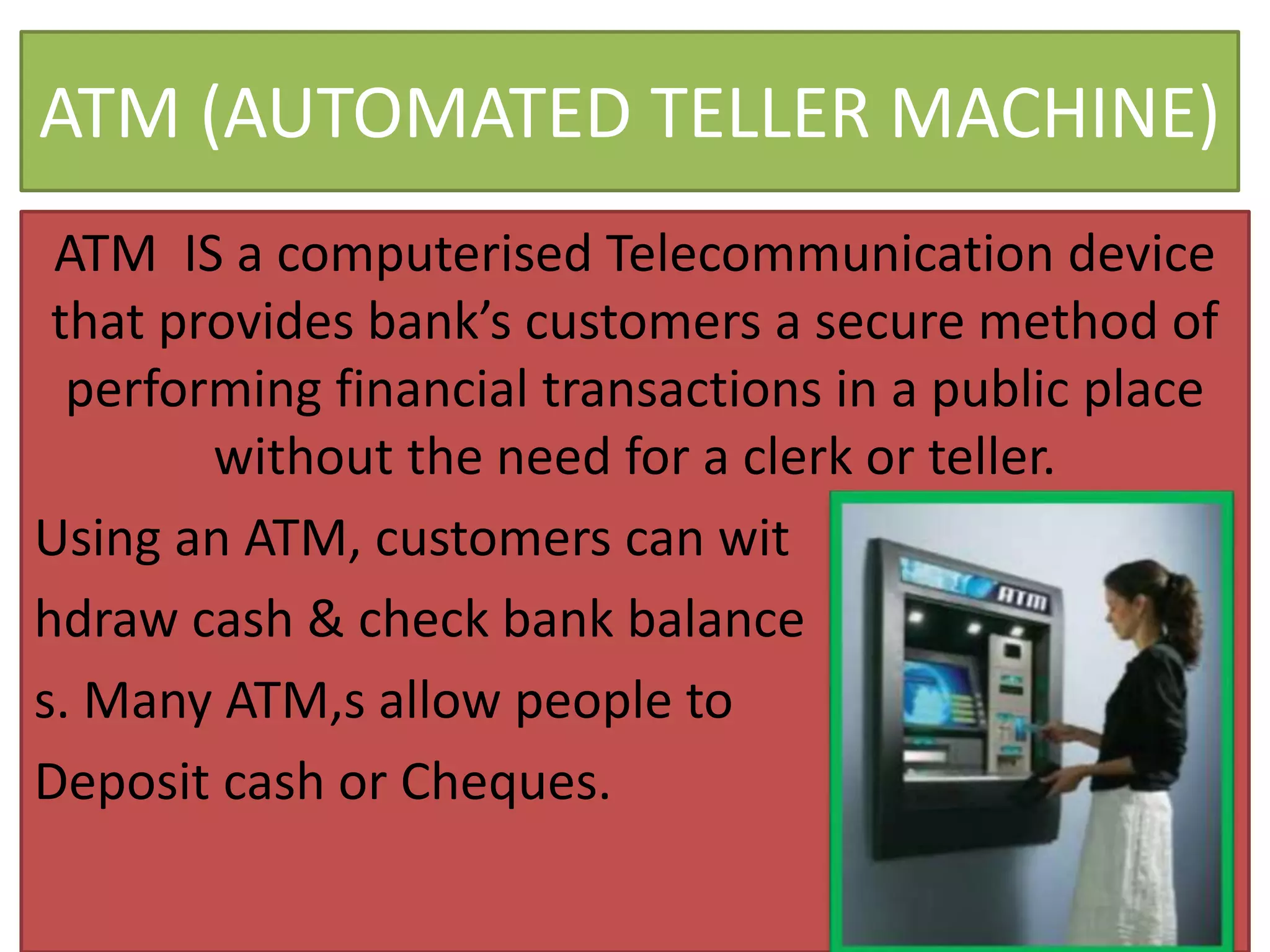

ATM (Automated Teller Machine) allows customers to securely perform financial transactions without a clerk by withdrawing cash, checking balances, and depositing cash or checks using a plastic card with a magnetic stripe containing their card number and security information. Customers verify their identity by entering a personal identification number (PIN).

Internet banking enables banking online through a bank's website, reducing operating expenses. Customers can access accounts, perform transactions, and avail bank services from anywhere at any time by logging in with identification and a PIN issued by the bank.

A credit card enables cardholders to purchase goods and get credit from banks for up to 45 days. An average consumer prefers using a credit card for personal purchases to defer payments