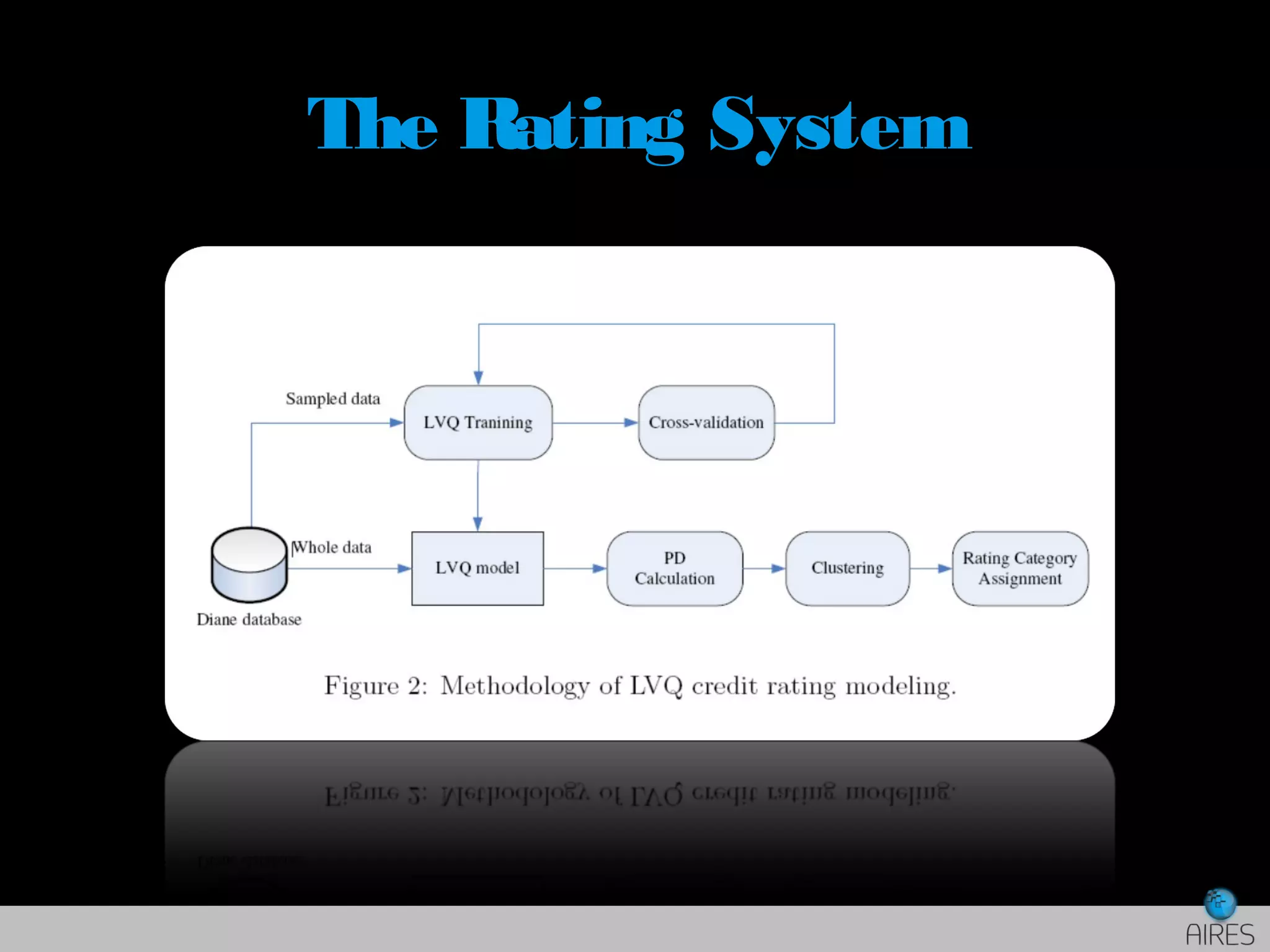

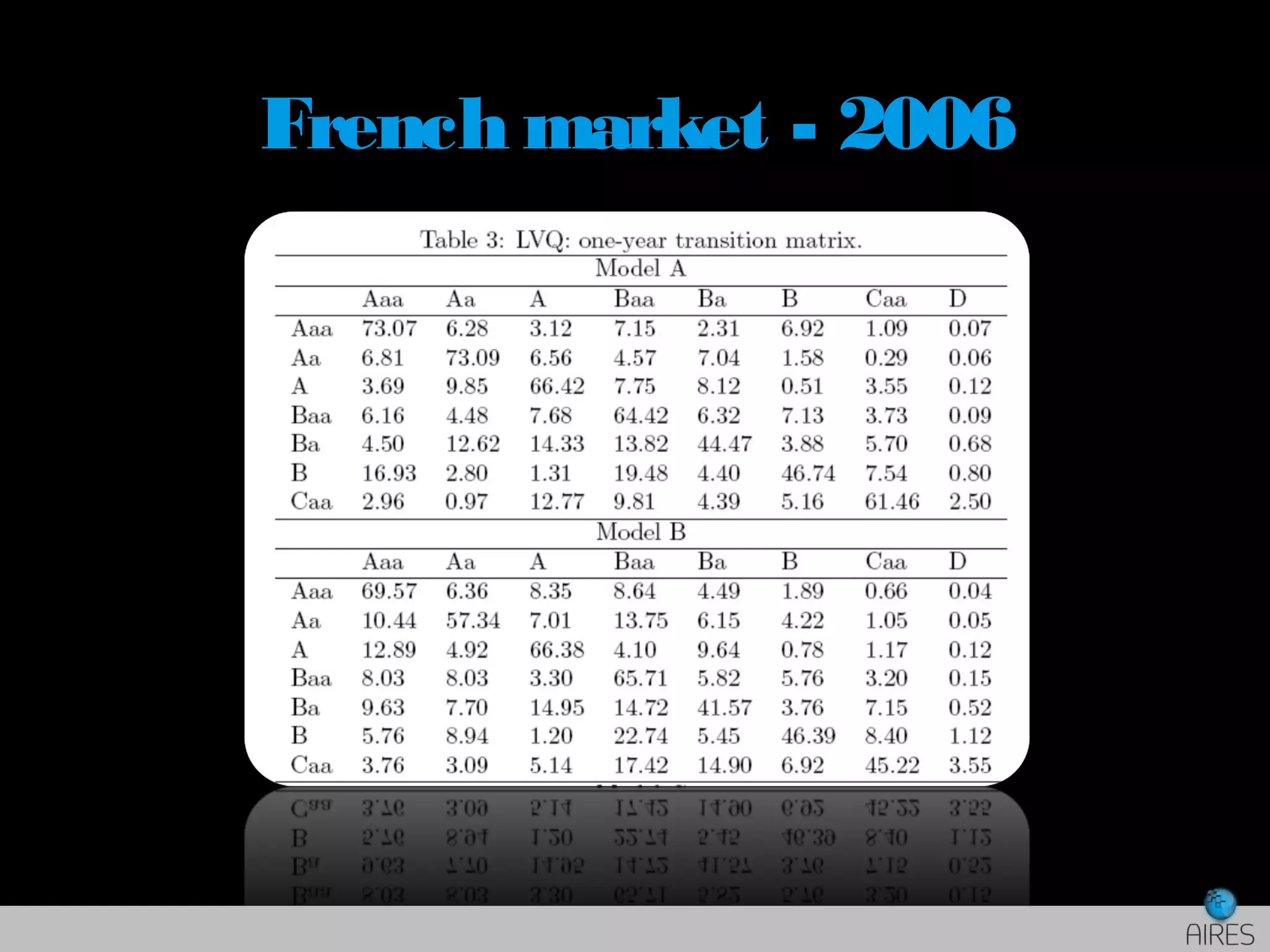

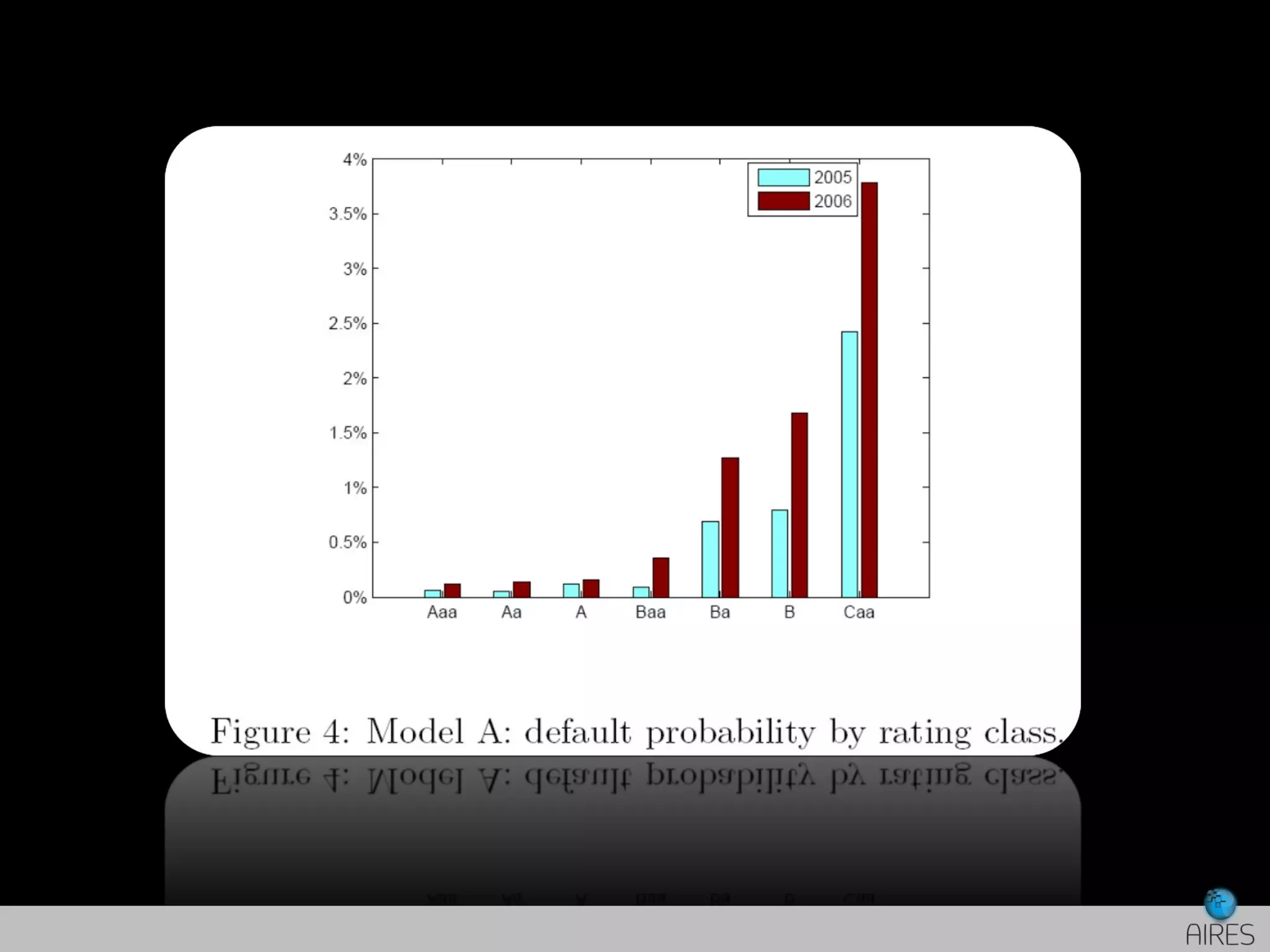

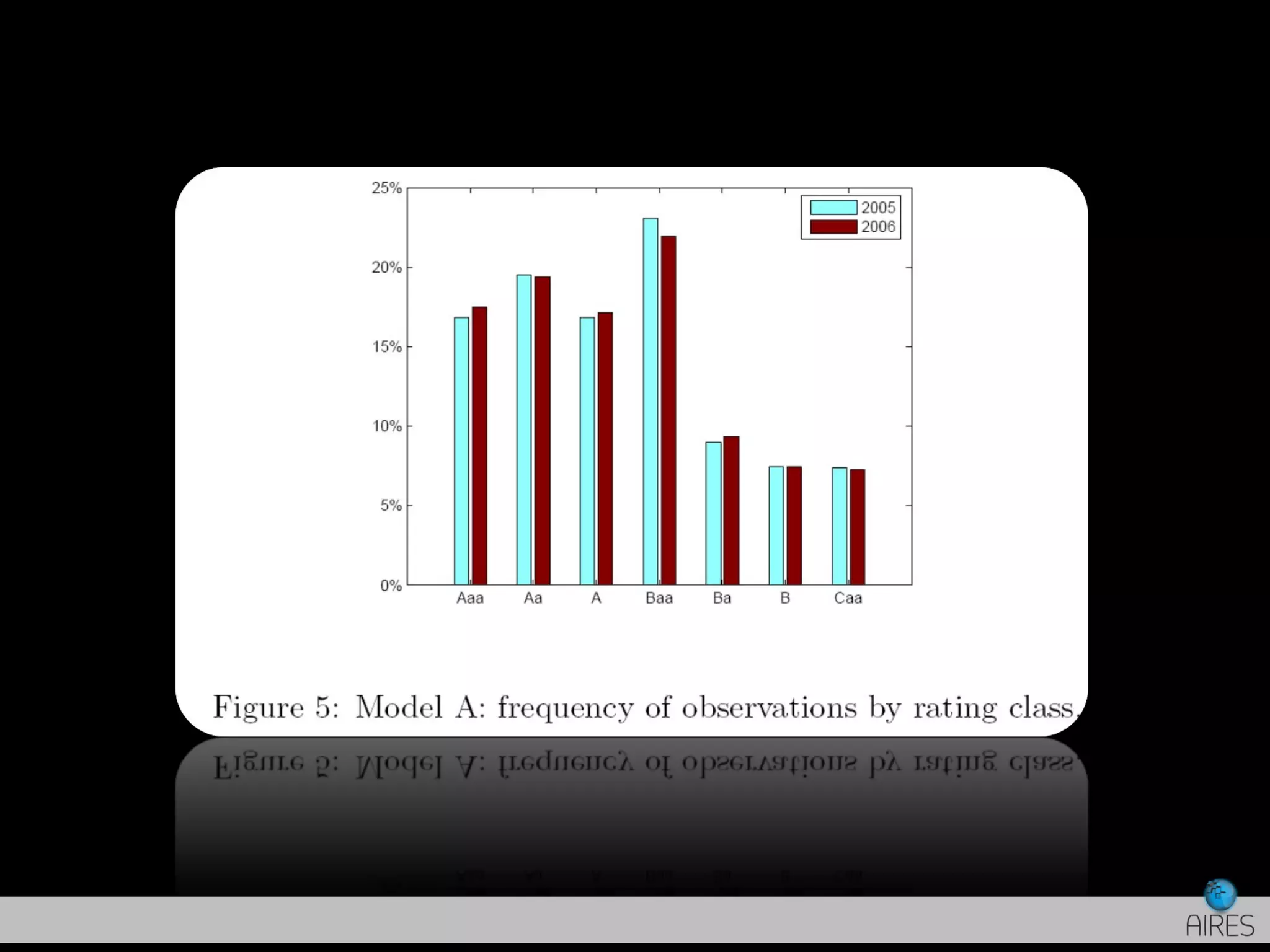

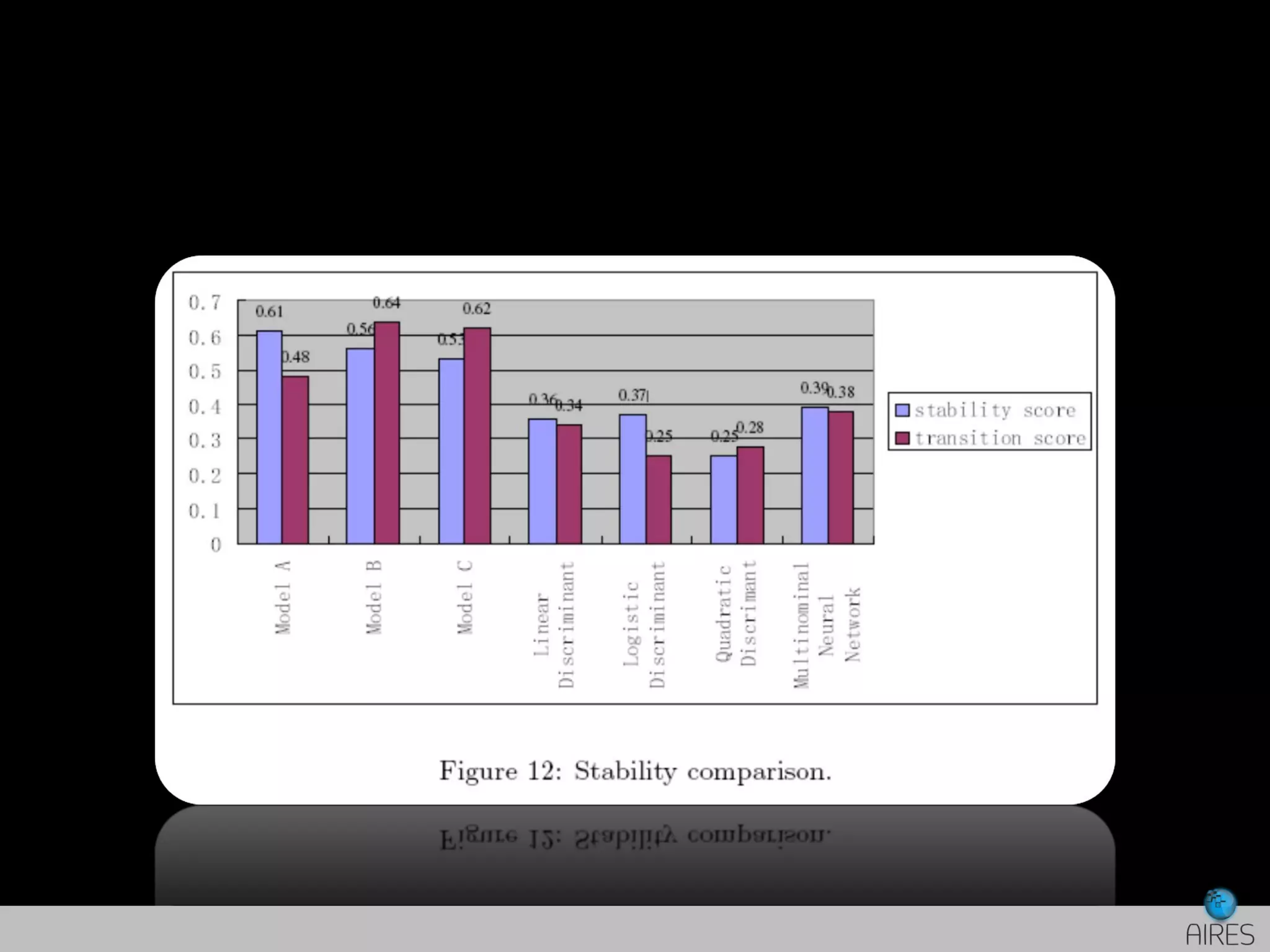

