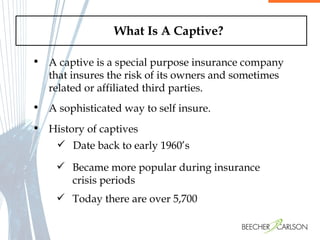

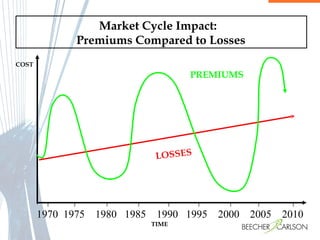

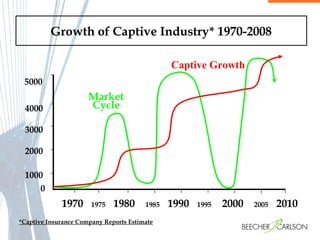

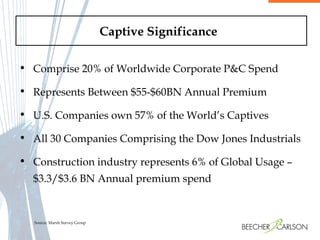

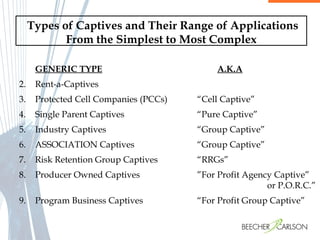

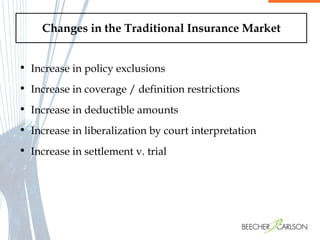

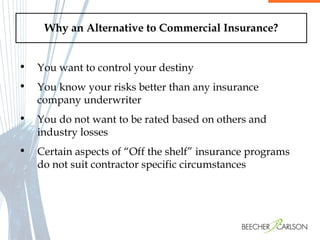

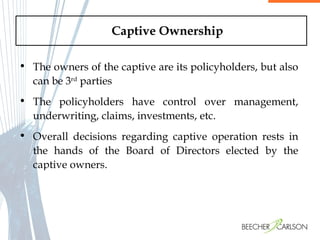

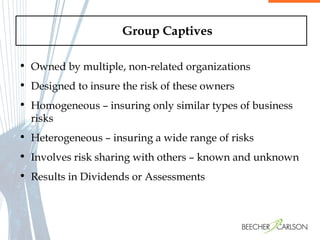

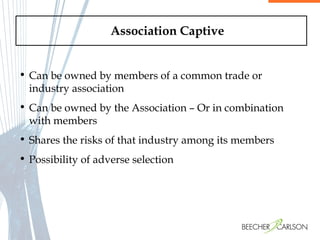

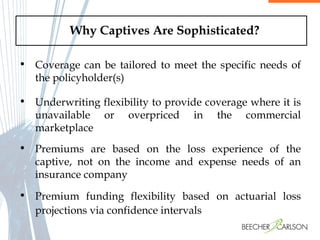

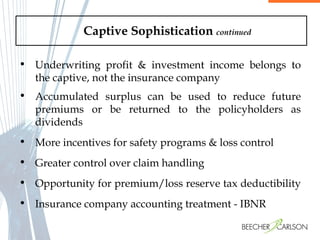

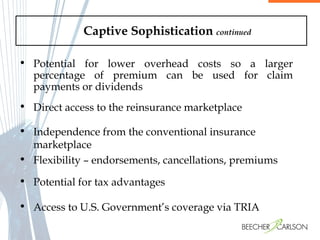

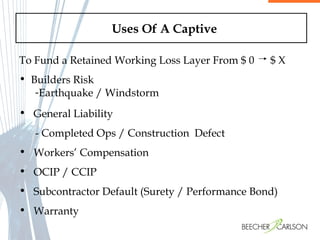

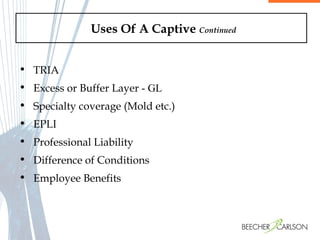

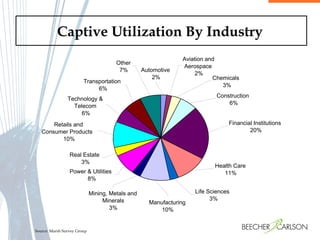

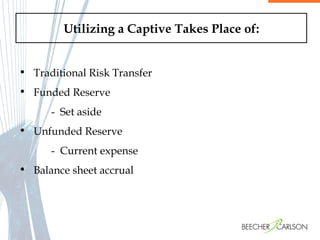

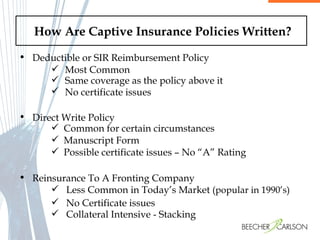

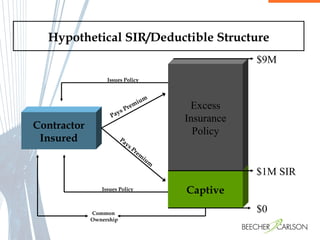

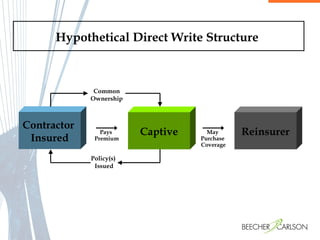

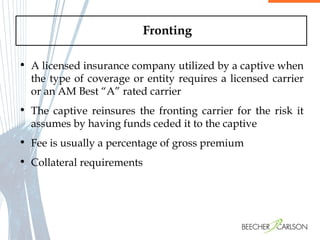

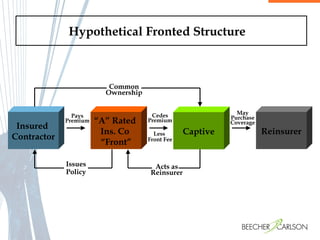

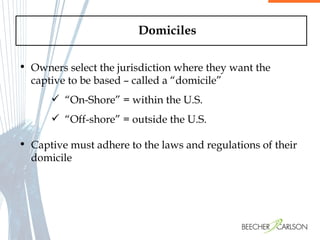

