Credit Assessments and Financial Ratios in Mainland China

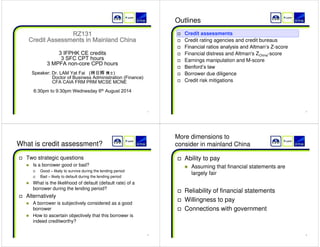

- 1. 1 RZ131 Credit Assessments in Mainland China 3 IFPHK CE credits 3 SFC CPT hours 3 MPFA non-core CPD hours Speaker: Dr. LAM Yat Fai (㨦㡴战 ◩⭺) Doctor of Business Administration (Finance) CFA CAIA FRM PRM MCSE MCNE 6:30pm to 9:30pm Wednesday 6th August 2014 2 Outlines † Credit assessments † Credit rating agencies and credit bureaus † )LQDQFLDOUDWLRVDQDOVLVDQG$OWPDQ¶V=-score † Financial distress and Altman's ZChina-score † Earnings manipulation and M-score † %HQIRUG¶VODZ † Borrower due diligence † Credit risk mitigations 3 What is credit assessment? † Two strategic questions „ Is a borrower good or bad? † Good ± likely to survive during the lending period † Bad ± likely to default during the lending period „ What is the likelihood of default (default rate) of a borrower during the lending period? † Alternatively „ A borrower is subjectively considered as a good borrower „ How to ascertain objectively that this borrower is indeed creditworthy? 4 More dimensions to consider in mainland China † Ability to pay „ Assuming that financial statements are largely fair † Reliability of financial statements † Willingness to pay † Connections with government

- 2. 5 Credit assessment techniques Credit assessment External (by independent expert) Corporate credit rating Internal (by lender) Corporate Retail Retail FICO score 0HUWRQ¶VFRUSRUDWH default model $OWPDQ¶V=-score Credit scoring Credit scoring 6 Outlines † Credit assessments † Credit rating agencies and credit bureaus † )LQDQFLDOUDWLRVDQDOVLVDQG$OWPDQ¶V=-score † Financial distress and Altman's ZChina-score † Earnings manipulation and M-score † %HQIRUG¶VODZ † Borrower due diligence † Credit risk mitigations 7 Major credit rating agencies † Global credit rating agency „ Moody's Investors Service http://www.moodys.com „ Standard Poor's http://www2.standardandpoors.com „ Fitch Ratings http://www.fitchratings.com † Specialist credit rating agency „ A.M. Best http://www.ambest.com „ Dagong Global Credit Rating http://dagongcredit.com/dagongweb/english/index.php 8 Solicited vs unsolicited ratings † Solicited rating „ A corporation provides its confidential information for the propose of credit assessment and pay a service charge to a credit rating agency in order to obtain a credit rating „ Potential conflict of interests „ Business model of the three largest CRAs † Unsolicited rating „ A credit rating agency takes an initiative to rate a corporation based on publicly available information „ Lenders pay a fee to access credit ratings

- 3. 9 Credit rating scales Grade 6 3¶V)LWFK 0RRG¶V Investment AAA Aaa AA Aa A A BBB Baa High yield BB Ba B B CCC Caa CC Ca C C 10 Rating definitions (1) Rating Definition AAA A corporation rated AAA has extremely strong capacity to meet its debt obligations. AA A corporation rated AA has very strong capacity to meet its debt obligations. It differs from a highest-rated borrower only to a small degree. A A corporation rated A has strong capacity to meet its debt obligations but is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than a borrower in higher-rated categories. 11 Rating definitions (2) Rating Definition BBB A corporation rated BBB has adequate capacity to meet its debt obligations. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the borrower to meet its debt obligations. BB A corporation rated BB is judged to have speculative elements and are subject to substantial credit risk. B A corporation rated B is more vulnerable than a borrower rated BB, but the borrower currently has the capacity to meet its debt obligations. Adverse business, financial, or economic conditions will likely impair the borrower's capacity or willingness to meet its debt obligations. 12 Rating definitions (3) Rating Definition CCC A corporation rated CCC start to experience financial distress, and is dependent upon favorable business, financial, and economic conditions to meet its debt obligations. CC A corporation rated CC is currently in financial distress. C A corporation rated C is typically in deep financial distress, with very little prospect to meet its debt obligations.

