Embed presentation

Download to read offline

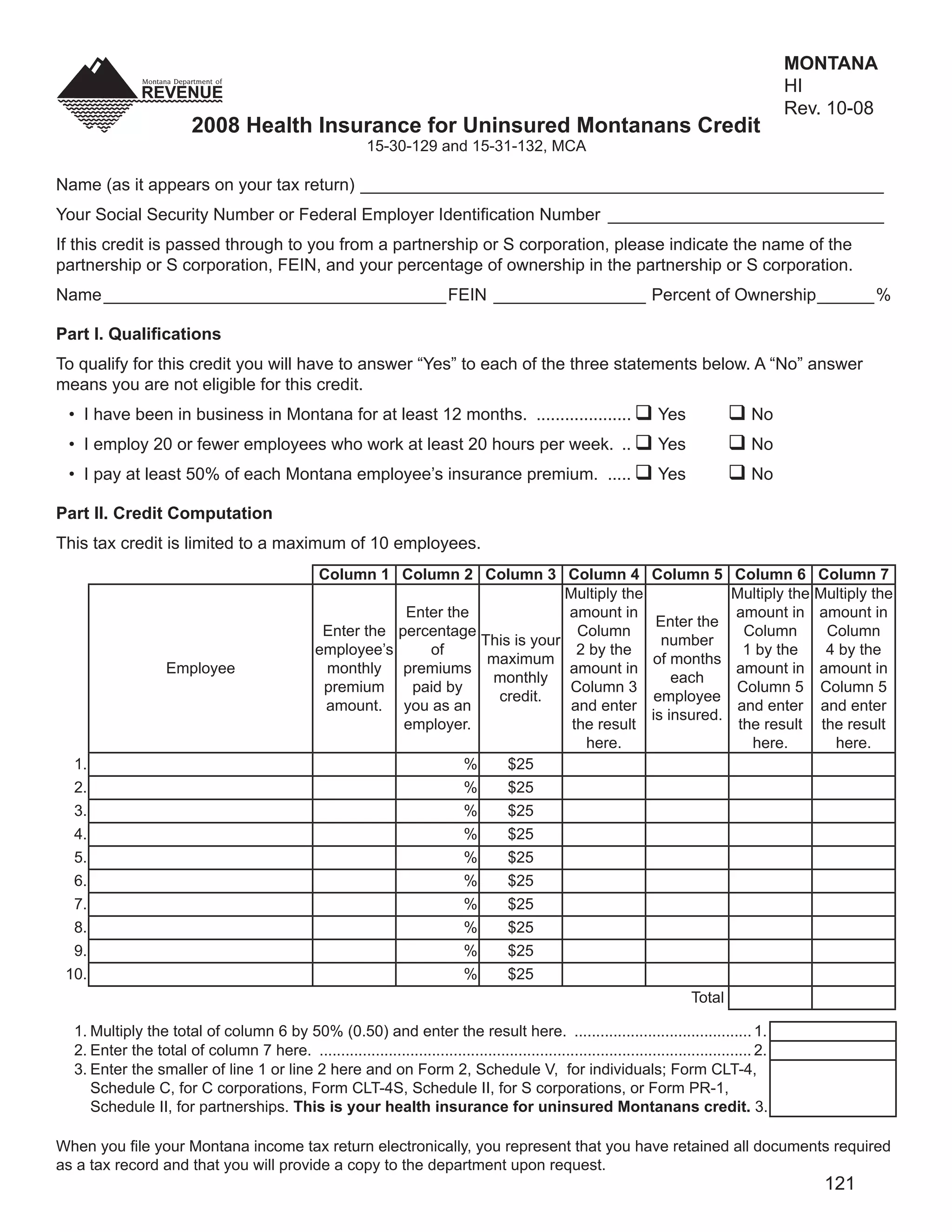

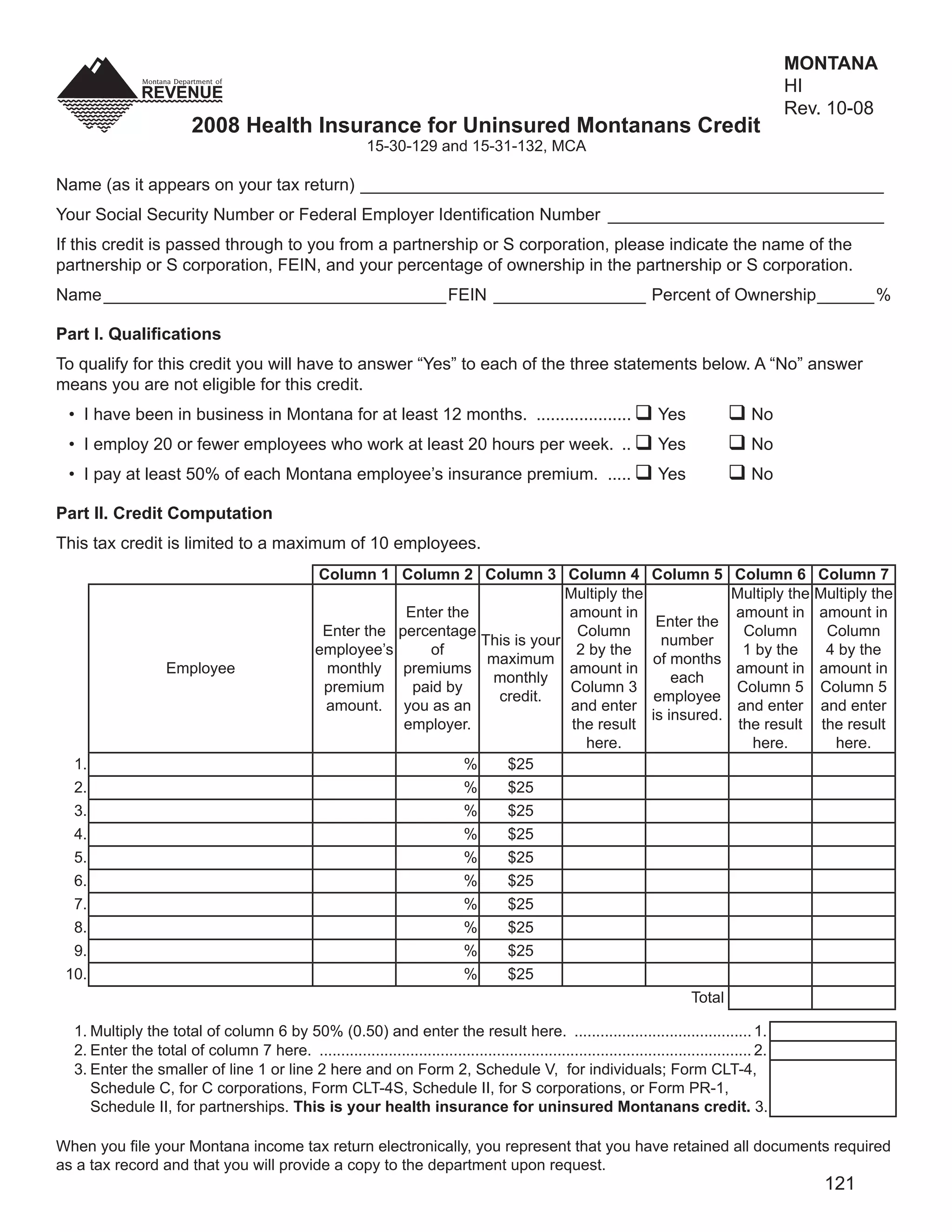

This document provides information about a Montana tax credit for small employers who provide health insurance to their employees. To qualify for the credit, employers must: have been in business in Montana for at least 12 months, employ 20 or fewer employees who work at least 20 hours per week, and pay at least 50% of each employee's health insurance premiums. The credit is calculated based on percentage of premiums paid and number of insured employees. It is claimed on Montana tax forms and cannot exceed tax liability or be carried over to other years.