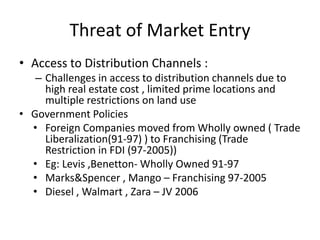

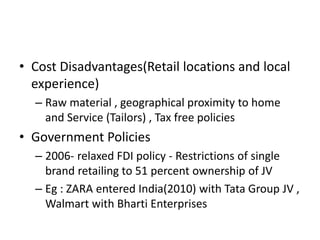

The apparel industry in India faces moderate threats from suppliers and substitutes but high threats from buyers and new market entrants. Suppliers have low bargaining power due to abundant cotton production and labor in India. Substitute threats are moderate as customers will switch to higher quality brands. However, buyer power is high with many shopping and brand options, and market entry threats are high due to challenges in distribution channels, foreign investment restrictions that have recently eased, and established local manufacturers.