- 4. 13 Average 1-year default rates Group Rating Moody¶s (%) SP¶s (%) Fitch (%) 1983 - 2012 1981 - 2012 1990 - 2012 Excellent AAA 0.00 0.00 0.00 Good AA 0.03 0.02 0.03 A 0.07 0.07 0.09 BBB 0.20 0.22 0.21 Moderate BB 1.14 0.96 1.24 B 4.04 4.29 2.72 Financial distress CCC 13.76 26.85 27.61 CC and C 41.40 14 Only 4 AAA corporations in the world † Manufacturing firms „ Johnson Johnson „ Exxon Mobil Corporation † Technology firms „ Microsoft Corporation „ Automatic Data Processing, Inc. These corporations are richer than most countries in the world 15 Basel III ECAI rating scale Rating 3-year DR (%) AAA and AA 0.10 A 0.25 BBB 1.00 BB 7.50 B 20.00 16 Basel III ECAI Plus rating scale Group Rating 3-year DR (%) PD (%) Excellent AAA 0.03 0.0100 Good AA (+,-) 0.10 0.0333 A (+,-) 0.25 0.0834 BBB (+,-) 1.00 0.3345 Moderate BB (+,-) 7.50 2.5652 B (+,-) 20.00 7.1682 Financial distress CCC 40.00 15.6567 CC 65.00 29.5270 C 95.00 63.1597

- 5. 17 Domestic credit rating agencies in China † Solicited rating „ Dagong Global Credit Rating „ Pengyuan Credit Rating „ Chengxin International Credit Rating 0RRG¶V

- 6. „ China Lianhe Credit Rating (Fitch 49%) „ Shanghai Brilliance Credit Rating Investor Service (strategic alliance with SP) † Unsolicited rating „ China Credit Rating 18 Major retail credit bureaus † Individual persons „ TransUnion „ Equifax „ Experian † Small and medium enterprises „ Dun Bradstreet 19 Where comes personal credit data? † Banks¶ contribution † Public records † Negative data „ Overdue records, bankruptcy records, court orders † Positive data „ Loan types, no. of mortgages and no. of credit cards 20 Composition of FICO score † Payment history (35%) „ The historical records of default, bankruptcy, lawsuit, court order and delayed payment will reduce the FICO score „ The more recent, more frequent and more severe the negative payment history is, the lower the FICO score will be † Credit utilization (30%) „ A large ratio of outstanding debt amount to total credit limit will reduce the FICO score † Credit history (15%) „ Credit history is represented by the age of the oldest loan account and the average age of all loan accounts „ A longer credit history will increase the FICO score † Credit experience (10%) „ Credit experience means the history of using different types of credit products „ A more diversified credit experience will increase the FICO score. † Recent enquiry (10%) „ The recent enquiries from a large number of loan applications will decrease the FICO score

- 7. 21 FICO score Group From To Super prime 740 850 Prime 680 739 Alt-A 620 679 Subprime 550 619 Deep subprime 350 549 22 FICO scores vs default rates From To 1-year DR (%) 800 850 1 750 799 2 700 749 5 650 699 14 600 649 31 550 599 51 500 549 70 350 499 83 23 Credit bureaus in China † 3HRSOH¶V%DQNRIKLQD „ http://www.pbccrc.org.cn † Huaxia DB China „ http://www.huaxiadnb.com † Crediteyes „ http://www.crediteyes.com † 60 24 Outlines † Credit assessments † Credit rating agencies and credit bureaus † )LQDQFLDOUDWLRVDQDOVLVDQG$OWPDQ¶V=-score † Financial distress and Altman's ZChina-score † Earnings manipulation and M-score † %HQIRUG¶VODZ † Borrower due diligence † Credit risk mitigations

