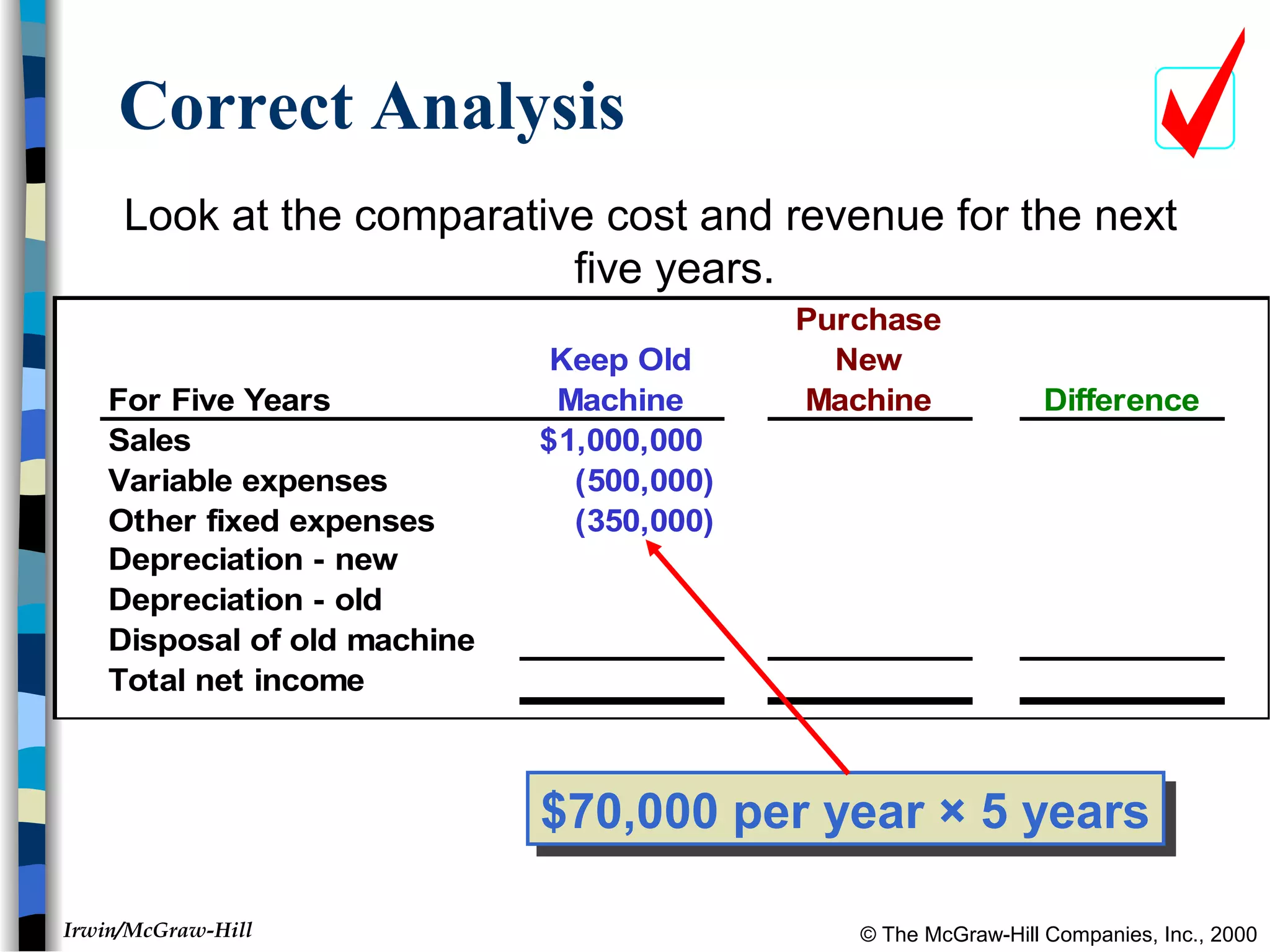

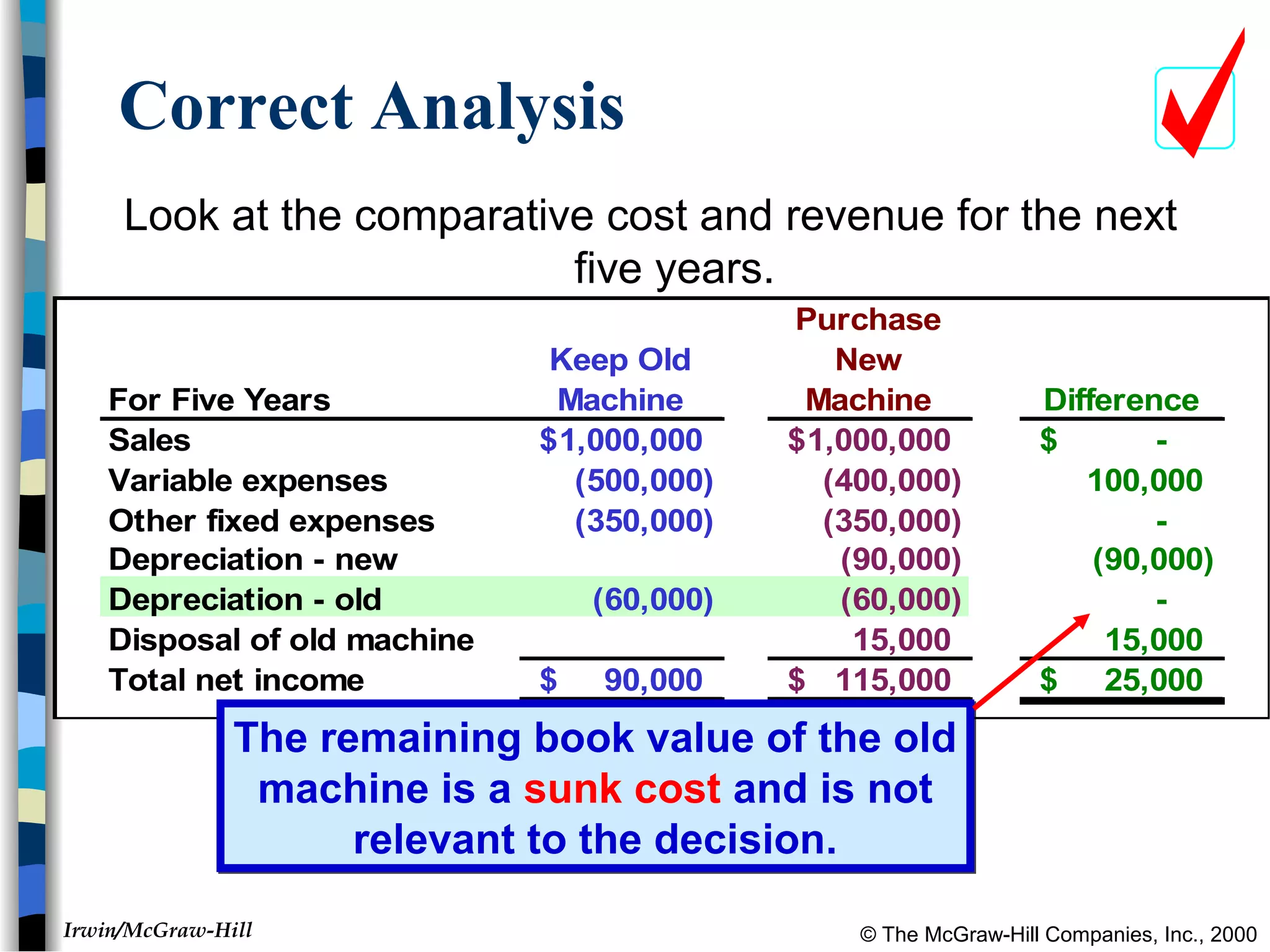

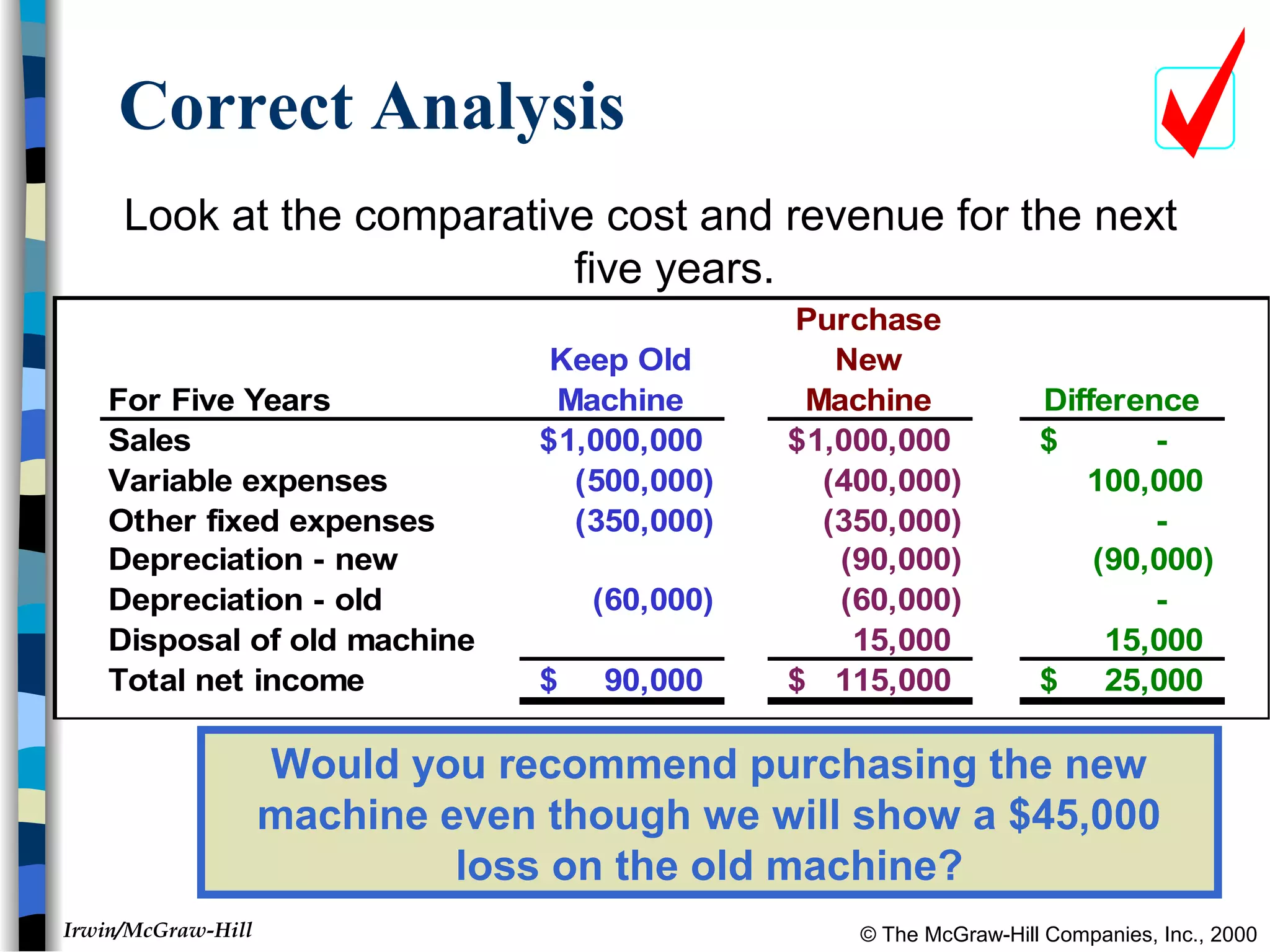

