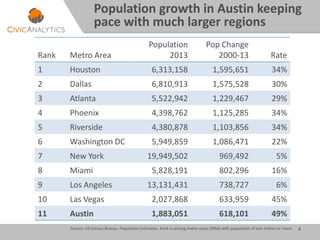

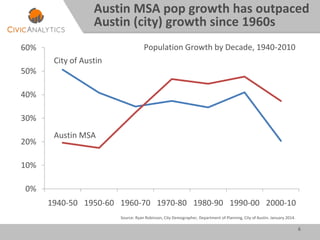

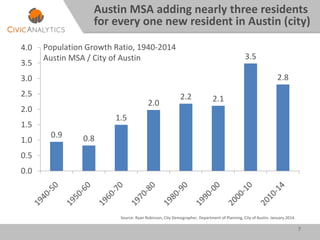

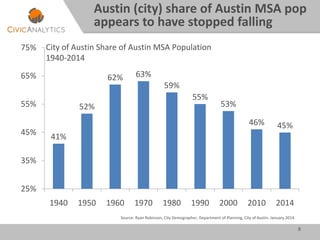

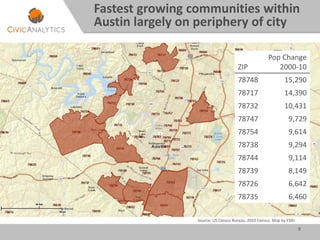

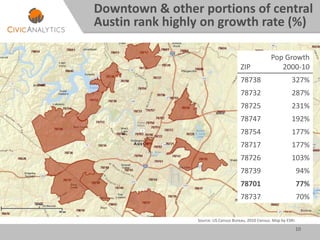

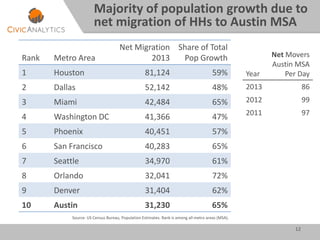

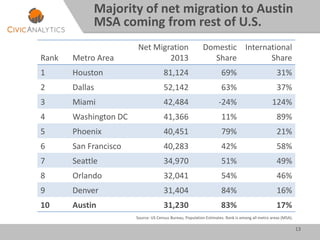

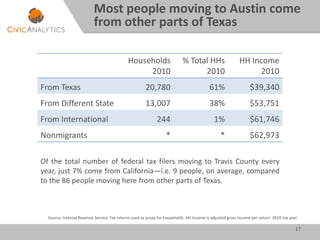

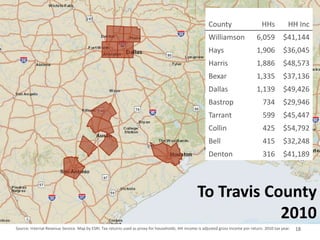

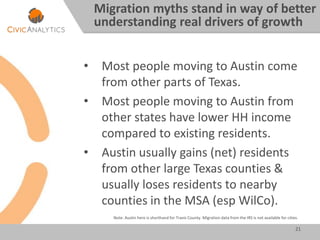

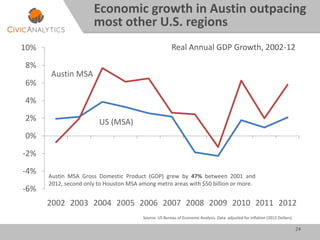

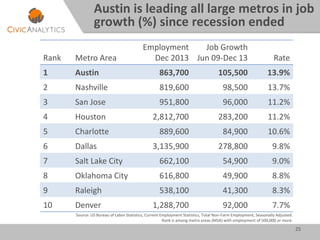

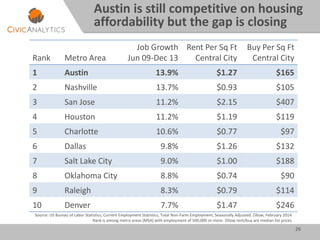

Austin is experiencing rapid population growth, averaging 49% each decade since the 1960s. This growth is fueled mainly by domestic migration, as 61% of new households moving to Austin come from other parts of Texas. Key factors attracting newcomers include a strong economy with 13.9% job growth since 2009, second only to Nashville. While housing costs in Austin remain competitive for now, affordability is declining with median home prices rising 65% in the last decade. High-paying jobs in technology, engineering, healthcare and education are contributing to Austin's status as an attractive place to live and work.