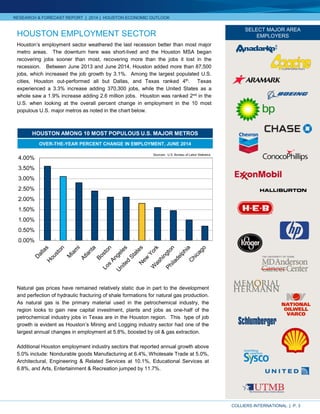

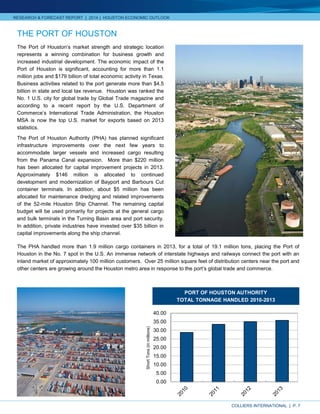

Houston has consistently ranked among the top 10 cities for job and population growth. The document provides statistics showing Houston gained over 82,000 jobs in 2013, has an unemployment rate of 4.6% as of April 2014, and grew its population by over 2% annually from 2012-2014. Houston's economy is led by the energy sector, with over 50% of employment related to energy industries, cementing Houston as the "Energy Capital of the World".