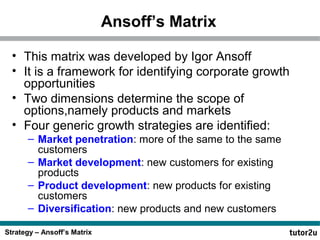

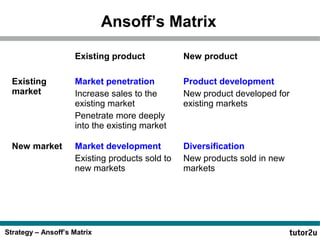

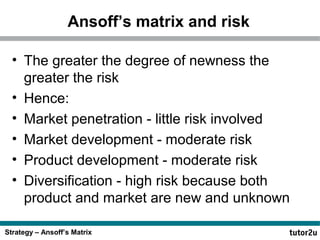

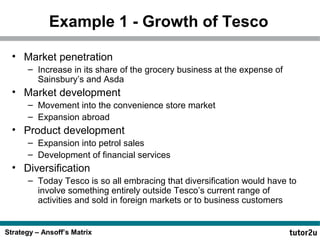

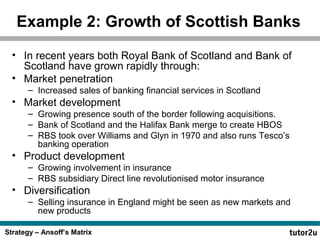

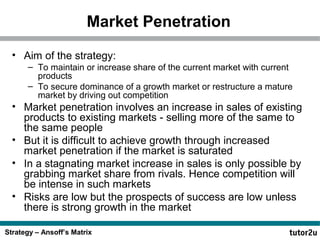

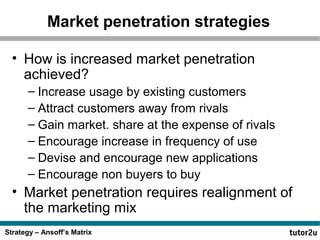

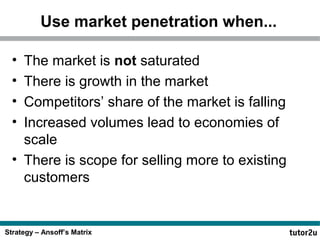

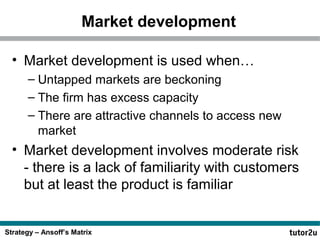

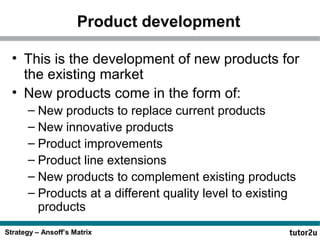

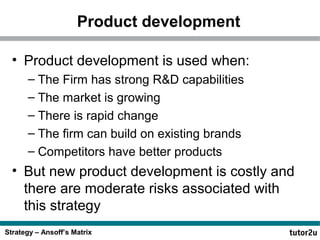

Ansoff's Matrix is a framework developed by Igor Ansoff for identifying corporate growth opportunities. It outlines four growth strategies based on whether new or existing products are used in new or existing markets: market penetration, market development, product development, and diversification. The greater the degree of newness in a strategy, the greater the risk involved. Ansoff's Matrix is useful for analyzing a business's potential strategic directions and growth opportunities while considering expected returns and risks.