- 8. 25 Financial statements † Balance sheet http://finance.yahoo.com/q/bs?s=F+Balance+S heetannual † Income statement http://finance.yahoo.com/q/is?s=F+Income+Stat ementannual † Cash flow statement http://finance.yahoo.com/q/cf?s=F+Cash+Flow annual 26 Financial ratios † Liquidity ratios † Leverage ratios † Return on investment ratios † Operating profitability ratios † Operating efficiency ratios † Turnover ratios † Coverage ratios † Growth ratios 27 Liquidity ratios Current assets Current ratio = Current liabilities Cash + Marketable securities + Account receivables Quick ratio = Current liabilities Cash + Marketable securities Cash ratio = Current liabilities 28 Leverage ratios Total liabilities Liabilities-to-equity ratio = Total equity Total liabilities Liabilities-to-assets ratio = Total assets Total equity Equit-to-assets ratio = Total assets

- 9. 29 ROI ratios Earnings before interest and taxes Return on total assets = Total assets Earnings before interest and taxes Return on total equity = Total equity Earnings before interest and tax Return on common equity = es Common equity 30 Peer analysis and trend analysis † Peer analysis „ Comparison with † Other similar corporations † Industry statistics „ average, median, mode „ lower bound, upper bound † Trend analysis „ Comparison with † $FRUSRUDWLRQ¶VRZQKLVWRU 31 Financial ratios † Advantages „ Direct measure of a company¶s financial healthiness „ Published regularly „ Audited at least annually † Disadvantages „ Financial ratios highly industry specific „ Large no. of financial ratios „ Inconsistency among less related financial ratios „ Book value economic value „ Subject to accounting cosmetics „ Peer figures and industry statistics difficult to collect from emerging industries and private firms 32 Survival and default groups † Assume that personal credit quality is driven by „ x1 : monthly income „ x2 : outstanding loan amount † Historical record „ Based on bank¶s internal records, plot the default and survival borrowers into two groups „ Preferable at least 60 in each group „ Determine the centre of two groups † Potential borrower „ Classified as good borrowers if near the centre of survival group „ Classified as bad borrowers if near the centre of default group

- 10. 33 Historical distribution 34 Three-group classification 35 Borrower distribution in a real bank 36 Explanatory variables (1) † EBIT/Total tangible assets † Net available for total capital/Total capital † Sales/Total tangible assets † Sales/Total capital † EBIT/Sales † Net available for total capital/Sales † Log tangible assets † Interest coverage † Log(Interest coverage) † Fixed charge coverage † Earnings/Debt † Earnings, 5-year maturity † Cash flow/Fixed charges † Cash flow/Total debt

- 11. 37 Explanatory variables (2) † Working capital/Total debt † Current ratio † Working capital/Total assets † Working capital/Cash expenses † Retained earnings/Total assets † Book equity/Total capital † Market value of equity equity/Total capital † 5-year market value of equity equity/Total capital † Market value of equity equity/Total liabilities † Standard error of estimate of EBIT/Total tangible assets † EBIT drop † Margin drop † Capital lease/Assets † Sales/Fixed assets 38 Altman¶s Z-score for listed manufacturing companies (1) † Explanatory variables 1 2 3 4 5 Market value of equity X = Book value of liabilities Current assets - Current liabilities X = Total assets Retained earnings X = Total assets Earnings before interest and taxes X = Total assets Sales X = Total assets 39 Altman¶s Z-score for listed manufacturing companies (2) † 1 2 3 4 5 Z = 0.6X + 1.2X + 1.4X + 3.3X + 0.999X „ Good ± Z 2.99 [AA to BBB] „ Moderate ± 1.81 Z 2.99 [BB to B] „ Bad ± Z 1.81 [CCC to C] 40 Altman¶s Z¶-score for private manufacturing companies (1) † Explanatory variables 1 2 3 4 5 value of equity X = Book value of liabilities Current assets - Current liabilities X = Total assets Retained earnings X = Total assets Earnings between interests and taxes X = Total assets Sales X = Book Total assets