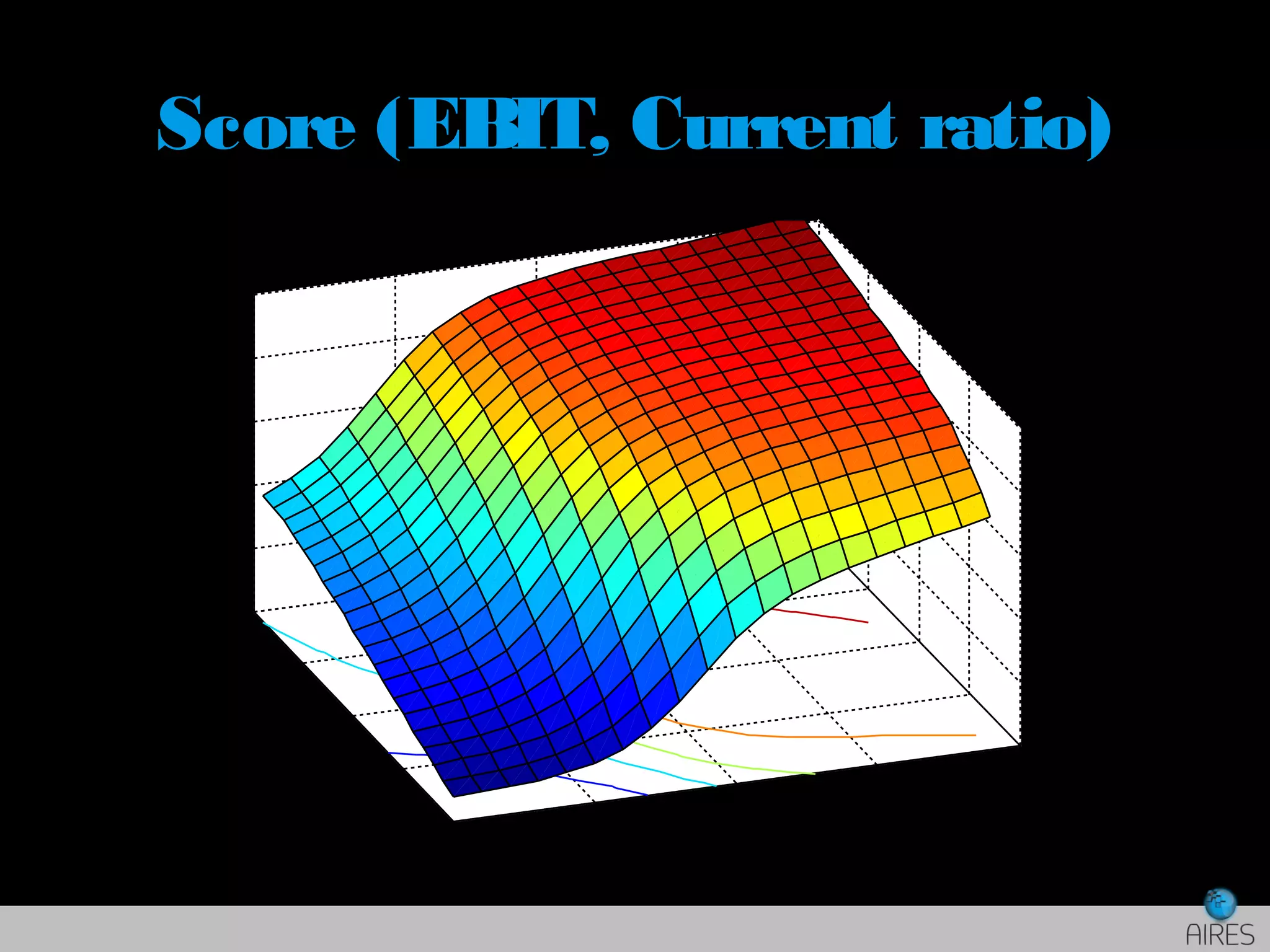

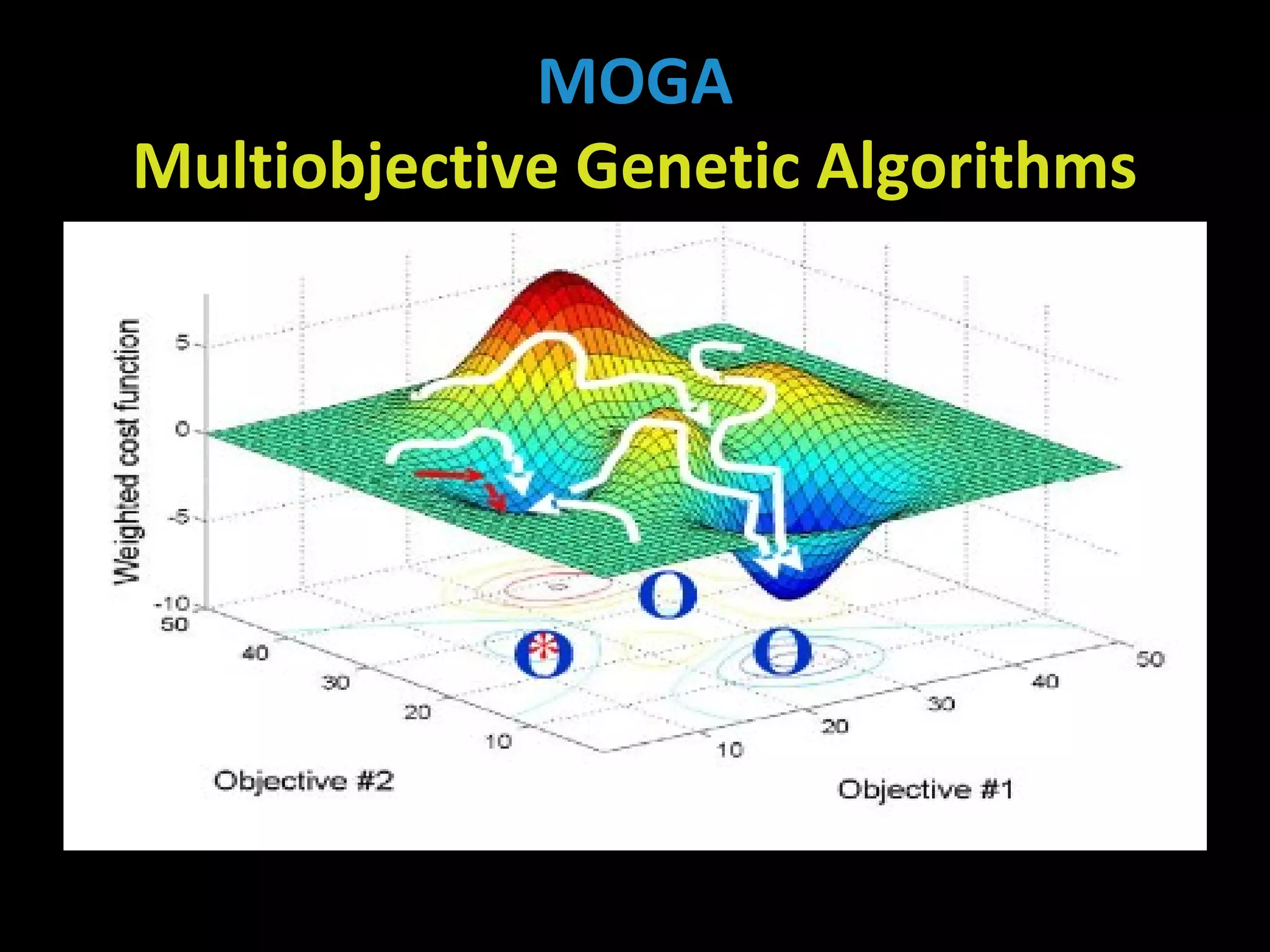

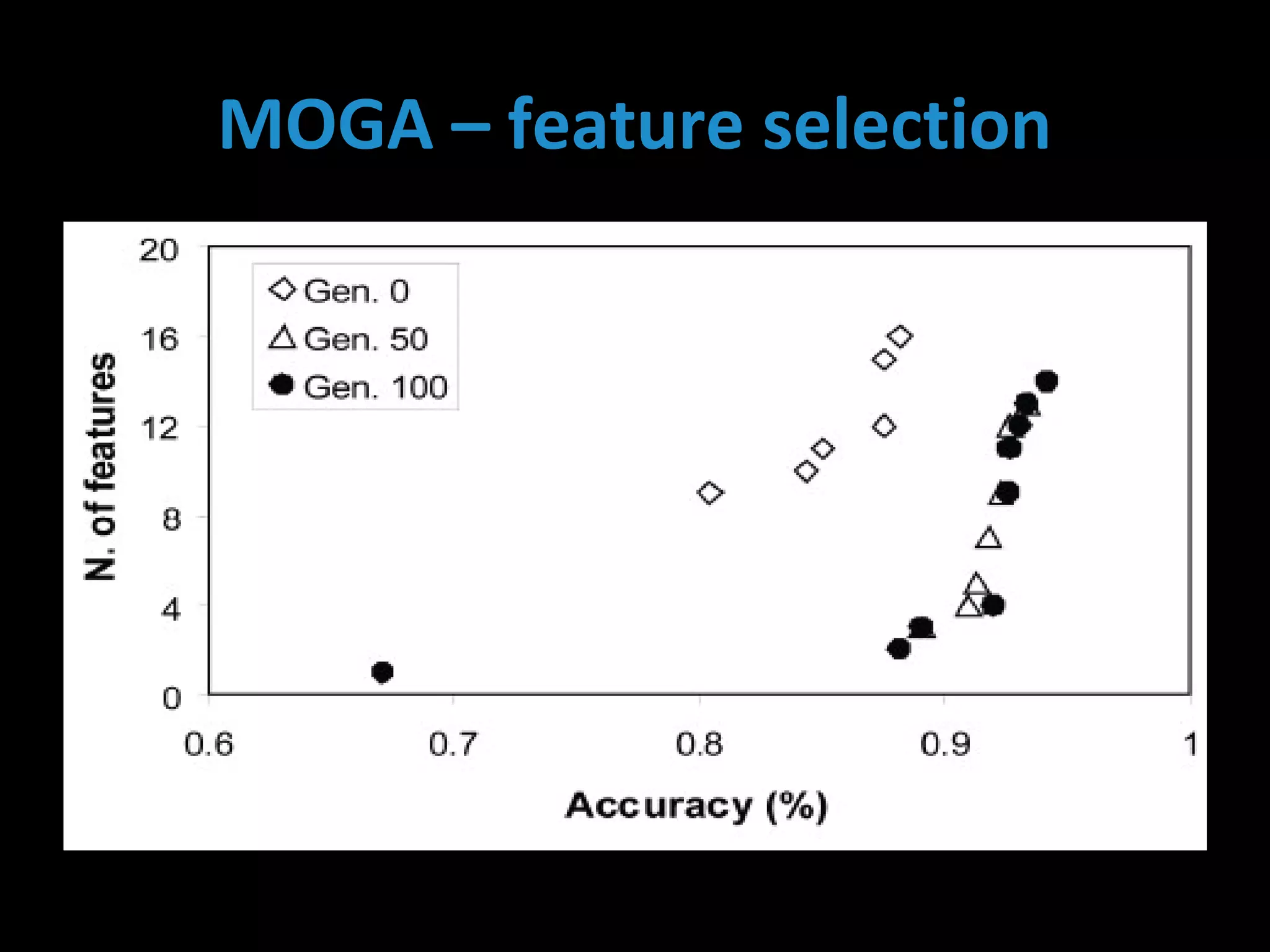

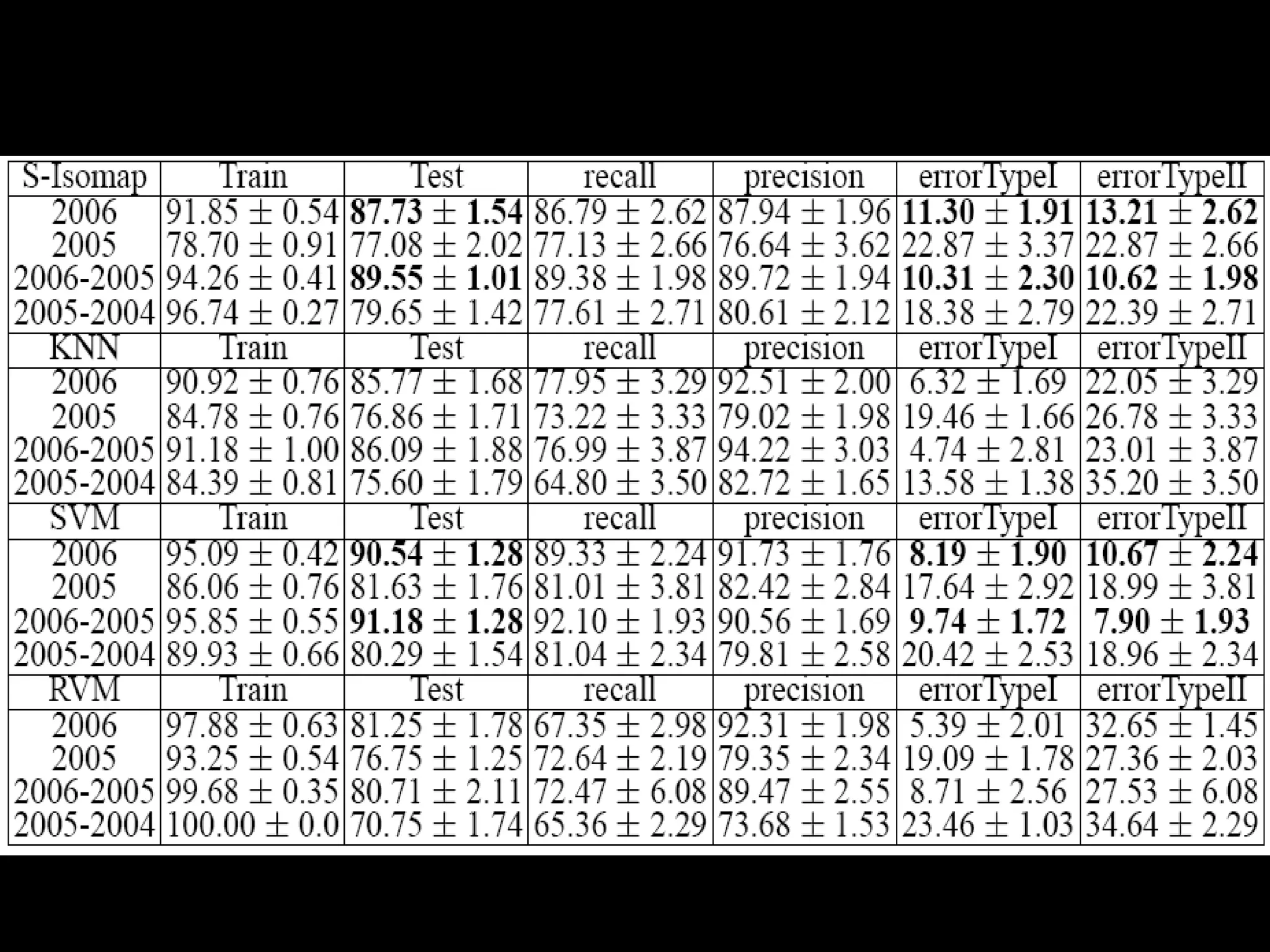

