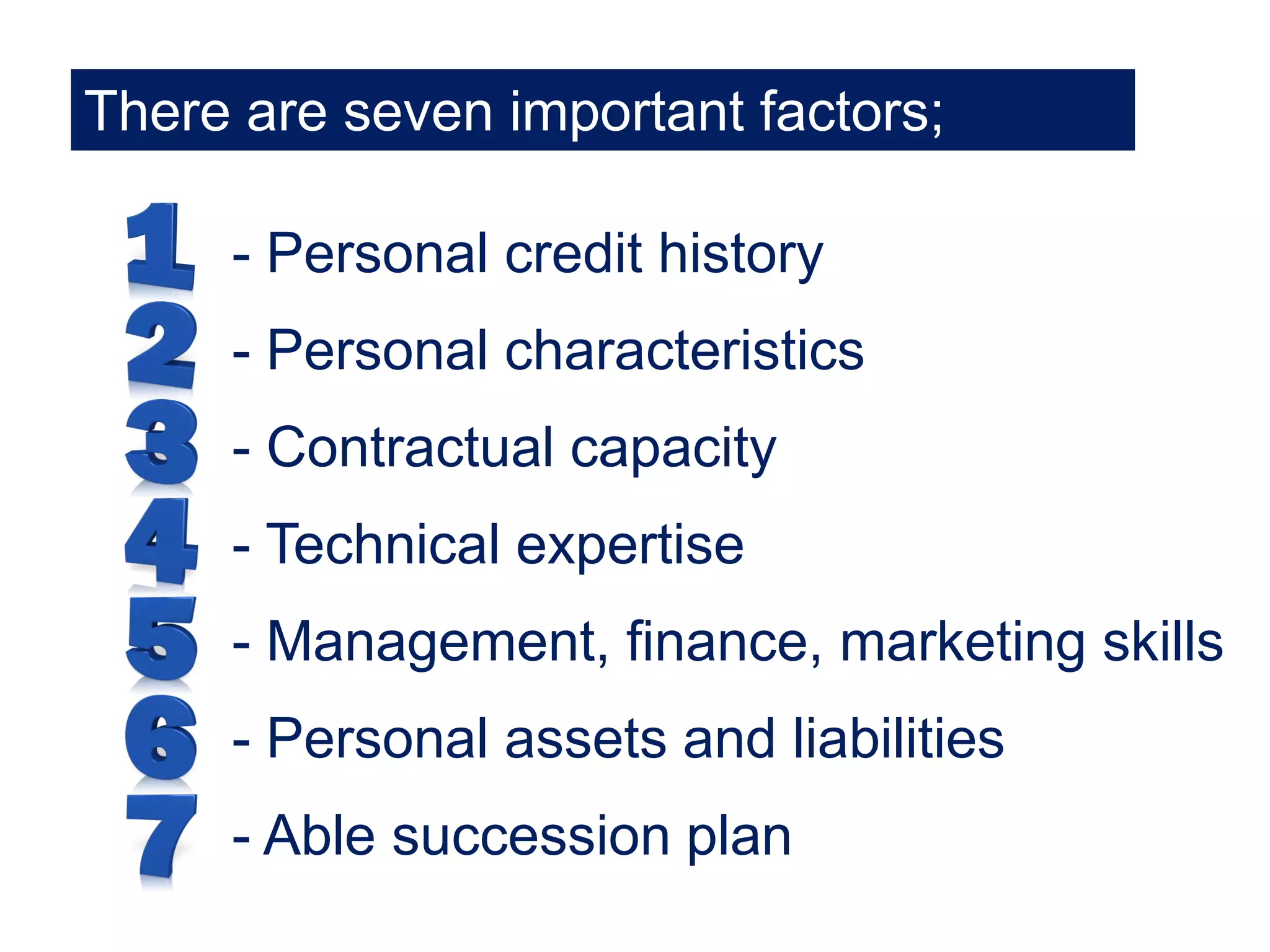

The document discusses the importance of analyzing management quality as a key step in assessing business risk for credit evaluation. It outlines seven critical factors to consider when evaluating a management team, including personal credit history, characteristics, skills, assets, and succession plans. The analysis emphasizes the need to understand both the internal management dynamics and external environments before determining a business's financial health.