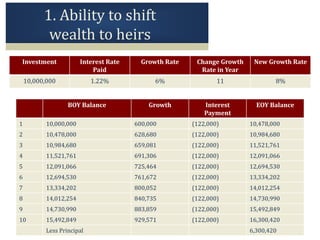

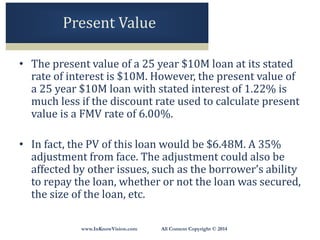

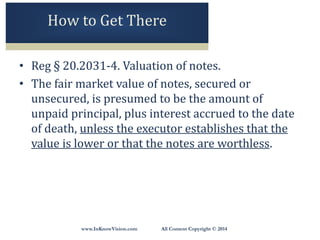

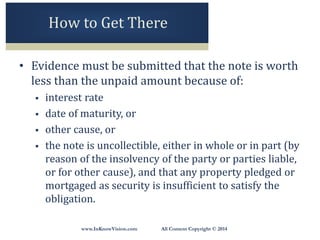

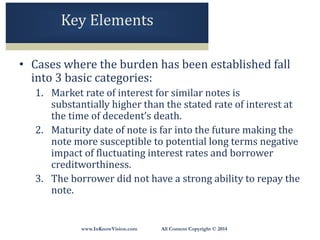

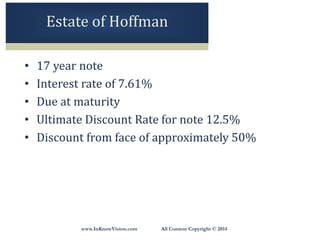

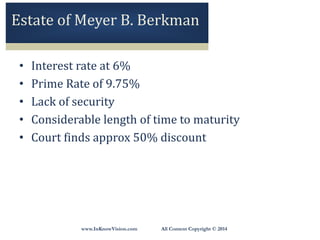

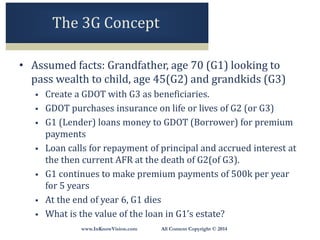

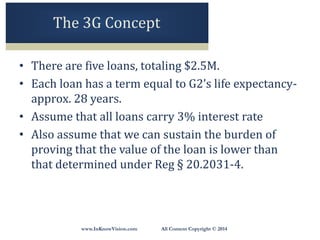

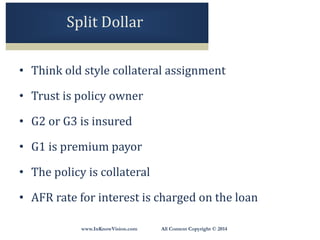

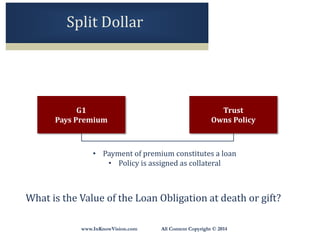

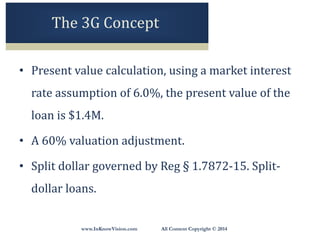

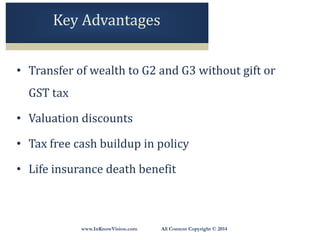

The document outlines strategies for wealth shifting using split dollar and intra-family loans, focusing on tax advantages and transferring wealth to heirs without incurring gift taxes. It includes examples involving a father loaning money to a trust, demonstrating potential wealth transfer benefits and the importance of rate adjustments for valuation. Key elements discussed include the burden of proof regarding note valuation, illustrating how estate taxes could be minimized for family members.