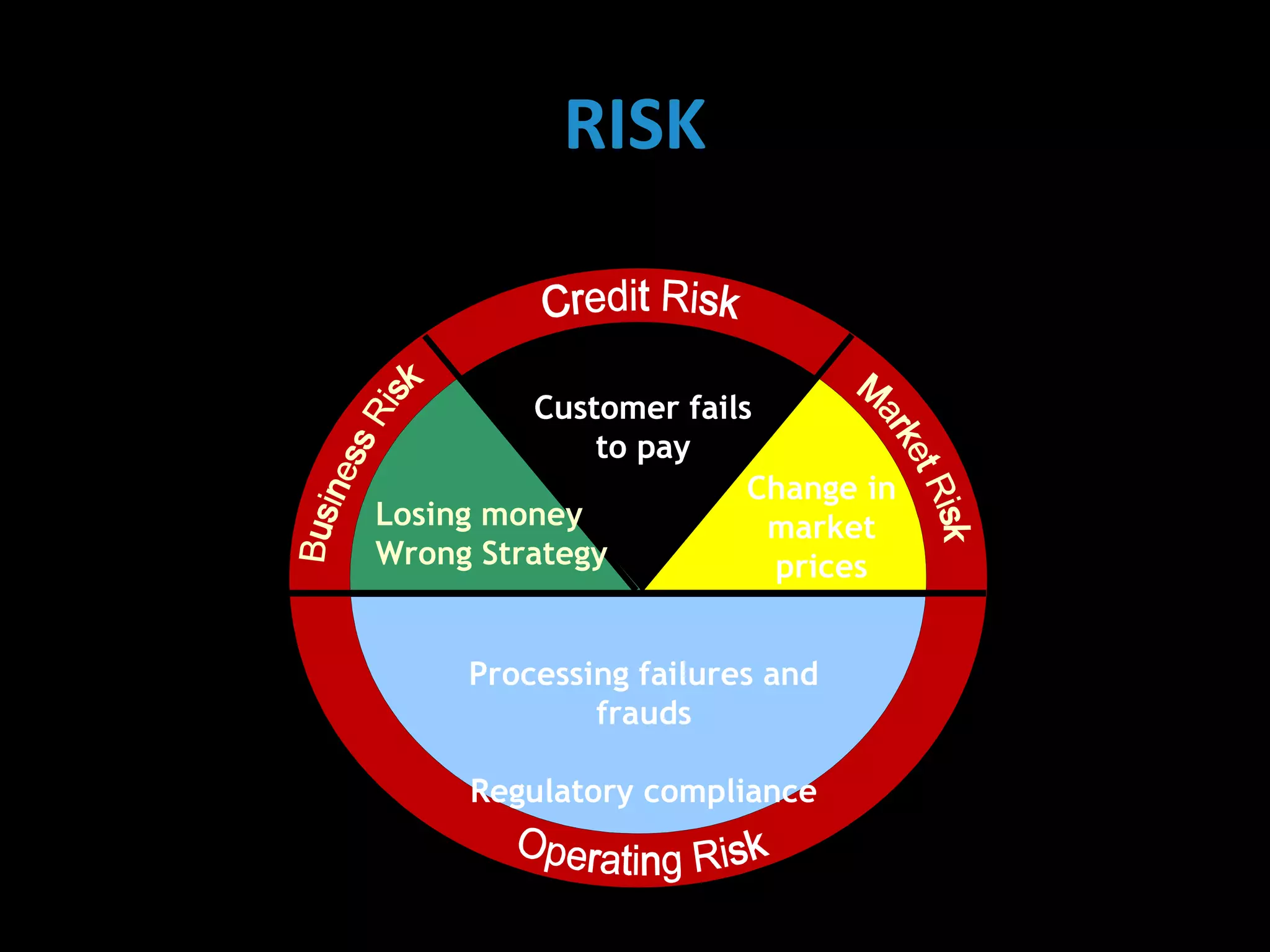

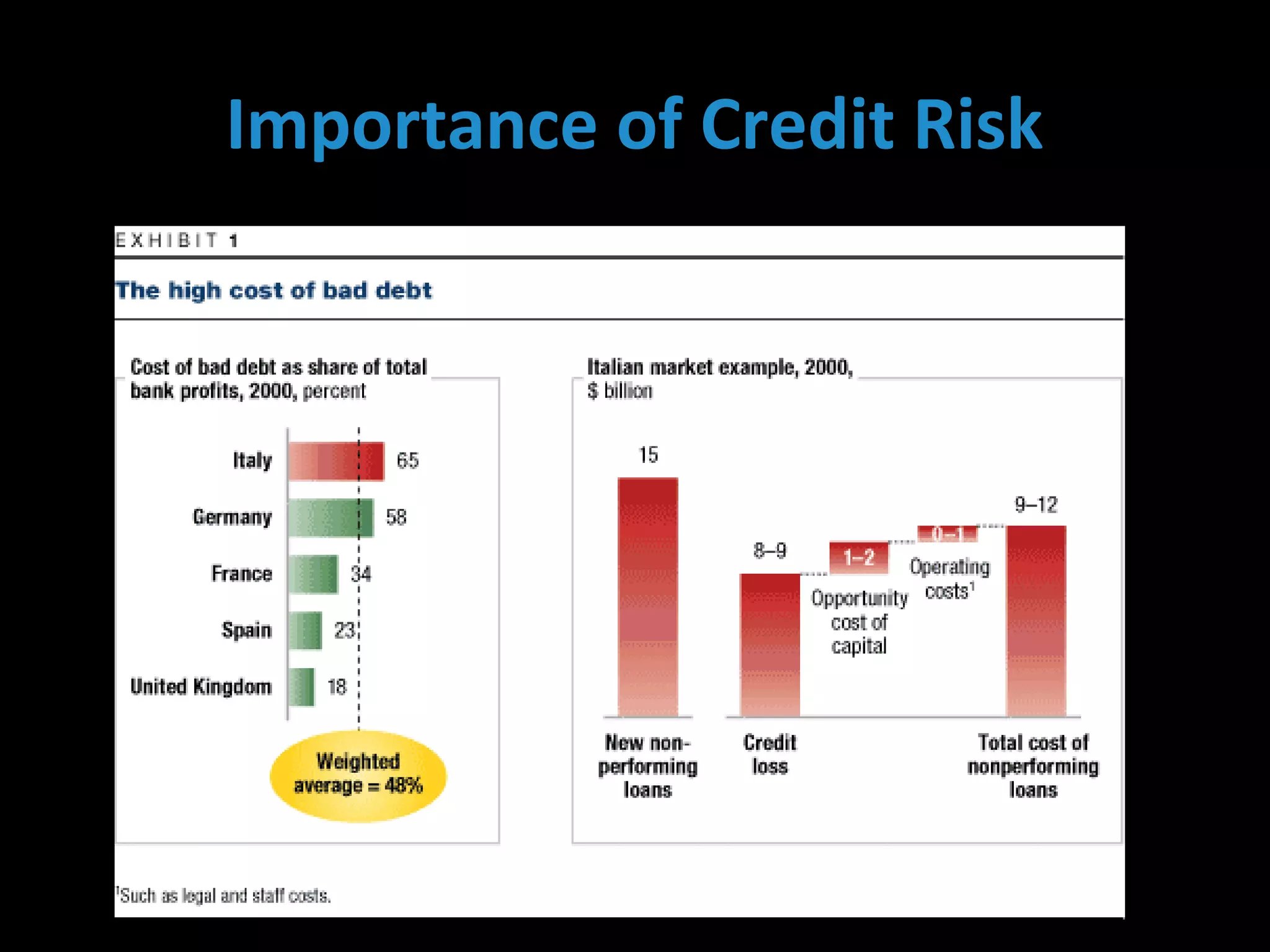

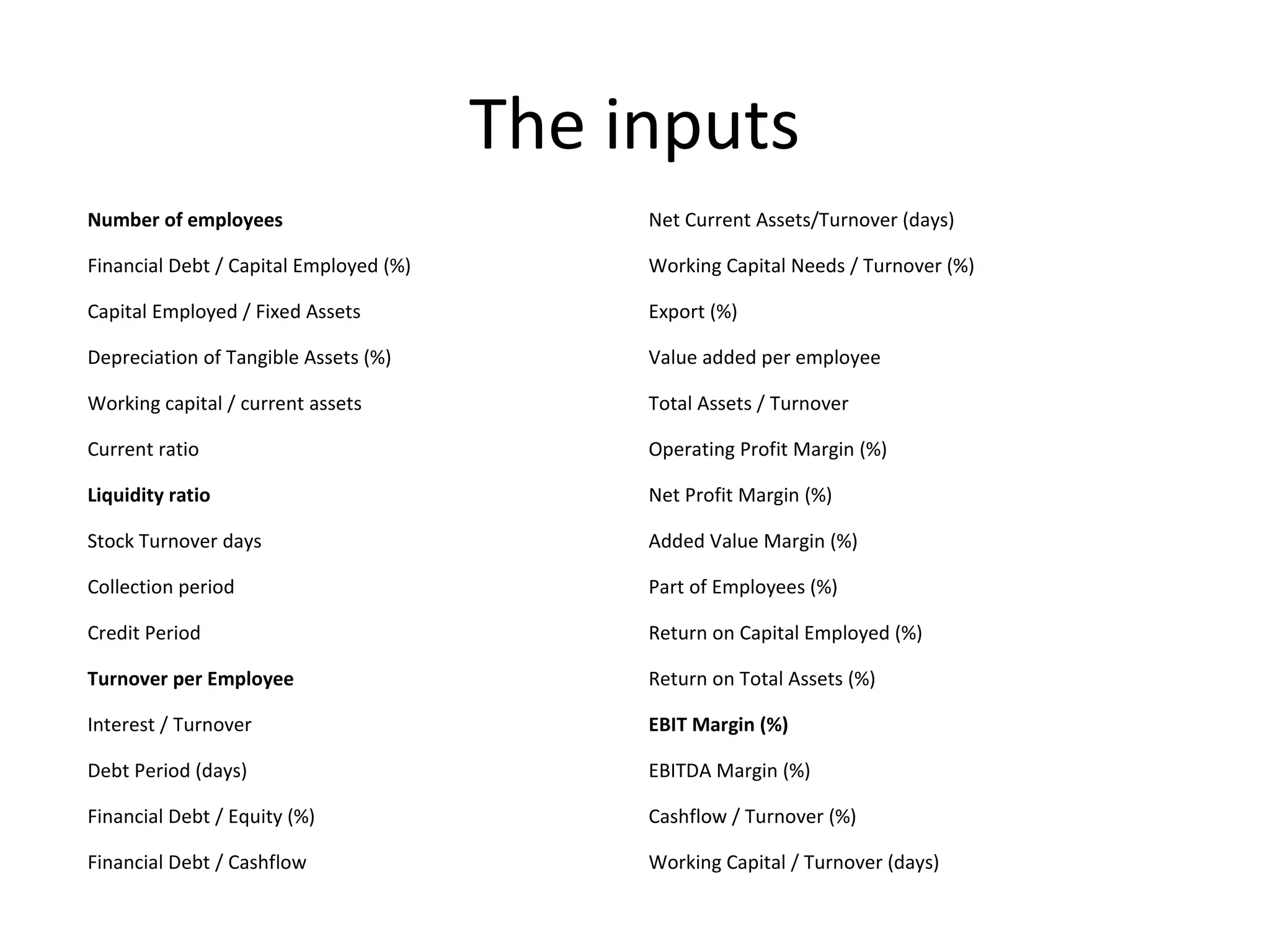

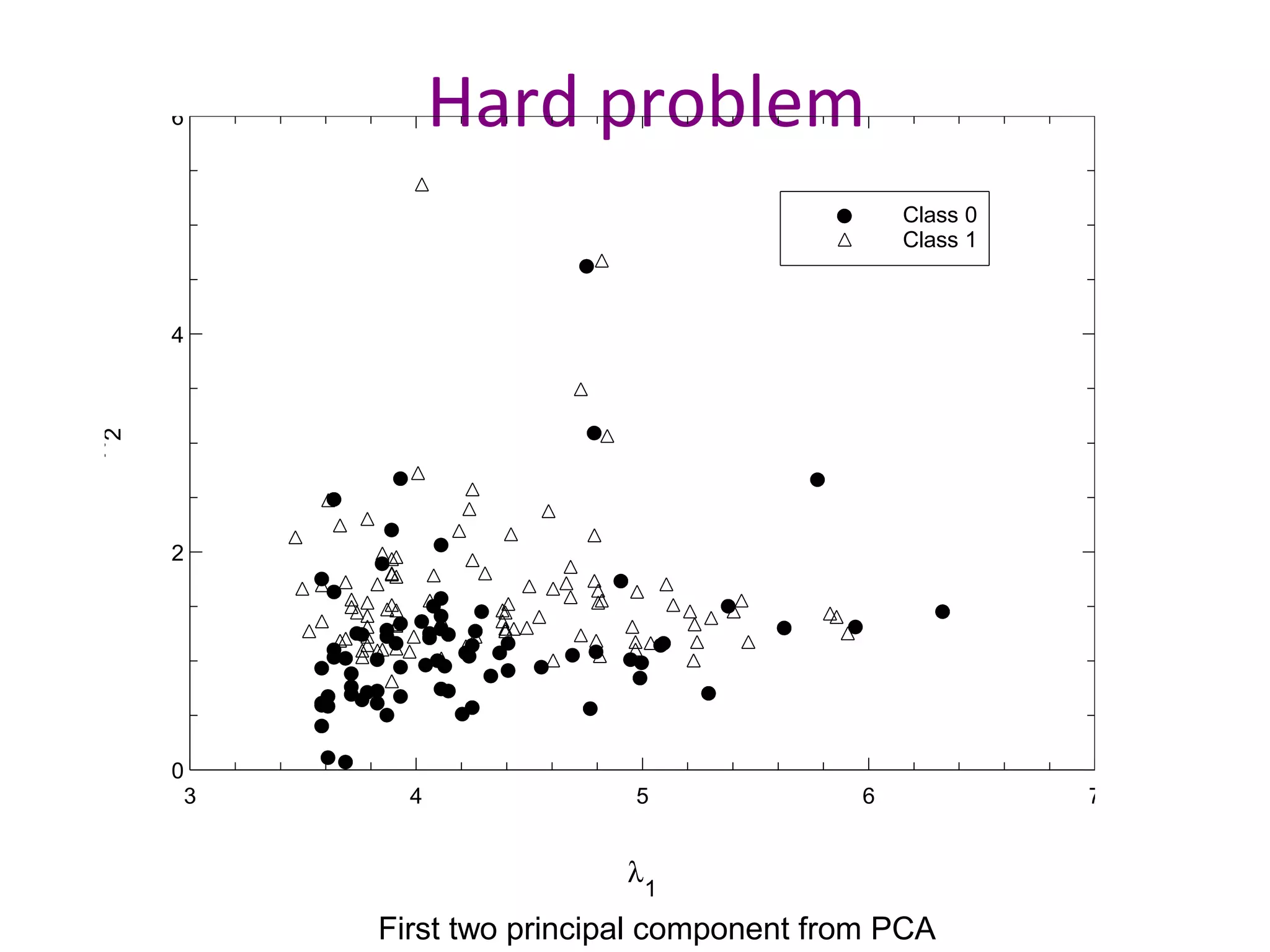

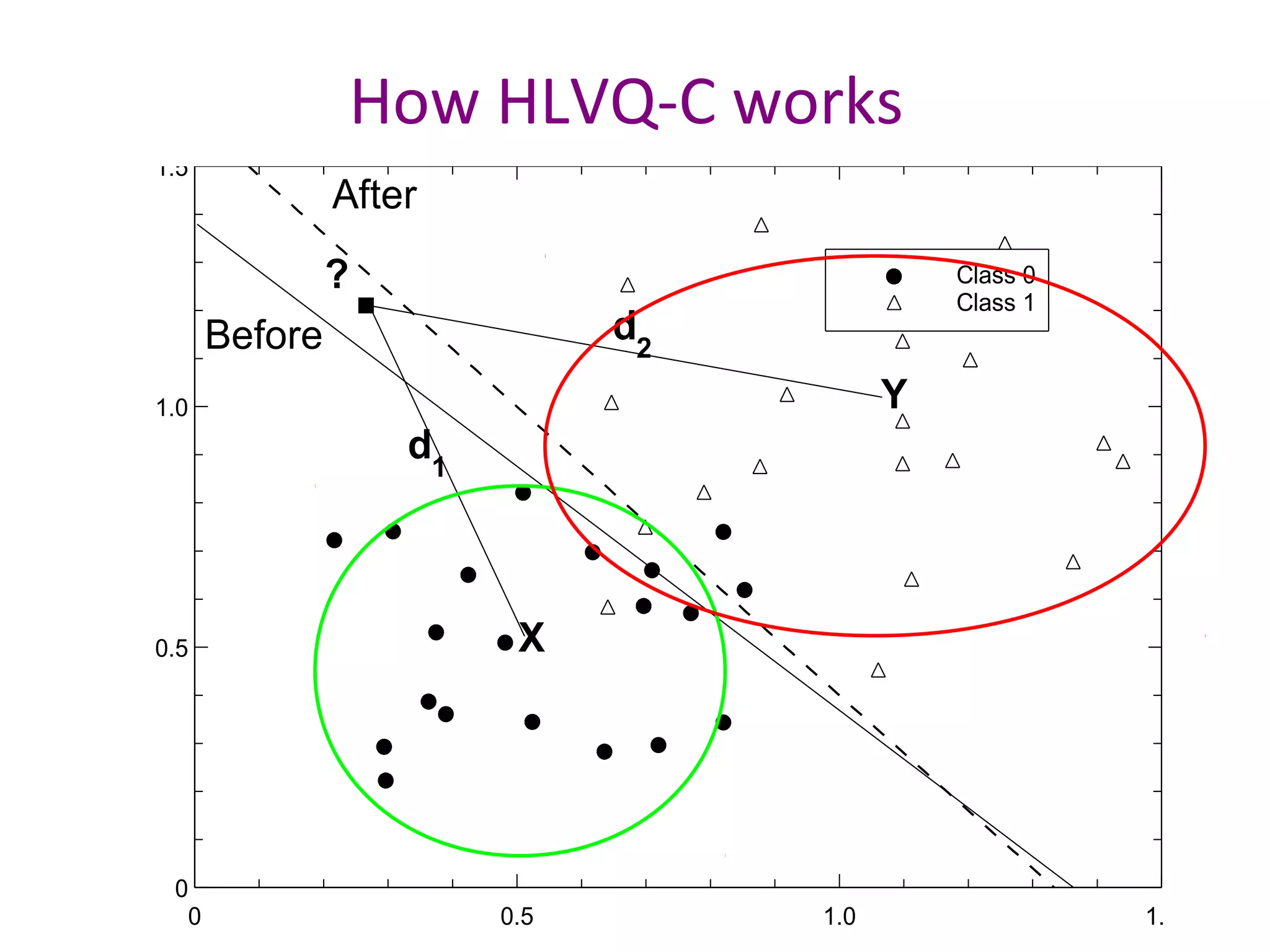

