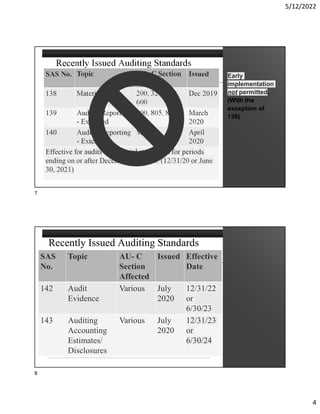

The document discusses recently issued auditing standards from the AICPA Auditing Standards Board, including SAS 134-143. SAS 134-140 relate to auditor reporting and were originally effective for periods ending on or after December 15, 2020 but have been amended to be effective for periods ending on or after December 15, 2021, with early implementation permitted. The standards introduce significant changes to the form and content of audit reports, including placing the auditor's opinion first and introducing key audit matters.

![5/12/2022

10

Illustration 3: An Auditor’s Report on Financial Statements for a Single Year Prepared in

Accordance With Accounting Principles Generally Accepted in the United States of America

Circumstances include the following:

Audit of a complete set of general purpose financial statements (single year).

The audit is not a group audit.

Management is responsible for the preparation of the financial statements in accordance with accounting

principles generally accepted in the United States of America as promulgated by the Financial

Accounting Standards Board.

The terms of the audit engagement reflect the description of management’s responsibility for the financial

statements in AU-C section 210, Terms of Engagement.

The auditor has concluded that an unmodified (that is, “clean”) opinion is appropriate based on the audit

evidence obtained.

Based on the audit evidence obtained, the auditor has concluded that there are no conditions or events,

considered in the aggregate, that raise substantial doubt about the entity’s ability to continue as a going

concern for a reasonable period of time in accordance with AU-C section 570, The Auditor’s

Consideration of an Entity’s Ability to Continue as a Going Concern.

The auditor has not been engaged to communicate key audit matters.

19

Opinion Paragraph Presented First

Independent Auditor’s Report

[Appropriate Addressee]

Report on the Audit of the Financial Statements1

Opinion

(We have audited the financial statements of ABC Company, which comprise the balance sheet as of December

31, 20X1, and the related statements of income, changes in stockholders’ equity, and cash flows for the year then

ended, and the related notes to the financial statements.)

We have audited the accompanying financial statements of the governmental activities, the business-type

activities, the aggregate discretely presented component units, each major fund, and the aggregate remaining

fund information of [Typical County], Tennessee, as of and for the year ended [June 30, 201X], and the related

notes to the financial statements, which collectively comprise the county’s basic financial statements as listed in

the table of contents.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial

position of ABC Company as of December 31, 20X1, and the results of its operations and its cash flows for the

year then ended in accordance with accounting principles generally accepted in the United States of America.

20

19

20](https://image.slidesharecdn.com/auditingstandardsupdatehandout-220815063134-3fd4705d/85/AuditingStandardsUpdateHandout-pdf-10-320.jpg)

![5/12/2022

14

New Responsibilities for Management

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the

financial statements in accordance with accounting principles generally accepted

in the United States of America, and for the design, implementation, and

maintenance of internal control relevant to the preparation and fair presentation of

financial statements that are free from material misstatement, whether due to fraud

or error.

In preparing the financial statements, management is required to evaluate whether

there are conditions or events, considered in the aggregate, that raise substantial

doubt about ABC Company’s ability to continue as a going concern for [insert the

time period set by the applicable financial reporting framework- SAS 132].

27

New Responsibilities for Auditors

Auditor’s Responsibilities for the Audit of the Financial Statements

Many new additions

Mainly a clarification of extant responsibilities

Important terms used: "reasonable assurance," "material misstatement"

These are explained in detail to report user

28

27

28](https://image.slidesharecdn.com/auditingstandardsupdatehandout-220815063134-3fd4705d/85/AuditingStandardsUpdateHandout-pdf-14-320.jpg)

![5/12/2022

18

New Auditor’s Responsibilities

Next paragraph provides some details on what is done as part of

an audit (see next slide)

35

New Auditor Responsibilities (cont’d)

In performing an audit in accordance with GAAS, we:

Exercise professional judgment and maintain professional skepticism throughout the audit.

