As 2- Indian Accounting Standard -Valuation of Inventory

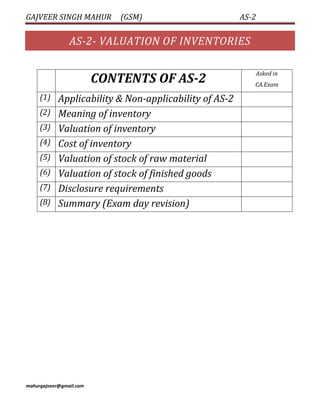

- 1. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com AS-2- VALUATION OF INVENTORIES CONTENTS OF AS-2 Asked in CA.Exam (1) Applicability & Non-applicability of AS-2 (2) Meaning of inventory (3) Valuation of inventory (4) Cost of inventory (5) Valuation of stock of raw material (6) Valuation of stock of finished goods (7) Disclosure requirements (8) Summary (Exam day revision)

- 2. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com [1] Applicability & Non-applicability of AS-2 Applicability This Standard should be applied in accounting for inventories: Finished goods stock; Work-in-progress stock; Raw material stock Non- applicability As-2 is not applicable in following types of inventories: 1) work in progress arising under construction contracts, including directly related service contracts; ( being covered under AS); Note: building under construction is a WIP, but AS-2 is not applicable on this WIP. Note: But Inventory held for use in construction, (e.g. cement lying at the site) is covered by AS 2. 2) work in progress arising in the ordinary course of business of service providers(audit in progress, medical services in progress) 3) shares, debentures and other financial instruments held as stock-in-trade; and 4) producers’ inventories of

- 3. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com Note: where sale is assured under a forward contract or a government guarantee or where a homogenous market exists and there is negligible risk of failure to sell.

- 4. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com [2] Meaning of Inventory Meaning of Inventory Inventories are assets: 1) held for sale in the ordinary course of business(finished goods) 2) in the process of production for such sale(work-in- progress) 3) in the form of materials or supplies to be consumed in the production process or in the rendering of services(raw material, stores, spares, consumables) Containers and Empties 1) Containers and empties are neither goods for sale in the ordinary course of business, nor are they goods in the production process nor they are materials or supplies for consumption in the production process or in rendering of services. 2) The Expert Advisory Committee of ICAI has however expressed an opinion that containers and empties are items of inventory. 3) It seems nevertheless that containers and empties having useful life more than one year should be regarded as depreciable assets, in accordance with AS 6. Machinery spares (A) Machinery spares treated as Inventory: 1) Machinery spares, which are not specific to a particular item of fixed asset but can be used generally for various item of fixed assets, should be treated as inventories for the purposeofAS-2. 2) Such machinery spares should be charged to the statement of profit and loss and when issued for consumption in the ordinary course of operations.

- 5. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com (B) Machinery spares treated as capital spares : The machinery spares of the following types should be capitalized being of the nature of capital spares/insurance spares- i) Machinery spares which are specific to a particular item of fixed assets ,i.e., they can be used only in connection with a particular item of the fixed asset, and ii) Their use is expected to be irregular. Note:(1) Machinery of the nature of capital spares/insurance spares should be capitalized separately at the item of their purchase whether procured at the time of purchase of the fixed asset concerned or subsequently. Note:(2) insurance spares should be allocated on a systematic basis over period not exceeding the useful life of the principal item, i.e., the fixed asset to which they relate. Note:(3) When the related fixed asset is either discarded or sold, the written down the value less disposal value, if any, of the capital spares/insurance spares should be written off. Note:(4) The stand–by equipment is a separate fixed asset in its own right and should be depreciated like the any other fixed asset.

- 6. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com Explanation of meaning of inventory Note: containers & empties are treated as inventories (opinion of EAC)

- 7. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com Explanation of machinery spares parts

- 8. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com [3] Valuation of Inventories Valuation of Inventory Inventories should be valued at: cost or Net realisable value Whichever is lower. Note:(1) Cost is to be calculated separately for stock of: Raw material Work-in-progress Finished goods Note:(2) Cost may be calculated as follows: 1) Actual cost 2) Estimated cost Note:(3) Actual cost of inventory may be calculated by using following cost formula: a) Specific identification method b) Other method FIFO method Weighted average method Note:(4) Estimated cost may be calculated as follows: a) Standard cost b) Retail method Meaning of NRV Estimated selling price Less: estimated cost of completion Less: estimated costs necessary to make the sale(selling expenses) XXXX (XXXX) (XXXX) Net realisable value XXXX

- 9. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com Note:(1) How to estimate NRV: i) Estimates of net realisable value are to be based on the most reliable evidence available at the time the estimates are made as to the amount the inventories are expected to realise. ii) These estimates take into consideration: fluctuations of price or Cost directly relating to events occurring after the balance sheet date to the extent that such events confirm the conditions existing at the balance sheet date. iii) Net realisable value of the quantity of inventory held to satisfy firm sales or service contracts is based on the contract price. iv)If the sales contracts are for less than the inventory quantities held, the net realisable value of the excess inventory is based on general selling prices. v) An assessment is made of net realisable value as at each balance sheet date. vi)The AS 2 is silent whether an item of inventory carried at net realisable value, can be written up on subsequent increase of net realisable value. The IAS 2, Inventory permits such write-ups. When to apply specific identification method Specific identification method should be applied in following conditions: 1) items are not ordinarily interchangeable and 2) Goods are specifically segregated for specific projects.

