This document discusses banking technology in India, including:

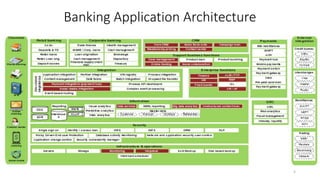

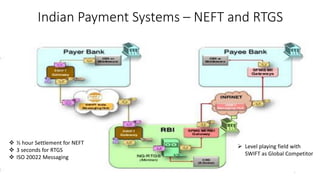

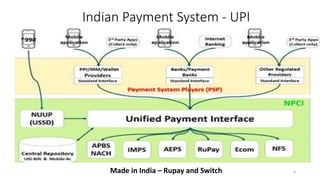

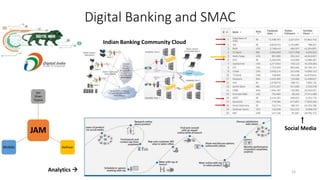

1) It outlines the evolution of banking technology from basic ledger posting machines in the 1980s-90s, to core banking solutions in the 2000s, to modern technologies like mobile/internet banking, analytics and cloud computing now.

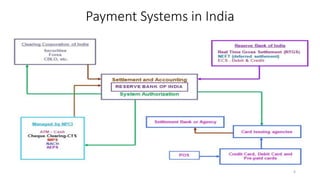

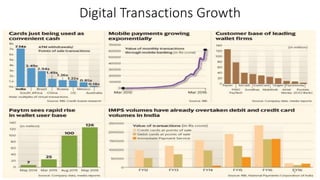

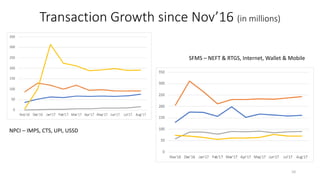

2) It provides current statistics on digital transactions growth in India, with over a billion digital transactions processed monthly through systems like UPI and IMPS.

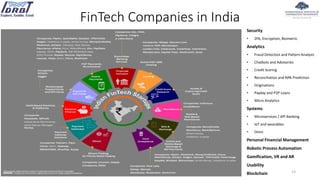

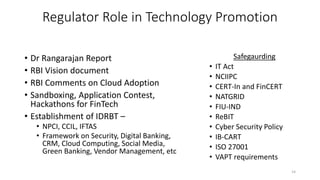

3) It examines trends shaping Indian banking technology, such as the increased role of regulators in promoting fintech innovation, the rise of digital-only banks, and new technologies around data, analytics and blockchain.