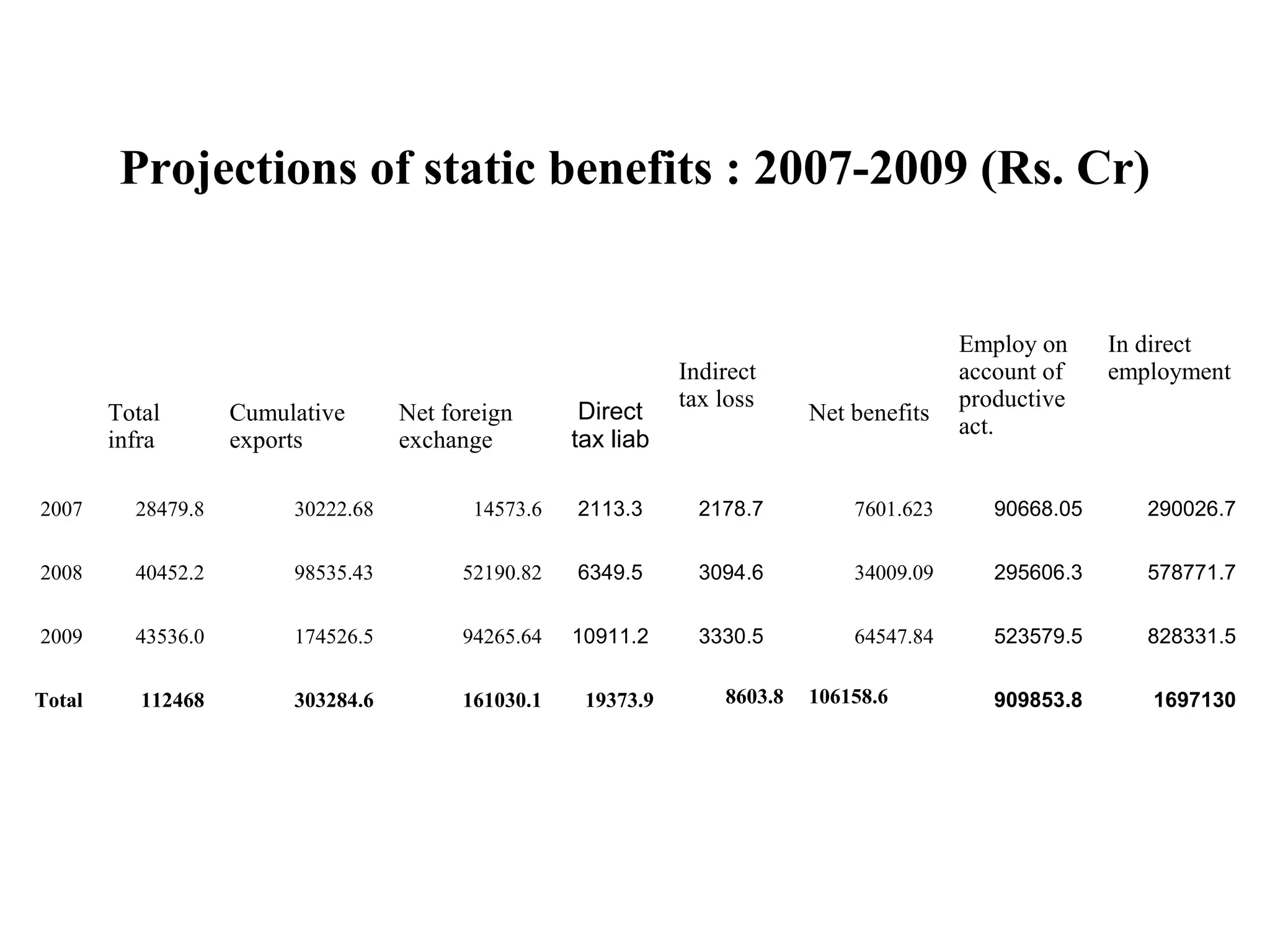

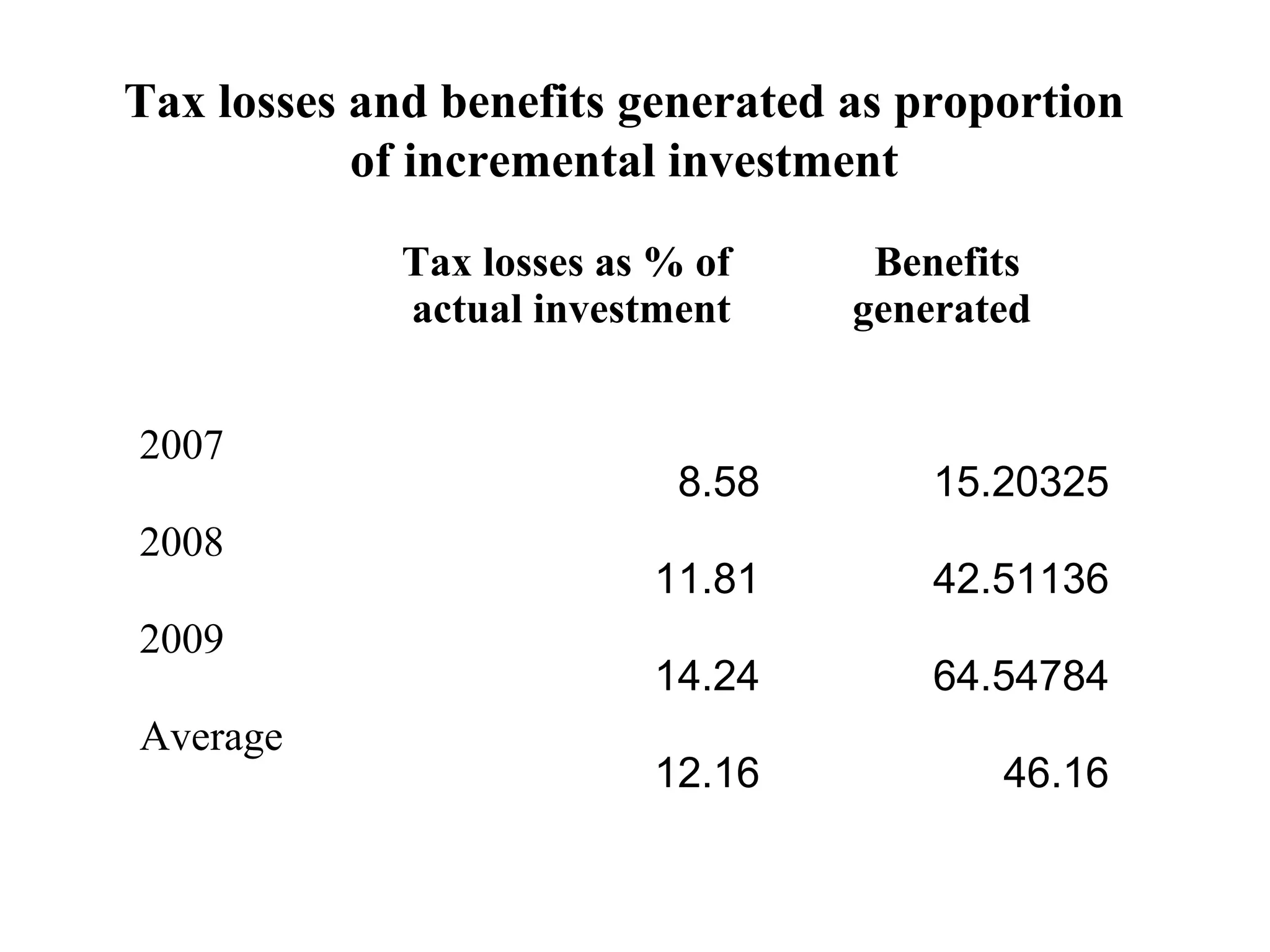

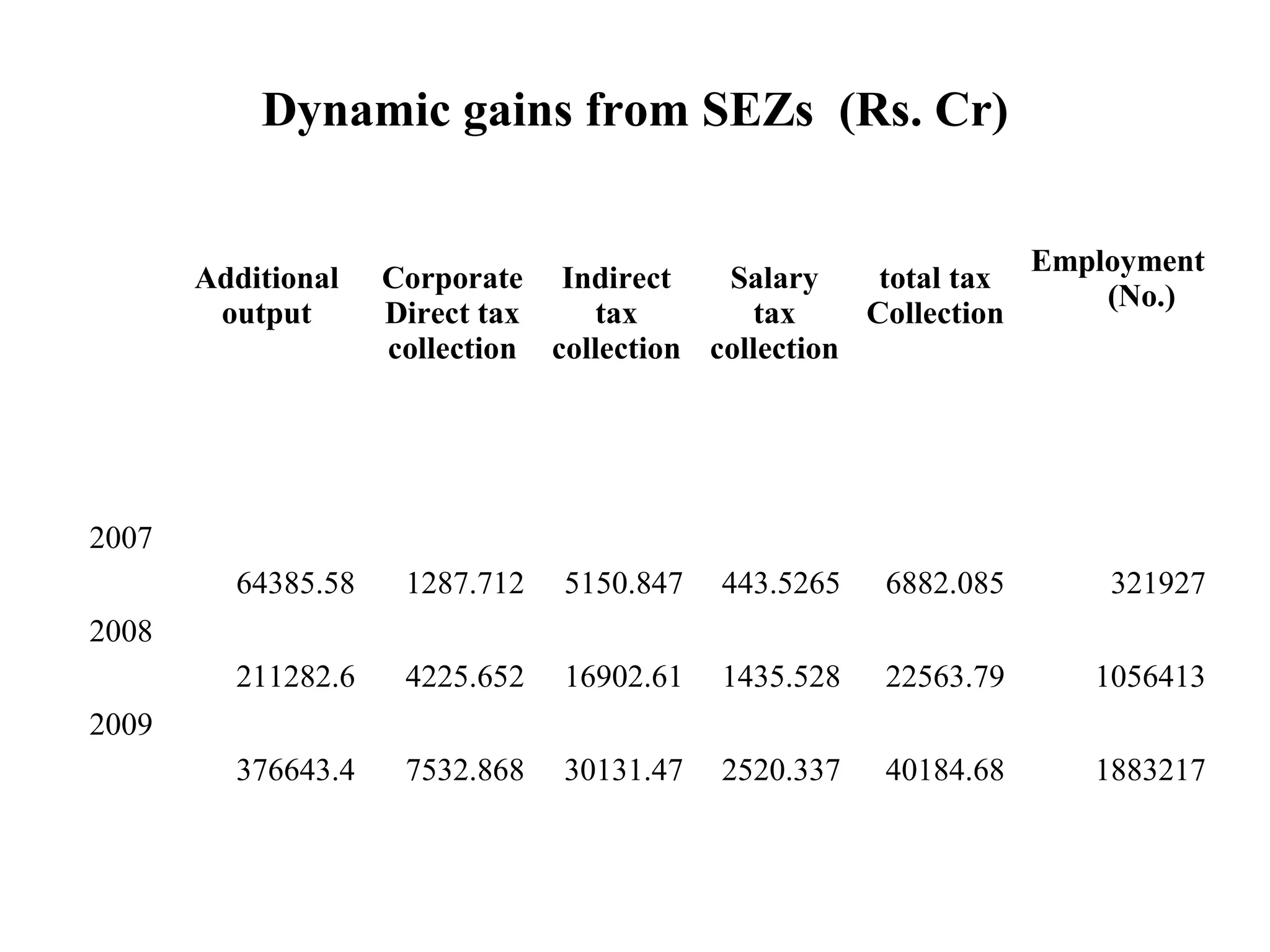

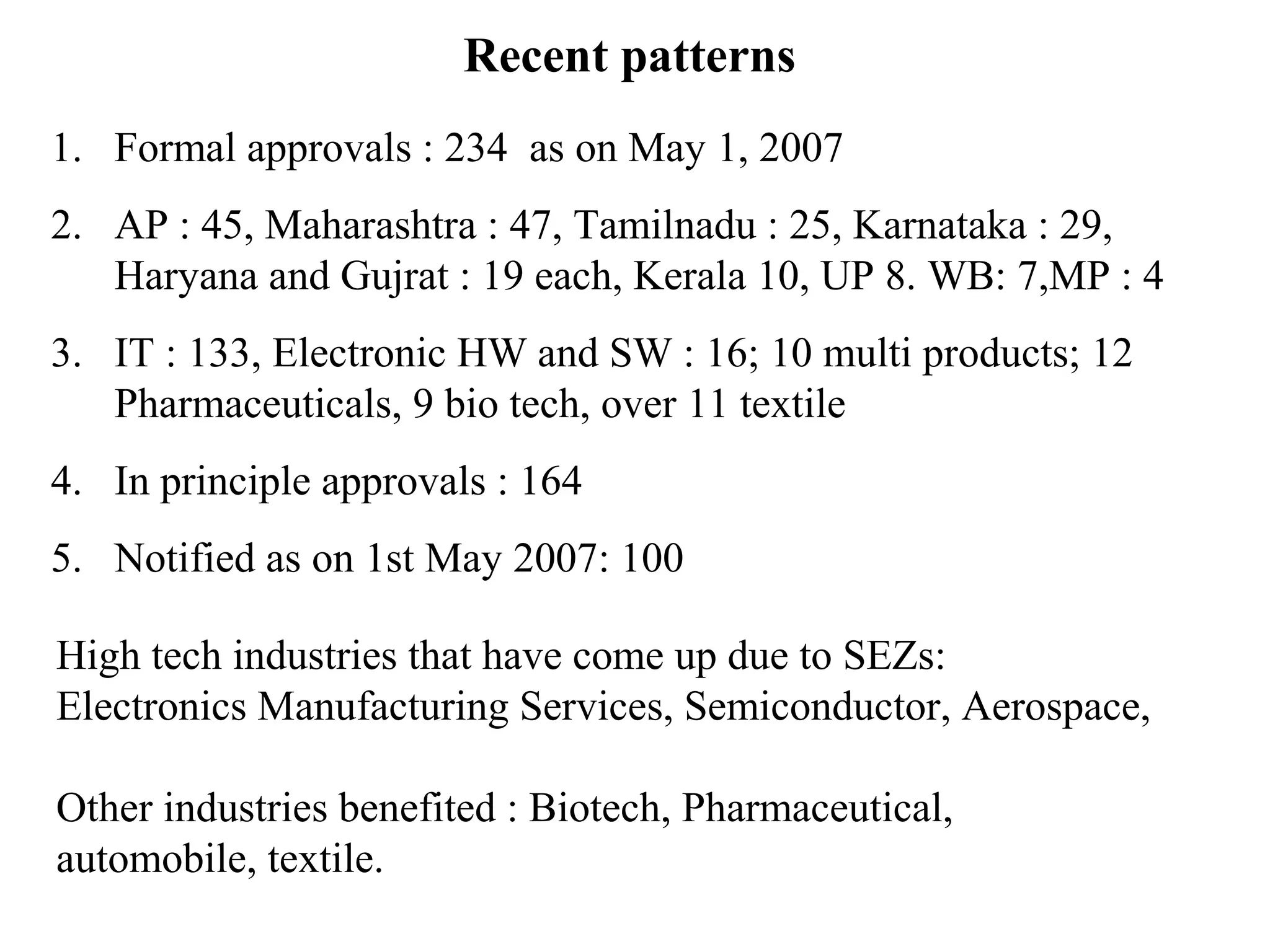

This document provides a quantitative assessment of the costs and benefits of Special Economic Zones (SEZs) in India. It finds that SEZs provide both direct and indirect benefits to the economy through foreign exchange earnings, employment, and spillover effects. However, they also impose costs through tax incentives and indirect job losses. A quantitative analysis estimates that the net benefits of SEZs outweigh the costs, but there are also many indirect and non-quantifiable effects. The document concludes that SEZs can promote growth if implemented effectively, but the process needs to slow down and address issues like land acquisition and compensation.