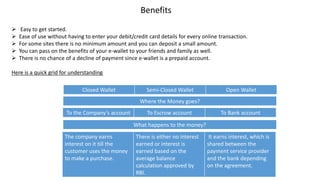

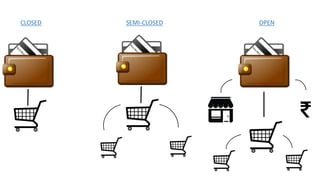

Prepaid payment instruments allow users to store funds that can be used for transactions and include items like smart cards, magnetic strip cards, internet accounts, and mobile wallets. They provide convenience compared to cash and allow for e-payments. The Reserve Bank of India regulates prepaid payment instruments in India and classifies them into closed systems only usable with one company, semi-closed systems usable at identified merchants, and open systems usable anywhere with cash withdrawal. Non-bank companies can only issue closed and semi-closed instruments while banks can issue all types and interest is earned on funds depending on the system and agreements. As mobile phone usage exceeds bank accounts in India, prepaid payment instruments and mobile wallets are becoming increasingly important for digital