Embed presentation

Download to read offline

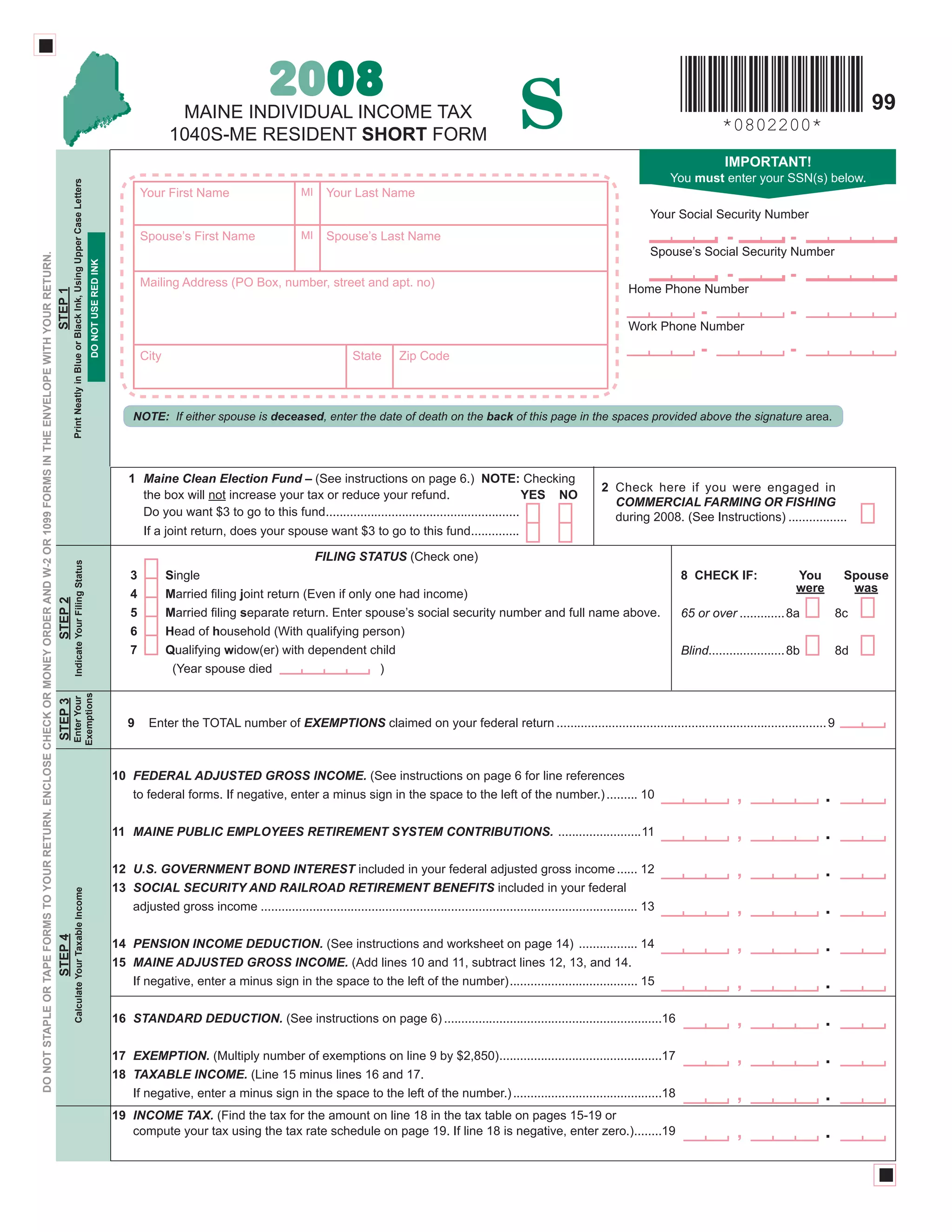

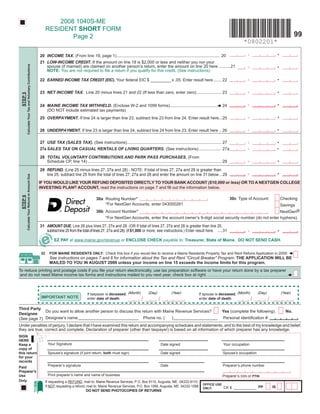

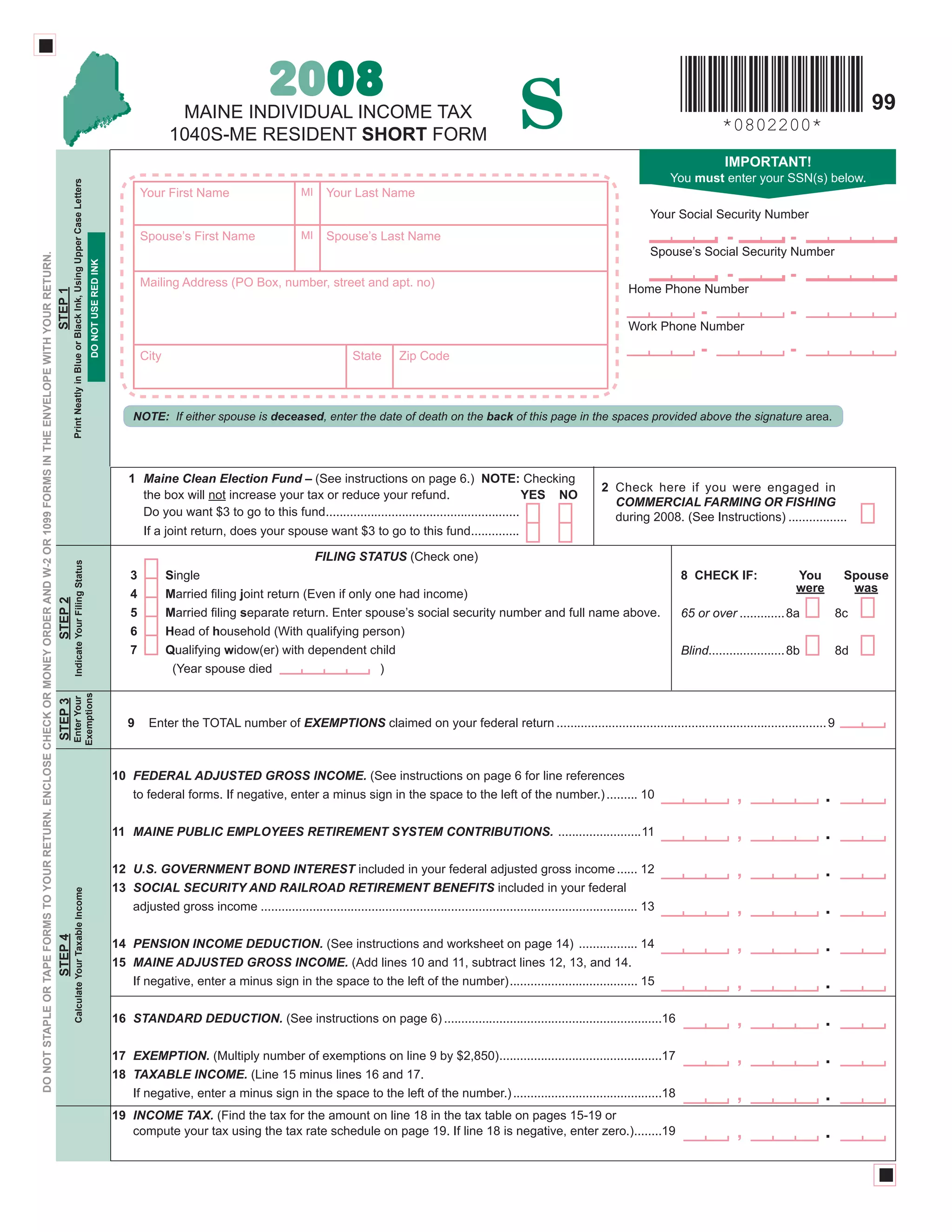

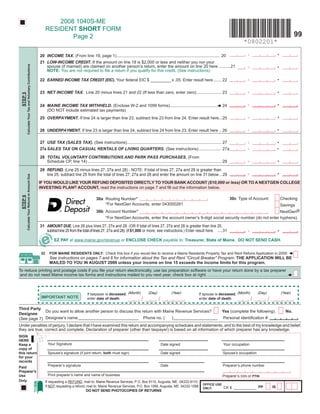

This document is a Maine individual income tax form for 2008. It provides instructions for a resident short form and requests basic identifying information such as names, addresses, social security numbers. It also contains a note about including W-2 and 1099 forms and making checks payable to the state of Maine. There is an optional checkbox to donate $3 to the Maine Clean Election Fund and a checkbox if the filer was engaged in commercial farming or fishing.