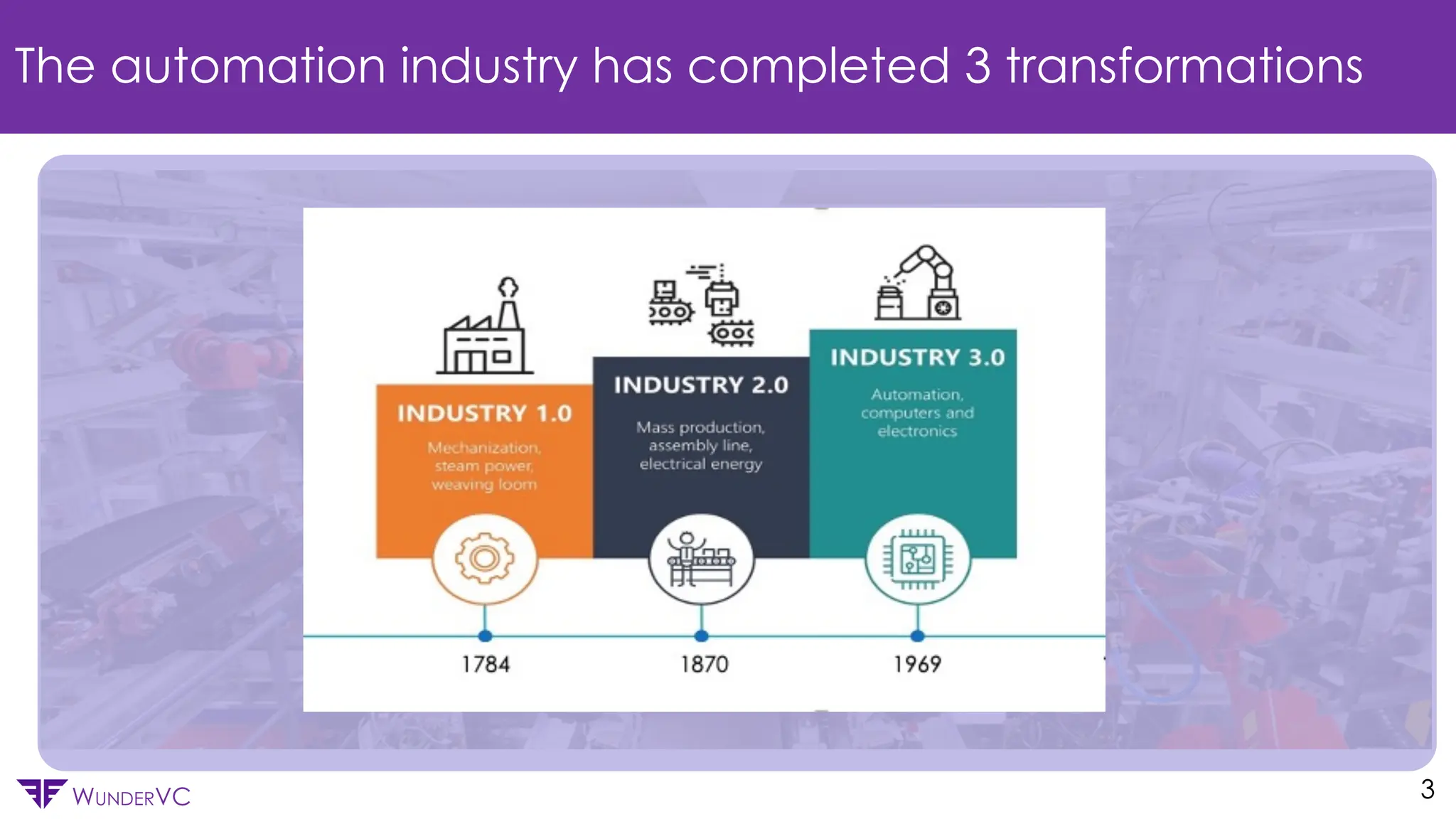

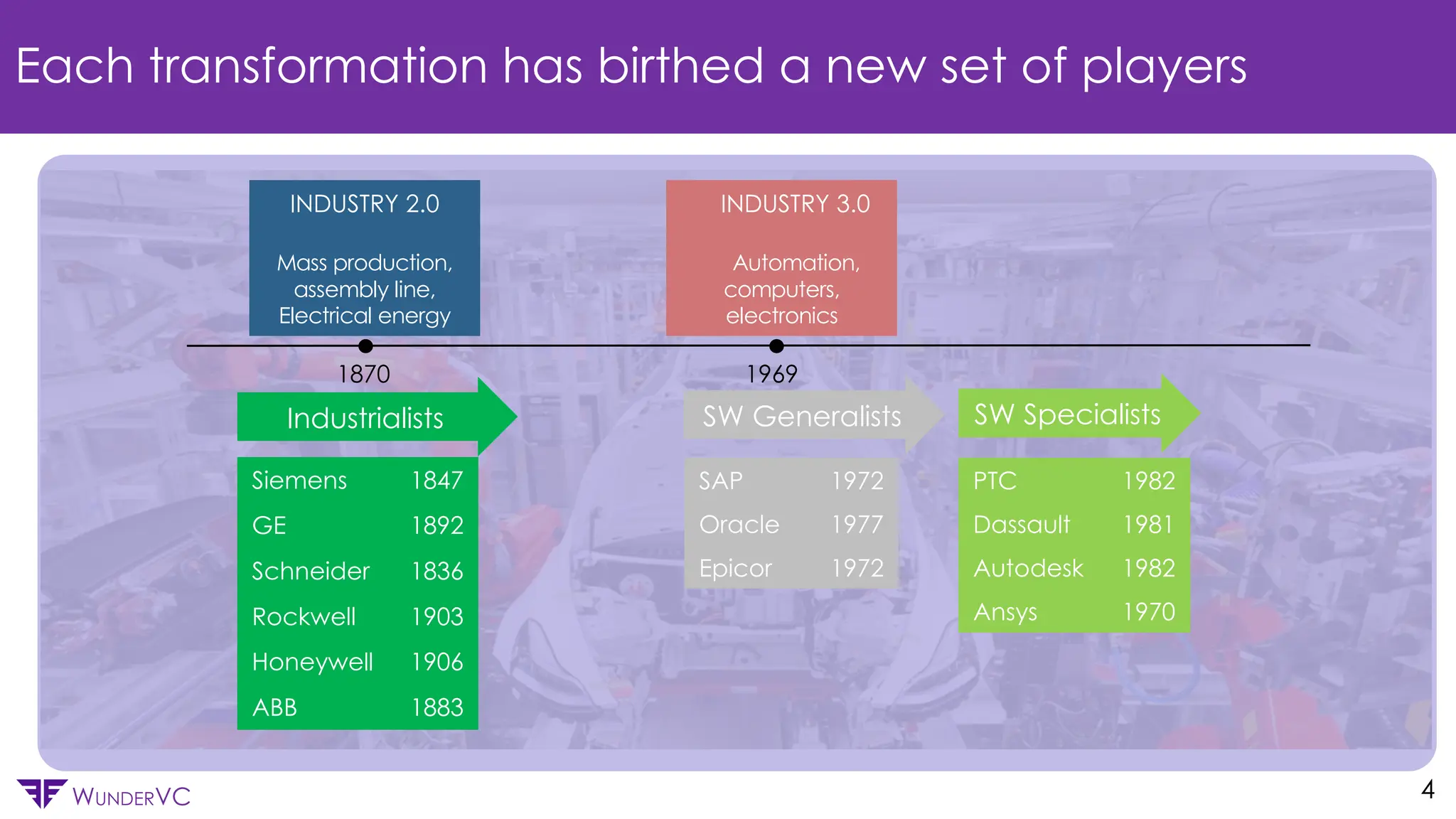

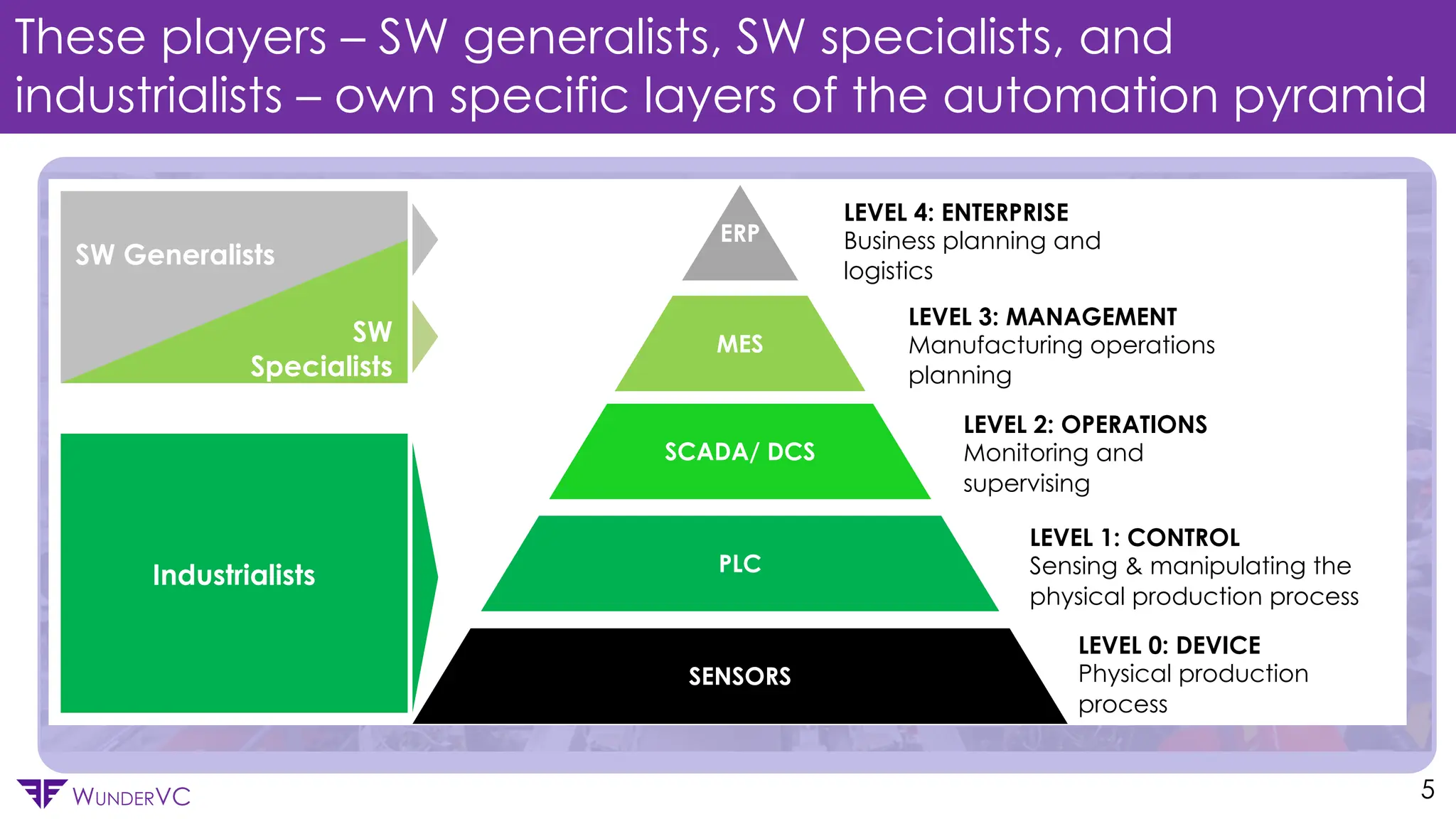

