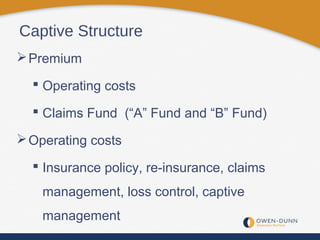

This document provides information about group captive insurance programs. A group captive is a reinsurance company owned by policyholders that allows them to manage risk and control insurance costs. Key benefits include transparency of costs, reduced premiums over time, and the ability to build equity from unused premiums. The structure involves paying annual premiums to cover operating costs and claims through "A" and "B" funds. Unused premiums can be returned as dividends or kept as equity. The Owen-Dunn agency specializes in alternative risk programs like captives, with over a decade of experience placing over 100 clients.