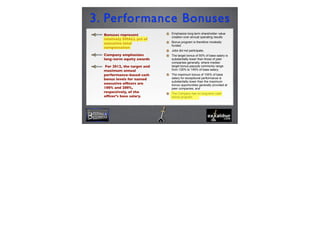

The document outlines Apple's executive compensation policy focused on team-based approaches and long-term equity awards, particularly using restricted stock units (RSUs) to align incentives with shareholder interests. It emphasizes lower cash compensation and performance bonuses compared to peer companies, with performance criteria linked to net sales and operating income. Additionally, executive officers are employed at will without severance agreements or perks beyond standard employee benefits.