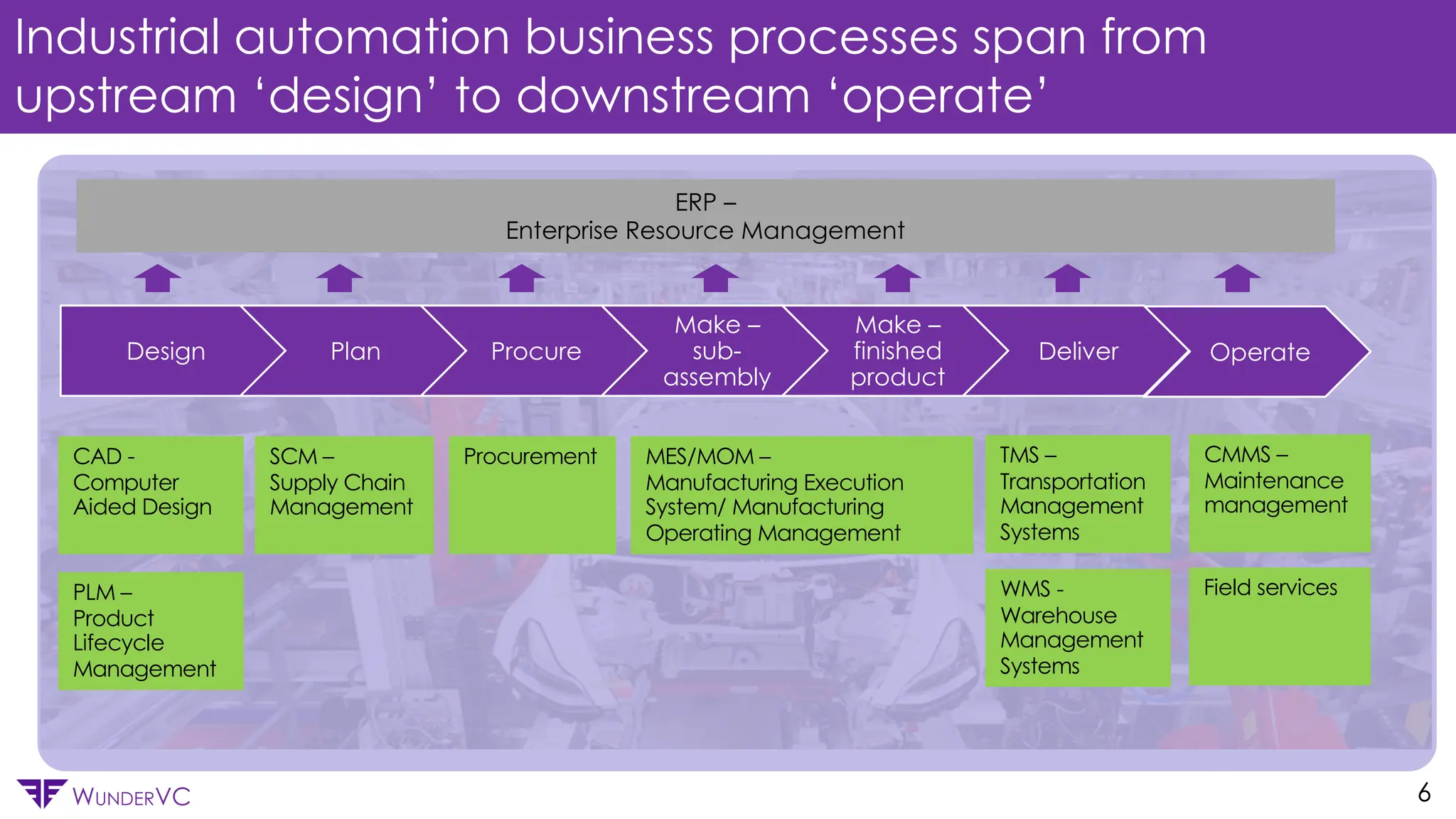

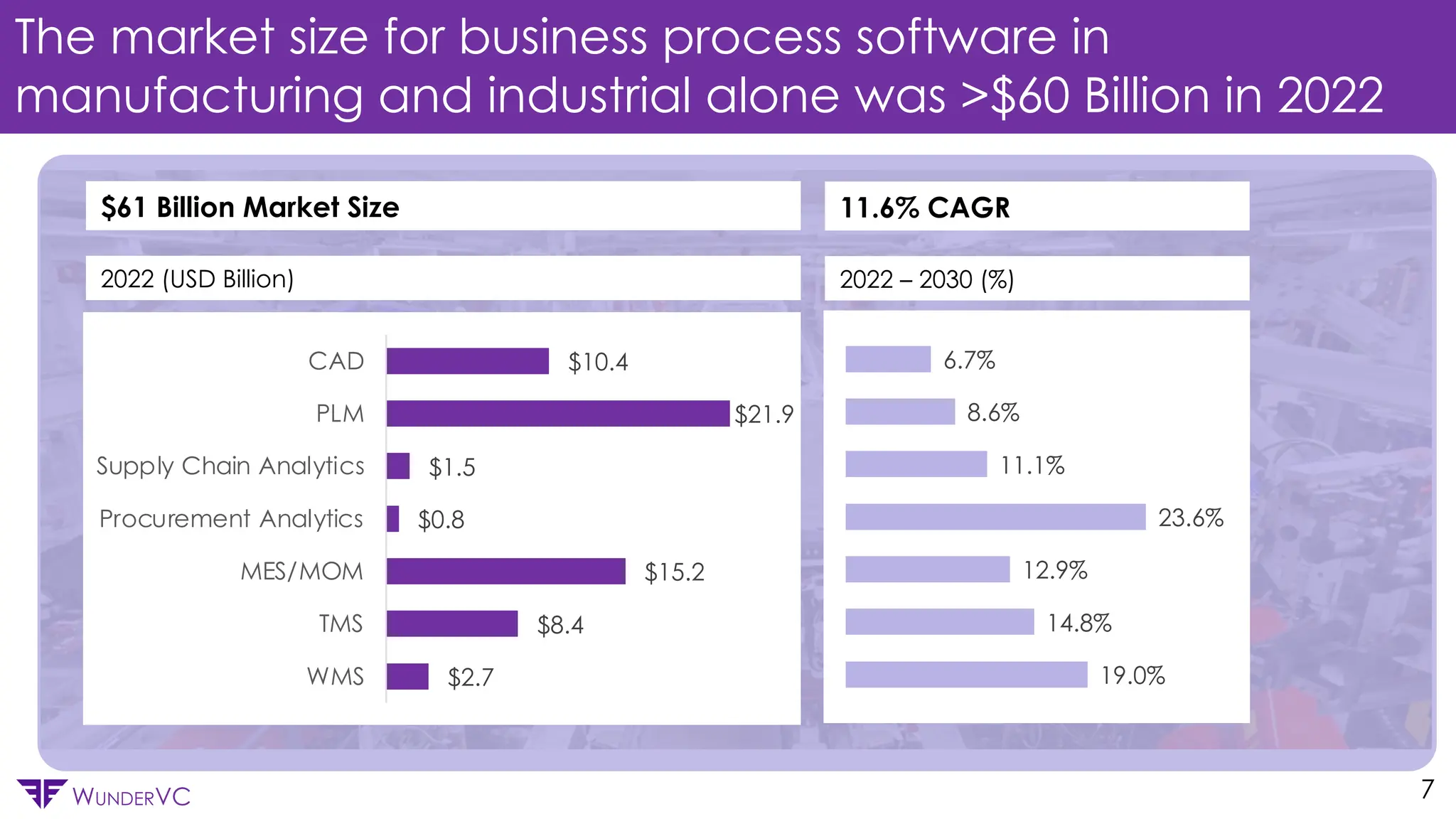