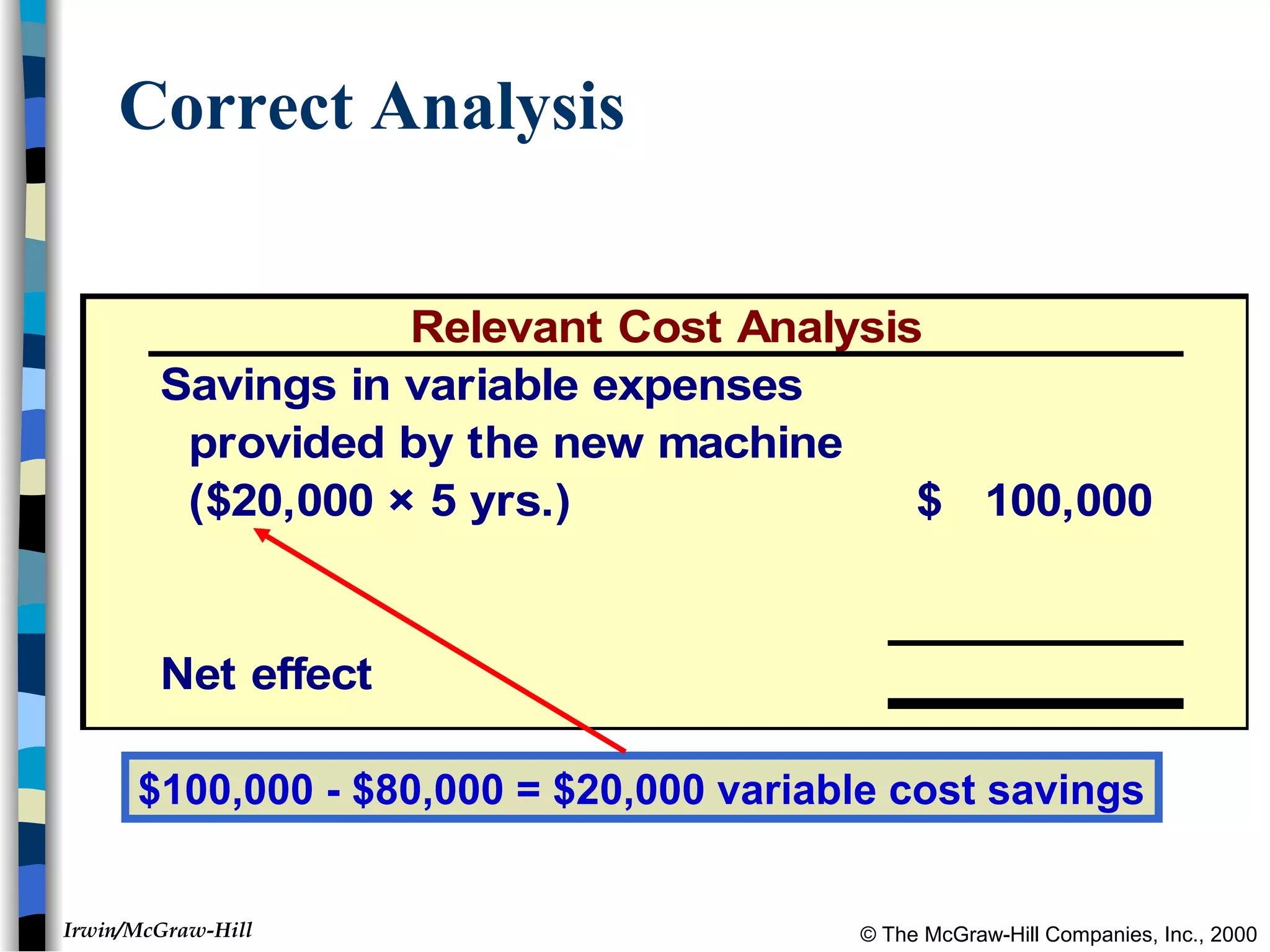

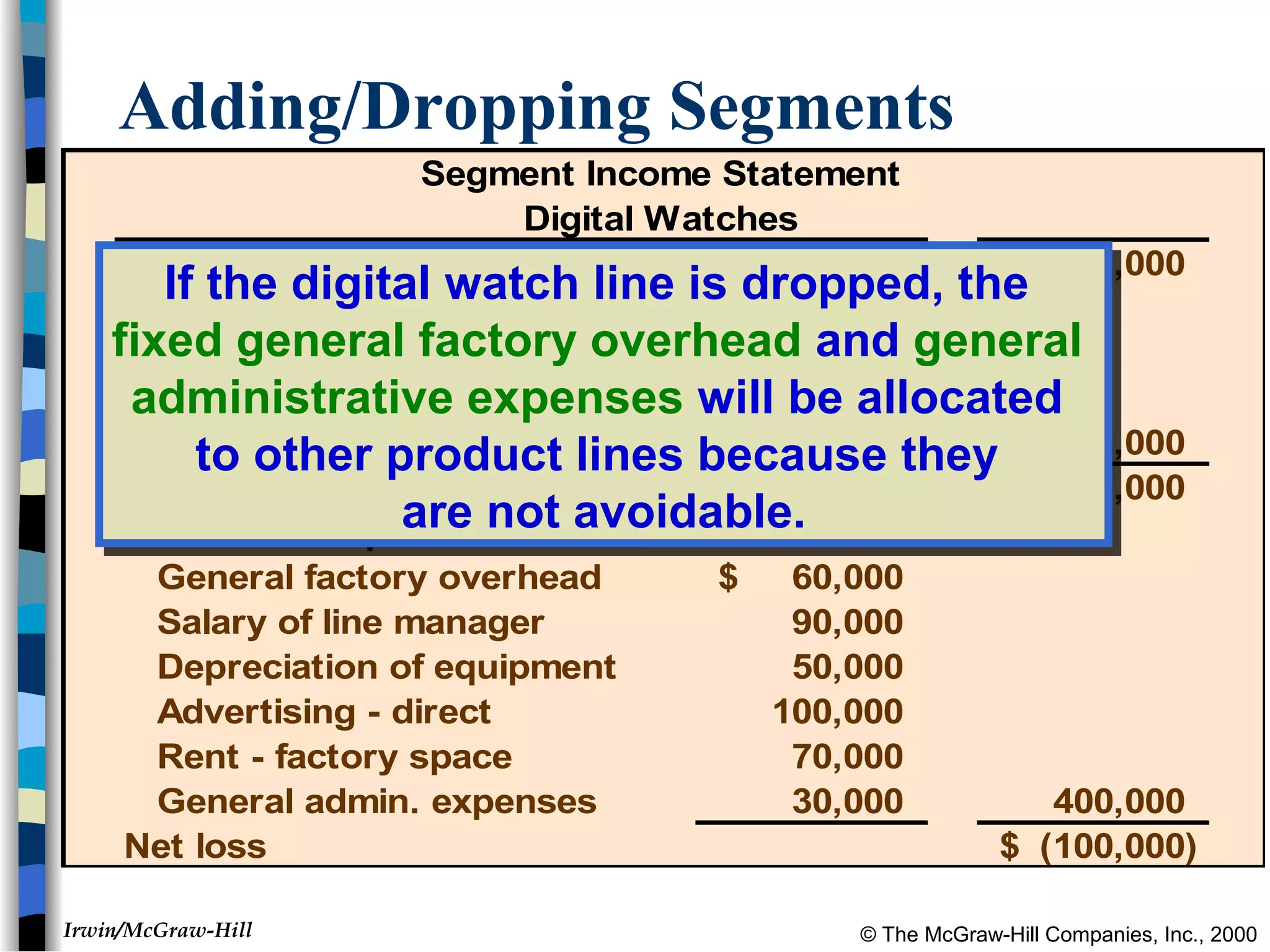

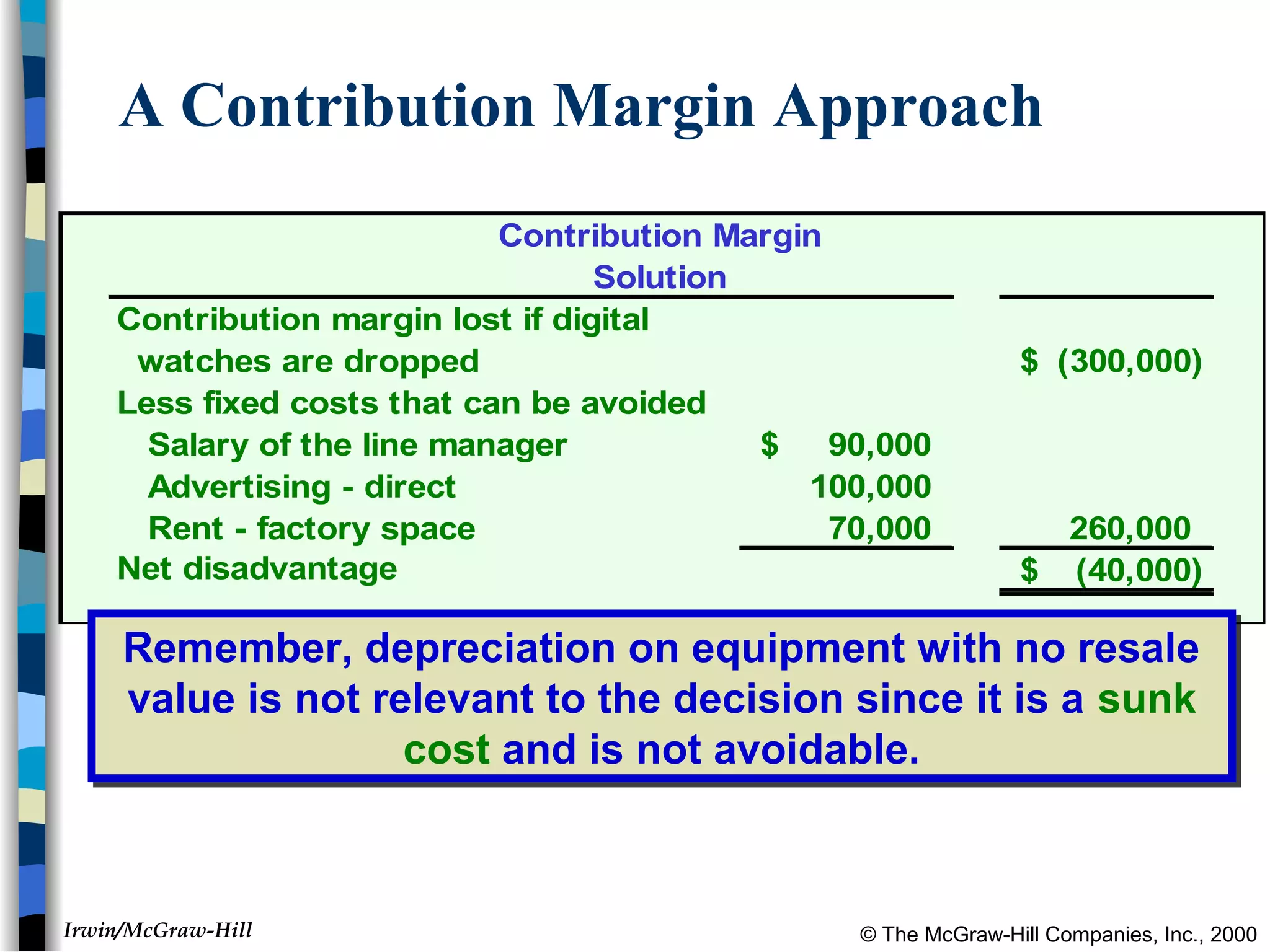

