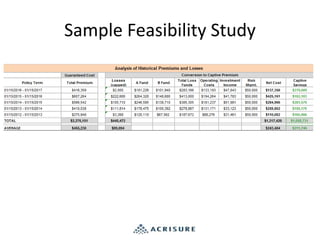

Acrisure, founded in 2005, is the 7th largest insurance broker in America, known for its rapid growth of approximately 80% per year, driven by a management-led buyout. The document discusses the alternative insurance market, particularly the role of captives, self-insurance, and risk retention groups as risk financing vehicles, highlighting their advantages and disadvantages. It emphasizes the relevance of captives for businesses seeking greater control over insurance costs and risk management, with specific qualifications for potential clients interested in adopting captive strategies.