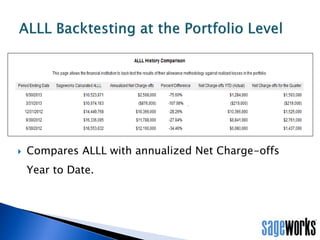

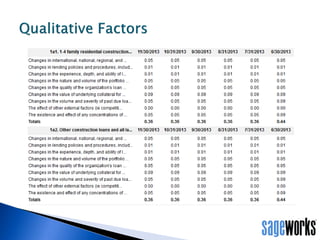

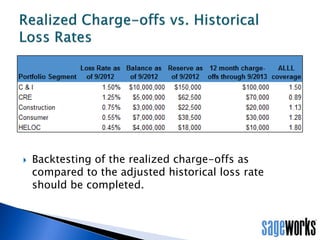

The document discusses backtesting as a critical method for measuring the effectiveness of methodologies used in managing credit and model risk for financial institutions, particularly focusing on the ALLL (Allowance for Loan and Lease Losses) model. It outlines the importance of backtesting in comparing actual outcomes with forecasts and ensures model accuracy in assessing losses over time, while addressing challenges posed by models and the FASB's CECL framework. The document emphasizes the need for sufficient data and ongoing analysis to successfully navigate model risk and support the robustness of financial practices.