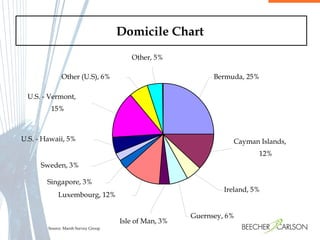

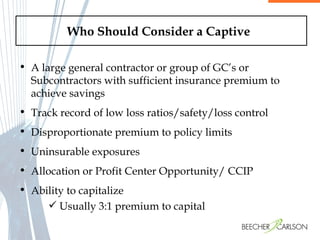

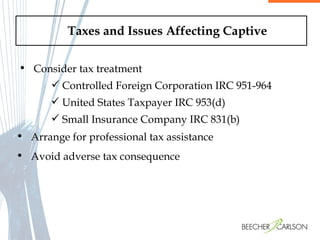

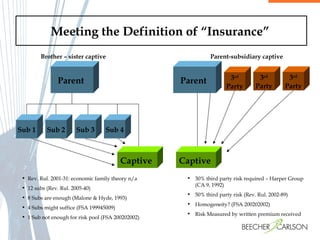

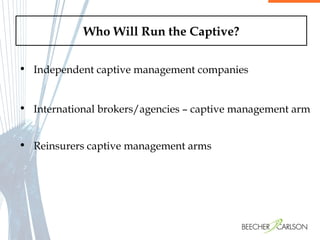

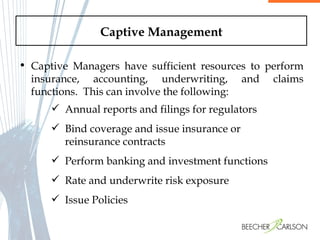

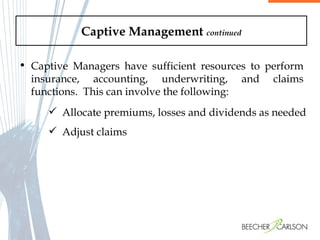

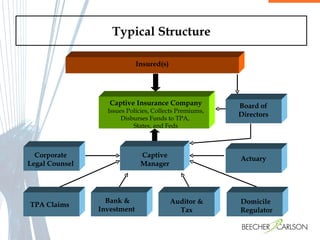

The document discusses captives, which are special purpose insurance companies that insure the risks of their owners. It provides an overview of what captives are, their history and growth, types of captives, benefits of using a captive compared to commercial insurance, considerations for utilizing a captive such as ownership structure and domicile selection, and functions related to managing a captive.

![AGC / CFMA Conference Self Insurance with Sophistication Are You Ready for a Captive? October 23, 2008 Mark Ouimette, ARM [email_address]](https://image.slidesharecdn.com/areyoureadyforacaptive-123985678934-phpapp01/75/Are-You-Ready-For-A-Captive-1-2048.jpg)