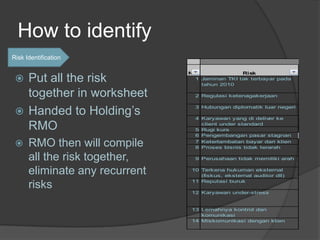

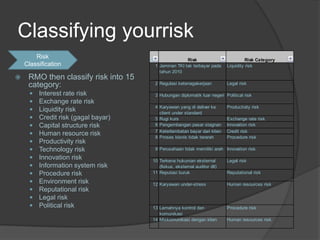

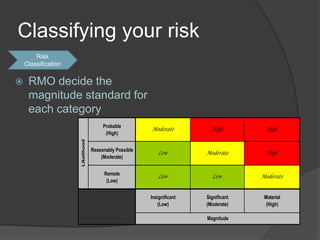

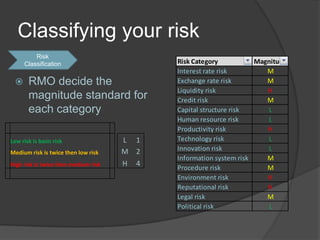

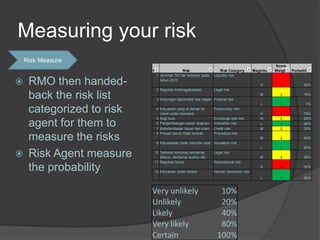

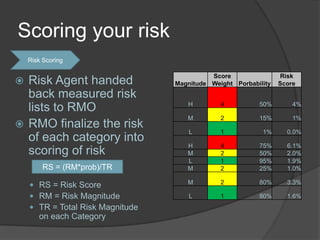

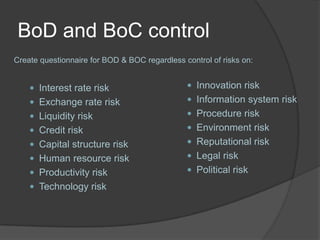

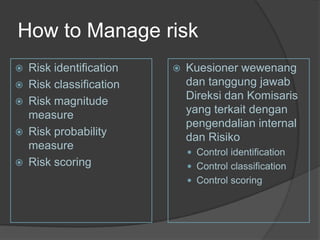

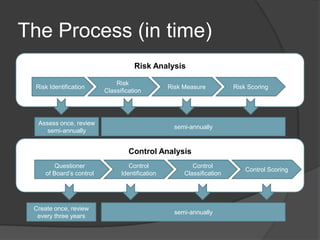

This document outlines a risk management process that involves identifying risks, classifying them by category, measuring their probability and magnitude, scoring the risks, analyzing controls, and visualizing the risk profile. Key steps include appointing risk agents to identify risks, classifying risks into 15 categories, determining probability and impact scales, calculating risk scores, creating a questionnaire to assess board controls, and comparing risks to controls in a visualization. The process is meant to be implemented on a semi-annual basis to regularly review and update the organization's risk assessment and management.

![How to identify

Risk Identification

Create counterpart per

department, per Company with

“SK Direksi” to be the man in-

charge at their company as risk

agent [because risk owner will

precisely identify any on going

risk happen better than Holding’s

RMO]

Risk Agent will define the

business process in a flowchart

form at their department

Risk Agent then identify the risk

on each process](https://image.slidesharecdn.com/masterplan-riskmanagement-120508042444-phpapp01/85/Annual-Company-Risk-Assessment-5-320.jpg)