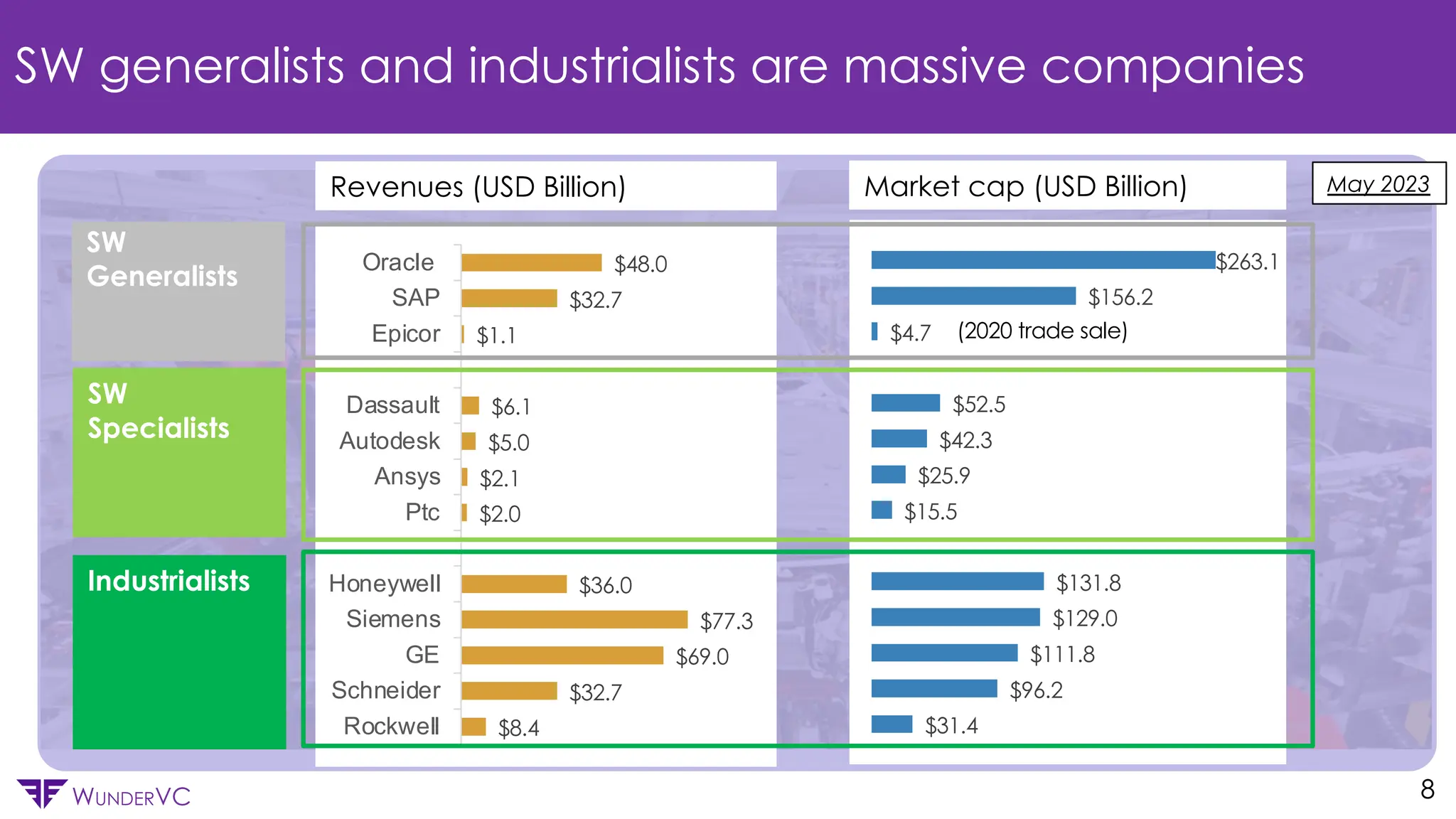

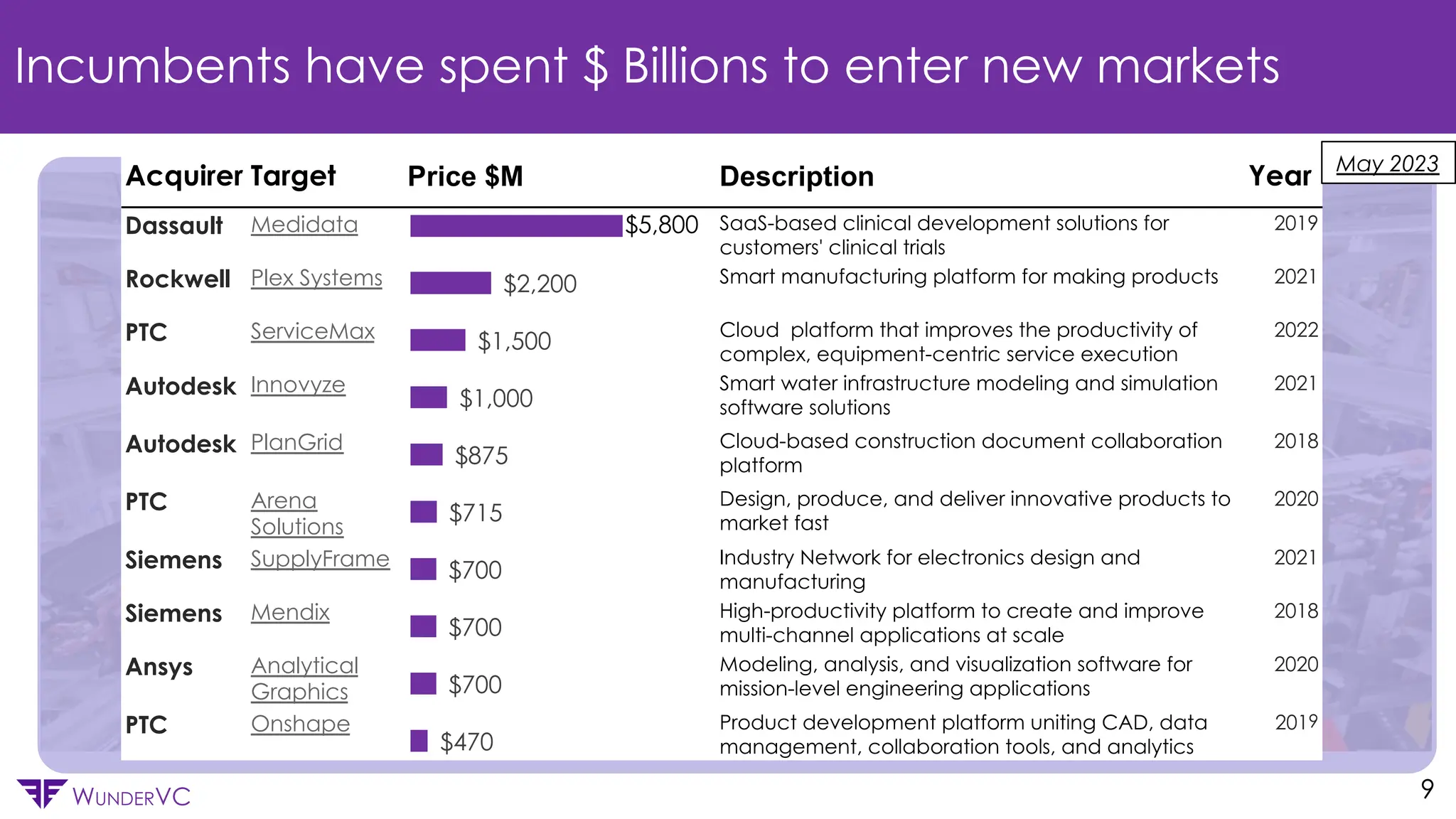

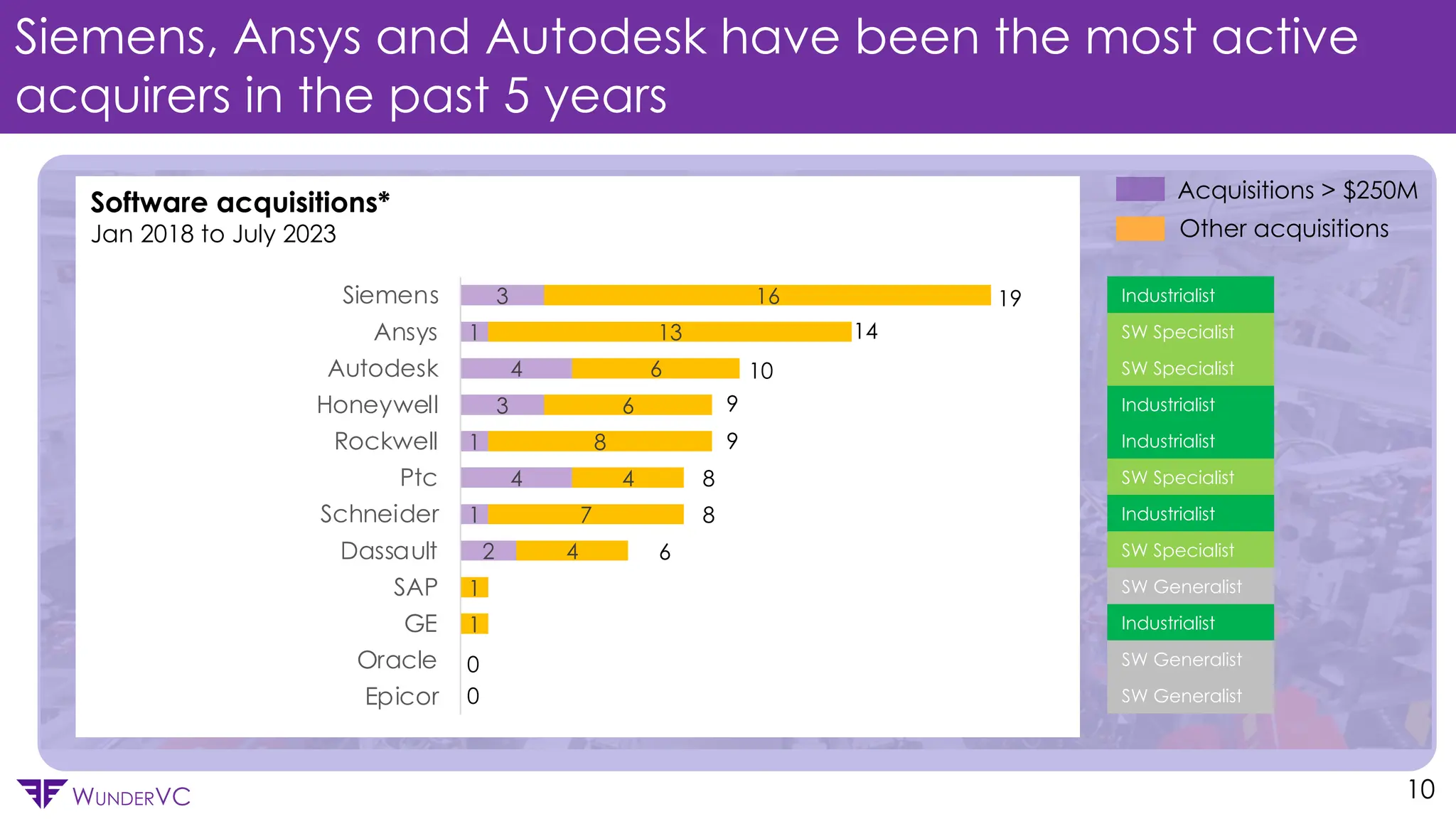

