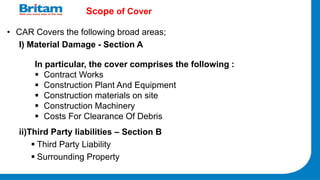

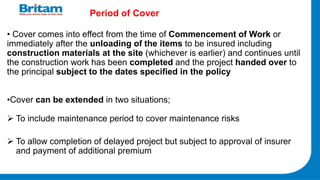

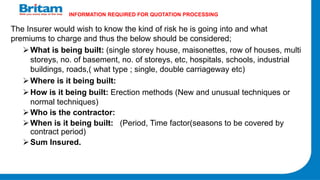

CAR (Contractors All Risks) insurance provides coverage for property damage and third-party liability claims that may occur during construction projects. It covers materials, equipment, and machinery on site. The policy scope includes sections for material damage and third-party liability, and covers risks like fire, earthquake, flood, and theft. Coverage begins when work starts and lasts until project completion, and can be extended to include maintenance periods. Eligible projects include buildings, roads, bridges, dams, and more. Underwriters require details on project type, location, construction methods, contractor, timelines, and sum insured to provide a quotation. The commission rate for CAR policies is 20%.