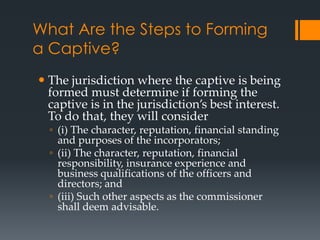

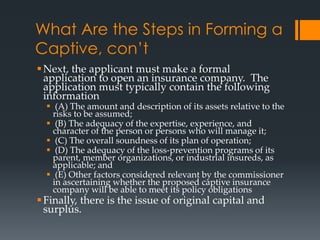

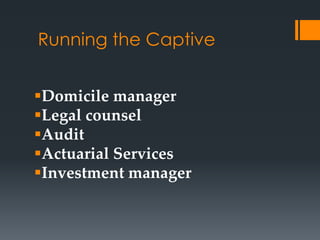

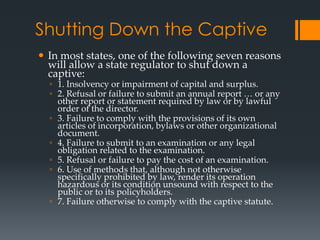

The document provides an introduction to captive insurance, outlining who should form a captive based on risk profile and financial resources, the types of companies that typically benefit from captives, and the benefits such as custom policies, tax advantages, and negotiating leverage. It also describes the key steps to forming a captive including performing a feasibility study, applying to the jurisdiction, and requirements around capital and surplus as well as ongoing requirements like using a domicile manager.