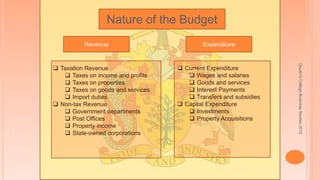

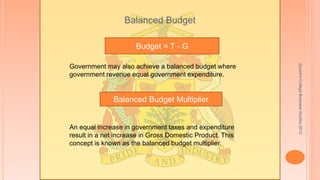

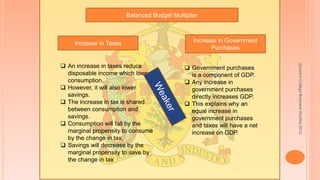

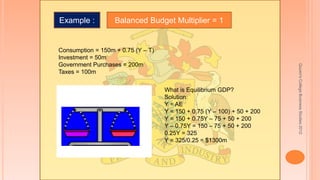

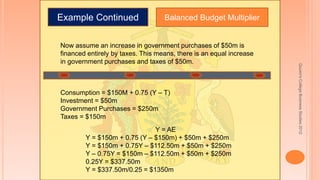

The document discusses government budgets, including sources of government revenue from taxes and non-tax sources. It describes budget deficits that occur when spending exceeds revenues and surpluses when revenues are greater than spending. A balanced budget occurs when revenues and spending are equal. The balanced budget multiplier is explained as being equal to 1, meaning an increase in government spending fully financed by tax increases will increase GDP by the same amount. An example demonstrates how an increase in spending and taxes of $50 million leads to a $50 million increase in GDP.