resources.

According to Solomon, "Financial management is concerned with the efficient

use of an important economic resource, namely, Capital Funds".

According to J.F. Bradley, "Financial management is the area of business

management ~evo_ted to the judicious use of capital and careful selection of

sources of ~ap1tal m order to enable a spending unit to move in the direction of

reaching its goals".

Acco~ ~ ~eston _and Brigham, "Financial management is an area of

flnancial decision m~g, hannonising, individual motives and enterprise

• goals0

•

~1.4. Scope/Approaches of Financial Management

~e scope of rmancial management has ~wn over the years. In this respect,

different schools of thought/approaches have 01 th · ·

o&ven err views:

Scope/Approaches ofFinancial

Management

I Traditional School ofThought :t--◄1

Modem School of Thought ]](https://image.slidesharecdn.com/unit1-220511162922-018d9493/75/unit-1-pdf-2-2048.jpg)