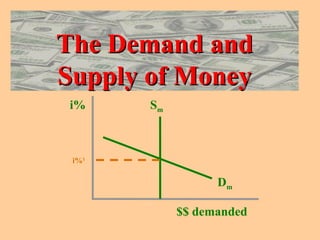

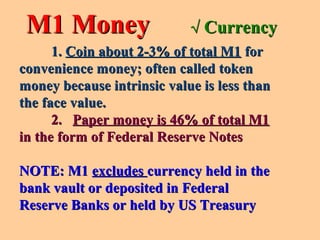

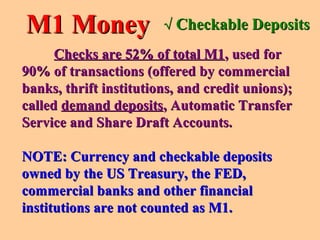

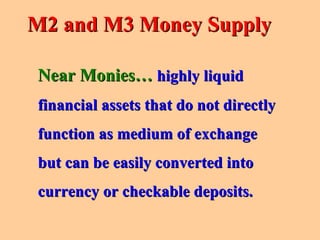

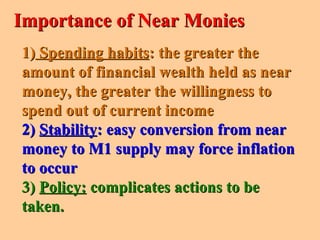

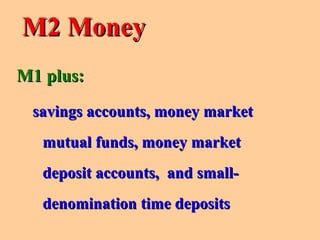

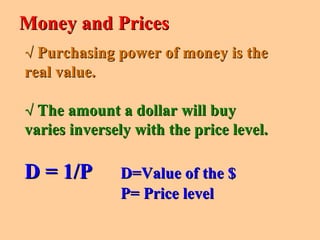

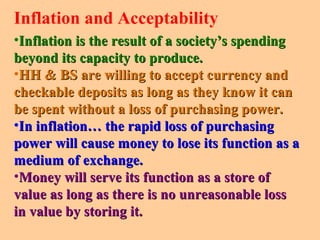

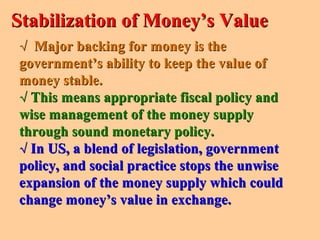

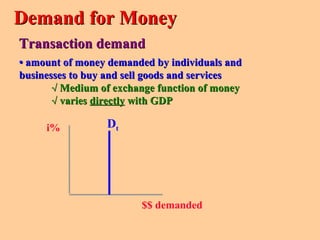

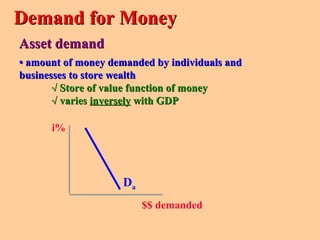

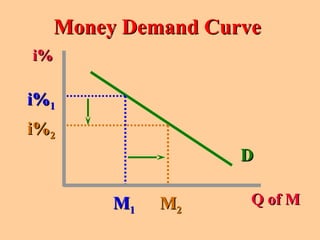

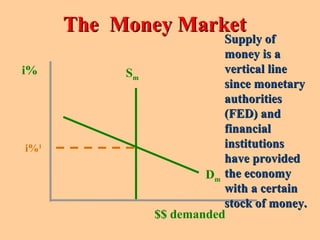

The document discusses the demand and supply of money. It defines different measures of the money supply (M1, M2, M3) which include currency, checkable deposits, savings deposits, money market funds and other savings instruments. The amount of money in circulation depends on how much is demanded by individuals and businesses for transactions and storing wealth. The supply of money is determined by monetary authorities like the Federal Reserve and expands/contracts to meet business needs. Money derives its value from its functions as a medium of exchange, store of value and unit of account which depend on it maintaining stability and purchasing power over time.