The document discusses Riskpro's Certification in Risk Management (CRM). It provides an overview of the following:

1. The need for risk management certification and how Riskpro's CRM program aims to address this need by providing comprehensive risk management training and certification.

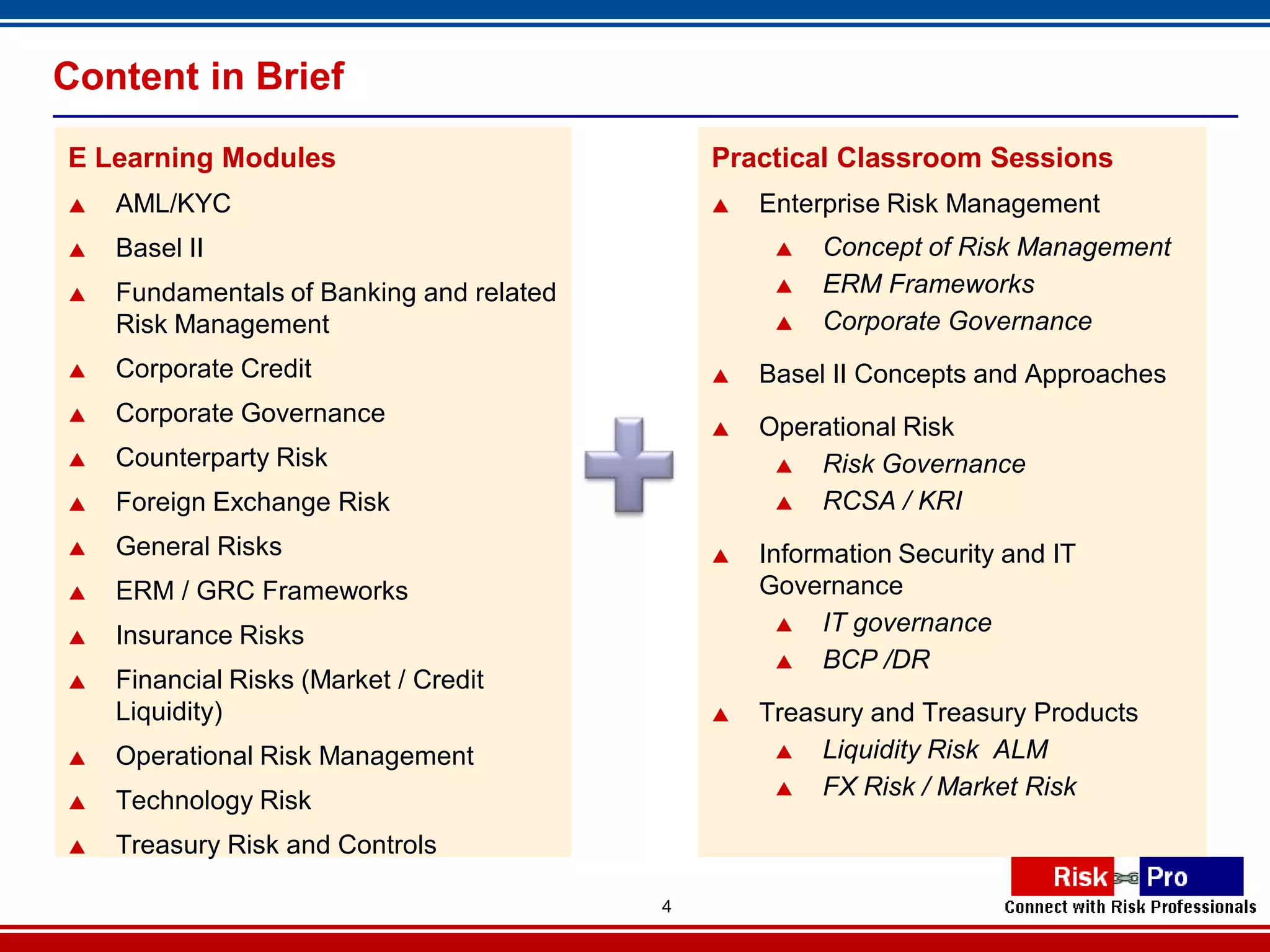

2. Details of the CRM program which includes e-learning modules, classroom training, assessments, engagement activities and certification upon completion.

3. FAQs addressing questions around recognition, cost, effectiveness of online vs. classroom learning and comparisons to other risk certifications.

4. Next steps for those interested in exploring the CRM certification and contact information.