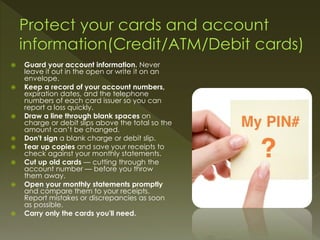

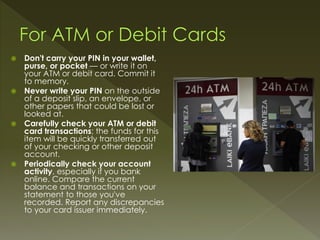

This document provides tips for safely using ATM machines. It advises being attentive and careful when withdrawing cash, as there are risks of card theft or hacking. Some key tips include avoiding isolated ATMs, hiding your PIN from cameras, promptly reporting any lost or stolen cards, and changing your PIN regularly. Being aware of your surroundings and account activity can help protect from fraud.