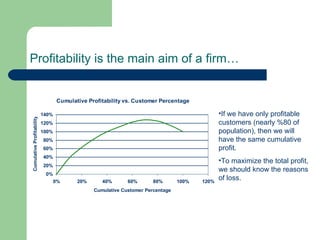

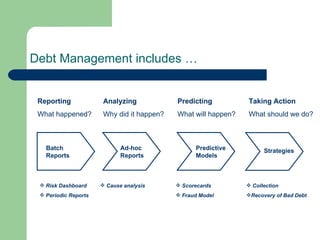

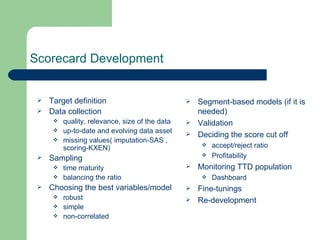

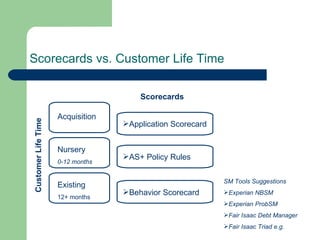

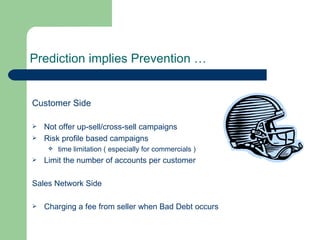

The document discusses credit vetting and debt management strategies aimed at maximizing profitability while managing debts effectively. It emphasizes the importance of reporting, prediction, and prevention in debt management processes and highlights the need for automated and flexible systems for scorecard development. Key strategies include optimizing collection techniques, improving cash flow, and enhancing customer retention through effective communication and tailored approaches.