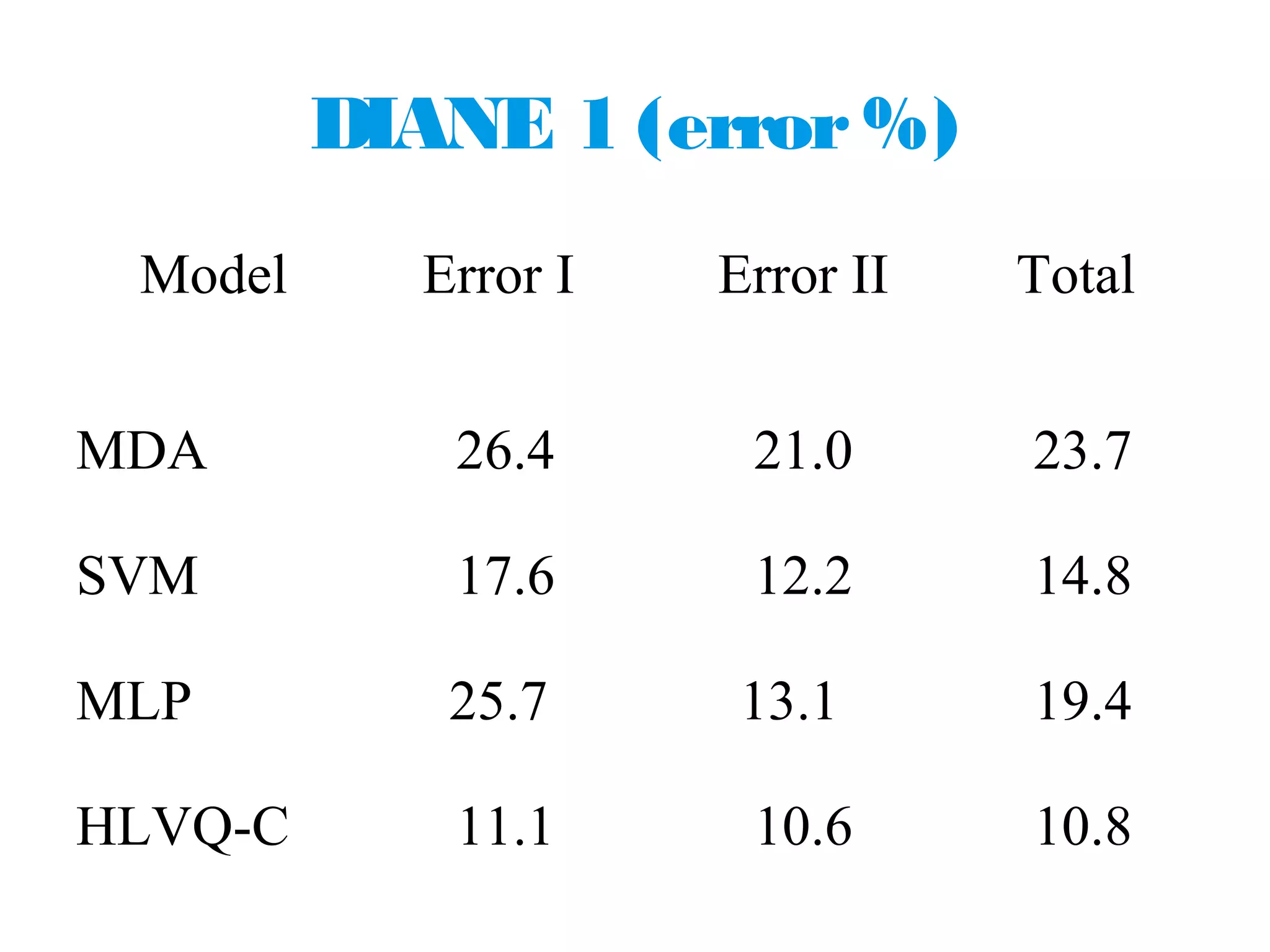

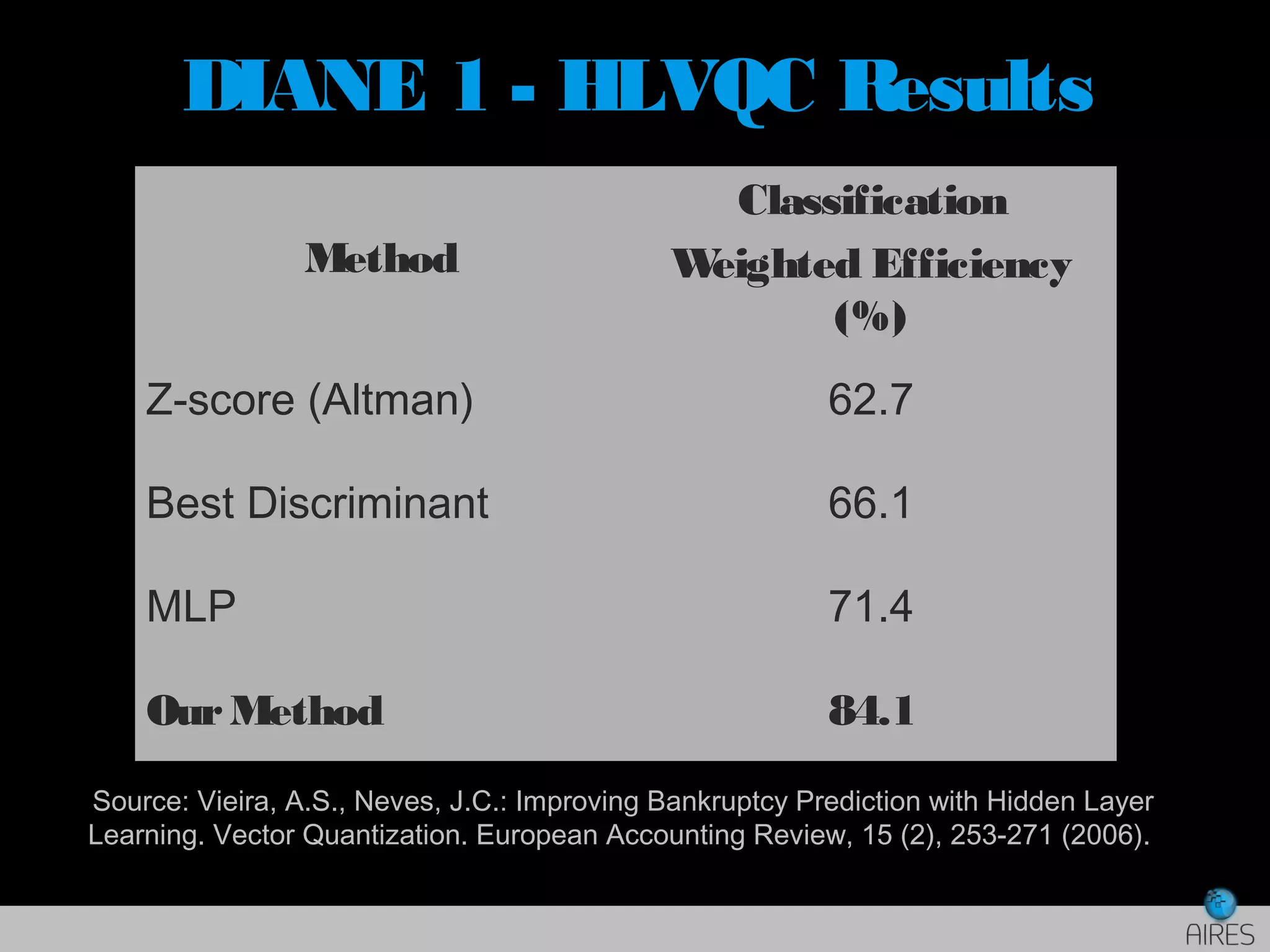

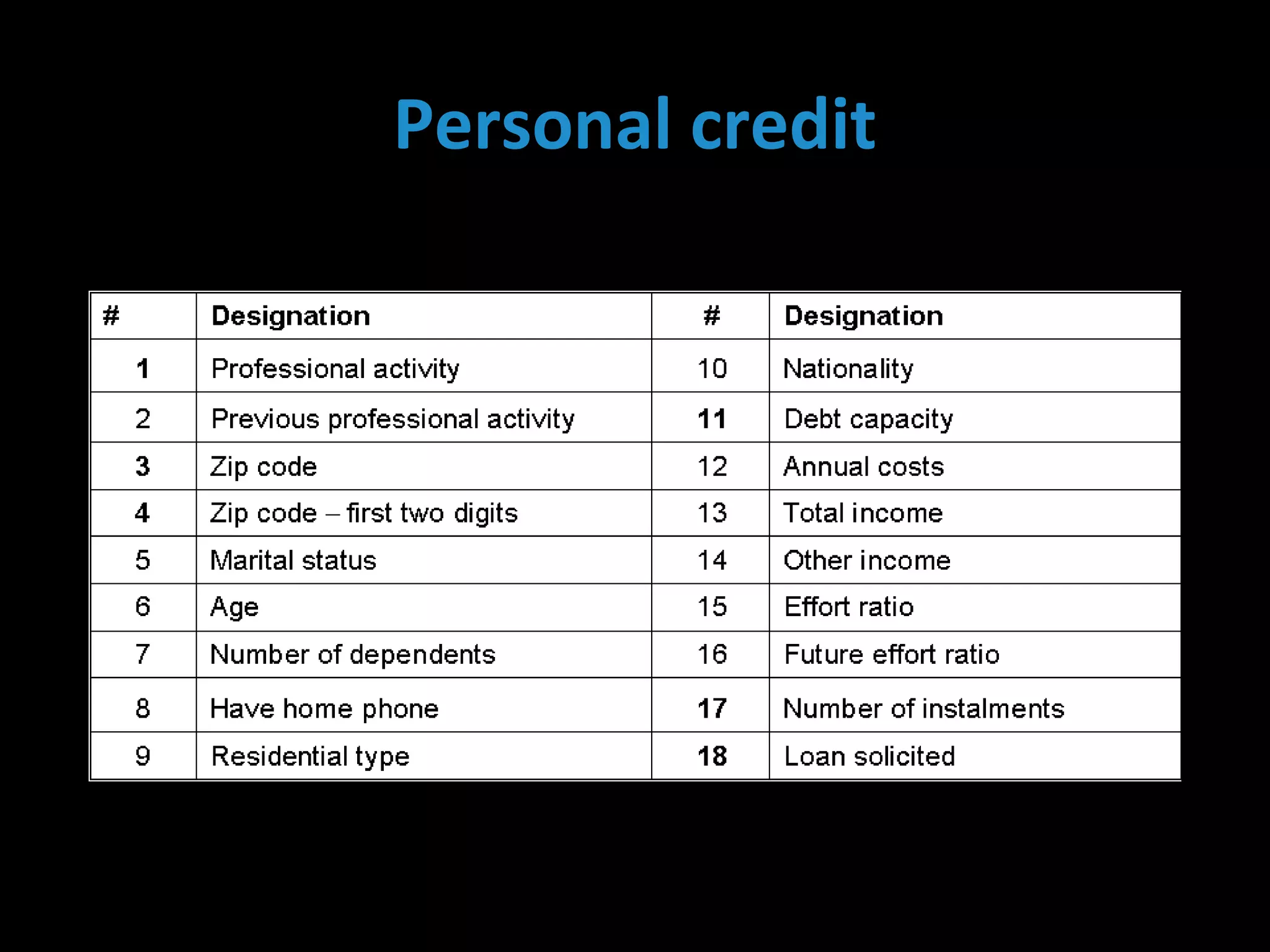

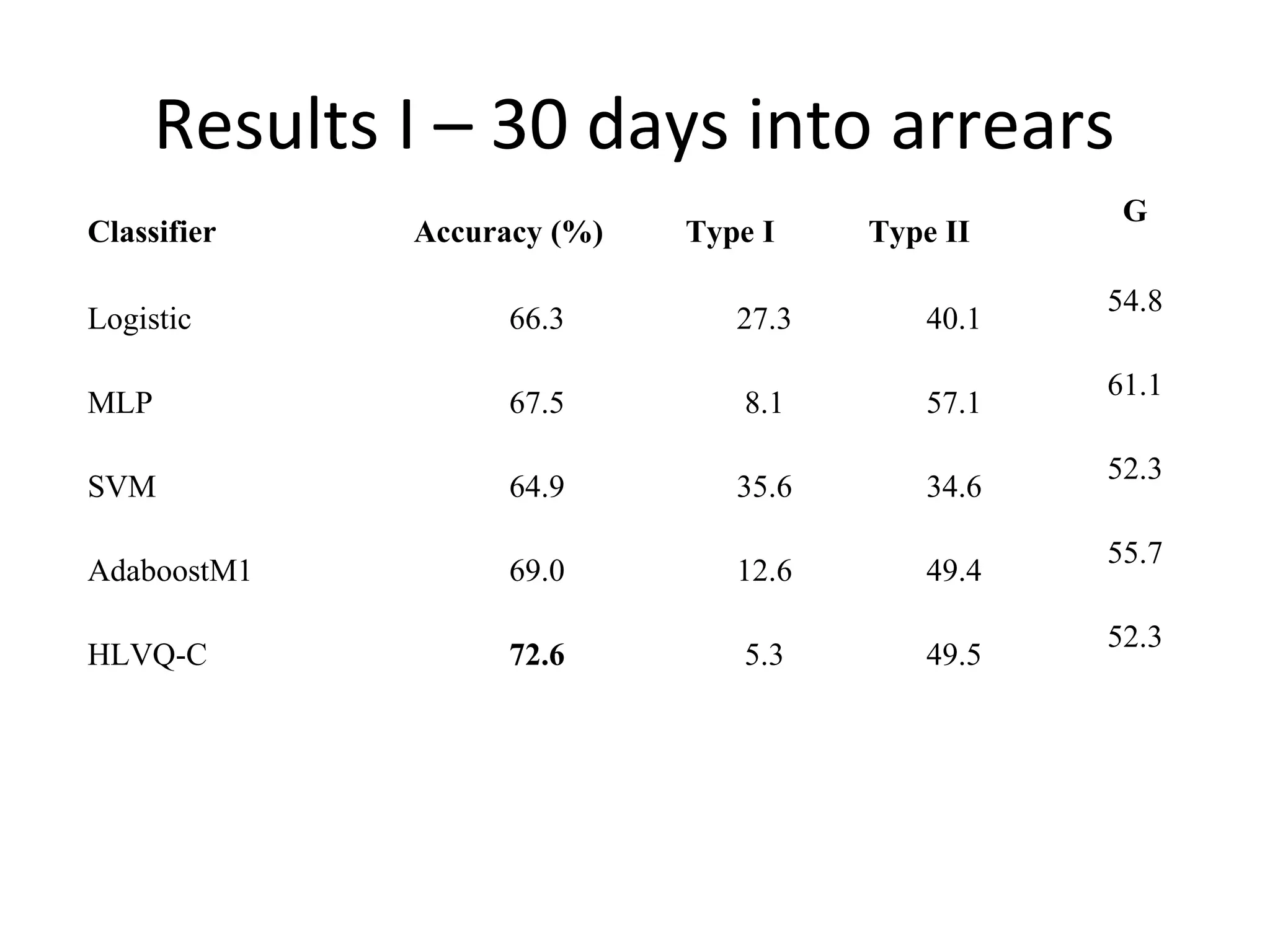

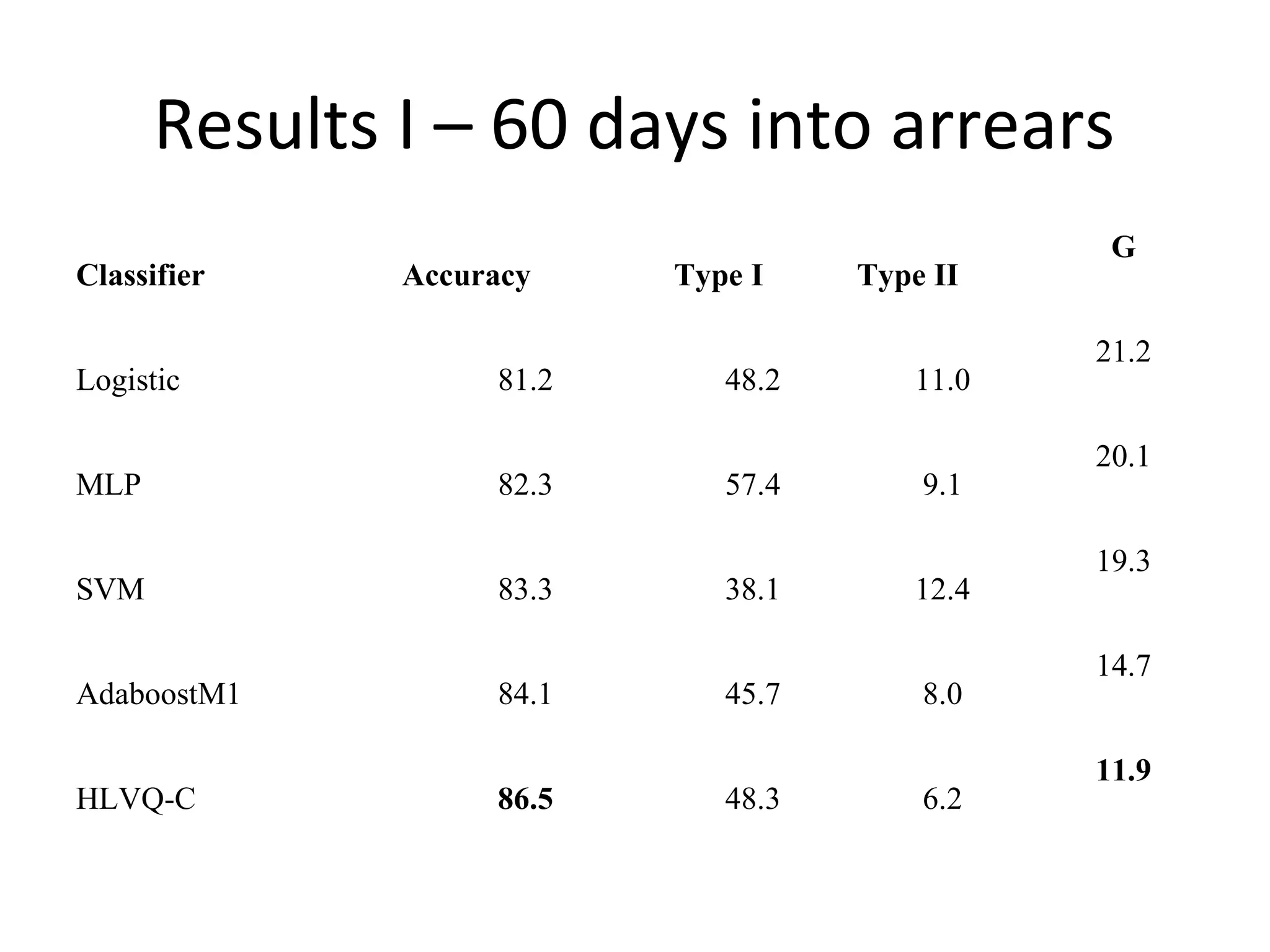