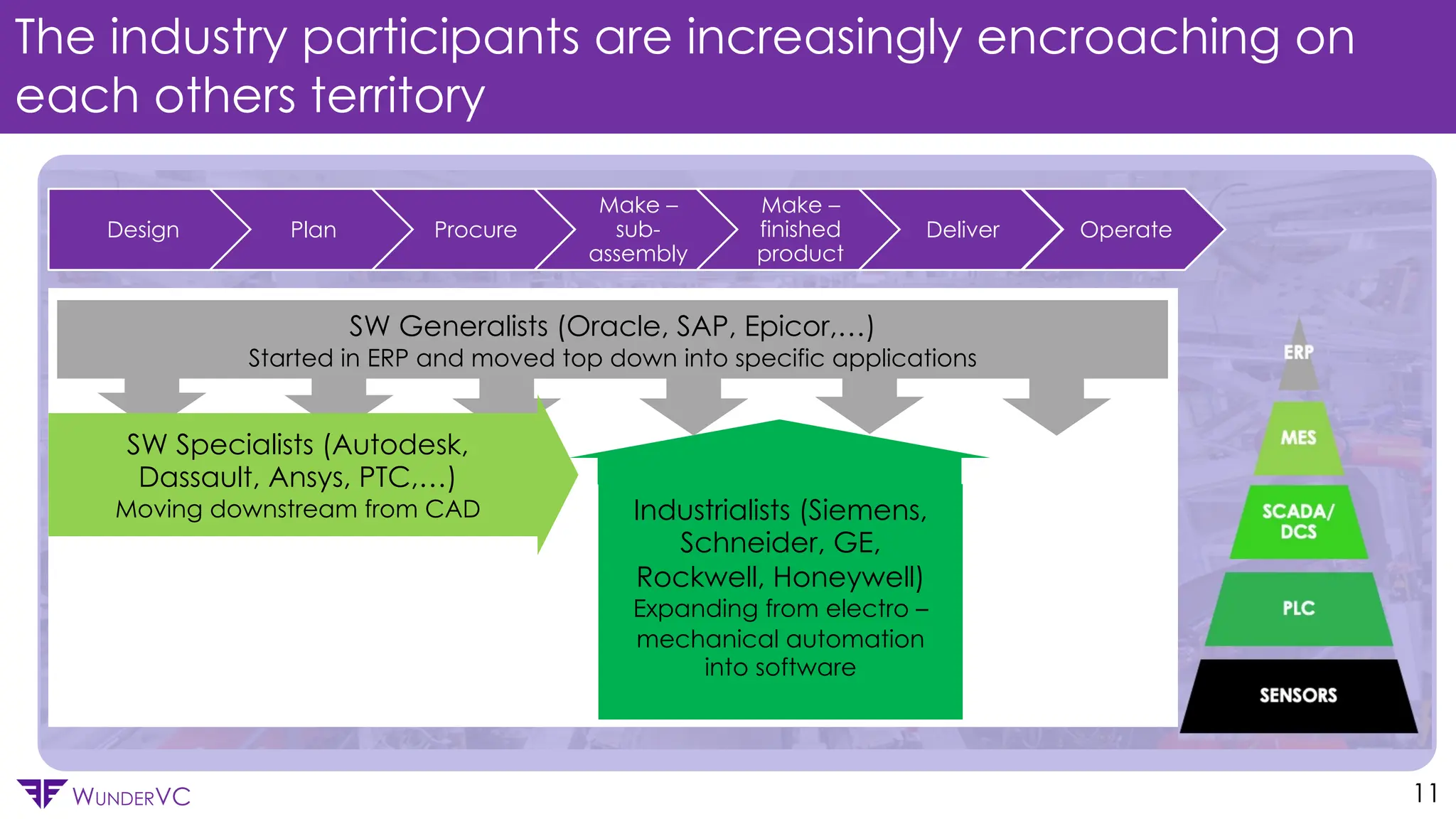

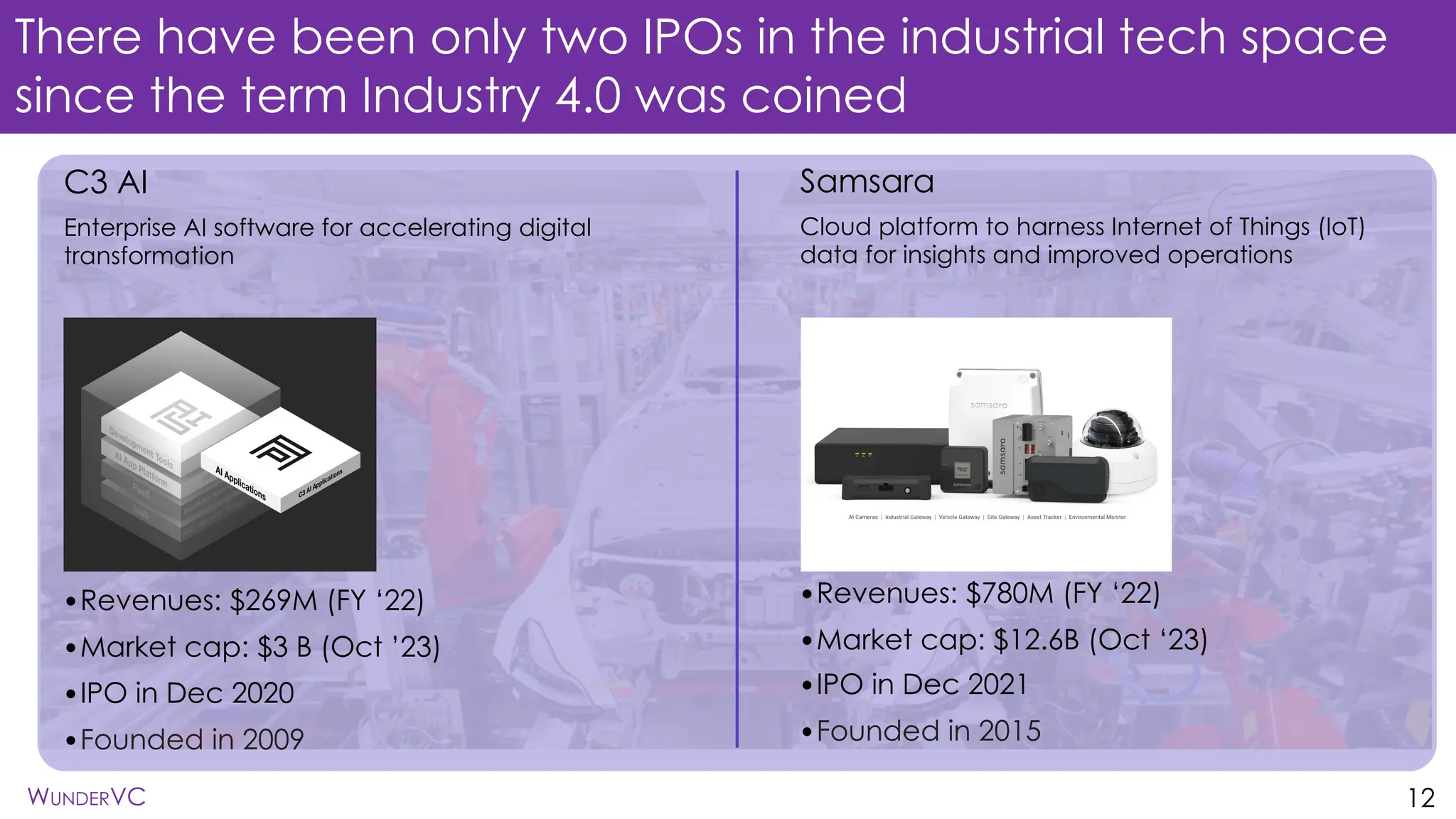

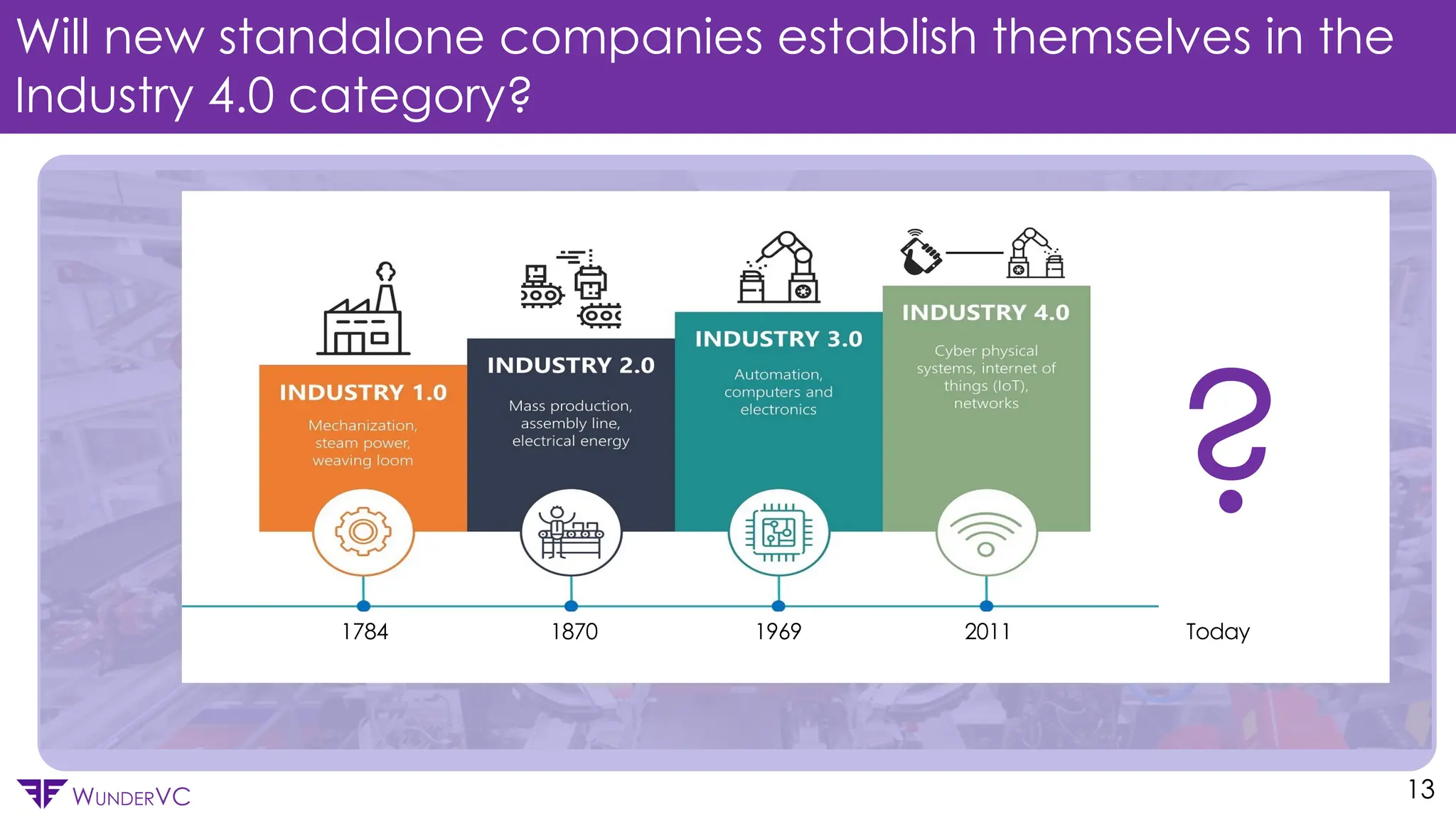

The automation industry has undergone three transformations, creating distinct player categories such as software generalists, specialists, and industrialists. The business process software market is valued at over $60 billion and is characterized by significant acquisitions among incumbents to expand into new areas. Moving forward, there is uncertainty regarding whether new standalone companies will emerge within the Industry 4.0 sector.