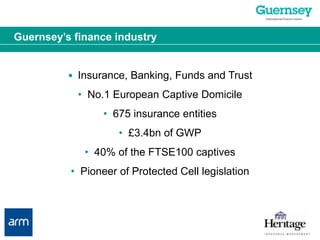

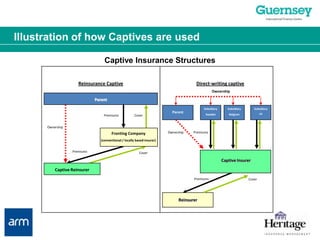

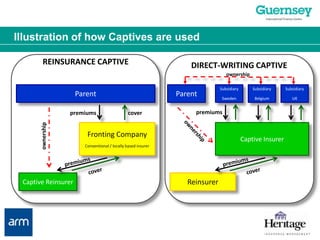

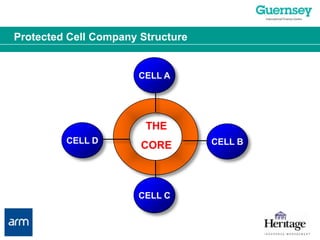

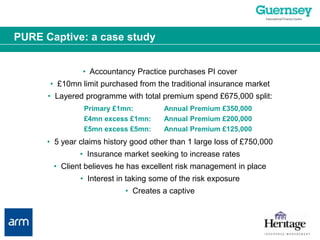

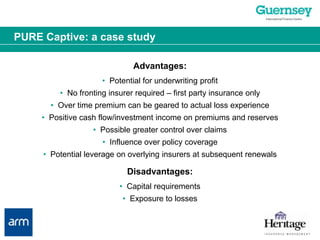

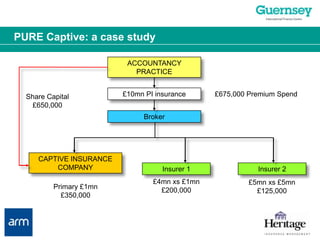

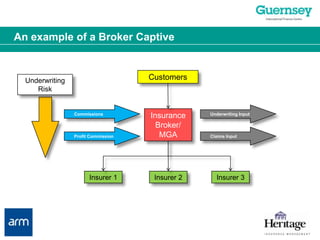

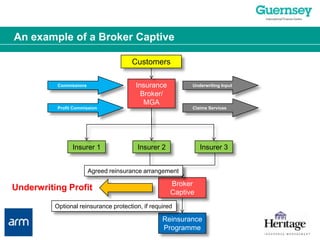

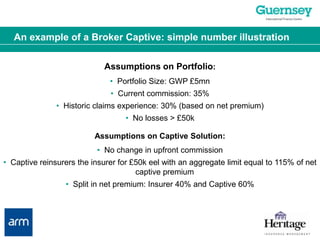

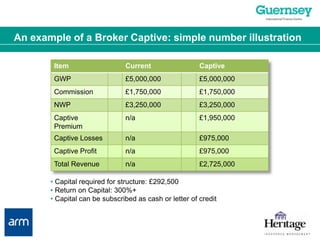

This document provides an overview of captive insurance structures and discusses why brokers may set up their own captive insurance companies. It begins with definitions of captive insurance and describes common structures like pure captives and protected cell companies. Specific case studies are presented on how a pure captive could benefit an accounting practice client and how a broker captive could generate additional revenue from profitable business lines. Key benefits for brokers are maximizing control and flexibility while earning profit commissions. Guernsey is highlighted as a leading domicile for captives due to its infrastructure, reputation, and less stringent capital requirements compared to Solvency II.