Identify and assess the risks of material misstatement of the financial statements, whether due to

fraud or error, and design and perform audit procedures responsive to those risks. [see AU-C 315 for

basic process] Such procedures include examining, on a test basis, evidence regarding the amounts

and disclosures in the financial statements.

Obtain an understanding [not simply considering I/C] of internal control relevant to the audit in order

to design audit procedures that are appropriate in the circumstances, but not for the purpose of

expressing an opinion on the effectiveness of ABC Company’s internal control. Accordingly, no such

opinion is expressed. [clarifying auditor's responsibility with respect to internal control risk]

Evaluate the appropriateness of accounting policies used and the reasonableness of significant

accounting estimates made by management, as well as evaluate the overall presentation of the

financial statements.

Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that

raise substantial doubt about ABC Company’s ability to continue as a going concern for a reasonable

period of time.

36

35

36](https://image.slidesharecdn.com/auditingstandardsupdatehandout-220815063134-3fd4705d/85/AuditingStandardsUpdateHandout-pdf-18-320.jpg)

![5/12/2022

27

Other Information–Definitions

Misstatement of the other information. A misstatement of

the other information exists when the other information is

incorrectly stated or otherwise misleading. (Ref: par. A11–

A12).

Other information. Financial or nonfinancial information

(other than financial statements and the auditor’s report

thereon) included in an entity’s annual report. (Ref: par.

A13)

53

Other Information

Reporting Illustration 1: The Auditor Has Not Identified an Uncorrected Material

Misstatement of the Other Information

Other Information [Included in the Annual Report] Management is responsible for the

other information [included in the annual report]. The other information comprises the

[information included in the annual report] but does not include the financial statements

and our auditor’s report thereon.

Our opinion on the financial statements does not cover the other information, and we do

not express an opinion or any form of assurance thereon. In connection with our audit of

the financial statements, our responsibility is to read the other information and consider

whether a material inconsistency exists between the other information and the financial

statements, or the other information otherwise appears to be materially misstated. If,

based on the work performed, we conclude that an uncorrected material misstatement of

the other information exists, we are required to describe it in our report.

54

53

54](https://image.slidesharecdn.com/auditingstandardsupdatehandout-220815063134-3fd4705d/85/AuditingStandardsUpdateHandout-pdf-27-320.jpg)

![5/12/2022

28

Other Information

Reporting Illustration 2: The Auditor Has Concluded That an Uncorrected Material Misstatement

of the Other Information Exists

Other Information [Included in the Annual Report] Management is responsible for the other

information [included in the annual report]. The other information comprises the [information

included in the annual report] but does not include the financial statements and our auditor’s

report thereon.

Our opinion on the financial statements does not cover the other information, and we do not

express an opinion or any form of assurance thereon. In connection with our audit of the financial

statements, our responsibility is to read the other information and consider whether a material

inconsistency exists between the other information and the financial statements, or the other

information otherwise appears to be materially misstated. If, based on the work performed, we

conclude that an uncorrected material misstatement of the other information exists, we are

required to describe it in our report. As described below, we have concluded that such an

uncorrected material misstatement of the other information exists.

[Description of material misstatement of the other information]

55

Other Information

Question

Does the Annual Report under SAS 137 include information in the Annual

Comprehensive Financial Report Audit such as

Letter of Transmittal

Combining Statements if not engaged to give an in-relation opinion

Corrective Action Plans submitted by Management in compliance with regulations

Introductory Section information such as a List of Officials and TCWG and Table

of Contents

Etc.

What about the Statistical Section?

Mostly depends on the agreement with Management!

56

55

56](https://image.slidesharecdn.com/auditingstandardsupdatehandout-220815063134-3fd4705d/85/AuditingStandardsUpdateHandout-pdf-28-320.jpg)