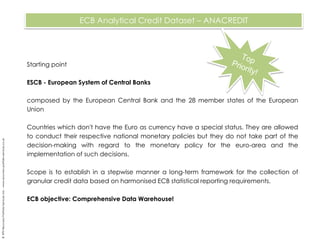

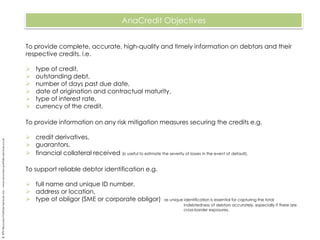

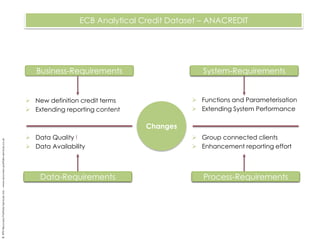

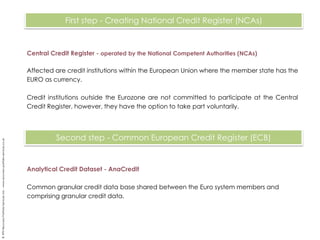

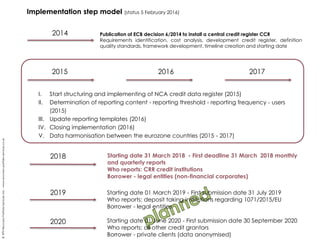

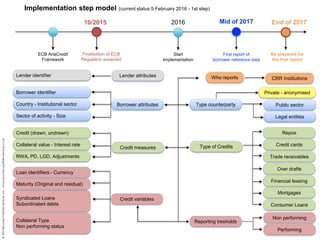

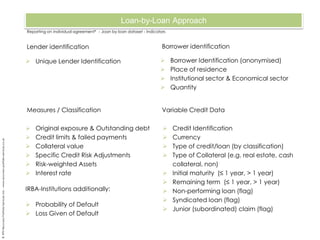

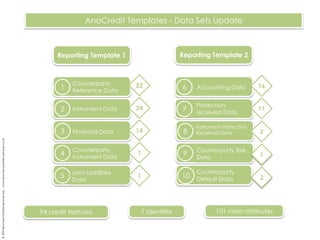

The document details the European Central Bank's analytical credit dataset, known as AnaCredit, aimed at establishing a long-term framework for collecting granular credit data across the Eurozone. It highlights the objectives of providing comprehensive data on debtors, credit exposure, and risk mitigation measures while outlining the steps and requirements for implementing a central credit register. Additionally, it describes the involvement of national competent authorities and the required changes for effective data collection and reporting.