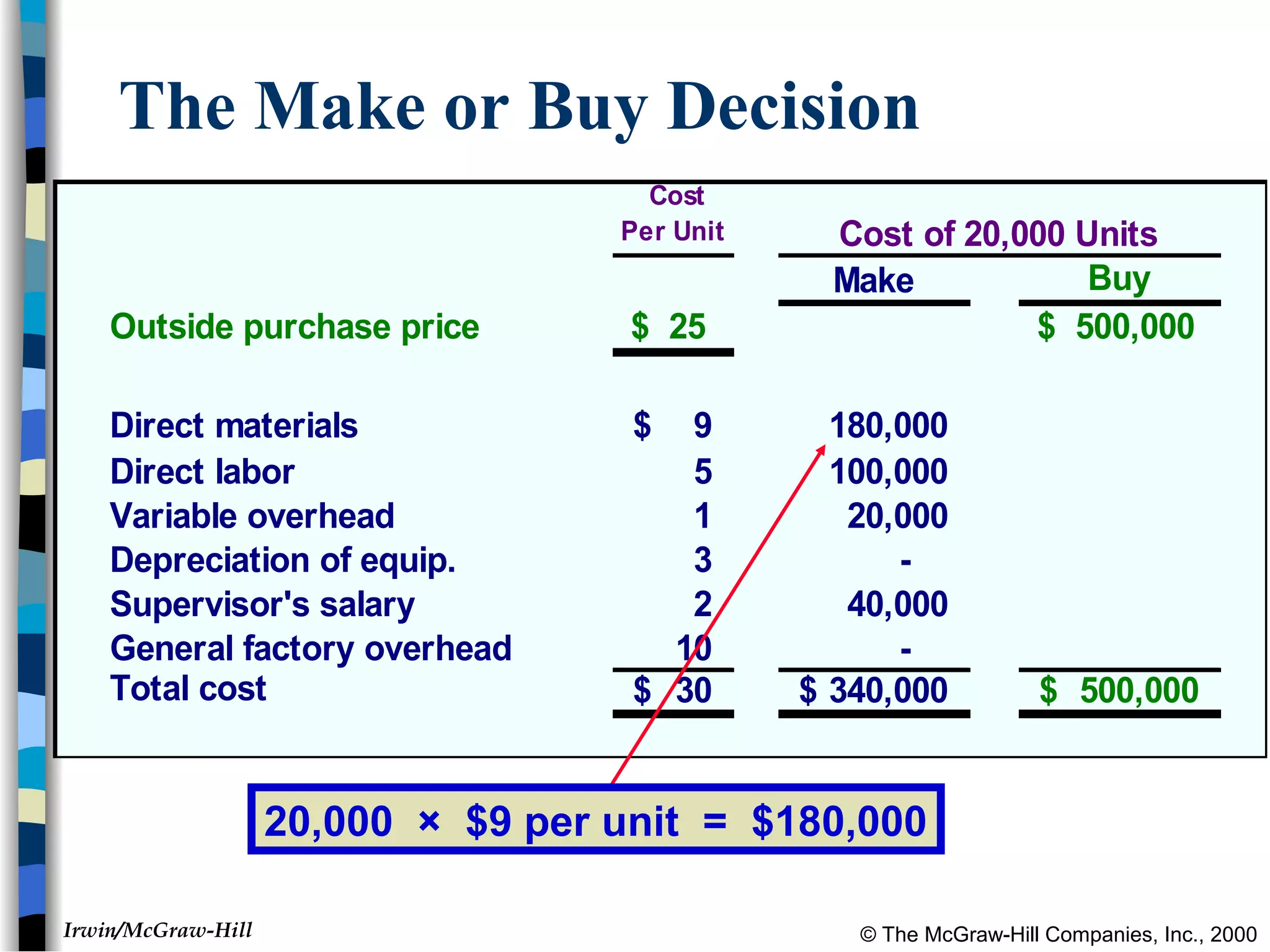

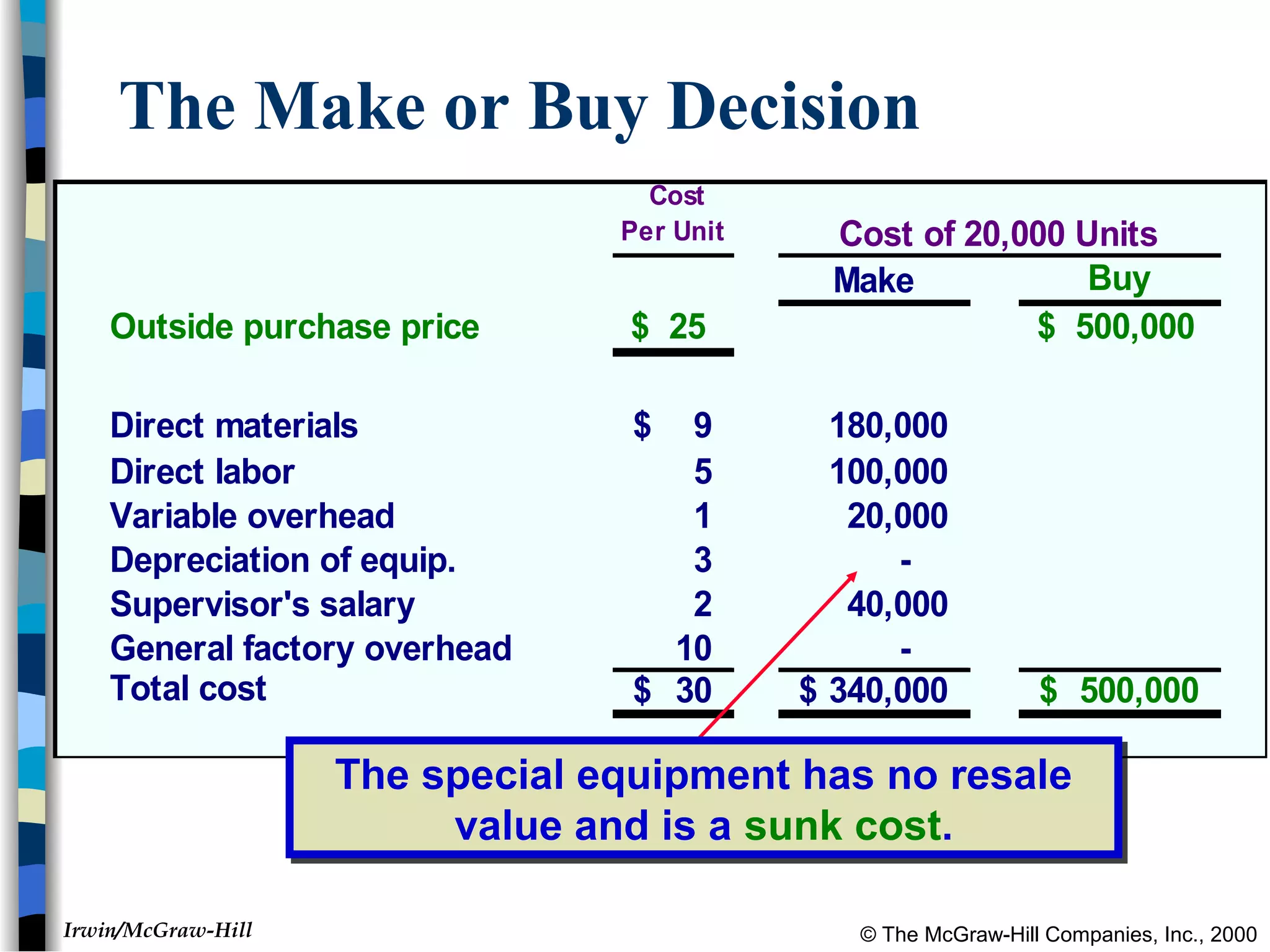

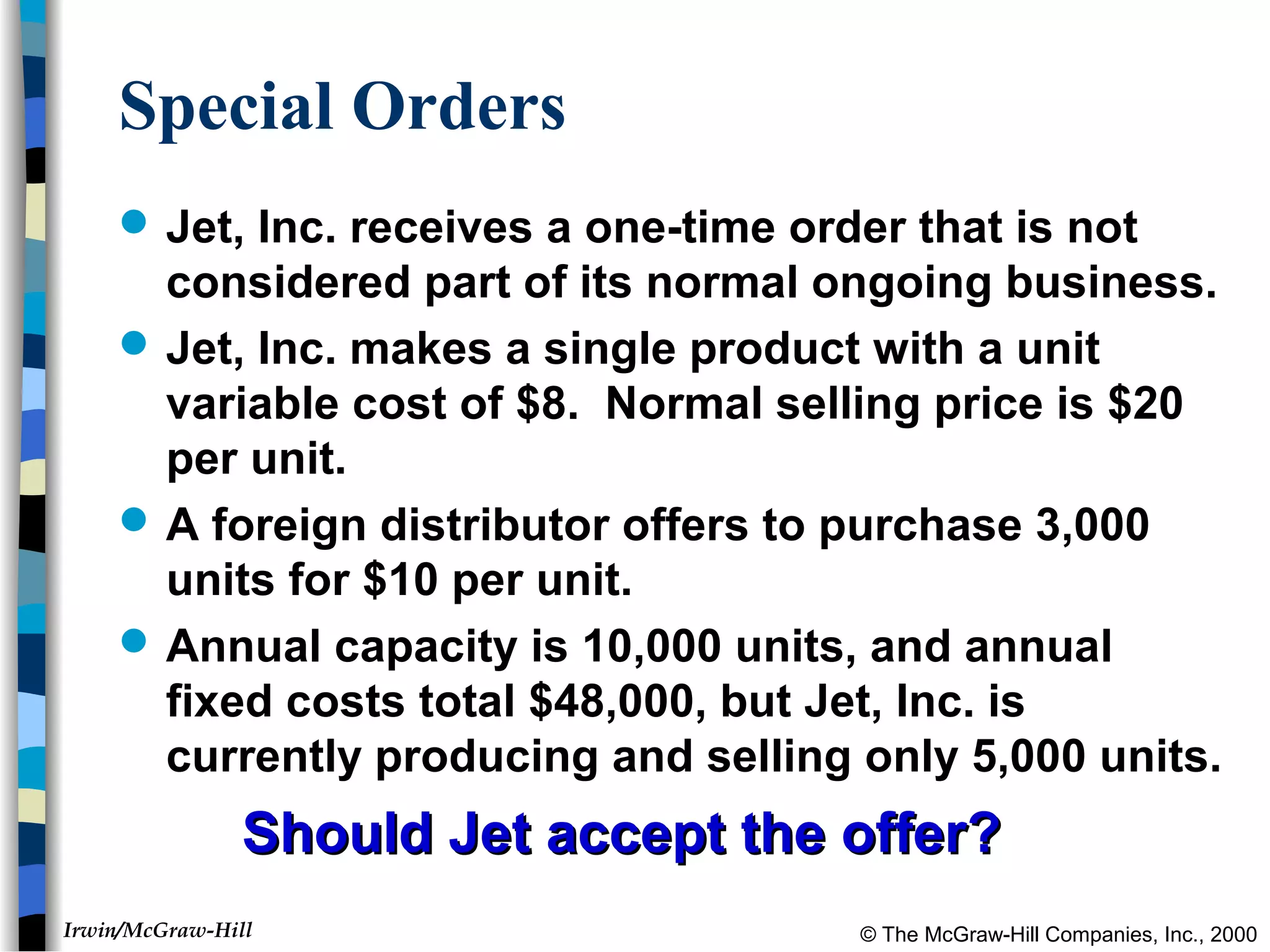

