Reports & Analytics for a core banking system

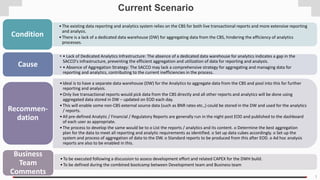

- 1. 1 •The existing data reporting and analytics system relies on the CBS for both live transactional reports and more extensive reporting and analysis. •There is a lack of a dedicated data warehouse (DW) for aggregating data from the CBS, hindering the efficiency of analytics processes. Condition • • Lack of Dedicated Analytics Infrastructure: The absence of a dedicated data warehouse for analytics indicates a gap in the SACCO's infrastructure, preventing the efficient aggregation and utilization of data for reporting and analysis. • • Absence of Aggregation Strategy: The SACCO may lack a comprehensive strategy for aggregating and managing data for reporting and analytics, contributing to the current inefficiencies in the process. Cause •Ideal is to have a separate data warehouse (DW) for the Analytics to aggregate data from the CBS and pool into this for further reporting and analysis. •Only live transactional reports would pick data from the CBS directly and all other reports and analytics will be done using aggregated data stored in DW – updated on EOD each day. •This will enable some non-CBS external source data (such as BNR rates etc.,) could be stored in the DW and used for the analytics / reports. •All pre-defined Analytic / Financial / Regulatory Reports are generally run in the night post EOD and published to the dashboard of each user as appropriate. •The process to develop the same would be to o List the reports / analytics and its content. o Determine the best aggregation plan for the data to meet all reporting and analytic requirements as identified. o Set up data cubes accordingly. o Set up the system and process of aggregation of data to the DW. o Standard reports to be produced from this after EOD. o Ad hoc analysis reports are also to be enabled in this. Recommen- dation •To be executed following a discussion to assess development effort and related CAPEX for the DWH build. •To be defined during the combined bootcamp between Development team and Business team Business Team Comments Current Scenario

- 2. 2 Gather Information Collect relevant data about the member, including personal information, financial history, employment status, income level, and any existing loans or credit facilities they have with the SACCO. Assess Credit History Review the member's credit history within the SACCO, including their repayment behavior, outstanding debts, and any defaults or delinquencies. Analyze Financial Position Evaluate the member's financial stability by assessing their income sources, assets, liabilities, savings, and investments. Consider factors such as debt-to-income ratio and liquidity. Evaluate Risk Tolerance Determine the member's risk tolerance level by understanding their willingness and ability to take on financial risks. This can be assessed through discussions, questionnaires, or surveys. Consider External Factors Consider external factors that may impact the member's financial situation, such as economic conditions, industry trends, and regulatory changes. Assess Stability and Reliability Evaluate the member's stability and reliability based on factors like employment tenure, consistency in income, and overall financial discipline. Review Behavioral Patterns Analyze the member's behavior regarding financial decisions, spending habits, savings patterns, and previous interactions with the SACCO. Assign Risk Rating Based on the collected information and analysis, assign a risk rating to the member. This rating can range from low to high risk or can be categorized using a numerical scale. Document Findings Document all findings and assessments in the member's profile, including the rationale behind the assigned risk rating. Monitor and Update Regularly monitor the member's financial activities and update their risk profile as needed, especially in response to significant changes in their financial situation or external factors. Implement Risk Mitigation Strategies Based on the member's risk profile, implement appropriate risk mitigation strategies, such as adjusting credit limits, requiring collateral, or offering financial counseling. Communicate with the Member Communicate the risk assessment findings and any resulting actions or recommendations to the member in a transparent and constructive manner. Process to create a risk profile for a member

- 3. 3 Parameters used by credit scoring models Credit History • This includes factors such as the individual's payment history on existing credit accounts, the length of credit history, the types of credit used (such as credit cards, mortgages, or installment loans), and the amount of available credit being utilized. Credit Utilization Ratio • This ratio measures the amount of credit being used relative to the total credit available. A lower utilization ratio is generally seen as favorable. Payment History • Timely payments on credit accounts are typically viewed positively, while late payments or defaults can negatively impact credit scores. Credit Inquiries • The number of recent inquiries into an individual's credit report can affect their credit score, with multiple inquiries within a short period potentially indicating higher risk. Types of Credit • Having a mix of different types of credit, such as installment loans and revolving credit accounts, can positively influence credit scores.

- 4. 4 Credit Age • The length of time an individual has held credit accounts can impact their credit score, with longer credit histories generally being viewed more favorably. Public Records • Bankruptcies, foreclosures, and other negative public records can significantly lower credit scores. Debt-to-Income Ratio • This ratio compares an individual's total monthly debt payments to their gross monthly income and is used to assess their ability to manage additional debt. Employment and Income • Some credit scoring models may consider an individual's employment status and income level as factors in determining creditworthiness. Behavioral Analysis • Some newer credit scoring mechanisms incorporate behavioral analytics, analyzing non-traditional data such as social media activity or online shopping behavior to assess credit risk. Machine Learning and AI • Advanced credit scoring models may utilize machine learning algorithms to analyze vast amounts of data and identify patterns that traditional scoring methods might miss. Parameters used by credit scoring models

- 5. 5 Risk-weighted aggregated approach for marking member loans as NPL Risk-Weighted Aggregated Approach • RWAA is a methodology used by financial institutions, including SACCOs, to determine the level of risk associated with their loan portfolios. • It involves assigning specific risk weights to different categories of loans based on the probability of default and potential loss given default. •Risk Assessment Process • SACCOs typically assess various factors to determine the credit risk of member loans. This assessment includes factors such as borrower credit history, collateral, loan purpose, and economic conditions. • Based on this assessment, loans are categorized into different risk buckets, such as low risk, moderate risk, and high risk. Determining Risk Weights • Once loans are categorized, specific risk weights are assigned to each category based on the probability of default and expected loss. • For example, low-risk loans might have a risk weight of 20%, moderate-risk loans 50%, and high-risk loans 100%. Aggregating Risk-Weighted Exposure • After assigning risk weights to individual loans, the SACCO aggregates the risk-weighted exposure of its entire loan portfolio. • This involves multiplying the outstanding balance of each loan by its respective risk weight and summing these values across all loans. Identification of (NPLs) • Loans are classified as Non-Performing when they meet specific criteria, typically related to overdue payments or failure to meet contractual obligations. • In the context of RWAA, NPLs are identified within each risk category based on predefined criteria set by the SACCO or regulatory authorities. Treatment of NPLs • Once identified, NPLs may be subject to specific provisioning requirements and risk management measures. • SACCOs may need to set aside provisions to cover potential losses associated with NPLs, thereby safeguarding their financial health.