- 10. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com When to apply FIFO/Weighted average method When there are large numbers of items of inventory which are ordinarily interchangeable. When to use standard cost When it is impracticable to calculate the actual cost and standard cost may be used for convenience if the results approximate actual cost. When to use retail method The retail method is generally used i) In the retail trade ii) Inventories of large numbers of rapidly changing items iii) goods have similar margins and iv)For which it is impracticable to use other costing methods. Note :(1) The cost of the inventory is determined by reducing from the sales value of the inventory the appropriate percentage gross margin. Cost of inventory =(sales value-gross margin) Note :(2) The percentage used takes into consideration inventory which has been marked down to below its original selling price. Note :(3) An average percentage for each retail department is often used.

- 11. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com Explanation of valuation of inventory

- 12. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com [4] Calculation of the cost of inventories How to calculate cost of raw material Cost of raw material includes: Purchase price Less: trade discount Add: excise duty on raw material (if non refundable) Add: vat/sales tax/CST (if non refundable) Add: cost of containers Add: freight/ insurance Add: loading /unloading charges Add: other cost directly attributable to acquisition Less: rebate Less: duty drawback XXXX (XXXX) XXXX XXXX XXXX XXXX XXXX XXXX (XXXX) (XXXX) Cost of raw material XXXX Note:(1) following costs are excluded from the cost of raw material: 1) Abnormal loss of material 2) Storage cost 3) Interest and borrowing cost Note:(2) storage cost: Storage costs are normally not included in cost of raw material but in following cases storage cost may be included in the cost of raw material: i) Storage cost are necessary in the production process prior to a further production stage

- 13. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com How to calculate cost of finished goods & WIP Costs of finished goods comprise: Cost of raw material + costs of conversion + Add: other costs incurred in bringing the inventories to their present location and condition XXXX XXXX XXXX Cost of finished goods XXXX Note: (1) present location means at factory stage. Note: (2) present condition means at finished stage. Note: (3) Cost of conversion: cost of conversion means cost of converting raw material into finished goods(excluding cost of raw material) Direct labour + Direct expenses + Systematic allocation of Fixed and variable production overheads XXXX XXXX XXXX Cost of conversion XXXX Note: (4) Variable production overheads are assigned to each unit of production on the basis of the actual capacity. Note: (5) fixed production overheads are recovered on the basis of: Normal capacity or Actual capacity

- 14. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com Whichever is higher. Note: (6) Excise duty on output is product cost rather than period cost. Hence taken in production cost and consequently in cost of inventory. Note: (7) Other Costs may be included in cost of inventory provided they are incurred to bring the inventory to their present location and condition. Eg. Cost of design Note: (8) Treatment of amortisation of intangibles for ascertaining inventory costs. It appears that amortisation of intangibles related to production, e.g. patents right of production or copyright for a publisher should be taken as part of inventory costs. Note: (9) Exchange differences are not taken in inventory costs under Indian GAAP. Note: (10)Exclusions from the cost of inventories Following costs are not included in cost of inventories i) Abnormal amounts of wasted materials, labour, or other production costs; ii) Storage costs, unless the production process requires such storage; iii) Administrative overheads that do not contribute to bringing the inventories to their present location and condition; iv)Selling and distribution costs. Note: (11) Interest and other borrowing costs are usually considered as not relating to bringing the inventories to their present location and condition. These costs are therefore not usually included in cost of

- 15. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com inventory. Interests and other borrowing costs however are taken as part of inventory costs, where the inventory necessarily takes substantial period of time for getting ready for intended sale. Example of such inventory is wine. Allocation of joint costs to joint or By- product 1) The value of by products, scrap and wastes are usually not material. Therefore these by-products are valued at net realisable value 2) Costs incurred up to the stage of split point (joint costs) should be allocated different joint products on a rational and consistent basis. 3) The basis of allocation may be: Sale value at split off point Net realisable value 4) The cost of main product is allocated joint cost minus net realisable value of by-products, scraps or wastes. [5] Valuation of raw material stock If finished goods are expected to be sold at or above cost Stock of raw material should be valued always at cost of raw material if the finished products in which they will be incorporated are expected to be sold at or above cost If finished goods are expected to be sold at below cost Stock of raw material should be valued at NRV (replacement cost of raw material) when: i) There has been a decline in the price of materials and ii) It is estimated that the cost of the finished

- 16. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com products will exceed net realisable value Explanation of valuation of inventory of raw material

- 17. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com [6] Valuation of finished goods stock/ WIP stock Valuation of stock of finished stock Finished goods stock should be valued at: cost of finished goods or Net realisable value Whichever is lower. Valuation on item by item basis 1) Inventories are usually written down to net realisable value on an item- by-item basis. 2) In following cases, similar or related items may be grouped together i) Items of inventory are relating to the same product line that have similar purposes or end uses and ii) These product are produced and marketed in the same geographical area and iii) These product cannot be practicably evaluated separately from other items in that product line. [7] Disclosure requirements Disclosures in notes to accounts The financial statements should disclose: 1) The accounting policies adopted in measuring inventories, including the cost formula used; and 2) The total carrying amount of inventories and its classification appropriate to the enterprise. Note: Common classifications of inventories are raw materials and components, work in progress, finished goods, stores and spares, and loose tools.

- 18. GAJVEER SINGH MAHUR (GSM) AS-2 mahurgajveer@gmail.com