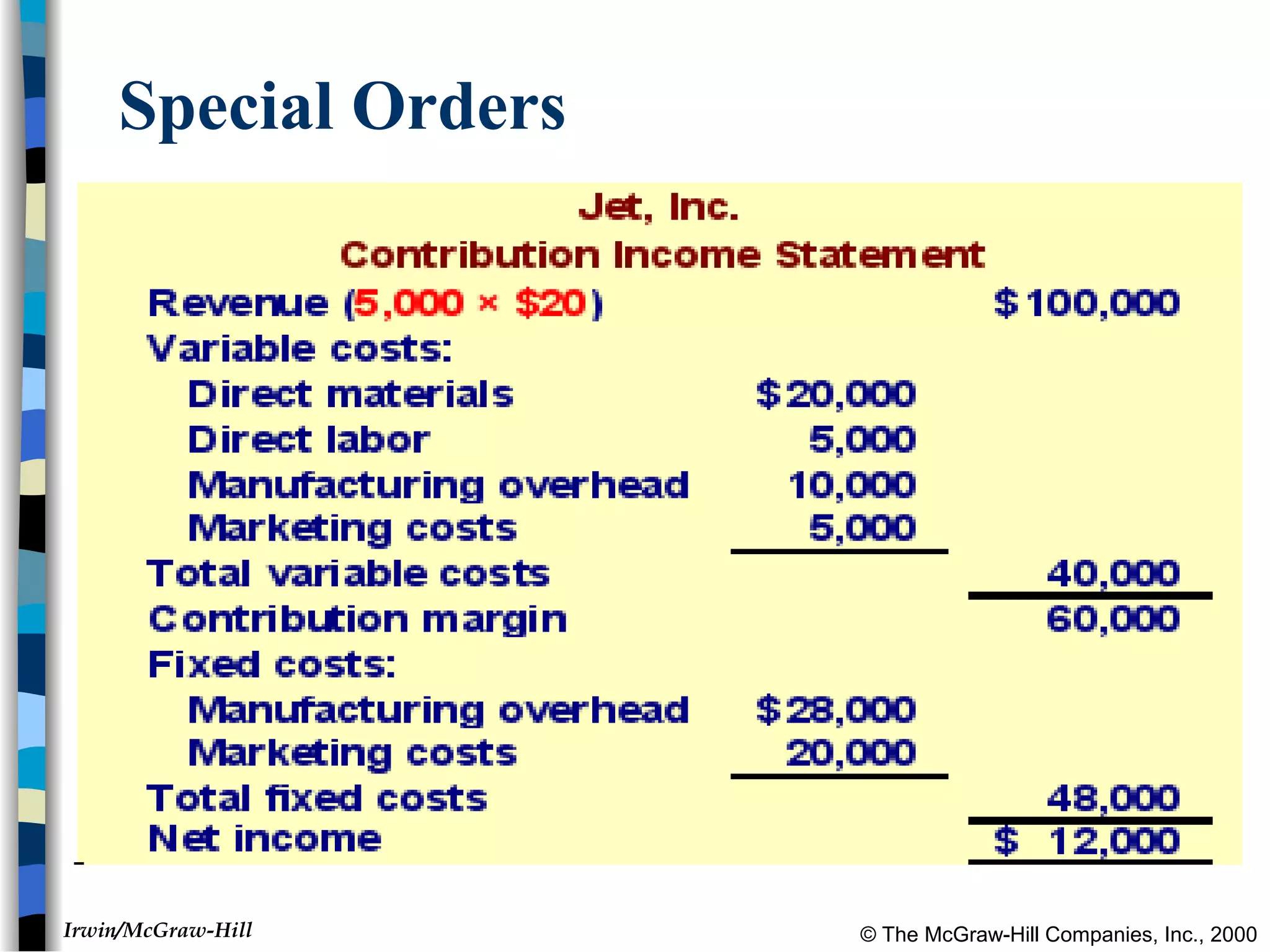

The document discusses relevant costs for decision making. It defines relevant costs as costs that differ between alternatives. It identifies avoidable costs as relevant costs, as they can be eliminated by choosing one alternative over another. Unavoidable costs like sunk costs and future costs that do not differ between alternatives are never relevant. The document uses examples to illustrate identifying relevant costs and sunk costs. It discusses applying relevant costs to decisions like whether to purchase a new machine or keep an old one, and whether to add or drop a business segment.