- 12. 41 Altman¶s Z¶-score for private manufacturing companies (2) † 1 2 3 4 5 Z' = 0.42X + 0.717X + 0.847X + 3.107X + 0.998X „ Good ± Z¶ 2.90 [AA to BBB] „ Moderate ± 1.23 Z¶ 2.90 [BB to B] „ Bad ± Z¶ 1.23 [CCC to C] 42 Altman¶s Z¶¶-score for non-manufacturing companies (1) † Explanatory variables 1 2 3 4 Book value of equities X = Book value of liabilities Current assets - Current liabilities X = Total assets Retained earnings X = Total assets EBIT X = Total assets 43 Altman¶s Z¶¶-score for non-manufacturing companies (2) † 1 2 3 4 Z = 1.05X + 6.56X + 3.26X + 6.72X „ Good ± Z´ 2.60 [AA to BBB] „ Moderate ± 1.10 Z´ 2.60 [BB to B] „ Bad ± Z´ 1.10 [CCC to C] 44 Outlines † Credit assessments † Credit rating agencies and credit bureaus † )LQDQFLDOUDWLRVDQDOVLVDQG$OWPDQ¶V=-score † Financial distress and Altman's ZChina -score † Earnings manipulation and M-score † %HQIRUG¶VODZ † Borrower due diligence † Credit risk mitigations

- 13. 45 Default vs financial distress † Default „ Many defaults but very few default records „ Data removed from major financial information providers „ Some countries apply confidential treatments to records of defaulted corporations † Horizon „ No. of defaults in 3 years No. of defaults in 1 year † Financial distress „ A boarder definition of poor credit quality „ Records of financial distress corporations are accessible 46 Basel III ECAI Plus rating scale Group Rating 3-year DR (%) PD (%) Excellent AAA 0.03 0.0100 Good AA (+,-) 0.10 0.0333 A (+,-) 0.25 0.0834 BBB (+,-) 1.00 0.3345 Moderate BB (+,-) 7.50 2.5652 B (+,-) 20.00 7.1682 Financial distress CCC 40.00 15.6567 CC 65.00 29.5270 C 95.00 63.1597 47 Financial distress of listed companies † 5DWHG³´WR³´EFUHGLWUDWLQJDJHQFLHV † Listed companies „ Delisted due to reasons other than privatization † Special treatment in China „ Negative cumulative earnings over two consecutive years „ Equity value registered capital „ Likely to be dissolved „ Re-organization, settlement or bankruptcy liquidation „ Opinions from auditors „ Concerns from CSRC 48 High credit quality borrower † Differentiation „ Good ± to stay as investment grade in following three years „ Bad ± to migrate to high yield grade or default in following three years

- 14. 49 Altman¶s ZChina-score for listed companies in China † Explanatory variables 6 7 8 9 Total liabilities X = Total assets Net profit X = Average total assets Currrent assets - Current liabilities X = Total assets Retained earnings X = Total assets 50 Altman¶s ZChina-score for listed companies in China † China 6 7 8 9 Z = 0.517 - 0.460X + 9.320X + 0.388X + 1.158X „ Good ± ZChina 0.9 [AA,A] „ Moderate ± 0.5 ZChina 0.9 [BBB] „ Bad ± ZChina 0.5 [BB,B] † Market value of equity/Total assets not an explanatory financial ratio http://finance.google.com 51 New lending operations † Even financial distress records over 3 years are not available † Proxy by a similar group of listed companies in terms of asset size and industry † Cutoff scaled up in accordance with the experience of and subjective view from a lender 52 Outlines † Credit assessments † Credit rating agencies and credit bureaus † )LQDQFLDOUDWLRVDQDOVLVDQG$OWPDQ¶V=-score † Financial distress and Altman's ZChina-score † Earnings manipulation and M-score † %HQIRUG¶VODZ † Borrower due diligence † Credit risk mitigations

- 15. 53 6(¶VUHSRUWRQ financial statement frauds 38% 12% 12% 38% Earnings manipulation Expenses manipulation Improper disclosures Others 54 How good is the quality of financial statements? † All financial statements are subject to accounting cosmetics † To reject ALL loan applications assuming unreliable quality „ Loss all lending businesses „ Good borrowers cannot obtain finance † To accept ALL loan applications by assuming good quality „ Potentially large default loss 55 Beneish¶s M-score for earnings manipulation Net income - Cash flow from operations TATA = Total assets Receivables DSRI = Total sales SGI = Total sales Fixed assets in current year - Property, plant and equipment AQI = Total assets Total liabilit LVGI = ies Total assets Selling, general and administrative expenses SGAI = Income Gross profit GMI = Total sales Depreciation DEPI = Depreciation + Property, plant and equipment 56 Beneish¶s M-score for earnings manipulation † „ Lower manipulation ± M 2.22 „ Moderate manipulation ± 1.78 M 2.22 „ Higher manipulation ± M 1.78 DSRI current year M = 4.84 - 4.679 × TATA current year - 0.92 × DSRI previous year SGI currrent year AQI current year - 0.892 × - 0.404 × SGI previous year AQI previous year LVGI current year + 0.327 × LVGI SGAI current year + 0.172 × previous year SGAI previous year GMI previous year DEPI previous year - 0.528 × - 0.115 × GMI current year DEPI current year