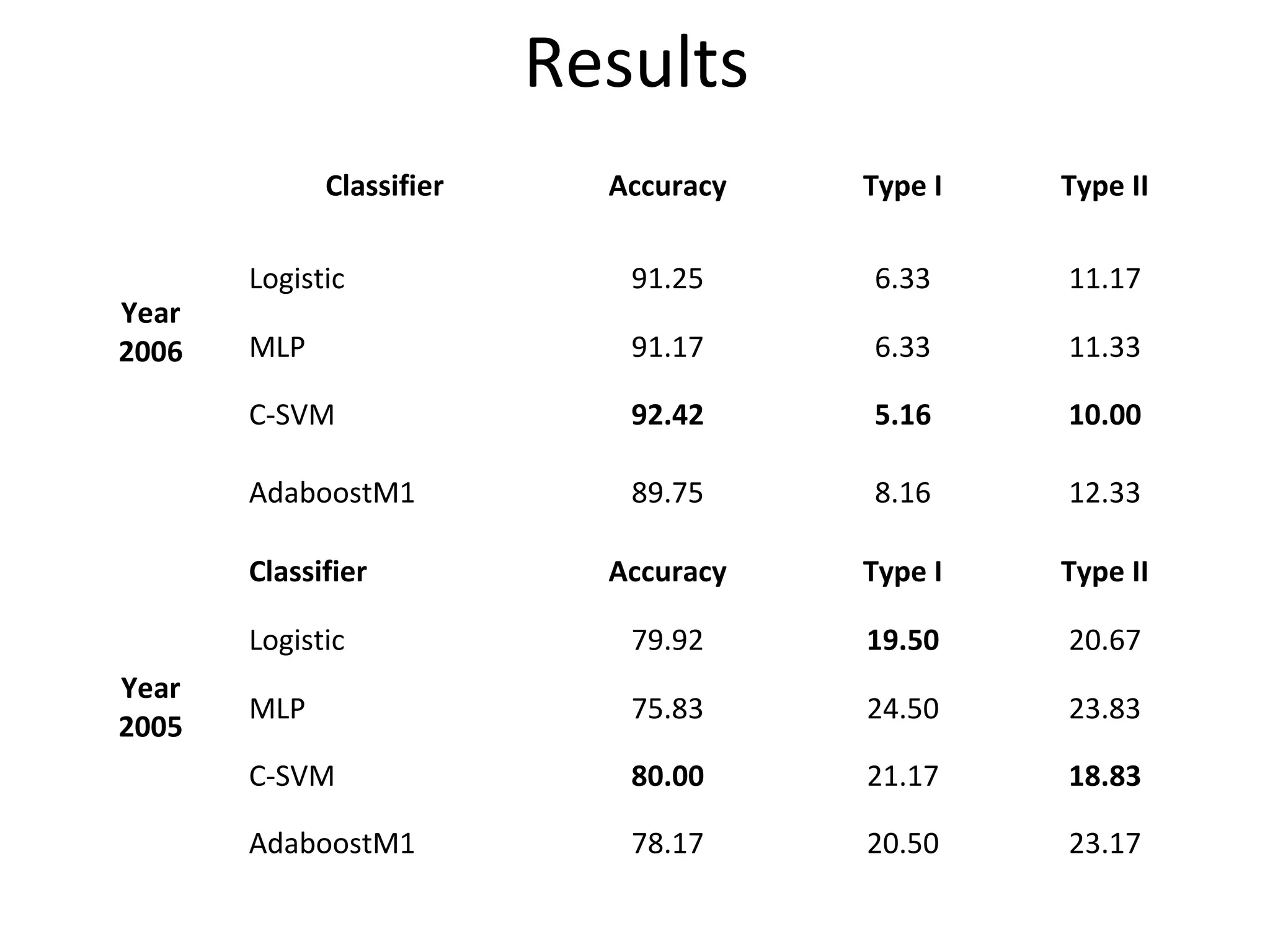

The document discusses credit risk management with AI tools. It summarizes that credit scoring is used to statistically quantify risk by converting applicant information into numbers and a score. The objective is to forecast future performance based on past client behavior. It then discusses using various machine learning models like HLVQ-C and neural networks to predict financial distress, classify companies, and improve bankruptcy prediction. The models were tested on real world credit and financial datasets.

![How useful?

[ ]mexexNV III )1()1( −−−=η

−

>>

− I

II

e

e

mmG

x

x

11](https://image.slidesharecdn.com/leuven-130813074714-phpapp01/75/Credit-risk-with-neural-networks-bankruptcy-prediction-machine-learning-19-2048.jpg)