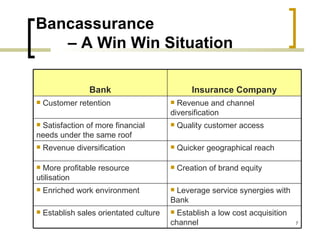

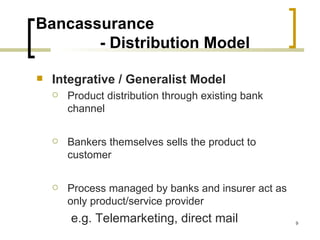

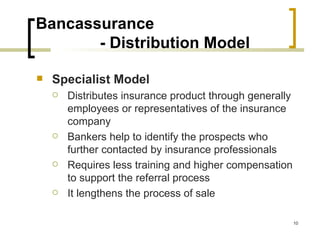

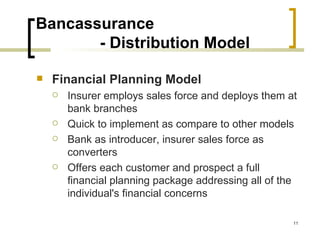

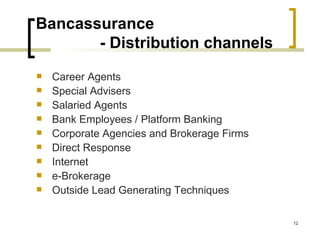

The document outlines the agenda for a discussion on bancassurance. It provides background on bancassurance including its origins in France in the 1980s and introduction to India in 1999. It describes the evolution of bancassurance as a way for banks to address pressures around customer retention, staff retention, universal banking, and optimizing resources. For insurers, bancassurance provides benefits like channel diversification, access to customers, geographical reach, and establishing a sales-focused culture. The document then characterizes bancassurance as a win-win situation for both banks and insurers and outlines different distribution models including integrative, specialist, and financial planning. It closes with a discussion of distribution channels and a