- 16. 57 Two-dimensional assessment 58 Outlines † Credit assessments † Credit rating agencies and credit bureaus † )LQDQFLDOUDWLRVDQDOVLVDQG$OWPDQ¶V=-score † Financial distress and Altman's ZChina-score † Earnings manipulation and M-score † %HQIRUG¶VODZ † Borrower due diligence † Credit risk mitigations 59 %HQIRUG¶VODZ † For computed numbers @ Prob st digit x 10 1 1 log 1 x § · ¨ ¸ © ¹ 60 Occurrence of 1st digit

- 17. :KHQ%HQIRUG¶VODZLVXVHIXO 61 62 63 Outlines † Credit assessments † Credit rating agencies and credit bureaus † )LQDQFLDOUDWLRVDQDOVLVDQG$OWPDQ¶V=-score † Financial distress and Altman's ZChina-score † Earnings manipulation and M-score † %HQIRUG¶VODZ † Borrower due diligence † Credit risk mitigations 64 Borrower due diligence † Financial reporting due diligence † Corporate governance due diligence † Regulatory due diligence † Business partner due diligence † Counterparty due diligence

- 18. 65 Forensic accounting † Forensic accounting utilizes accounting, auditing, and investigative skills to conduct an examination into a company's financial statements, thus providing an accounting analysis that is suitable for court † Forensic accountants are trained to look beyond the numbers and deal with the business reality of a situation 66 Business partners † Joint venture agreement with large projected revenues † Newly incorporated company † /RZVKDUHKROGHUV¶FDSLWDO † Small office † No licence 67 Muddy water report † Field enquiries confirmed that Zhangzhou Lusheng operates at the address on the 5th floor. There are four desks in =KDQJ]KRX/XVKHQJ¶VRIILFH which appeared to be approximately 180 m2 with 5- 6 employees in the office at the time of visit. This implies that Lusheng has an extremely efficient computer system (given that it processes so much money and so many payments with a small staff). 68 Onsite due diligence † Observations on Sino Forest by Muddy Waters „ Very few employees reporting duty every day „ Very few number of trucks in and out every day „ Do not match the transaction volume † Onsite visits are expensive „ Brach offices in different cities „ Joint ventures with onsite examination experts „ E.g. annual ISO 9000 examinations by SGS

- 19. 69 Outlines † Credit assessments † Credit rating agencies and credit bureaus † )LQDQFLDOUDWLRVDQDOVLVDQG$OWPDQ¶V=-score † Financial distress and Altman's ZChina-score † Earnings manipulation and M-score † %HQIRUG¶VODZ † Borrower due diligence † Credit risk mitigations 70 Credit risk mitigations † Credit substitution „ Credit guarantees „ Credit default swaps † Collateral „ Properties „ Financial assets „ Plants and equipments † Local partner „ Each city and industry has its own characteristics 71 Property price † Between purchaser and seller „ CNY 1,000,000 † Real estate agency „ CNY 1,500,000 † Registration with Land Resources Department „ CNY 850,000 † Mortgage „ CNY 2,000,000 72 My contacts † Personal e-mail „ quanrisk@gmail.com † Personal website „ https://sites.google.com/site/quanrisk † Book website „ https://sites.google.com/site/crmbasel

- 20. 73 Q A 74 Thank You 75 Upcoming IFPHK Continuing Education Programs: http://www.ifphk.org/CEP/ce-calendar Institute of Financial Planners of Hong Kong 13/F, Causeway Bay Plaza 2, 463 - 483 Lockhart Road, Hong Kong Tel: 2982 7888 Fax: 2982 7777 Email: education@ifphk.org Website: www.ifphk.org